Clinton Tax Plan Calculator

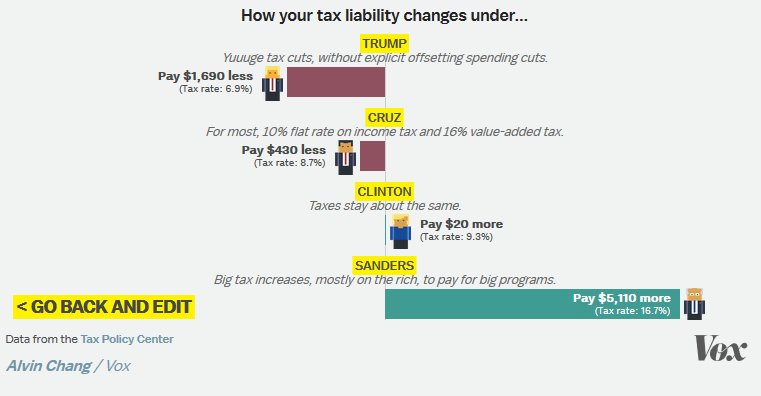

In general Trump would cut taxes dramatically while Clinton would raise taxes for those with very high incomes while targeting middle-income tax cuts to families with young.

Clinton tax plan calculator. According to the Tax Foundations Taxes and Growth Model Hillary Clintons tax plan would reduce the economys size by 1 percent in the long run. The Tax Policy Center created a calculator that will estimate how each presidential candidates tax plan would affect people like you. Overall Trump offers much more tax relief than.

But by 2036 Trumps tax cuts for the. It looks at household income marriage status and number of children and then applies each candidates tax plan were they to be elected. 2016 Presidential Candidate Tax Plan Calculator.

By analyzing how these plans would impact the economy federal revenue and the distribution of taxes paid this calculator highlights roughly what your tax bill is under current law and what it would be if Hillary Clinton Ted Cruz Bernie Sanders and Donald Trump were able to enact their tax plan according to the Tax Foundation. The plan would lead to 08 percent lower wages a 28 percent smaller capital stock and 311000 fewer full-time equivalent jobs. Clintons plan would make the tax code even more progressive than it is today.

A single filer with no dependents who earns 10 million for instance would get 632500 tax cut while paying 203228 under Clintons plan. The TPC has yet to offer its estimates of the effects. Trumps plan would reduce that amount substantially to less than 10000 a year.

Clintons plan involves a 4 surtax on income earned in excess of 5 million. Her plan would make the current tax code more progressive by raising taxes on top earners and cutting taxes for families with young children. Salary Wages yr What is your estimated before tax 2016 yearly income.

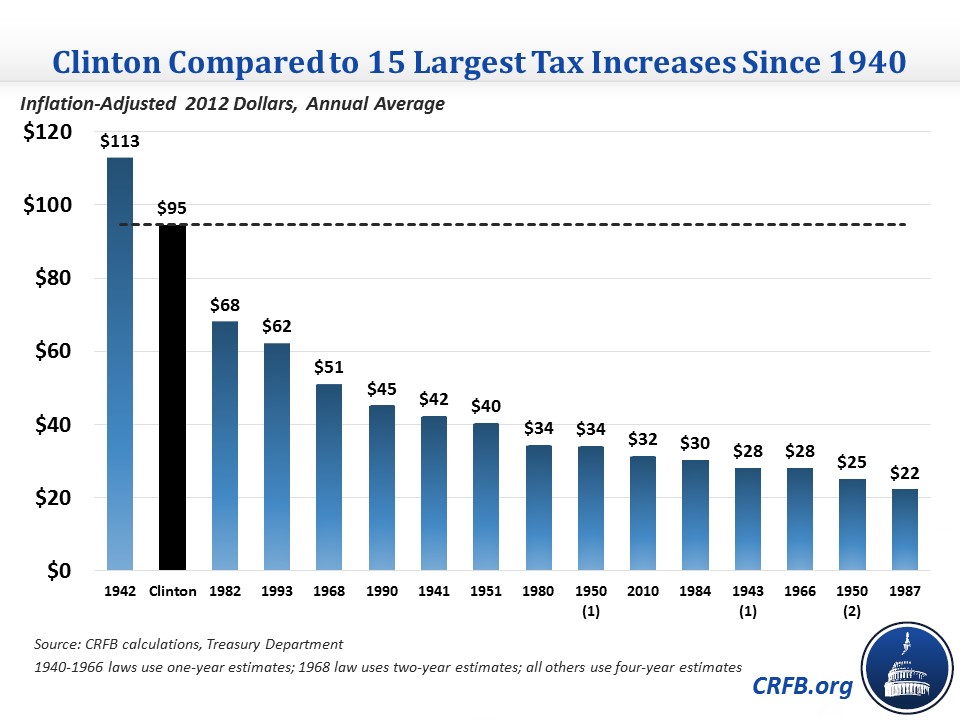

The cap on itemized deductions at a value of 28. Clintons plan would raise revenue by an estimated 14 trillion in the first 10 years then by another 27 trillion in the second decade. Changes from Clintons plan would be negligible for those below the top 10 percent of earners said Alan Cole an economist at the Tax Foundation.

Both Hillary Clinton and Donald Trump have both introduced Hillary Clintons tax plan would increase federal revenue by about 14 trillion over the next decade. It was created a few months ago so it includes Cruz and Sanders but its still interesting to see how different. According to a new study by the Wharton School and the Tax Policy Center Trumps tax plan would result in growth in the short term unlike Clintons.

Over a decade its projected to raise an. We analyzed the economic policies of the 2016 presidential candidates to estimate how their tax plans will affect your income and savings. The smaller economy results from somewhat higher marginal tax rates on capital and labor income.

Under Clintons plan there would be no change in what this taxpayer owes about 11000 a year. Hillary Clintons Tax Plan. John Kasich had not released enough.

Her plan would slightly increase marginal tax rates which would. Oct 20 2016 Updated Oct 21 2016 9. She would impose the so-called Buffett Rule requiring those with adjusted gross incomes over 1 million to pay a.

While testing TPCs cool election tax calculator I was surprised to see that some high-income singles could pay more income taxes under Donald Trumps plan than under Hillary Clintons. This tax would wind up affecting roughly one in every 5000 taxpayers. Enter your information to calculate your financial impact.

TPC estimates that Trumps plan will cost the Treasury 95 trillion over a decade while Cruzs plan racks up an 86 trillion loss. By Jacques Couret Senior Online Editor and Social Engagement Manager Atlanta Business Chronicle.

:format(png)/cdn.vox-cdn.com/uploads/chorus_image/image/49164203/front.0.0.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/6139385/Screenshot%202016-03-03%2012.41.45.png)