How Does New Tax Plan Affect Me

The new tax plan nearly doubled the standard deduction for all filers.

How does new tax plan affect me. This deduction was worth up to 20 of your business income but in fact is so complex and restricted that most business owners do not even know whether they have been. If youre a single filer or if youre married filing separately your standard deduction for 2020 is 12400. Here in the US we have a tax code that is thousands of pages long and can be very overwhelming.

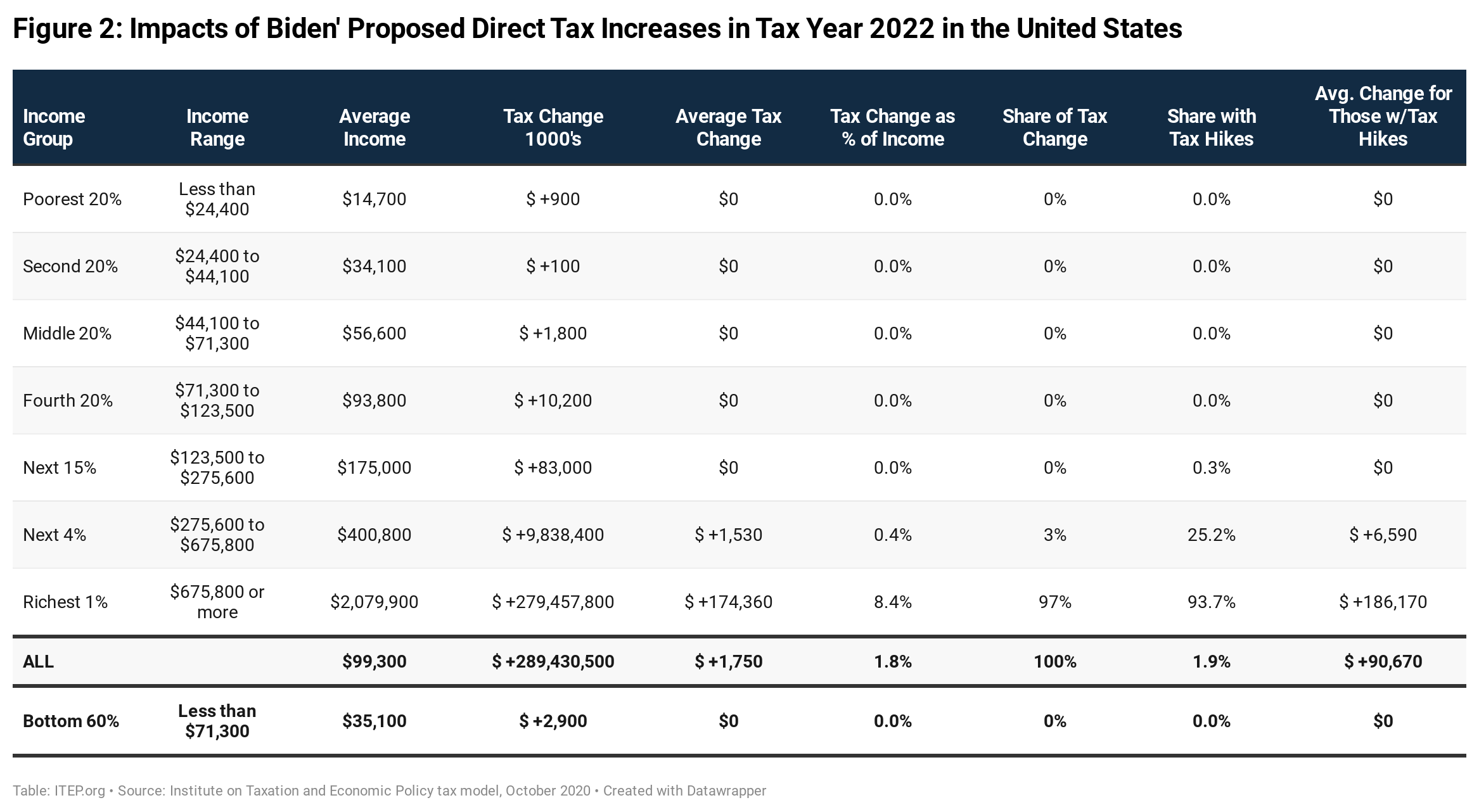

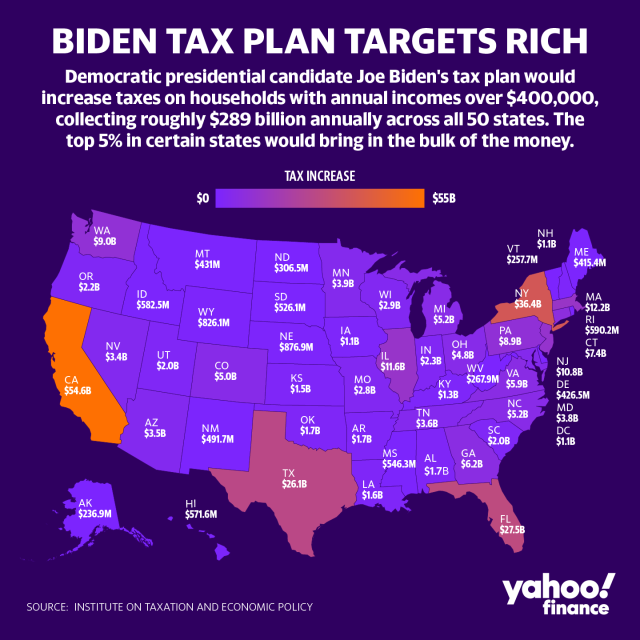

The Biden tax plan would replace the current tax deductions for contributions to traditional 401ks and IRAs with a new across-the-board 26 tax credit. The graphs below show that the tax cuts in the bill are tilted dramatically in favor of the richest California residents while the tax increases fall more heavily on lower-income California families. This calculator will be updated as.

Weve created a tax calculator that helps demonstrate how the Tax Cuts and Jobs Act TCJA and other major tax reform proposals could affect taxpayers in different scenarios. The enhanced child tax credit for 2021 is worth 3000 per child between ages six and 17. Right now with Bidens new pending tax plan there is a lot of uncertainty regarding corporate.

Then how does Trumps tax plan affect the middle class. For 2021 Bidens tax plan increased the child and dependent care credit qualifying expenses from up to 3000 per child to up to 8000 per child maximum 16000 for two or more dependents. If youre a single filer or if youre married filing separately your standard deduction for 2020 is 12400.

The new tax bill increases Julie and Nicks standard deduction to 24000 up from 12700. If you are an S-corp partnership or sole proprietor the proposed tax plan will eliminate your Qualified Business Income Deduction commonly referred to as the pass-through deduction. How Bidens Proposals Would Affect You.

If the bill is signed before the end of the year youll see some of the impact. Nick 66 also gets the extra 1300 standard deduction available to filers 65 and older. It depends on your frame of reference Published Tue Jun 15 2021 814 AM EDT Updated Tue Jun 15 2021 1228 PM EDT.

A cut in the estate tax the new deduction for businesses that are mostly owned by the richest 1 percent and cuts in the top income tax rate to name a few. Hence make sure you plan your taxes make tax-free investments like ELSS claim all the eligible deductions to get that TDS refund. Then you will receive a refund of the TDS deducted earlier.

President Joe Bidens 2022 budget proposal raises the top income tax rate up to 396. They pay taxes on a larger amount. For children under age six an extra 600 will be included in your familys tax credit payments.

Heres a look at some of the highlights in the new tax plan and how theyll affect you. For corporations he would raise the tax rate to 28 from 21 impose a new minimum tax and raise taxes on foreign income. For individuals he would raise the top rate to 396 from 37 create.

New Tax Regime The basic exemption limit is Rs 25 lakhs for an individual. However the couple loses 16200 in personal exemptions they took in 2017. The payment will serve as the first of six monthly payments of 250 or 300 depending on.

You can also input a custom scenario. Taxpayers with an adjusted gross income over 1 million will also have to pay this rate on long-term. When does it go into effect.

Does Biden tax plan affect those with income below 400000. Tax benefit of 54600 46800 us 80C 7800 us 80D is calculated at highest tax slab rate of 312 including Cess excluding surcharge on life insurance premium us 80C of 150000 and health premium us 80D of 25000Tax laws are subject to conditions under Section 80C 80D1010D 115BAC and other provisions of the Income Tax Act1961. The first installment payment of the advance child tax credit is scheduled to hit bank accounts on July 15.

These temporary individual provisions are sometimes called the middle-class tax cuts but most of their benefits actually go to the rich. Further remember you must file the income tax return on or before the due date to claim the tax.

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)