Nyc Deferred Compenstaion Plan

Interest rate declared quarterly and subject to change.

Nyc deferred compenstaion plan. You can also enroll by completing a DCP Enrollment Form. When you change jobs. Nonqualified deferred compensation plans dont have limits unless imposed at the plan level.

The New York State Deferred Compensation Plans paycheck impact calculator can help you estimate how increased savings would affect your paycheck. Executives can only contribute 19500 in a 401 k in 2021 increasing to 20500 in 2022 plus 6500 if age 50 or older. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. You can increase or decrease your deferral percentage as well as make investment changes in the 457 Plan the 401 k Plan or both. WHAT DOES DEFERRED COMPENSATION MEAN TO ME.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. When you have a 401 k and switch jobs you can roll the account over to an IRA. Therefore a participant should consider other ways to cover unexpected expenses.

The result is that the amount that you are investing for your retirement is greater than the. 1 For FrontLine Deferred Compensation Plans the interest rate may be less depending on the plan selected. You dont have to have a Deferred.

The New York City Deferred Compensation Plan DCP allows eligible New York City employees a way to save for retirement through convenient payroll deductions. NYCDCP is a retirement savings plan which lets you save for the future through easy payroll deductions. Deferred Compensation Retirement Planning Brochure.

Featuring the Retirement Calculator youll see your estimated monthly income goal in retirement and progress toward that goal. You can view and make changes to your Deferred Compensation Plan account at any time by accessing your account online at nycgovdeferredcomp. Selecting your deferral percentage the amount to be deducted from each paycheck.

1 via the Plans website at httpwwwnycgov wwwnycgovdeferredcomp or 2 by filling out a paper form and returning it to the Plans administrative offices. A 457 Plan and a 401 k Plan both of which offer pre-tax and Roth after-tax options. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings goals. This is an effective annual yield. 6 While the States memo does not mention it the Citys.

A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings goals. The minimum loan amount available from either the 457 or the 401k Plan is 2500. NYC Deferred Compensation Plan.

How to enroll in Your New York City Deferred Compensation plan You can enroll in the Deferred Compensation Plan in two ways. You will need your Social Security Number and PIN to enroll in the Plan online. 2 Nationwide offers the Participant Solutions Center through our affiliate Nationwide Securities LLC.

The products and services offered by Nationwide Securities LLC are separate. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings goals. For more information please visit the OLR website.

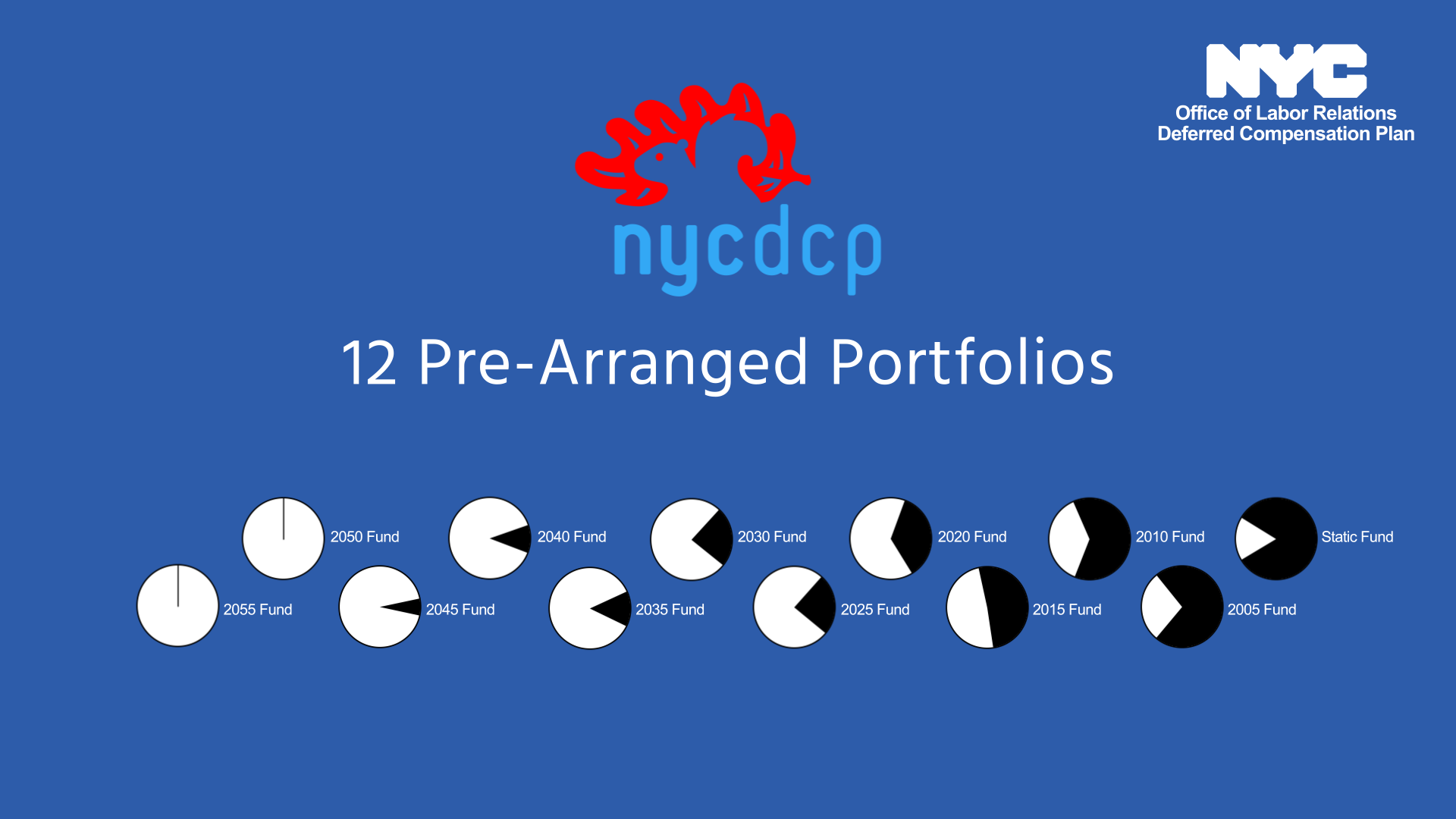

DCP is comprised of two programs. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings goals. Formally known as nonqualified deferred compensation plans the plans are a way to let highly paid employees typically those making at least 115000 but often much more stash away more.

The State advises that nonresidents are taxable on the amount of deferred compensation that they include in federal adjusted gross income and that they derived from New York sources as an employee or ownerpartnermember shareholder of a businessin the current year or a previous year. This plan is administered by The Office of Labor Relations OLR. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings goals.

Designating your beneficiaries. This booklet briefly describes the New York City Deferred Compensation Plan NYCDCP an umbrella program consisting of the 457 Plan and the 401k Plan. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

Choosing your investment allocation. The New York City Deferred Compensation Plan DCP allows eligible New York City employees a way to save for retirement through convenient payroll deductions. The impact on your take-home pay would be even less if you save in a tax-deferred plan because you wont have to pay income tax on those earnings until after you retire.

Deferred Compensation Plan Welcome to the New York City Deferred Compensation Plan. Whether youre on the go a little or a lot the NYC DCP mobile app allows you to view and manage your 457 401 k or NYCE IRA accounts whenever and wherever you want. The following how-to videos will take you through the various steps on.

The Maximum Loan Amount a participant may obtain is the lesser of.