Did The Gop Tax Plan Pass

Senate Majority Leader Mitch McConnell center and other Senate Republicans discuss passage of the GOPs 15 trillion tax plan after the vote.

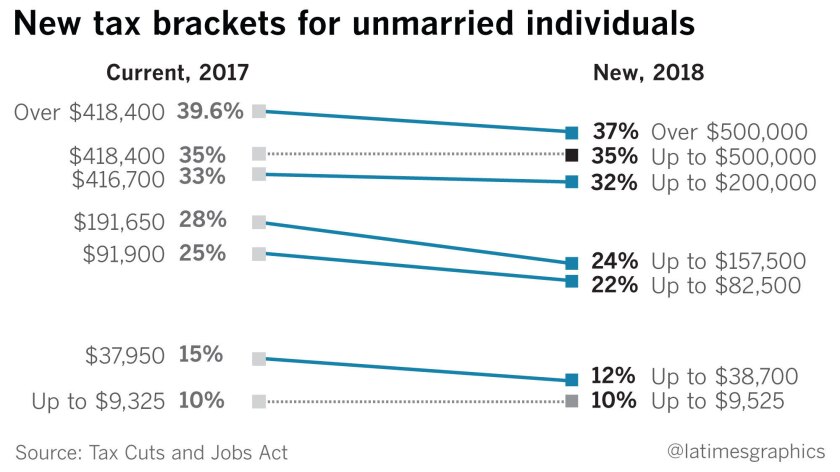

Did the gop tax plan pass. Michael Reynolds EPA Dec. Despite the hurdles facing the Senate tax plan only one Republican voted against it. The Tax Cut and Jobs Act of 2017 TCJA is a congressional revenue act of the United States signed into law by President Donald Trump which amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for businesses and individuals increasing the standard deduction and family tax credits eliminating personal exemptions and.

Vice President Mike Pence walks through the Capitol to the House Chamber to watch the passage of the Republican tax bill. The tax hike was planned all the way back in when President Donald Trump passed the 2017 Tax Cuts and Jobs Act which lowered taxes for most Americans at the time. By Lauren Fox and Phil.

Capitol cast a reflection on November 29 2017 in Washington DC. Answer 1 of 8. The procedural vote allows debate to begin on the measure with a final vote expected later today or tomorrow.

All but 12 Republicans voted for the tax bill. How all but one Republican senator found a way to pass tax reform. The Republicans rushed into this tax reform bill because they were attempting to create a sense of accomplishment heading into what promises to be a very contentious midterm cycle where their Senate majority which is already razor-thin is at risk.

The Senate passed its tax reform bill in the early hours of Saturday morning following a day full of Republican leaders making changes to bring enough members on board and a long night full of. Republicans pass historic tax cuts without a single Democratic vote. This is further compounded by.

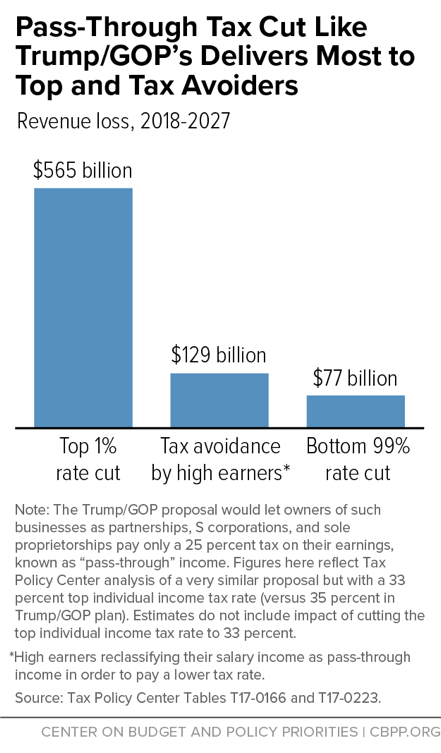

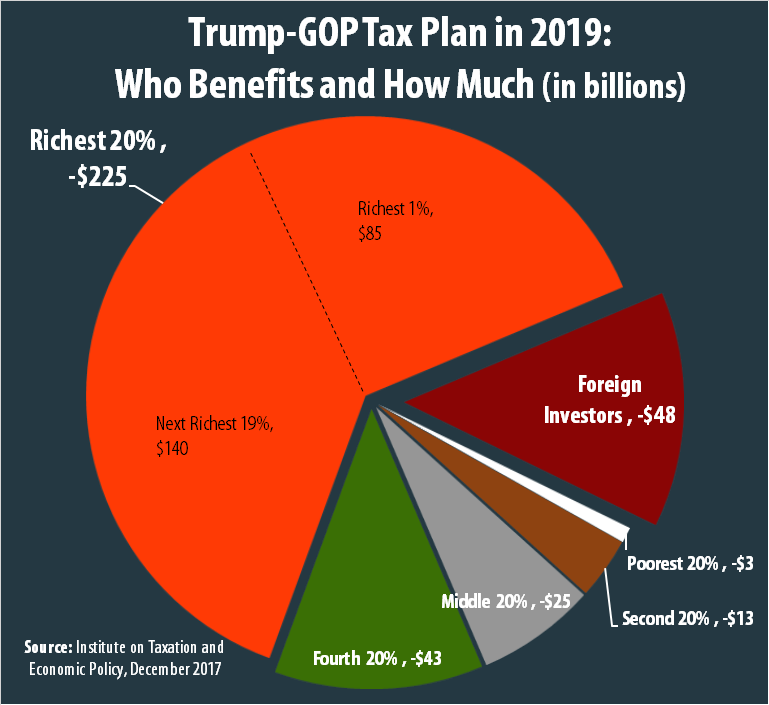

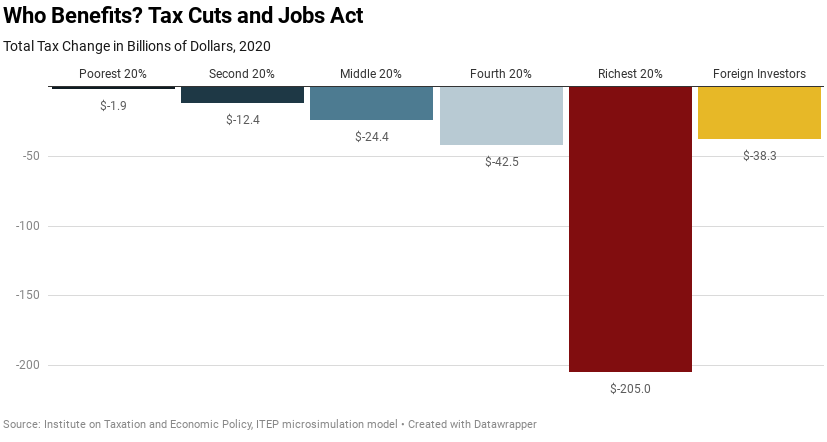

Under this plan a family making 50000 a year could be subject to a tax increase while millionaires get a 230000 tax break. The inequities are startling. As part of the bill Republicans approved tax breaks in 2017 for seven classes of assets many of the wealthier members of Congress held at the time including partnerships small corporations real estate and several esoteric investment vehicles.

WASHINGTON DC - NOVEMBER 29. However that temporary tax policy counted on the automatic increases coming next year. This budgets primary purpose is to provide reconciliation instructions for tax reform but the Republican plan is not tax reform it is a 24 trillion tax cut for the wealthy at the expense of everyone else.

The Senate has passed a procedural voteit passed 52-48on the tax bill. Democrats also stood to gain from the tax bill though not one voted for it. The Times found that the Tax Cuts and Jobs Act will cause automatic stepped tax increases every.

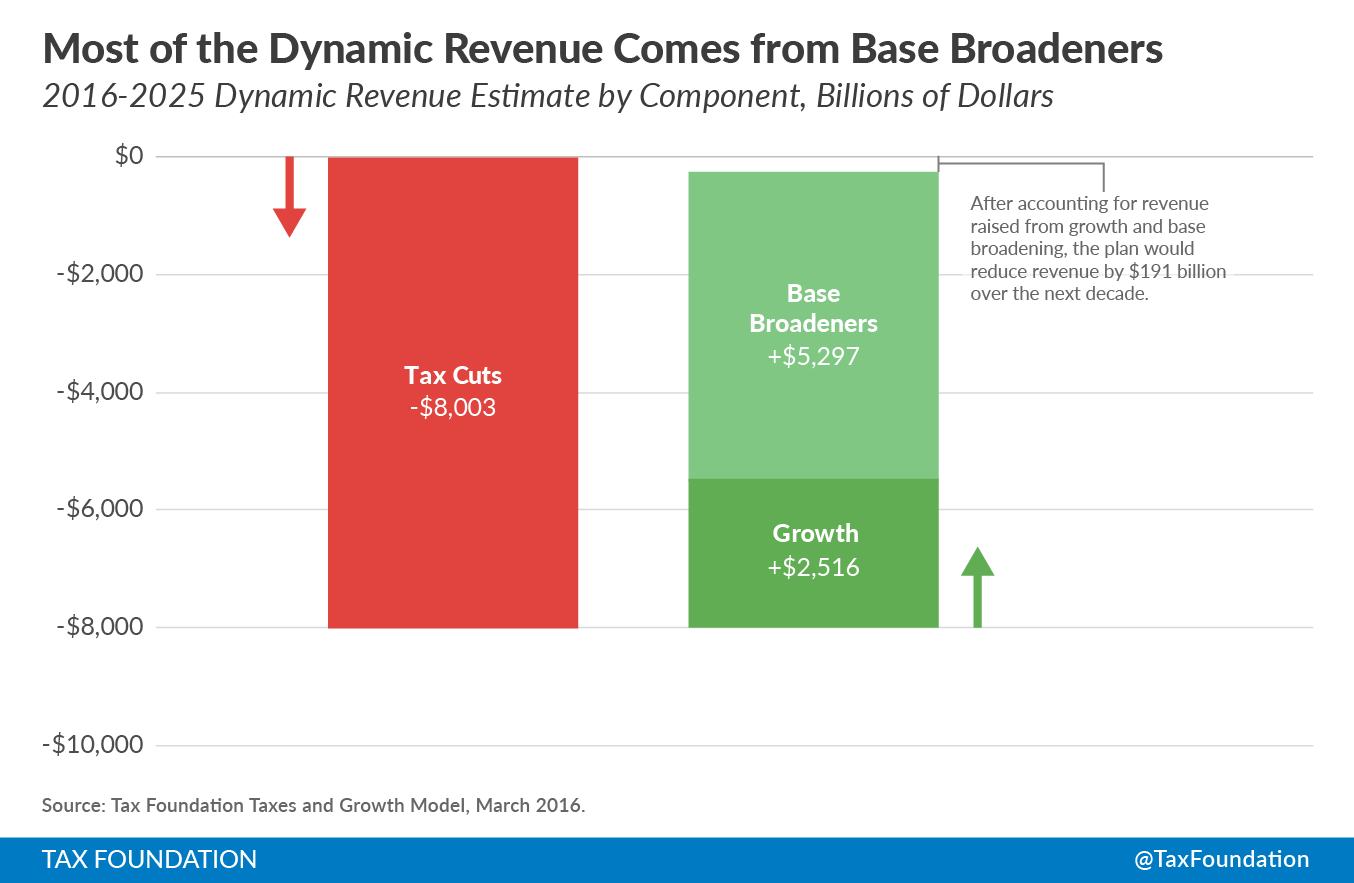

The new tax bill released by the House GOP on Thursday would permanently slash the corporate tax rate from 35 percent to 20 percent reduce the number of individual income tax brackets and repeal. Since 1986 the last time a major tax overhaul became law the body of federal tax lawbroadly definedhas swollen from 26000 to 70000 pages according to the House GOPs 2016 reform proposal. Congressional Republicans secured enough support Friday to pass their massive tax plan a measure that would deliver a major legislative victory to President Trump and his GOP.

19 2017 729 PM UTC. Republicans cheered with Treasury Secretary Steve Mnuchin among them Just before 230 pm the House had passed the bill 227-203. President Donald Trump weighed in as the vote finished.

Republicans 15 Trillion Tax Plan Appears on Track to Pass Next Week Read in app Senator Marco Rubio of Florida held a news conference in October to discuss the child tax credit. This week the Republican led Senate is trying gain enough votes to pass a US. Critics of the GOP tax plan argue that driving up the deficit with tax cuts is a prelude to Republicans demanding deeper spending cuts later like those included in the White House budget.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758221/picture1_24.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9899057/8_21_17tax_f1.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9693345/tpc_graph1.png)

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9785727/uninsured.png)