529 Plan Tax Rules

529 Plans and Gift Tax Rules.

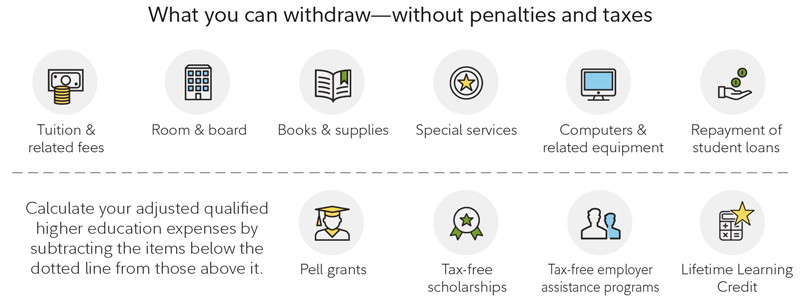

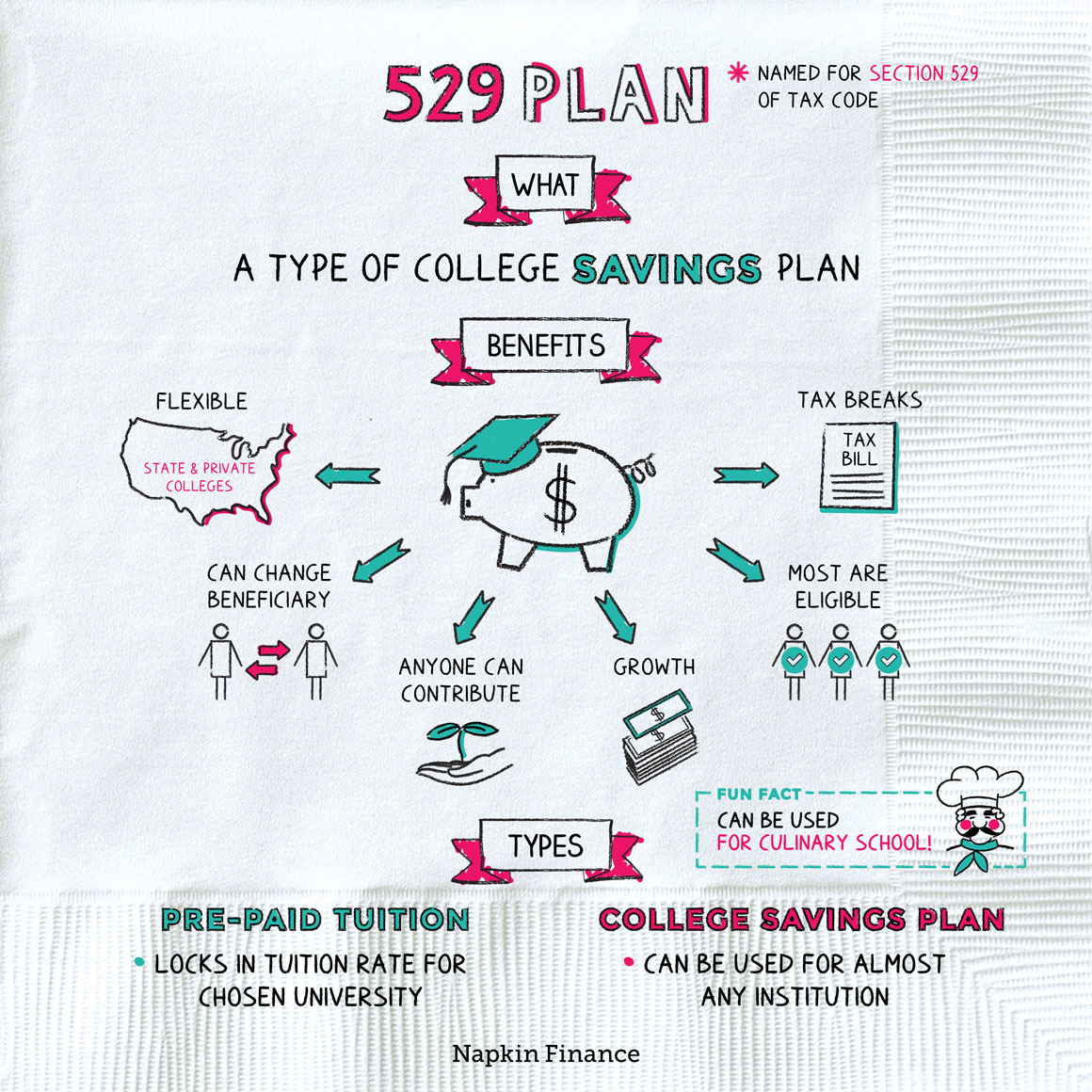

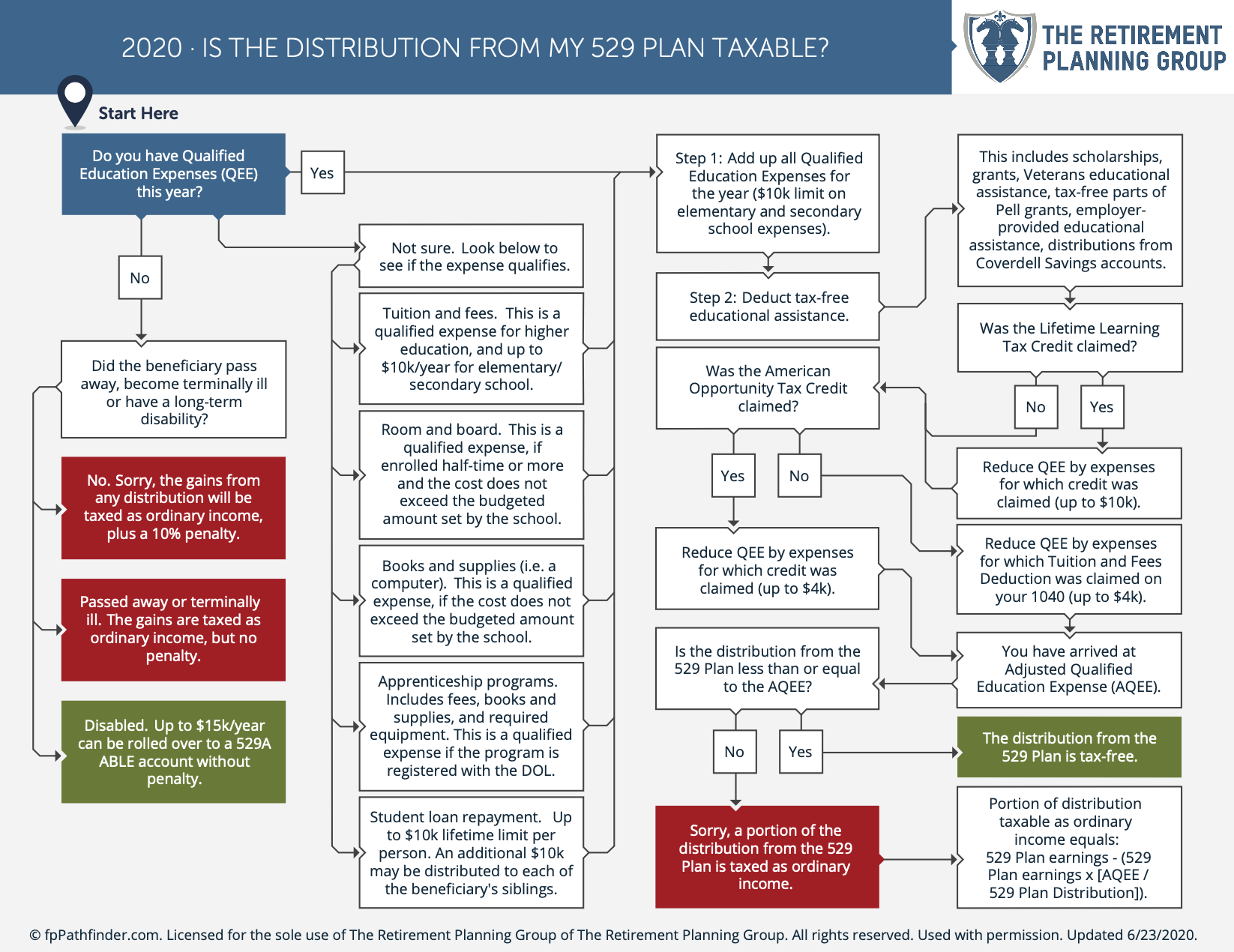

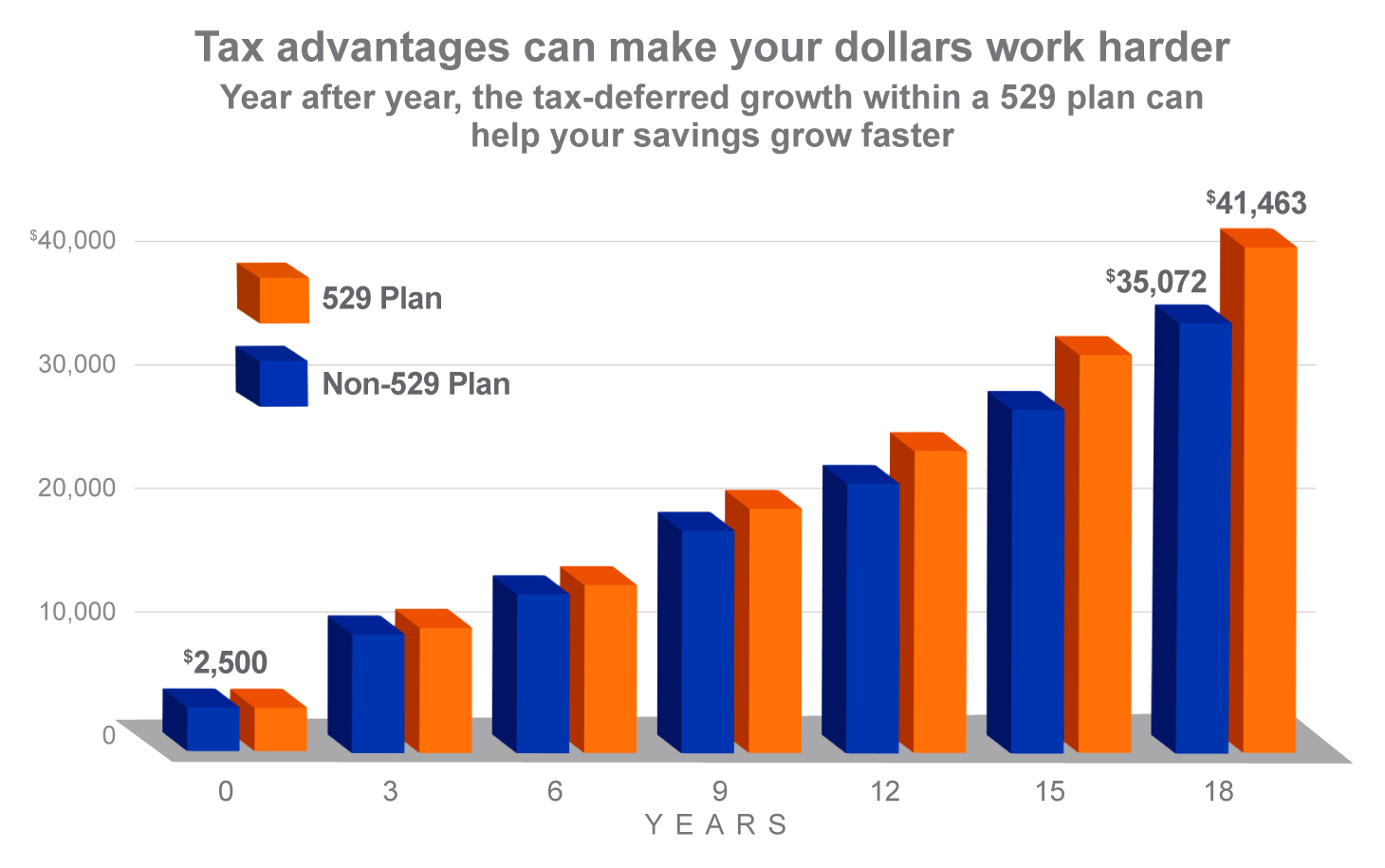

529 plan tax rules. Withdrawals from a 529 plan that are used to pay qualified higher education expenses are completely free from federal income tax and may also be exempt from state income tax. Federal tax laws passed in 2017 2019 and 2020 added several new tax benefits to 529 plans. 529 plan distributions are allocated between the earnings portion and the basis which is the contribution portion.

As of 2021 the gift tax exclusion is 15000 per recipient. 36 rows However each state has its own rules regarding the type of tax benefit. If funds from your 529 plans were not used for expenses that qualify such as tuition fee such withdrawal is termed unqualified.

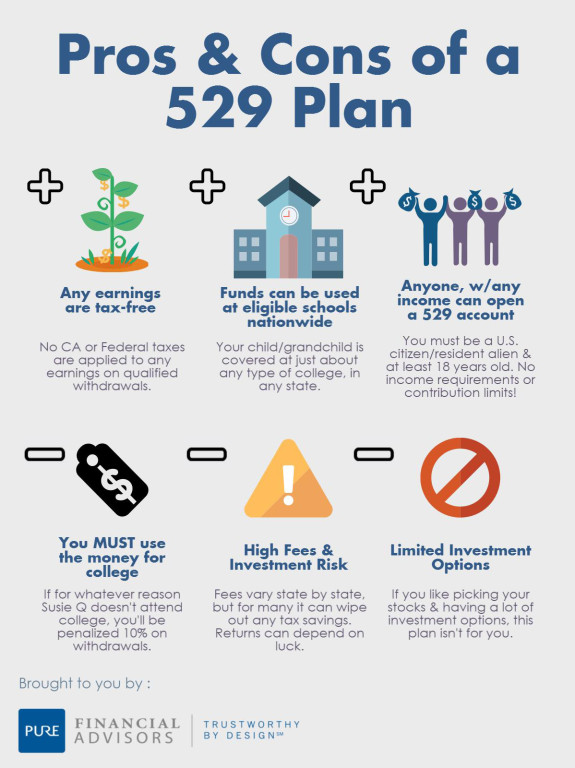

529 plan account owners can withdraw any amount from their 529 plan but only qualified distributions will be tax-free. You dont have to invest in your own states plan. Tax Rule for 529 Plans.

If you use 529 account withdrawals for qualified higher education expenses or tuition for elementary or secondary schools earnings in the 529 account are not subject to federal income tax and in many cases state income tax. As a result the portion of your withdrawal that you earn will be subjected to income tax alongside a 10 penalty. That means you can deposit up to 15000 into 529 plans for your grandson granddaughter and niece all in the same year.

Though many states offer residents a state tax deduction for doing so there is no federal tax deduction for 529 contributions. Most 529 plan contributions are not deductible. You might even have to return any tax deductions you claimed on contributions alongside state income tax.

California imposes an additional 25 state income tax penalty on the earnings portion of non-qualified 529 plan distributions. As of 2018 youd trigger a gift tax if you contribute more than 15000 to an individual in a year. The earnings portion of any non-qualified distributions must be reported on the account owners or the beneficiarys federal income tax return and is subject to income tax and a 10 penalty.

Some states do allow deductions but the money is not deductible on Federal taxes. Qualified higher education expenses generally include tuition fees books supplies and equipment required for enrollment or attendance at an eligible educational institution. The contribution portion will never be subject to tax or penalized since it was made with after-tax dollars.

When considering 529 plan rules its important to know that the federal government treats 529 plan contributions as gifts toward the beneficiary for tax purposes. However there may be other tax credits available when it comes time to spend the money according to the IRS. The same applies to a married couple filing jointly that makes a.

With a current state income tax rate of 307 a Pennsylvania resident could save.