New Tax Plan 2018

These are the rates that determine your tax bill and still apply in 2020.

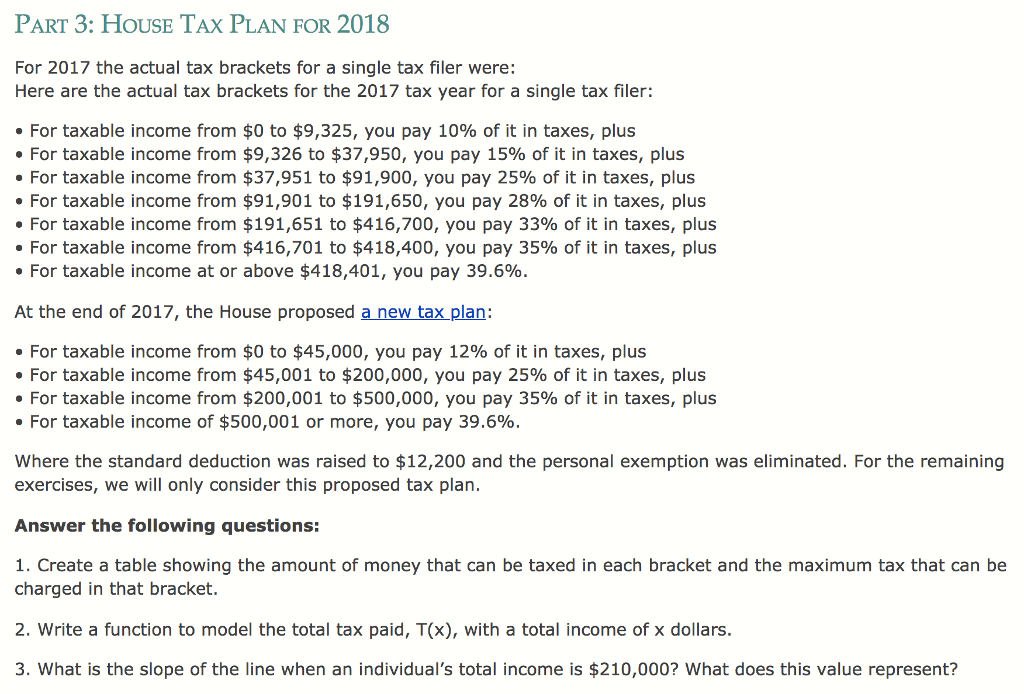

New tax plan 2018. See New Tax Brackets. Areas with high state and local income tax. Over 9525 to 38700.

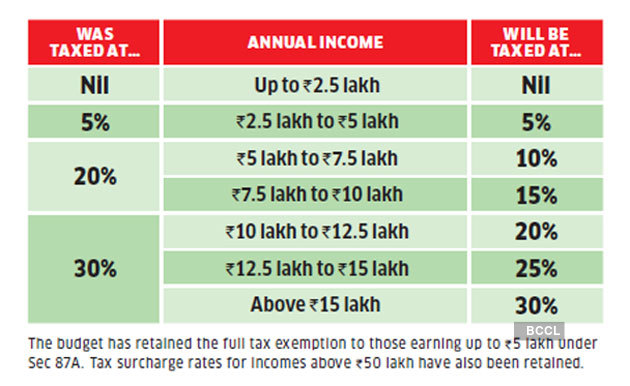

The Trump tax plan amended the state and local income tax SALT deduction so that taxpayers can only claim up to 10000 in combined state and local income sales and property taxes as an. The new tax brackets which applied as of January 2018 have rates of 10 12 22 24 32 35 and 37. We highlight the changes and give you the new tax calculator for FY 2017-18 AY 2018-19.

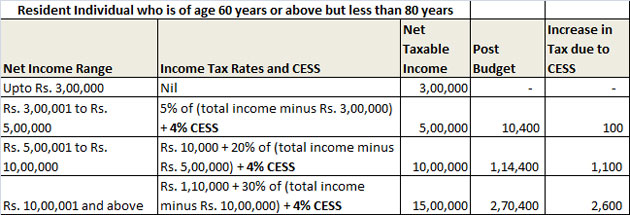

20 4 cess. Keep in mind that your 2020 federal tax filing is due May 17 2021 not April 15 2021. There are still seven federal income tax.

The law raised the standard deduction to 24000 for married couples filing jointly in 2018 from 12700 12000 for single filers from 6350 and to 18000 for heads of. The threshold for single taxpayers is AGI over 200000. Up to Rs25 lakh Nil Above Rs250 - Rs5 lakh 5 of the total income that is more than Rs25 lakh Above Rs5 lakh - Rs750 lakh 10 of the total income that is more than Rs5 lakh Rs12500 Above Rs750 lakh - Rs10 lakh.

Over 93700 to 195450. It lowered the corporate tax rate to 21 from 35 at the turn of 2018. The Trump tax plan doubled the estate tax exemption amount from 549 million in 2017 to 112 million in 2018.

The Tax Cuts and Jobs Act came into force when President Trump signed it. The credit will begin to phase out for AGI over 400000 for married couples. In his view the tax plan will create a temporary sugar high that will taper off after a couple of years.

Up to 25 lakhs. Tax Rate FY 2018-19 AY 19-20. The standard deduction is a tax deduction that most taxpayers can use to reduce their.

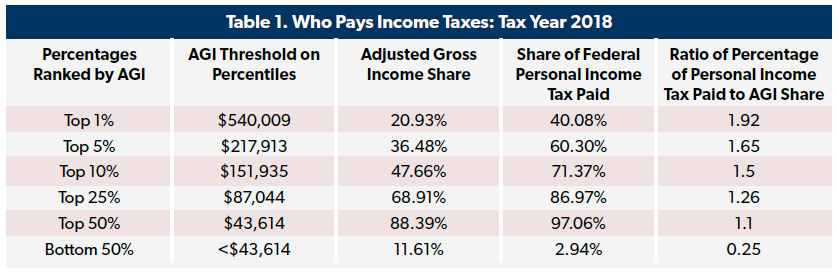

The Trump-GOP tax law will provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. A 500 non-refundable tax credit per dependent can also apply to a dependent other than a qualifying child. The economy will experience stronger near-term growth in 2018 and 2019 with the stimulus.

Income Tax Slab Tax Rate. Tax reduced from 10 to 5 for Income from Rs 250000 Rs 500000 leading to tax saving of up to Rs 12500. Income Tax Slab Tax rates as per new regime Tax rates as per old regime 0 - 250000.

These changes like lower marginal tax rates and a higher standard deduction will not affect the taxes that you need to pay by April 17 2018. There are only a couple of exceptions. Other changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions.

Tax Rate FY 2019-20 AY 2020-21. Nil 250001 - 500000. The changes didnt affect the way you file federal taxes until 2019.

Most of the new tax plan took effect on Jan. 5 4 cess. 5 500001 - 750000 12500 10 of total income exceeding 500000 12500 20 of total income exceeding 500000 750001 - 1000000 37500 15 of total income exceeding 750000.

The highest tax bracket is now 37 for big earners. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. The new tax plan updated tax brackets across the board lowering marginal tax rates and.

Income up to 9525. The bill goes into effect in 2018 but the provisions directly affecting families and individuals expire after 2025 with the exception of one provision that would raise their taxes. With the passage of the Tax Cuts and Jobs Act TCJA many tax brackets thresholds and rates will change in 2018.

Up to 1400 of this can go toward a tax refund. Noticeable changes to the structure of the individual tax code include the elimination of personal exemptions the elimination of the Pease limitation on itemized deductions and the expansion of the Child Tax Credit. The new tax reform in 2018 doubles the child tax credit.