Withdrawing From Thrift Savings Plan

This is referred to as a single partial withdrawal.

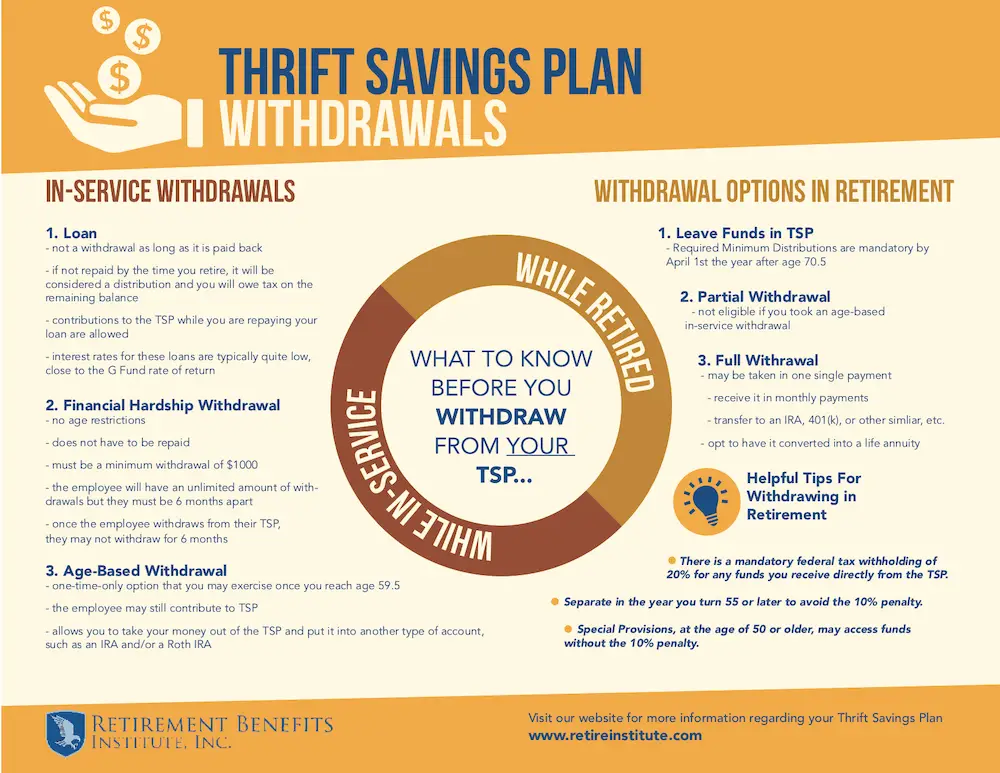

Withdrawing from thrift savings plan. The online tool is then used for requesting any type of TSP withdrawal. If your balance is less than 500 when you leave service we will automatically forfeit the balance to the Thrift Savings Plan. As long as these funds are kept in the TSP withdrawals are exempt.

Primarily this means taking qualified distributions after age 595. This adds an extra 10 percent charge on your entire withdrawal. Recurring negative monthly cash flow.

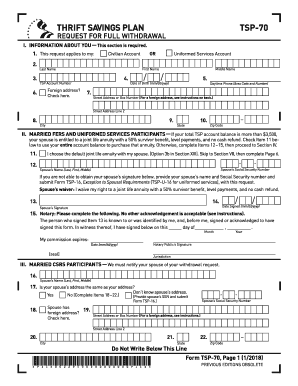

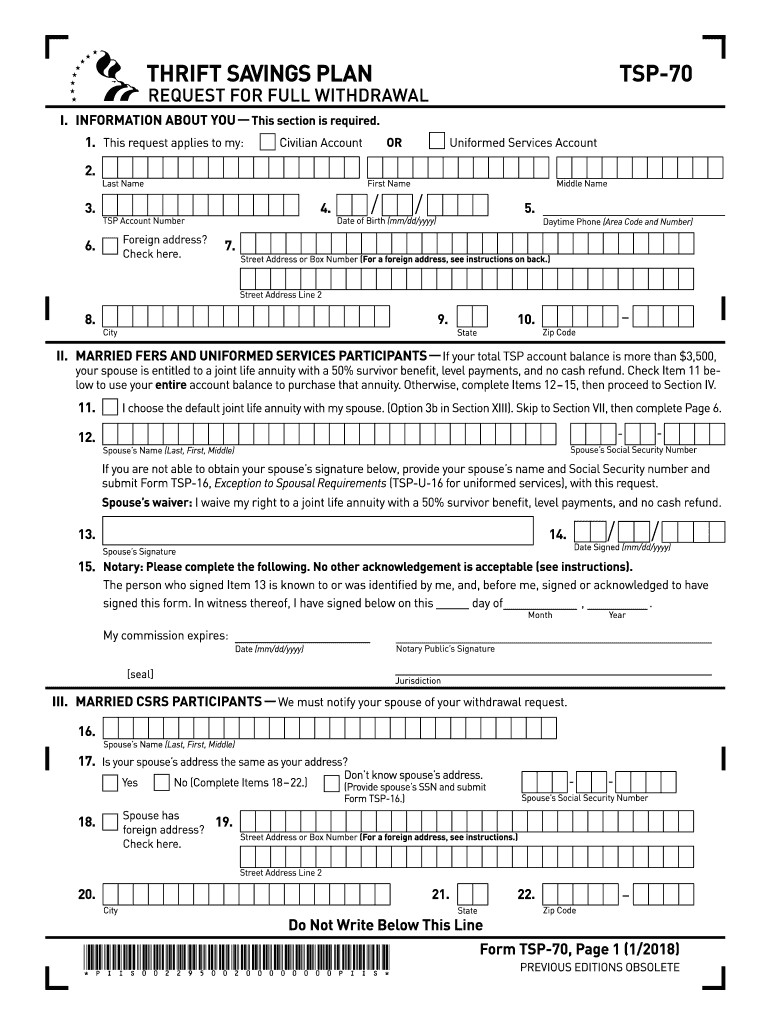

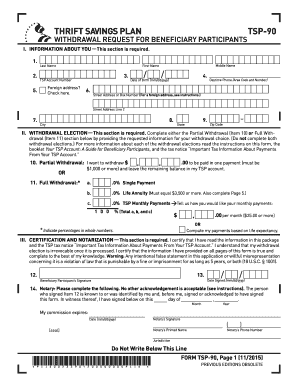

Withdrawing Your TSP Account After Federal Service. The Executive Director of the Federal Retirement Thrift Investment Board Board proposes to amend the regulations on methods of withdrawing funds from the Thrift Savings Plan TSP to eliminate the option to transfer a financial hardship in-service withdrawal to an individual retirement account IRA or other eligible retirement plan. Income tax on your cashout if all your withdrawals from the TSP throughout the year of your cashout add up to less than 200.

So we are excited to share a strategy to teach you how to withdraw from Thrift Savings Plan safely. My main concern is that the account balance is a moving target and I dont need to make a mistake. Depositing your withdrawal.

7 rows Requesting Withdrawals. After you leave federal service you may be able to transfer or roll over. If you withdraw money from your TSP for any other reason it will get hit by the early withdrawal penalty.

Our professionals are geographically convenient just for you. The minimum amount you can take is 1000 but there is no limit to how many you can take in your lifetime. Knowledgeable Independent professionals are available in nearly every market and have a vast array of experience and expertise regarding the TSP and other federal benefits.

In addition you will get. Another important concept to understand is that except for TSP. There is no limit on the number of single withdrawals that a separated or beneficiary TSP participant can make during his or her lifetime.

Can I withdraw money from my TSP without penalty. The ability to avoid the early withdrawal penalty if you. Before you request a withdrawal from your TSP savings be sure to read the booklet Withdrawing.

In addition to any taxes you owe on your withdrawal you will owe an additional 10. To qualify for a financial hardship withdrawal you must have a financial need for at least one of the following reasons. Making a withdrawal Requesting a withdrawal.

There are a number of ways to take a TSP withdrawal without penalty. Processing times limit you to one withdrawal every 30 days. The early withdrawal penalty is a 10 penalty.

5 rows Proportional Withdrawals. A financial hardship in-service withdrawal is a withdrawal that you can make from your TSP account if you have a genuine financial need. Transferring or rolling over your withdrawal.

To request any type of withdrawal including installment payments a TSP. Namely the TSP participant must log into the My Account section at httpswwwtspgov and click Withdrawals and Changes to Installment Payments. If you need a portion of your TSP savings right away but want to leave the rest to continue growing consider withdrawing just a portion of your account.