Nys Deferred Compensation Plan

The NYSDCP is a supplemental retirement plan which is also known as a 457b plan and their mission is to.

Nys deferred compensation plan. The state of New York is working on overhauling a wide range of investment options in its New York State Deferred Compensation Plan reported to be worth 194 billion. NYSDCP offers both traditional pre-tax and Roth accounts and you can create your. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

Welcome to the New York State Deferred Compensation Plan. We are very excited to announce that the New York State Deferred Compensation Plan 457b will be hosting two educational webinars on Thursday November 19 th for all employees who wish to attend and who are thinking of enrolling into the Plan. These nonqualified plans are.

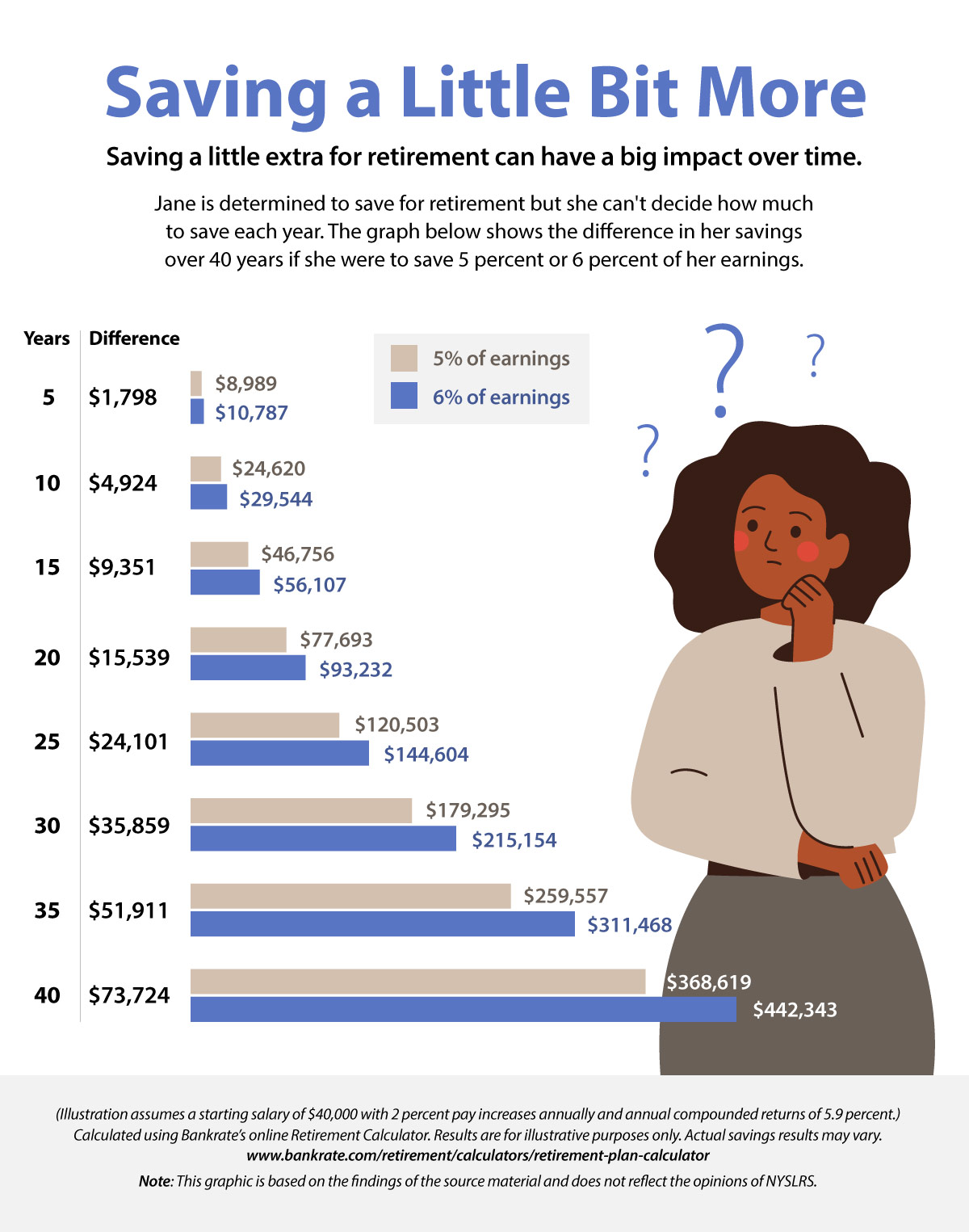

New York State Deferred Compensation Plan Albany is overhauling many investment options in the 194 billion planThe plans governing board approved the changes that will lead to replacing some. The amount you contribute to the Plan is deducted from your pay and any investment returns grow on a tax-deferred basis. You can contribute a portion of your salary through payroll deduction before federal and New.

When you participate in NYSDCP your contributions are automatically deducted from each paycheck. I am very new to all of this so all help is welcome. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings.

I provide education and guidance for State of NY employees and employees of local Governments in regards to. The New York State Deferred Compensation Plan. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

The governing board of this approved change which should lead to many investment options being replaced either for performance reasons a desire to. Offered only by state and local governments and some nonprofits 2. The Plan is a voluntary long -term retirement savings program designed for your retirement needs.

Its like a 401k or 403b in that contributions are made through payroll deductions and are tax deferred but they differ in a few other important ways. We gratefully acknowledge the cooperation of the New York State Deferred Compensation Plan who provided the information contained in this chapter and who are entirely responsible for its contents. The NYS Deferred Compensation Plan is a voluntary retirement savings program created by federal and state law that permits government employees to defer up to 100 of compensation after any required salary deductions but not more than the allowable maximum for the given year.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. New York State Deferred Compensation. Contributions to the Plan.

Not covered by ERISA so participants can. The Plan is governed by Section 457b of the Internal Revenue Code. The Board hereby establishes the following procedures to be followed when.

NYS Deferred Compensation Plan. A lesser-known nonqualified deferred compensation plan is the 457 plan. It is the first time in my life I have felt like I have an actual career and even though I plan to move.

The New York Power Authority Deferred Compensation Plan Plan is a voluntary retirement savings program that allows you to save and invest today for your retirement. Self-Help Guide 8-2 Overview The Deferred Compensation Plan the Plan is a voluntary retirement savings program. The Board enters into contracts with asset managers financial institutions and financial and other professional services to ensure proper administration of the Plan in accordance with Part 9003 of the Rules.

I have just turned 26 and recently starting working for NYS. The New York State Deferred Compensation Plan NYSDCP is the 457b plan created for New York State employees and employees of other participating public employers in New York. The minimum contribution to the Plan is 1 of your gross pay at.

Justjared5 08-23-2012 618 PM Post 3294629 0. 2007 - Present14 years. New York State Deferred Compensation Plan.

A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings. I guess the first thing to do is give a description of where I am at in all of this. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.