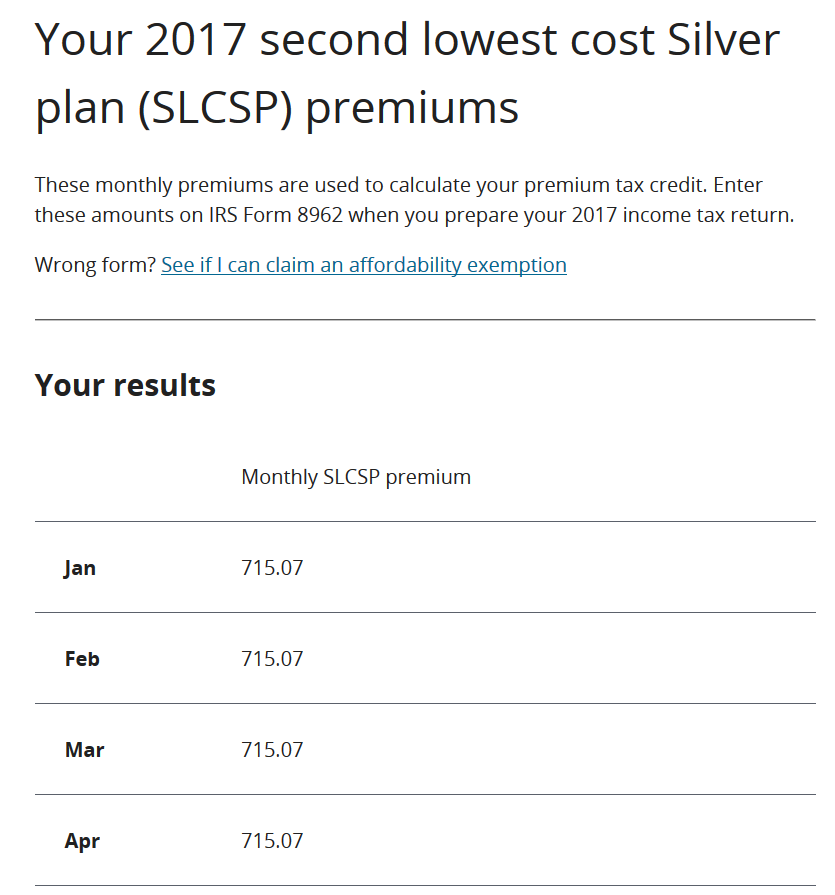

Second Lowest Cost Silver Plan By State 2017

The Second Lowest Cost Silver Plan SLCSP is used along with income and family size to calculate a households premium tax credit which is available to eligible individuals and.

Second lowest cost silver plan by state 2017. During Plan Year 2017 the federal CSR payments were withdrawn by the federal administration and were no longer a component of ConnectorCare cost-sharing. For 2017 the DC Health Link Benchmark Plan is the BlueChoice HMO Standard Silver 2000 and monthly. Tax Credit proposed rule released on July 8 2016.

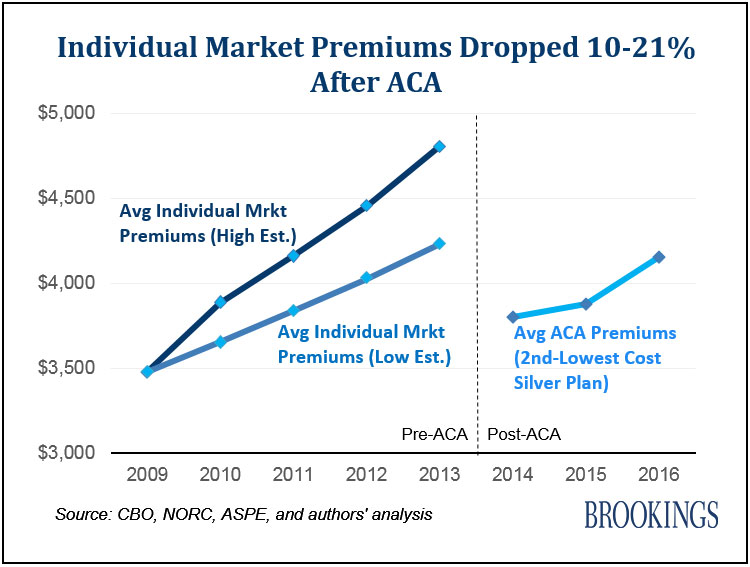

For example if the premium of the second lowest cost silver plan in 2017 is higher than it was in 2016 you will receive a higher subsidy. Get started Figure out your premium tax credit Claim an affordability exemption Claim an affordability exemption. The answers below apply to plan year 2017 before any of the proposed changes to the SLCSP determination would take effect.

You can check it out in the calculator below thats 2537 per year or 211 per month. Find the difference between what the government says you should pay and what youd actually pay. Marys County Somerset County Talbot County Washington County Wicomico County and Worcester County should refer to Table 1.

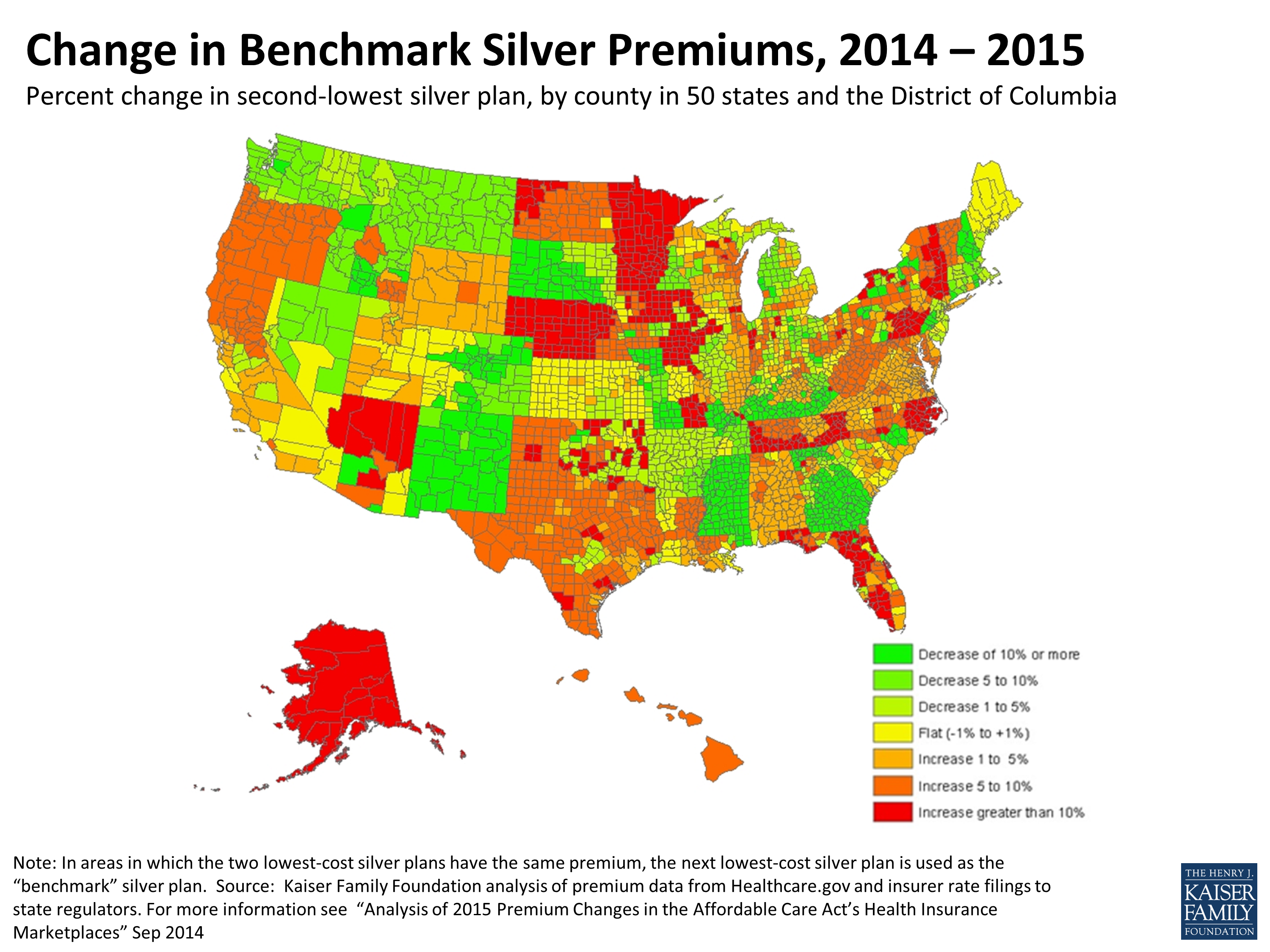

Go to the Marketplace website and pretend you are signing up for 2017 insurance. Table 1 below shows monthly premiums before applying a tax credit for the lowest-cost bronze second lowest-cost silver and lowest-cost gold plans insurers are offering on the ACA exchanges for 2019. If that second lowest cost silver plan premium changes the subsidy will change accordingly.

The second-lowest priced Marketplace health insurance plan in the Silver category that applies to you. For IRS Form 8965. Then find the Second Lowest Cost Silver Plan.

On the marketplace the second-lowest cost silver plan actually has a 585 monthly premium. To account for these lost federal funds carriers participating in ConnectorCare were permitted to load their Silver plan premiums netting higher APTC amounts. The Second Lowest Cost Silver Plan SLCSP in your states marketplace is used as the baseline plan for determining cost assistance.

To find this while searching the exchange sort the silver plans by price and find the one available to you and your family with the second lowest cost. Benchmark Plan is the Second Lowest Cost Silver Plan available to the family through the states health benefit exchange. SLCSP and lowest cost plan LCP across all 39 states using the using the HealthCaregov platform as well as state-level average SLCSP and LCP premiums.

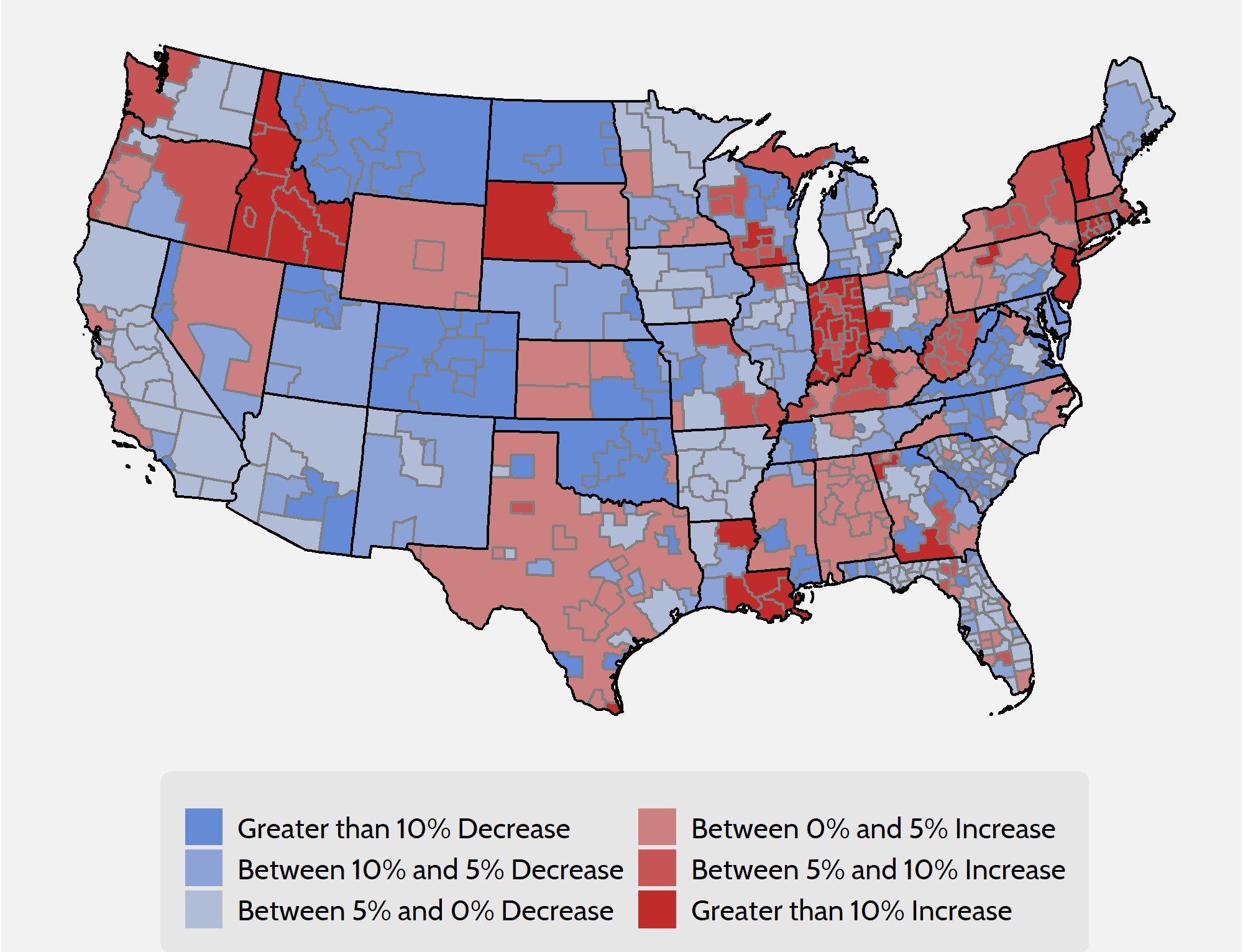

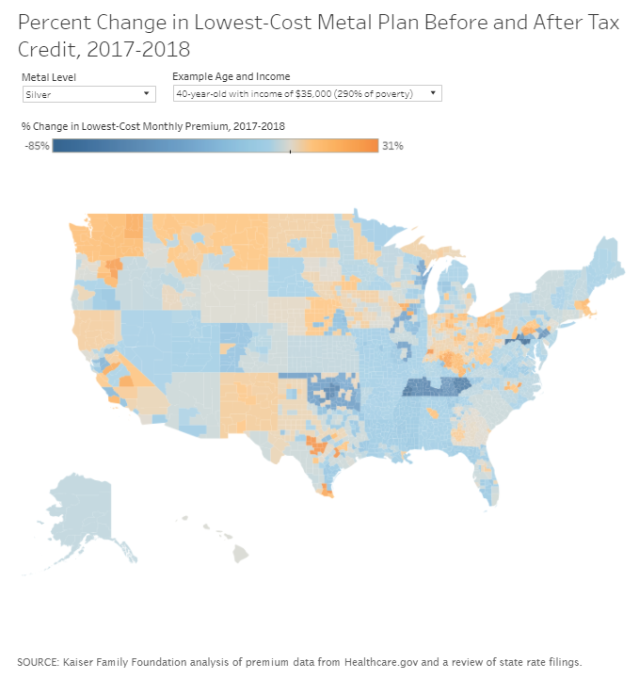

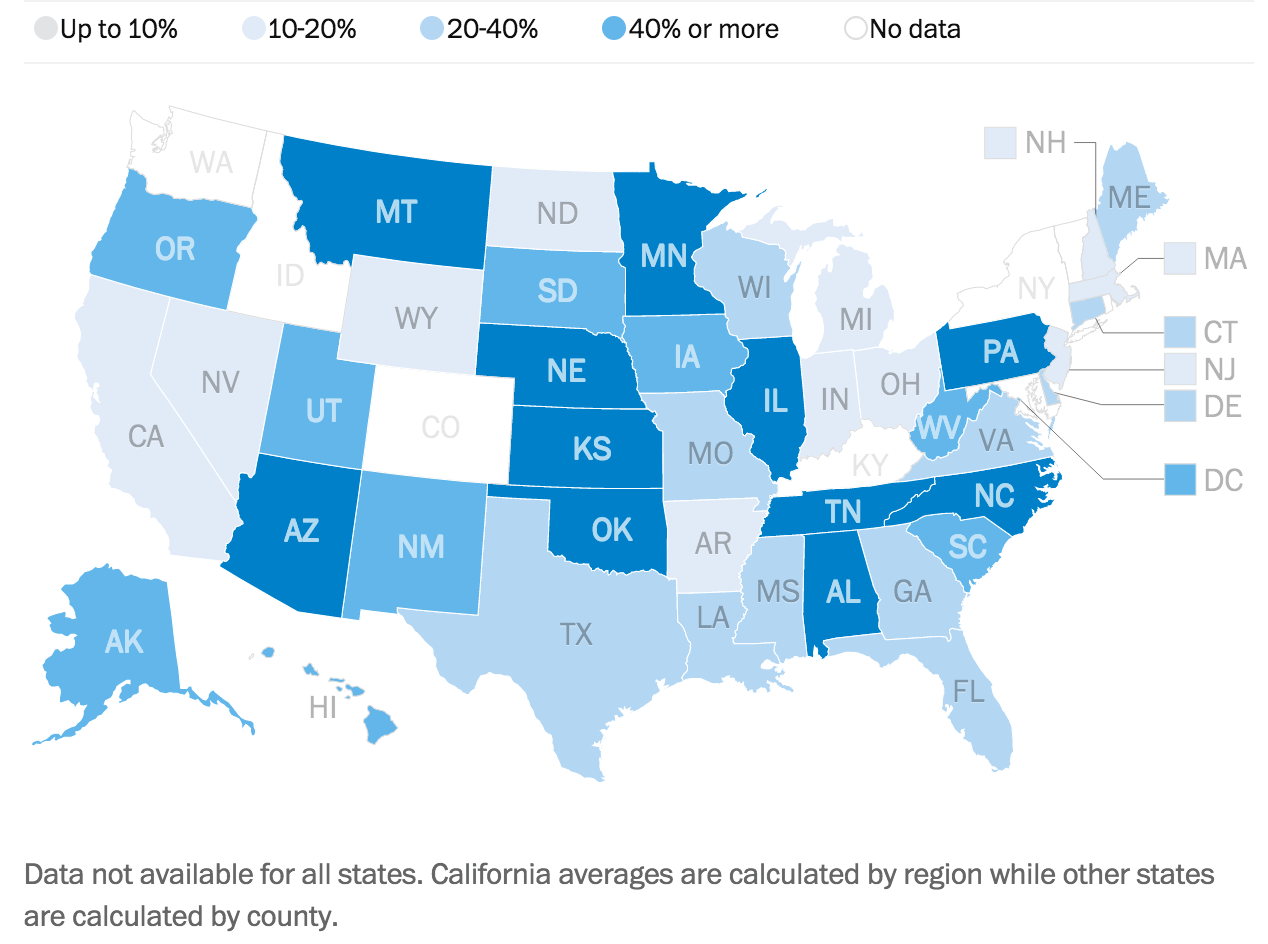

HealthCareGov only includes up to 2017. That was nearly double the 22 percent average increase across all the states that use HealthCaregov. County level premiums are weighted based on county enrollment for the respective.

The Second Lowest Cost Silver Plan is the silver plan with the second lowest cost and available in the area in which the taxpayer lives. The Premium Tax Credit is based on the Second Lowest. 2017 Monthly Premiums for Second Lowest Cost Silver Plans SLCSP by Coverage Family Type Families with Tax Dependents Ages 26-29 USE THIS TABLE IF YOU HAVE A TAX DEPENDENT CHILDREN AGES 26-29 ON YOUR POLICY COUNTY Individual Children Couple Children COUNTY Individual Children Couple Children.

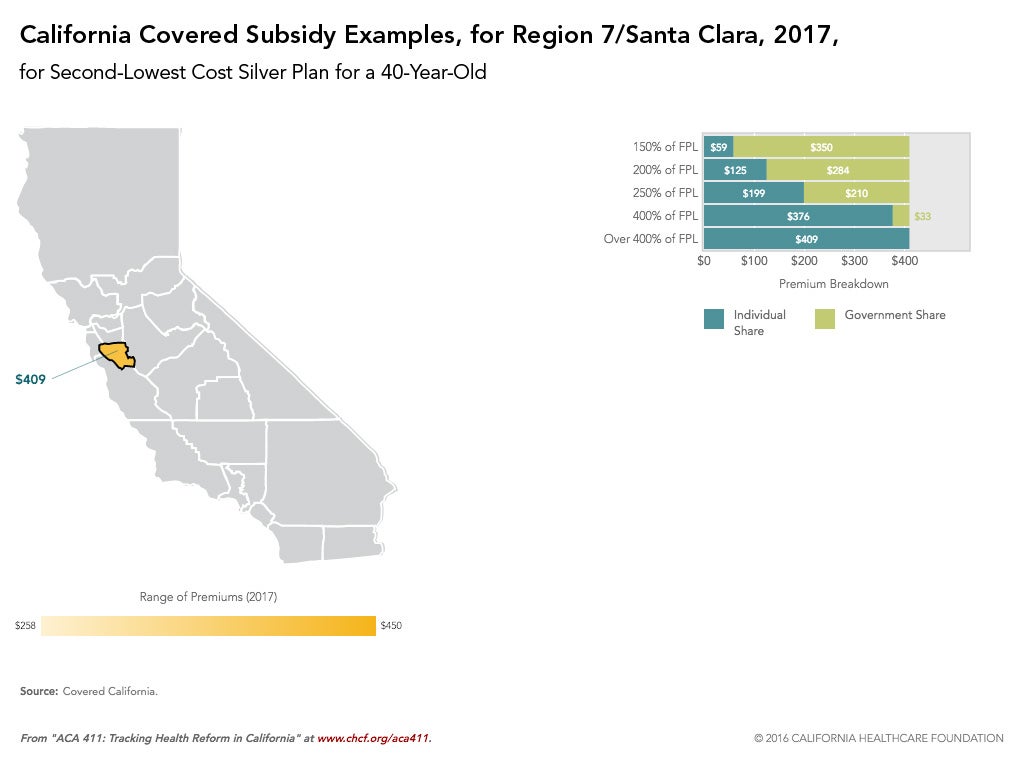

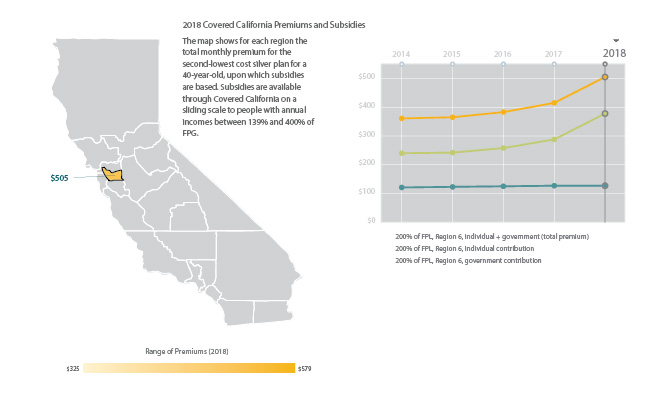

The silver premium shown in the calculator is the second-lowest-cost silver plan in your area. Subsidies are based on the cost of the second lowest cost silver plan available through the Marketplace. Benchmark Plan costs vary based on the age of each enrollee at the time of enrollment or renewal.

HHS reported that for a 27-year-old enrollee the average second-lowest-cost silver plan in the Texas exchange was 18 percent more expensive in 2017 than it had been in 2016 thats a little lower than the 2017 national average increase of 22 percent for second-lowest-cost silver plans. Get your second lowest cost Silver plan SLCSP premiums needed to complete your income tax form. So for instance if you qualified to have your tax credits capped at 95 of your household income you would receive the exact amount of credits for a plan with the same premium as the SLCSP less for higher-cost plans and more.

Get your lowest cost Bronze plan and second lowest cost Silver plan SLCSP premiums needed to complete the form. But in terms of actual dollar amounts the average second-lowest-cost silver plan in Illinois for a 27-year-old enrollee before subsidies was 298month in 2017 very much on par with the 296month average across all HealthCaregov states. Average Monthly Premiums for Second-Lowest Cost Silver Plan and Lowest Cost Plan for States Using the HealthCaregov.

2017 Second Lowest Cost Silver Plan SLCSP Worksheet 4 Residents of Allegany County Caroline County Cecil County Dorchester County Garrett County Kent County Queen Annes County St. You need to know your second lowest cost Silver plan SLCSP premium to figure out your final premium tax credit. The Health Insurance Marketplace Calculator will also show you the price of the lowest-cost bronze.

It may not be the plan you enrolled in. Benchmark Plan costs vary based on the age of each enrollee at the time of enrollment or renewal.

.jpg)