Mutual Of Omaha Plan F

This plan is fairly simple.

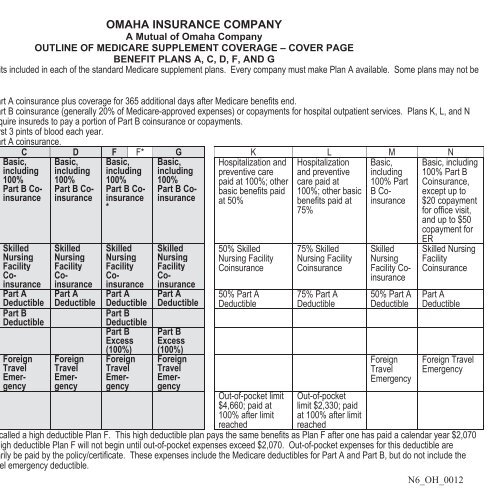

Mutual of omaha plan f. While Medicare can cover you for many of your hospital expenses and doctors visits it still leaves a lot of things for you to pay and with Mutual of Omaha Medicare Supplement. Mutual Of Omaha Plan F. Plan F coverage also includes your other doctor visits for illnesses and injuries.

Deductibles for Medicare parts A and B. Mutual of Omaha Dental PPO. Like Plan C Plan F also covers Medicare part B.

In particular we recommend Plan G and Plan N. Out-of-pocket expenses are covered for any hospital and outpatient medical service meaning no deductibles or coinsurance need to be met. These two plans both offer you lots of coverage and they are both cheaper than Plan F.

You donât have to deal with any copays coinsurance or deductibles when you have a Plan F. Its extremely comprehensiveit picks up where your part B plan leaves off covering the 20 part B doesnt pay. Mutual of Omaha Medigap Plan F claims about 40 percent of the Medicare Supplement market and protects you against deductibles coinsurance and even cases that Medicare itself wont cover.

Why Medicare Supplements are so Popular. Plan F is the most popular Anthem Mutual of Omaha Medicare Supplement plan. No other standardized Medicare Supplement plan offered in Indiana offers more complete protection for your uncovered Part B medical expenses than Plan F.

Medicare Part B first pays 80. This includes Medicare Supplement Plan F and Plan C. Plan G 233 deductible then 100 coverage.

And due to Federal law no matter what company you choose your plan F benefits will be the same. If you find that Mutual of Omaha Medicare Supplement Plan F is a good option for you then we suggest looking at some of the other plans that share some similarities. Copays and coinsurance related to Medicare parts A and B.

In 2020 Plan F was discontinued due to new legislation prohibiting the sale of plans covering Medicare Part. The Most Popular Plans. Plan F is widely considered one of the most complete Medigap plans covering almost every gap found in Original Medicare.

Medicare Supplement Plan F. Mutual of Omaha Medicare Supplement Plan F in Florida is one of the Medicare Supplement plans that you should look into when you compare benefits and options. Part A hospital coinsurance.

Plan N 233 deductible then 20 copay for outpatient visits. Emergency caregiving during overseas travel. Medicare Supplement Plan F is one of the most popular Medicare Supplement Insurance options.

Those who are looking to enjoy the most benefits on top of their Original Medicare coverage Medicare Part A and Medicare Part B often find that Mutual of Omaha Medicare Supplement Plan F in Florida is the best. Mutual of Omaha Medicare Supplement Plan F. The Top Mutual of Omaha Medicare Supplement Plans.

Then your Plan F supplement pays your deductible and the other 20. Plan F is the most popular Mutual of Omaha Medicare Supplement plan. This includes durable medical.

Plan F is a great plan for someone who has tons of medical expenses and who spends a lot of time in and out of the hospital. Your Part A deductible and coinsurance. Although it is generally the most expensive plan Mutual of Omaha Medicare Supplement Plan F is also the plan that will give you the most coverage on top of Medicare Part A and Part B.

Beginning January 1 2020 people who are newly-eligible for Medicare will not be able to select a Medicare Supplement plan that covers the Part B deductible. Your Part A deductible and coinsurance. You can see any doctor or hospital in the.

Mutual of Omaha Medicare supplement plans offer fantastic coverage and help pay the gaps or expenses in Medicare for you. It covers everything that Medicare does not pay in full. With Plan G you get nearly the full coverage.

Your Part A deductible and coinsurance. Mutual of Omaha Plan F is the most popular Medicare Supplement plan Mutual of Omaha offers. However its being phased out.

No other standardized Medicare Supplement plan offered in Iowa offers more complete protection for your uncovered Part B medical expenses than Plan F. Plan F offered by Mutual of Omaha is by far the most popular Medigap plan on the market right now. Plan F is the most popular Anthem Mutual of Omaha Medicare Supplement plan.

Many individuals aging into Medicare love a Plan F because it covers the remaining Medicare-approved charges. Plan F covers that for you. With Mutual of Omaha Medigap Plan F you will not have to worry about unexpected out-of-pocket costs for the things that Original Medicare does not cover.

Remember that a Plan F from Mutual of Omaha is the same as a Plan F from any other company. Some doctors charge a 15 excess charge beyond what Medicare pays. Plan F 100 coverage.

Plan F also pays the 20 for a long list of other Part B services. The cost of 365 extra days of hospital care during your lifetime after Medicare. No other standardized Medicare Supplement plan offered in Arizona offers more complete protection for your uncovered Part B medical expenses than Plan F.

Yep â all of them. All three provide 100 coverage for Inpatient Hospital services. No other standardized Medicare Supplement plan offered in Wisconsin offers more complete protection for your uncovered Part B medical expenses than Plan F.

Excess charges linked with Medicare part B. Your Part A deductible and coinsurance. Mutual of Omaha Medicare Supplement Plan F.

Mutual of Omaha offers up to a 12 household discount in many states and have extremely competitive premiums. For example Medicare covers about 80 across the board Plan F picks up the remaining 20.