Tax Plan Personal Exemption

Personal exemption phase out amount depends on the AGI.

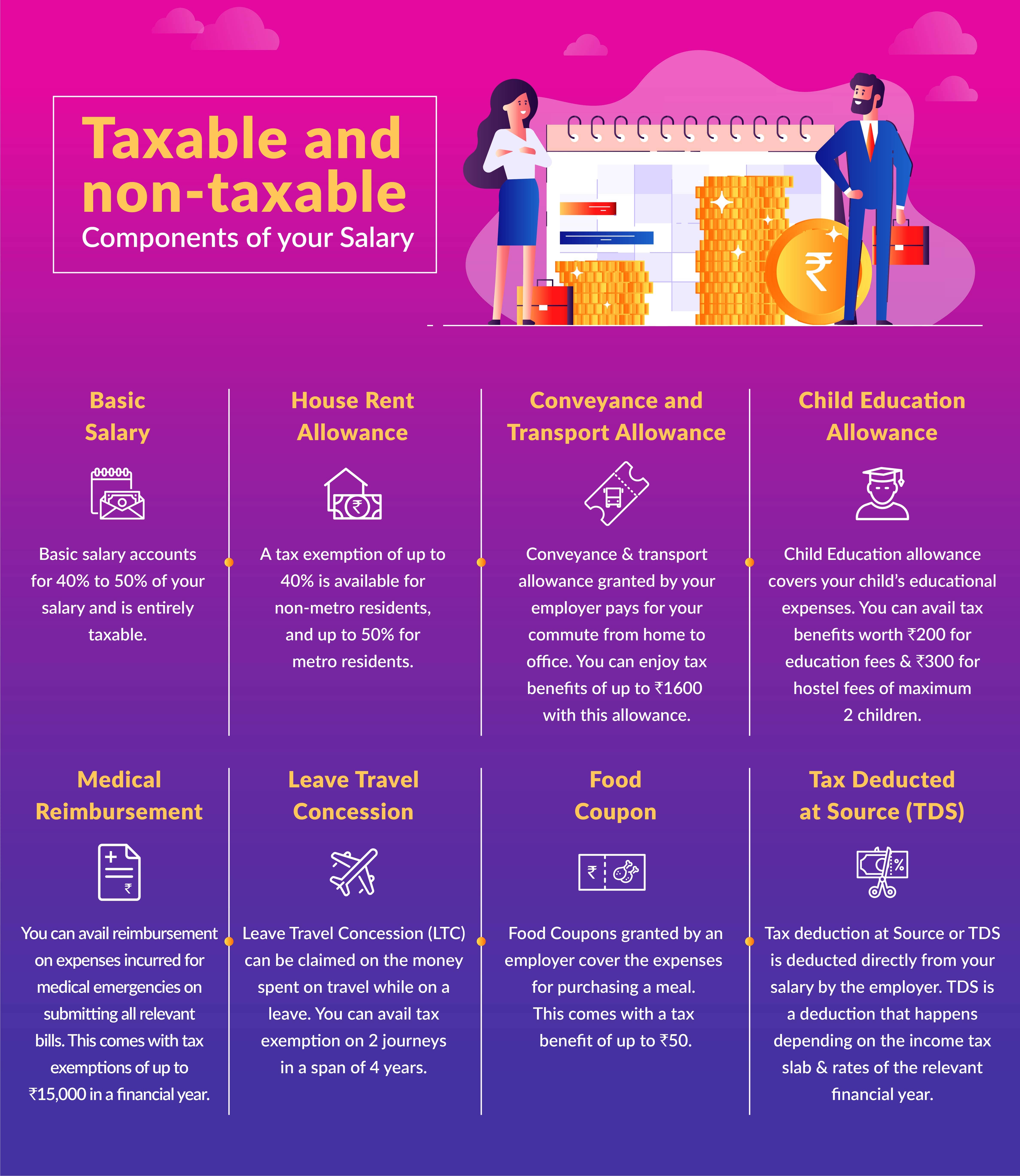

Tax plan personal exemption. Actual HRA received in the financial year. As per section 80D the income tax exemption is applicable for those who have taken a medical insurance for themselves family as well as their parents. This exemption will be available on electric cars for both personal and business use.

Following free meals shall be exempt from tax a Food and non-alcoholic beverages provided during working hours in remote area or in an offshore installation. In 2016 the personal exemption was 4050. Furthermore a super senior citizen enjoys the benefit of a higher basic exemption limit of Rs 500000.

12060000 The amount a person. Personal exemptions were one form of deduction you could use to reduce your taxable income prior to 2018s Tax Cuts and Jobs Act TCJA. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

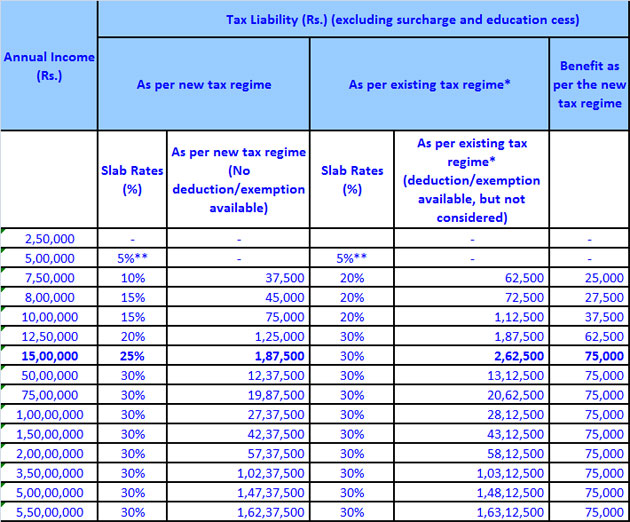

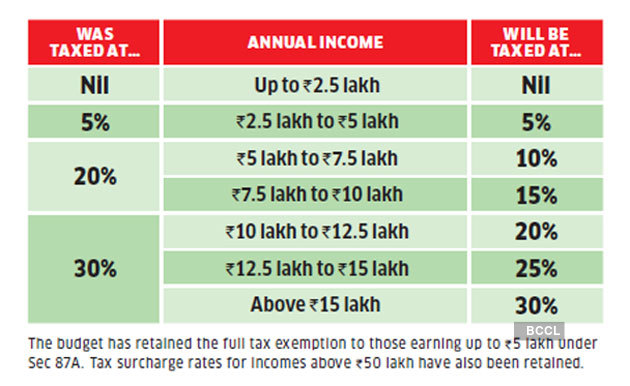

The Personal Exemption is still used in other areas of the tax code ie. Tax reduced from 10 to 5 for Income from Rs 250000 Rs 500000 leading to tax saving of up to Rs 12500. In 2016 a married couple filing jointly began losing their personal exemptions with 311300.

For people with net taxable income below Rs 35 lakh the tax rebate has been reduced to Rs 2500 us 87A. For tax year 2017 the taxes you filed in 2018 the personal exemption was 4050 per person. The personal exemption was available to all taxpayers with a couple of.

50 percent of your salary if your accommodation is in metro cities Mumbai Chennai Delhi Kolkata or else 40 percent for other cities. Tribal area allowance given in a Madhya Pradesh b Tamil Nadu c Uttar Pradesh d. For setting the gross income limitation for a qualifying relative.

Rent paid minus 10 percent of your salary. Regardless of your filing status is you qualify for the same exemption. Trumps plan would increase the standard deduction from 6300 to 15000 for single filers and from 12600 to 30000 for married couples filing jointly.

The current tax code sets a 0 Personal Exemption amount for the purposes of calculating taxable income effectively removing the Personal Exemption for tax filers. This leads to a tax saving of Rs 5000 for a senior citizen and Rs 25000 for a super senior citizen. 2 Exempt from tax.

The basic exemption limit for a regular taxpayer is Rs 250000. These amounts for the year 2018 is Increased to 4150 which was an increase of 100 to the previous year amount. Both Trumps campaign tax plan and the House Republicans June 2016 tax plan would increase standard deduction amounts end the additional standard deduction for senior and blind filers and eliminate personal exemptions.

The TCJA suspended this tax benefit howeverat least for the time being. B Tea Coffee or Non-Alcoholic beverages and Snacks during working hours are tax free perquisites. 200 per month to Rs.

Personal Tax Exemption. Personal tax exemption is modified for each year according to the inflation. For tax year 2022 participants who have self-only coverage in a Medical Savings Account the plan must have an annual deductible that is not less than 2450 up 50 from tax year 2021.

Amount exempt from tax varies from Rs. You effectively lowered the amount of income tax youd have to pay by reducing your taxable income. Any such allowance either to meet his personal expenses at the place of office or employment or at the place where he ordinarily resides or to compensate him for the increased cost of living.

For a senior citizen the basic exemption limit is Rs 300000. Thus a married couple with three children received a maximum exemption of 20250 or 4050 for each of the five family members. That means that an individual used to be able to subtract 4050 from their taxable income and a family of five used to be able to subtract 20250 5 times 4050.

A personal exemption was a specific amount of money that you could deduct for yourself and for each of your dependents. 10 surcharge on income tax if the total income exceeds Rs 50 Lakhs but less than Rs 1 crore. When AGI amount increases it begins to phase out.

Under Section 80EEB of Income Tax a tax deduction up to Rs 15 lakh is available on the interest amount on loan for an electric vehicle. The exemption was available to all people within a household and served to lower the taxable income for a family or individual. Individual Income Tax The House GOP tax plan would consolidate the regular standard deduction additional standard deductions for age or blindness and the personal exemption for tax filers into new standard deduction amounts of 12000 for single filers 18000 for head of household filers and 24000 for joint filers.

In 2017 the personal exemption per person was 4050. The limit of 80D exemption is Rs25000 for the premium paid for familyself. Under Section 80D of IT Act one can claim the deduction on the medical expenses.

NO RGESS Tax exemption from FY 2017-18.

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)