Clinton Vs Trump Tax Plan

If Clinton wins the election and theres any potential likelihood of her pushing through her estate tax plan practitioners and clients may all experience a repeat of 2012 with a mad rush to.

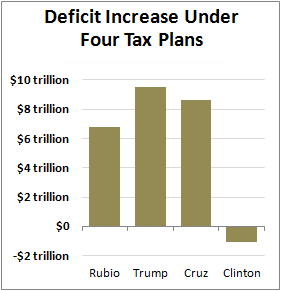

Clinton vs trump tax plan. Trumps proposals would reduce tax revenue by 61 trillion over the next ten years. Unlike Clinton Trump would keep the peak long-term capital gains tax rate unchanged at 20. Hillary Clinton wants to raise taxes by 14 trillion while Donald Trump would cut them by 62 trillion.

Clinton on the other hand plans to raise the rates on the highest. Mrs Clinton would keep taxes the same for most Americans but add an additional bracket for the highest earners. In general Trump would cut taxes dramatically while Clinton would raise taxes for those with very high incomes while targeting middle-income tax cuts to families with young children.

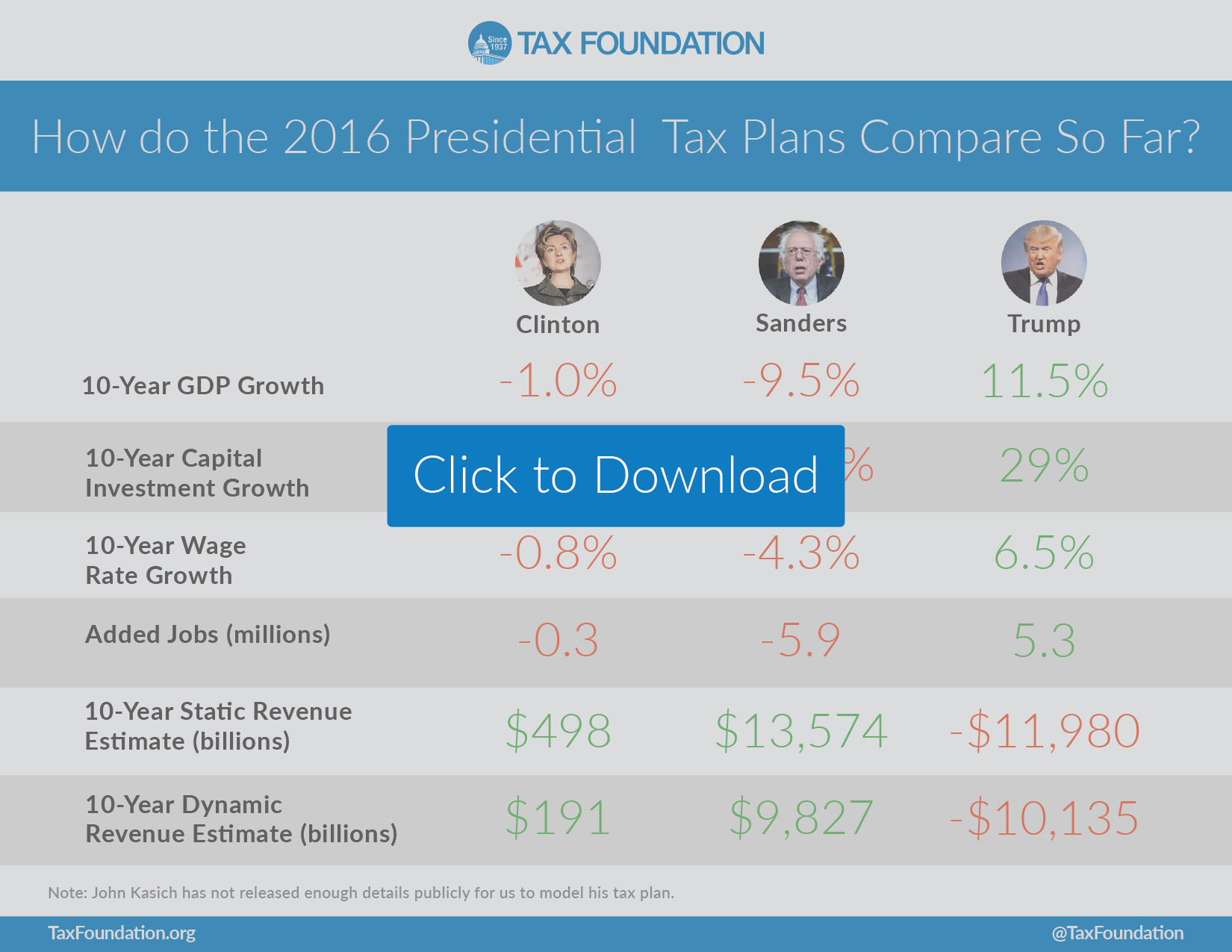

The income from that would be. The Tax Foundation has analyzed both the plans using our Taxes and Growth TAG model to estimate how their plans would impact taxpayers federal revenues and economic growth. Their tax plans are mirror images in some ways.

Trumps calls for substantial cuts in tax rates with savings to the wealthiest households while Clintons sets out to raise taxes on the very. However the one similarity the candidates share is that both would push for carried interest to be. In terms of spending however Trump adds nothing in new spending while Clintons new spending adds 165 trillion close to the amount her tax plan.

But the single childless person with 129000 or 420000 in incomethe top 1 or 01 percent respectively for singleswould pay a couple hundred bucks more under Trumps. Clinton would look to significantly raise taxes on millionaires and make. By contrast Trumps across-the-board tax cuts would represent a far bigger change than Clintons proposal.

Trump would cut taxes on the wealthy and offer tax breaks to working parents so they can pay less to the government. Clintons proposals would increase tax revenue by 14T over the next ten years. The Trump plan would give the richest 01 percent of taxpayers those with incomes of more than 37 million this year an average tax cut of 11 million for a 14 percent increase on.

-- Hillary Clinton ripped into Donald Trumps tax plan during her remarks at Camden County College in New Jersey today saying his plan was written by a billionaire for billionaires. Hed also raise the standard deduction to 15000 for singles and 30000 for households. Hillary has to raise taxes to 55 or 60.

He would reduce the top rate of tax to 33 from 396. Clintons claim on the impact of Trumps tax plan versus her plan. Highest earners tax increases proposed by Clinton.

September 26 by Michelle Lee. Would reduce the seven tax brackets in current law to three at 12 percent 25 percent and 33 percent. Theres no way she can do anything less than that Unlike Trump Clinton has not formally unveiled.

Independent experts have looked at what Ive proposed what Donald. Hillary Clintons Tax Plan. Download Attached DocumentBoth Hillary Clinton and Donald Trump have released tax plans during the campaign.

Trump in an interview on Fox Business News June 21. Trump also suggests a territorial tax regime for international business.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/7178083/TRUMP_CLINTON_TAXES.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/6139385/Screenshot%202016-03-03%2012.41.45.png)