How Will Tax Plan Affect Me

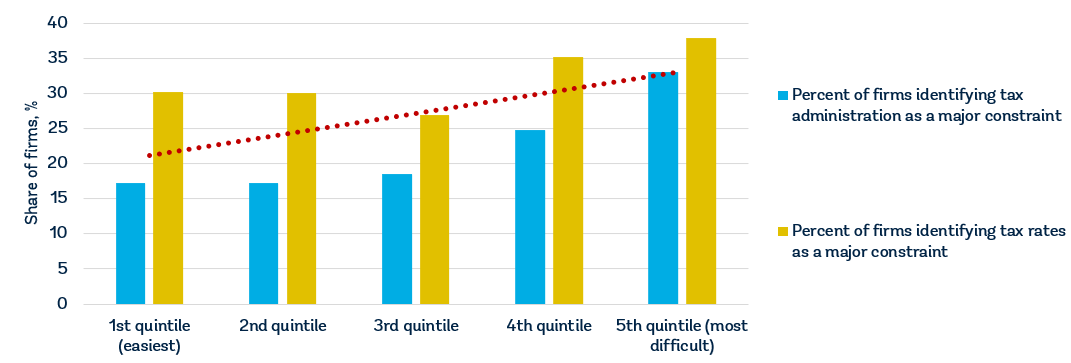

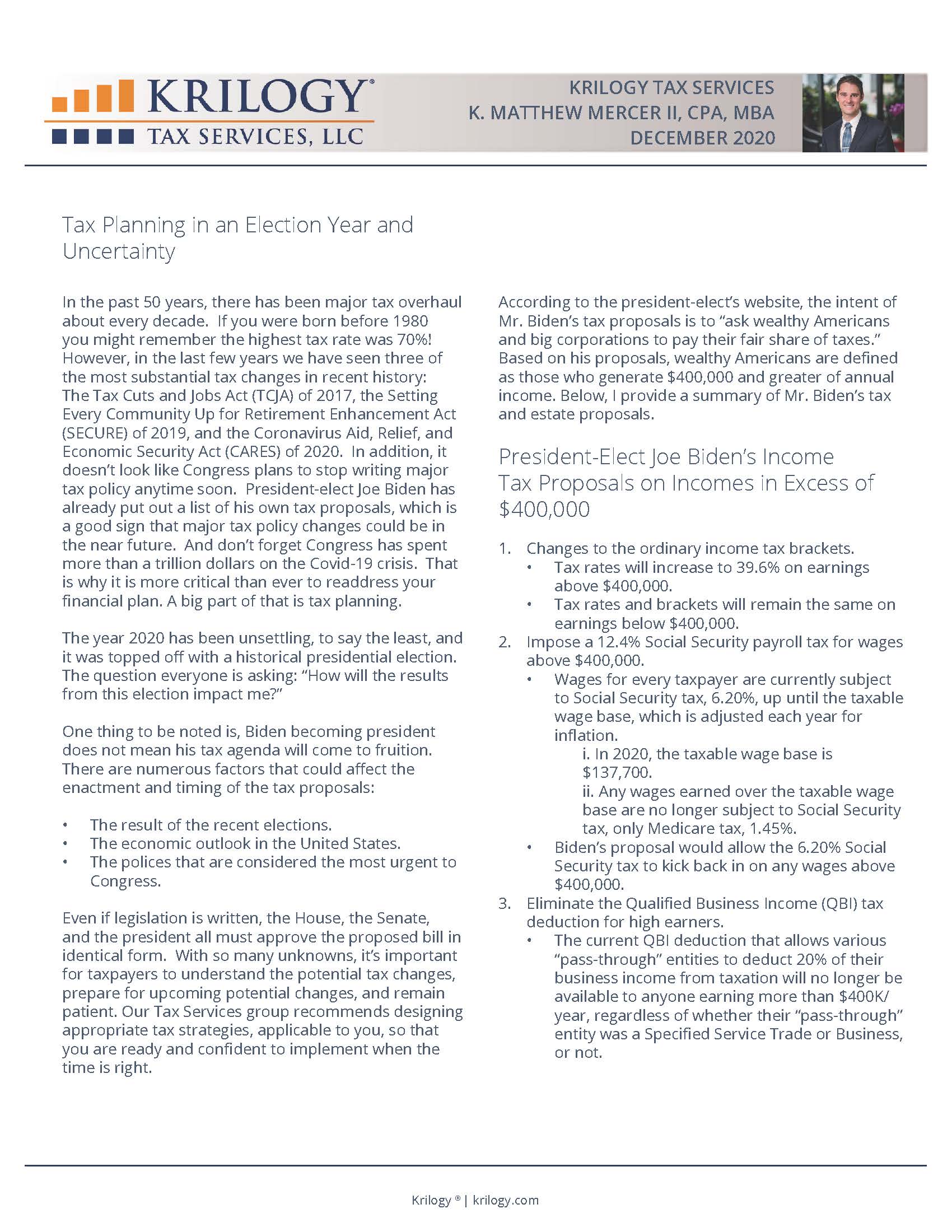

For corporations this means rolling back President Donald Trumps 2017 Tax plan which set a 21 flat tax for all businesses and raising it up to 28.

How will tax plan affect me. Thats a lie In fact under his plan an average family who earns over 50000 will see a tax increase. See How Trumps Tax Plan Will Change Things. Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending among other priorities.

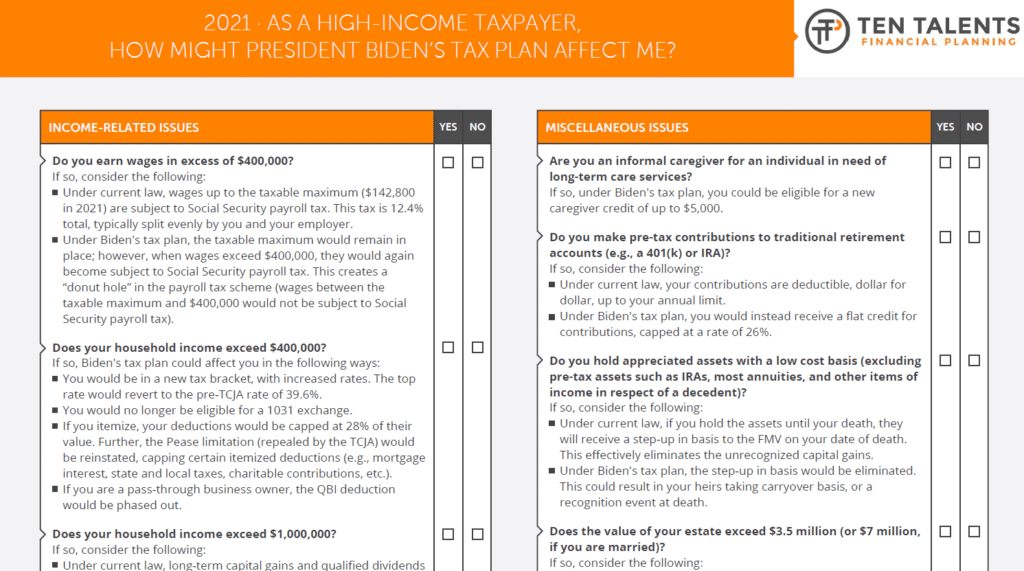

Bidens tax plan seeks to restore higher tax rates including top individual federal income tax which he wants to restore to the pre-Trump rate of 396 from 37 and corporate rates to 28. November 3 2021 Tax. The 2022 budget proposal says that it will reform the tax code to improve its administration and make the system more equitable and efficient.

How the Build Back Better Act Could Affect Your Tax Bill Depending on your income the Build Back Better Act recently passed by the House could boost or cut your future tax bills. This means even low-income families or families with no income. You will get half of that 3000 or 1500 as six monthly payments of 250 during the second half of 2020.

The Tax Cuts and Jobs Act came into force when President Trump signed it. For 2021 Bidens tax plan increased the child and dependent care credit qualifying expenses from up to 3000 per child to up to 8000 per child maximum 16000 for two or more dependents. Other changes include cutting the rates of income tax doubling standard deductions.

It lowered the corporate tax rate to 21 from 35 at the turn of 2018. The highest tax bracket is now 37 for big earners. This higher limit allows wealthy families to transfer more money tax-free to their heirs.

The Tax Foundations Biden tax plan tracker is tracking the latest Biden tax proposals to better inform policymakers journalists and taxpayers. President Biden said no one making under 400000 will see their federal taxes go up. The Trump tax plan doubles the estate tax deduction from the 2017 value of 549 million for individuals up to 1118 million.

Published Tue Jun 15 2021 814 AM EDT Updated Tue Jun 15 2021 1228 PM EDT. Unique to the child tax credit of 2021 under the American Rescue Plan stimulus relief bill is that the credit is fully refundable. Under the tax plan your company can pass through profits and losses on your personal income tax return and you will be able to deduct your first 20 percent of income tax-free.

Our tax tracker helps you stay up-to-date as new tax plans. The TCJA reduced the rate to 21. In 2021 well assume your childs age gets you 3000.

You will get the other half or 1500 when you file your tax return. If your income is. In 2020 you got a 2000 Child Tax Credit which turned into a 2000 refund.

Trump Tax Plan Lowers Corporate Tax Rate. The tax collector will indeed come for that money just not now. The Tax Cuts and Jobs Act which was introduced on November 2 in the House of Representatives includes some provisions that raise taxes and some that cut taxes so the net effect for any particular familys federal tax bill depends on their situation.

But a 401 k plan is. Biden will also apply a minimum 15 tax on corporate book earnings. Counting both tax increases and tax cuts the Biden plan would raise between 2 trillion and 3 trillion over a decade according to recent estimates by the Tax Policy Center and the American.

When one deducts charitable contributions for example from ones taxes it is a true deduction. Before 2018 the corporate tax rate was 35. Does Biden tax plan affect those with income below 400000.

It depends on your frame of reference.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)