529 Plan Federal Tax Deduction

In addition to the federal tax benefits 100 of contributions to your 529 account with The Education Plan are deductible from your New Mexico state taxable income each year.

529 plan federal tax deduction. 529 plan deduction from paycheck. So at a tax rate of 20 a 1000 deduction would save you 200. My old job state government allowed me to set up a paycheck deduction post-tax that went directly to my kids 529 college savings plan.

Although your contributions to a 529 College Savings Plan are not tax deductible you still receive a benefit. North Dakota Up to 5000 can be deducted per person annually. My current fed agency says they dont know how to do that.

Even if you dont however its still worth weighing the benefits of including a 529 college savings account in your long-term financial plan when saving money for education costs. 25 rows While federal tax rules do not allow families to deduct 529 contributions states have their. Only for account owners.

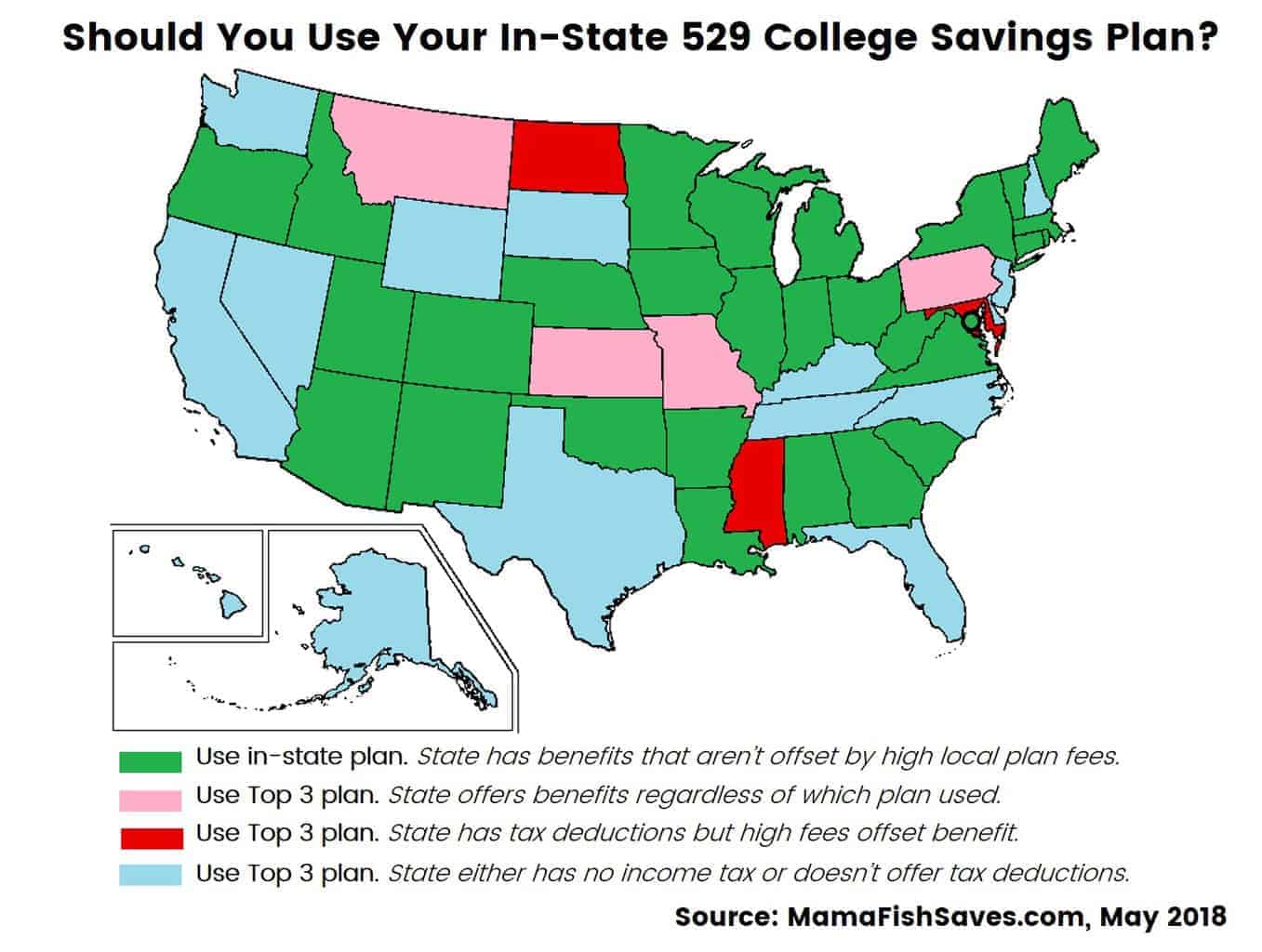

How total contribution affects your 529 Plan deduction. Some states allow a deduction or credit for contributions to any 529 plan. While there is no federal income tax deduction for contributions to a 529 plan many states offer taxpayers a deduction or credit on personal income tax returns for contributions made to the in-state program.

The 529 Plan is an opportunity to deduct educational expenses which can make saving for college much easier. Only offered to account owners and their spouses. The contributions made to the 529 plan however are not deductible.

Estate Planning Features Gift contributions to a NEST 529 account are considered a completed gift from the contributor to the beneficiary for federal gift and estate tax purposes. The tax advantages and rules of 529s differ from those of 401ks although they are similar. Federal Tax Deduction for 529 Plans.

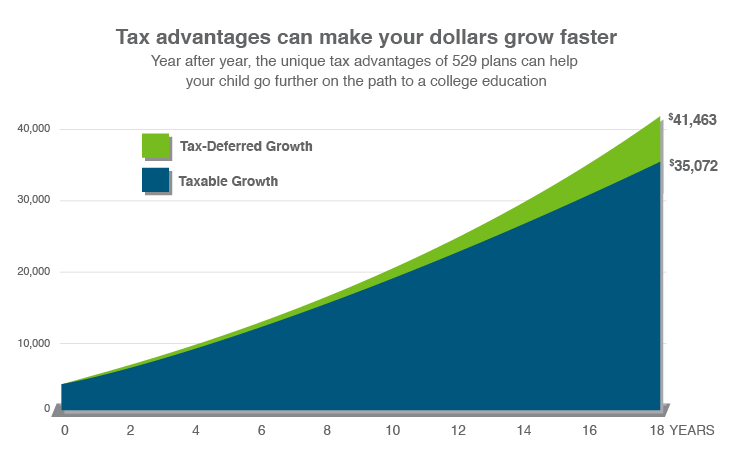

As an investment account the 529 plan accrues earnings which allows the 529 plan to grow tax-free. If you will be receiving a federal or state tax refund consider investing it into your Bright Start 529 account. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs.

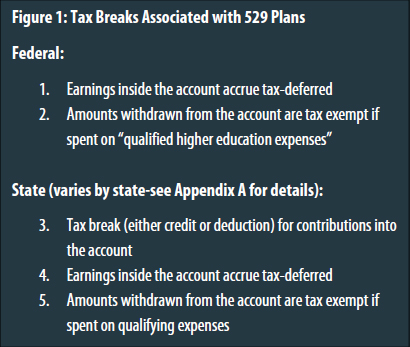

Tax deductions lower your taxable income by excluding specific income or expenses from taxation. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as room and board. Owners of 529 plans may also qualify for state-level tax deductions.

New York Can deduct up to 5000 per year per person. Tax benefits for contributions. For more information about 529 Contributions visit.

A qualified tuition program QTP also referred to as a section 529 plan is a program established and maintained by a state or an agency or instrumentality of a state that allows a contributor either to prepay a beneficiarys qualified higher education expenses at an eligible educational institution or to contribute to an account for paying those expenses. There are no federal tax deductions for 529 plans. Both the contribution and earnings portion of funds that were deposited rolled into a NEST account from a non-Nebraska 529 plan are eligible for the tax deduction.

While filing and spending fees tends to be distressing governing bodies offer a number of deductions that lower a familys tax burden while. April is normally tax season although COVID-19 has actually forced back the 2020 filing due date to July. Nebraska Can deduct up to 10000 per year.

Taxation Deduction guidelines for 529 Plans. Both your federal and state tax returns allow you to deposit all or a portion of any tax refund. New Mexico is one of only four states in the nation to provide an unlimited state tax deduction for contributions to its 529 plan.

While a 529 plan tax deduction isnt an option for federal taxes you may be able to snag one at the state level. Here is the information you will need when completing the Refund Direct Deposit section of your federal andor Illinois tax returns. New Mexico All contributions to in-state 529 plans are deductible.

One significant distinction is that unlike a 401k donations to this account are not eligible for federal tax deductions.

/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)