Pay As You Earn Repayment Plan

However eligibility is quite narrow and not many borrowers are able to qualify.

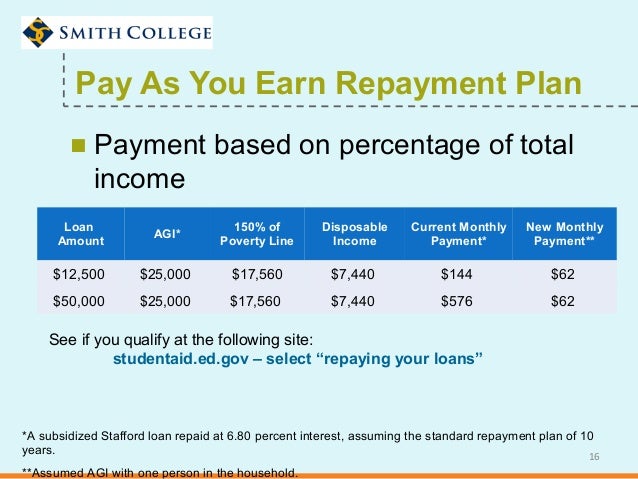

Pay as you earn repayment plan. Pay As You Earn PAYE and Revised Pay As You Earn REPAYE are both federal income-driven repayment plans that extend your student loan term set payments at 10 of your discretionary income and. Pay-as-you-earn repayment PAYE is an income-driven repayment plan that bases student loan payments on 10 percent of the borrowers discretionary income which is defined as the amount by which adjusted gross income exceeds 150 of the poverty line. The Revised Pay As You Earn REPAYE plan is a form of income-driven student loan repayment.

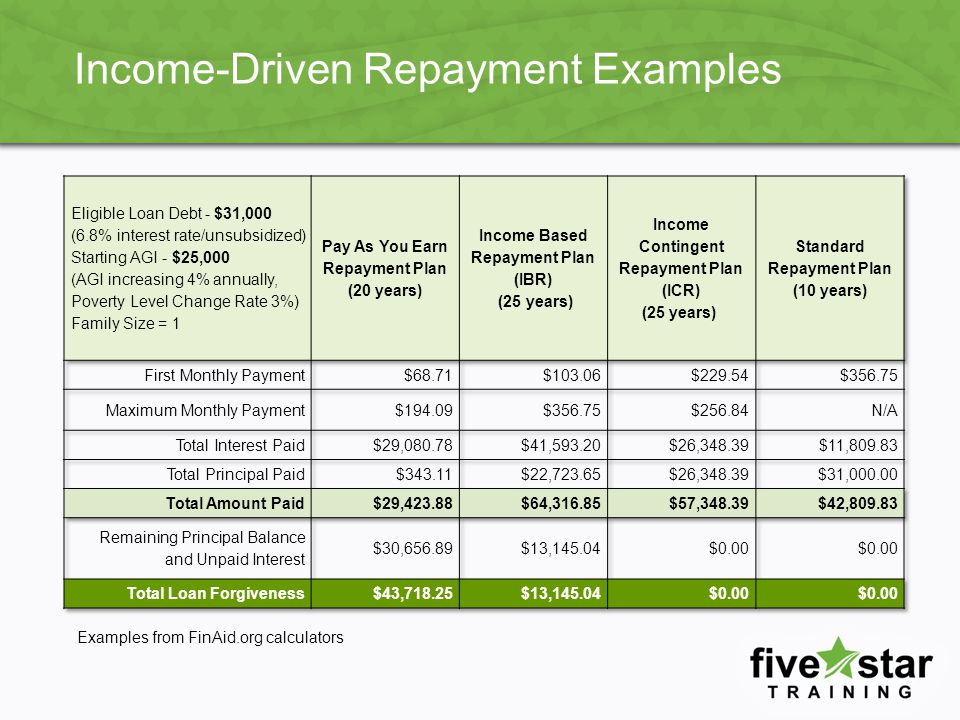

Pay As You Earn Repayment Calculator. When you put your. This repayment plan was an initiative to help 16 million students who are dealing with student loan debt.

The PAYE plan can only be used for federal student loans offered by the US. This calculator determines the monthly payment and estimates the total payments under the pay-as-you-earn repayment plan PAYE. The Department of Education DOE has four income-driven repayment plans where your income determines your monthly payment instead of your payment being determined by how much you owe.

The Pay As You Earn plan or PAYE plan is one of several income-driven repayment plans available for federal student loan borrowers. Pay-as-you-earn or PAYE repayment plan was introduced by the Obama government in 2011. After that period has passed any remaining balance may be forgiven.

Pay As You Earn is an income-driven repayment plan that caps federal student loan payments at 10 of your discretionary income and forgives your remaining balance after 20 years of repayment. It caps your monthly federal student loan payment at 10 percent of your discretionary income. Pay As You Earn or PAYE is a federal student loan repayment plan that is available to some borrowers with newer federal loans.

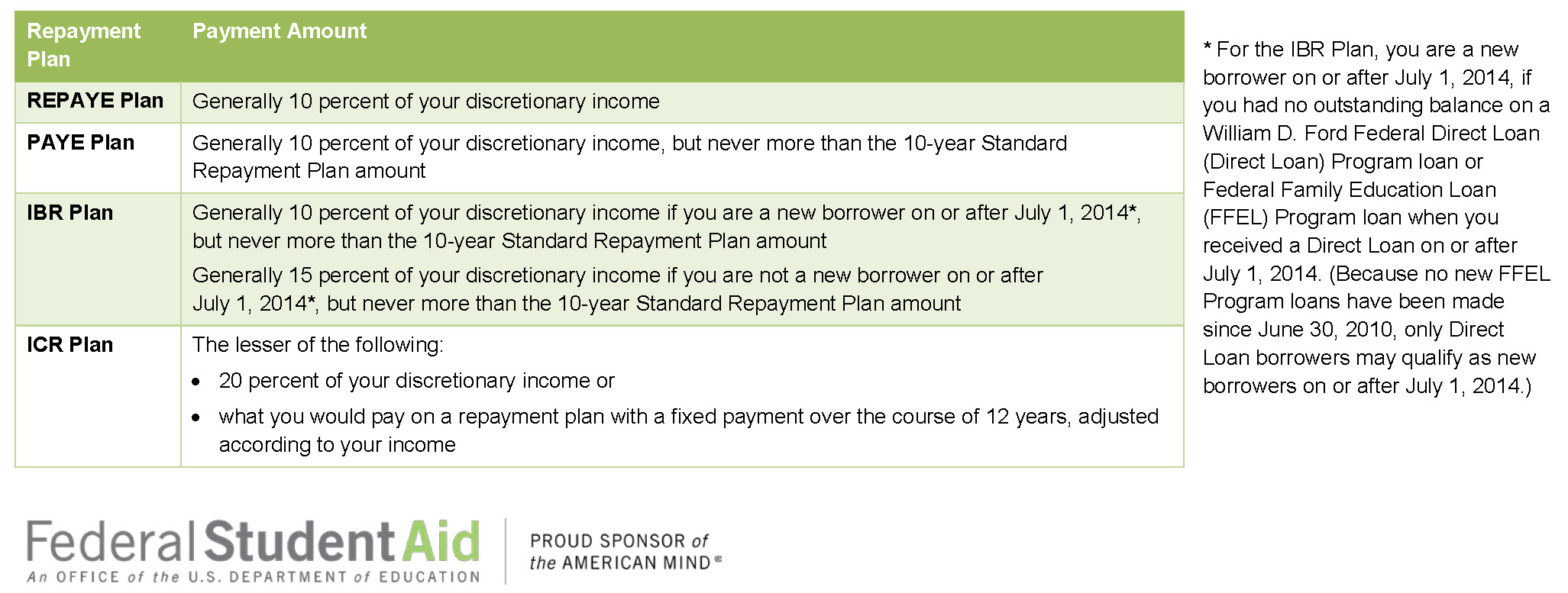

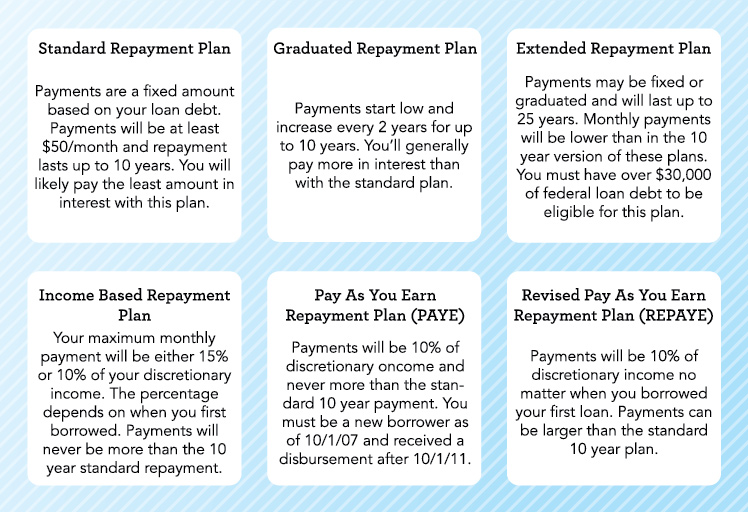

The information provided on this page is updated as of 0612021. 14 rows The Revised Pay As You Earn Plan allows for loan forgiveness of any remaining balance after 20. Income Based Repayment Plan Income-Contingent Repayment Plan Pay As You Earn Repayment Plan Pay As Your Earn Revised Repayment Plan.

If your payments increase significantly you can switch only to the Standard Plan to complete the principal payoff of your consolidated loan. When your loans are on the standard repayment plan you pay enough each month to get out of debt in 10 years. Federal Student Aid.

One of the best plans is Pay As You Earn PAYE. Thats where an income-driven repayment plan like PAYE can help. But if you owe a lot in student loans andor have a limited income you might struggle to afford these payments.

Pay As You Earn repayment plan. IDR plans include Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based Repayment IBR and Income-Contingent Repayment ICR Plans. Borrowers who opt into this plan pay 10 percent of their discretionary income for a total of 20 or 25 years depending on the specific type of loans that you have borrowed.

Another repayment program Income-Based Repayment IBR is currently available for all student loan borrowers and caps your. Under this repayment plan the borrower can pay back their loan in flexible monthly payments. The remaining debt is forgiven after 240 payments 20 years.

There are four income driven repayment plans. Under these plans your monthly payment is based on your income and family size. Your actual repayment terms may vary.

The Pay As You Earn Plan is one of the flexible repayment options available when you consolidate your student loans. The Pay As You Earn PAYE repayment plan is an income-driven repayment IDR plan for some federal student loans. Income-driven repayment plans can help lower your monthly student loan payment.

Lets see how different your payments could be.