Tax Plan Standard Deduction

This deduction is allowed from salary income before arriving at Gross Total Income.

Tax plan standard deduction. That deduction amount is going from. Standard deduction allows salaried individuals to claim a flat deduction from income towards expenses that would be incurred with relation to his or her employment. Most taxpayers claim the standard deduction on their federal tax returns.

15 lakhs us 80C and investment in NPS of Rs. Budget 2018 introduced the provision of standard deduction for both salaried employees and pensioners. TurboTax HR Block TaxSlayer and more.

46800 lesser than the new regime. Income tax deductions equivalent to 100 per cent of the income for first five years and 50 percent of the income incurred via such transactions for the coming five years depending on the rules of the land can be claimed by all the assesse. 5 rows Tax deductions lower your tax burden by lowering your taxable income and you can either claim.

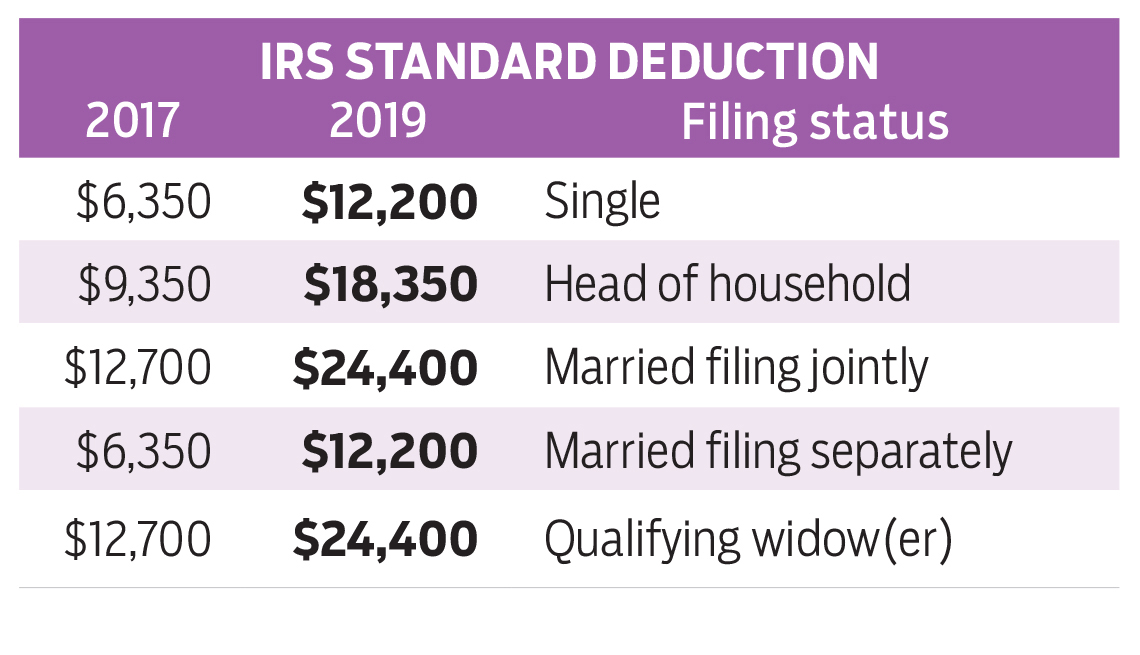

The Tax Cuts and Jobs Act TCJA increased the standard deduction to 12000 for single filers up from 6500 pre-TCJA 24000 for joint filers up from 13000 pre-TCJA and 18000 up from 9550 for heads of household. Standard deduction for salaried employees made a comeback in Union Budget 2018. Before Budget 2018 salaried individuals could claim reimbursement for travel expenses up to.

The new child tax credit was made fully refundable in 2021 and increased to up to 3600. In addition to the tax inflation adjustments the IRS also altered standard deductions. The salaried class will now be able to claim a standard deduction of Rs.

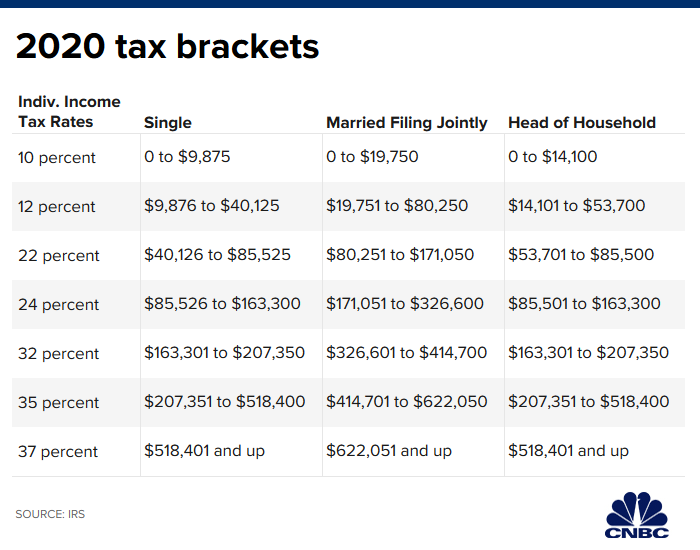

The law allowed full expensing of short-lived capital investments rather than requiring them to be. In case he also claims home loan interest deduction of Rs. While the above rates and brackets are at the federal level different states might have varying brackets and rates.

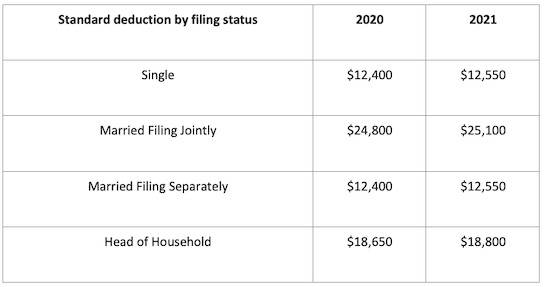

200000 subject to specified conditions All assessees. 25100 for 2021 to 25900 for 2022 for married couples filing jointly. Business Tax Corporate Tax Rate.

12550 for 2021 to 12950 for 2022 for single filers and married people who file separately. After deducting the municipal or property taxes Net Annual Value is derived. The standard deduction for AY 2020-21 under Income from House Property is 30.

According to a recent study 63 percent of taxpayers with incomes between 100000 and 200000 itemized in 2017 and only. Simply put the government and state tax agencies allow taxpayers to deduct a certain amount of their income from being subject to income taxes. 15 rows Therefore it is evident that the taxable income of salaried employees has been reduced since the.

40000 for FY 2018-19 Limit of deduction varies from section to section. The major difference between the two is on account of change in the tax rates under various slab along with foregoing of certain benefits under the new slab rateIf the taxpayer is opting for the new tax regime below are the main benefits that the taxpayer has to forgo in order to pay tax under the new rates. These deductions are allowed after calculating Gross Total Income.

What is the standard deduction. Owners of pass-through. Only a salaried individual or an individual claiming the pension can use it.

From the NAV the standard deduction of 30 percent is allowed and from the resultant figure - Net Rental Income interest on borrowed capital or home loan is deducted. Your retirement distribution strategy should consider your income tax. Standard deduction of Rs 50000 House rent allowance Leave travel.

2 lakhs or HRA exemption the old tax slab rate would be Rs. If a tax-payer claims a deduction of Rs. The table below shows the standard deduction amounts for 2021.

You reduce it from the salary income of the individual to lower the taxable amount. In the context of a let-out house property the rental value is known as Gross Annual Value. Current Tax Year 2021 Standard Tax Deductions.

It refers to a flat deduction of Rs. Like us 80C limit is Rs. 25 lakhs standard deduction of Rs.

The law created a single corporate tax rate of 21 and repealed the corporate alternative minimum. However standard deduction under the head of salaries is a default deduction. Standard deduction 30 of the annual value gross annual value less municipal taxes All assessees.

The limit of standard deduction is Rs. 18800 for 2021 to 19400 for 2022 for heads of household. 40000 for FY 2018-19 on taxable income providing tax relief to select group of individuals.

This amount for a single taxpayer in 2021 is 12550 - this has a few implications. 25A2 Standard deduction of 30 per cent of arrears of rent or unrealised rent received. The best tax software for 2021.

/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)