Ny State Tax Payment Plan

Web file your return.

Ny state tax payment plan. For example you owe back taxes on your NYS income tax return in the amount of 6500. Basically call 1-800-835-3554 enter your Taxpayer ID and 4 digit pin number that is found on your bill. Looking at an example makes this easier to understand.

Through your account you can request an IPA for a balance of 20000 or. Make a payment. You can also enter into a payment plan for any property with an assessed value of 30000 or less.

The maximum length of a payment plan is 36 months. A payment plan is one of the most common resolutions for NYS tax debt. If the charge is between 250 and 5000 and the property is a 1- to 6-family home you can enter into a payment plan.

Some states require you to wait until you receive a bill but NY doesnt specifically state that although it looks like youll need a bill to call in. For sidewalk repair charges you can submit a Sidewalk Repair Payment Plan Request as soon as you receive your bill and you must. Youll find information for setting up a payment plan with New York at the following link.

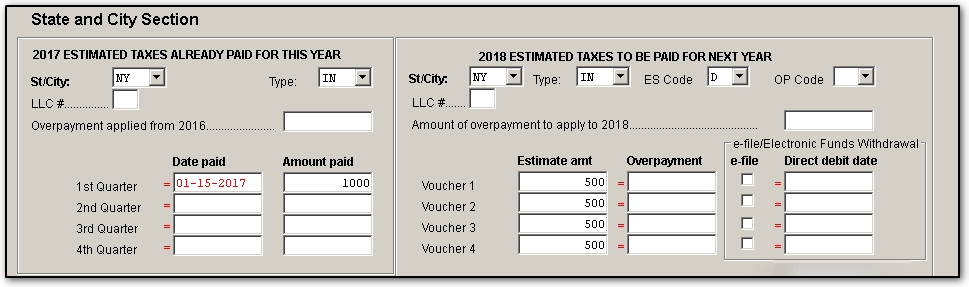

Before making or scheduling an estimated tax payment review Estimated tax law changes to determine if your 2021 estimated tax payments are affected by. Through your account you can request an IPA for a balance of 20000 or. Tax Department response to novel coronavirus COVID-19.

New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109. However over the years penalties and interest continue to. You must provide your taxpayer ID number usually your Social Security number and the four-digit PIN from your tax bill.

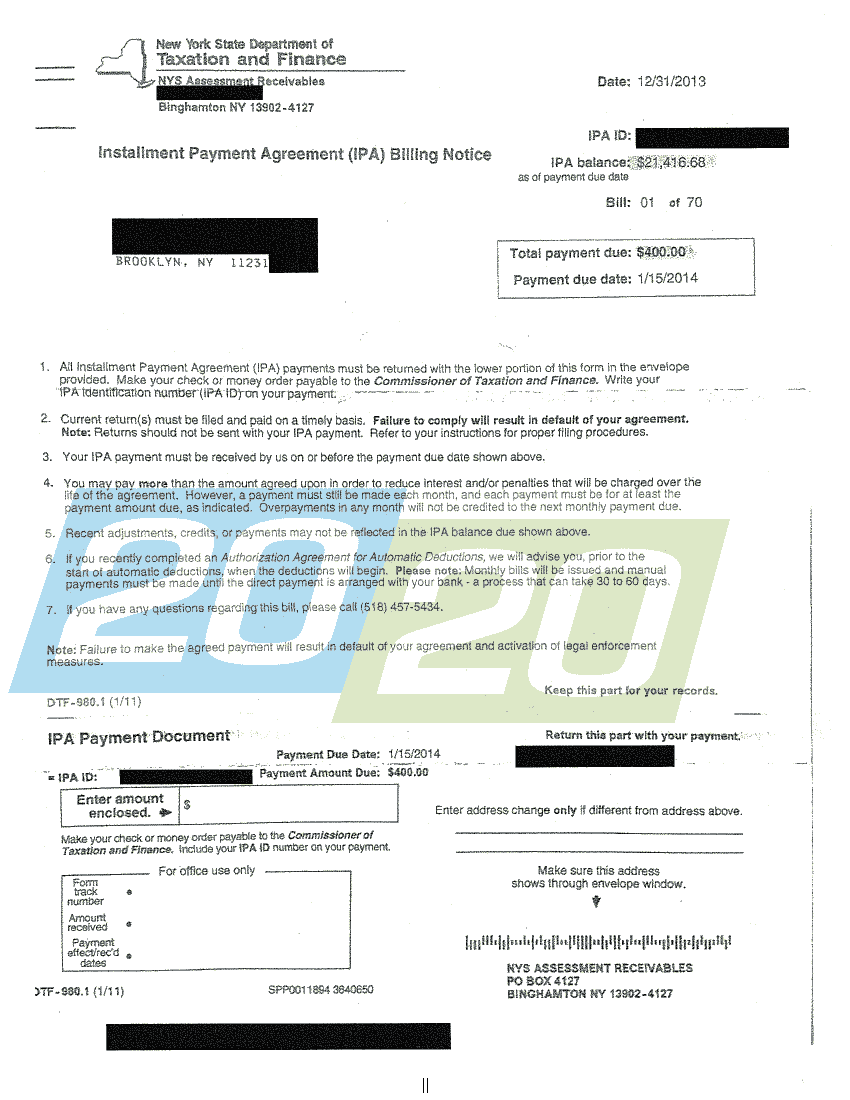

Under the agreement youll make monthly payments toward your unpaid tax balance. Visit us to learn about your tax responsibilities check your refund status and use our online servicesanywhere any time. If your debt is greater than 900 your minimum monthly payment will be your current balance due divided by 36.

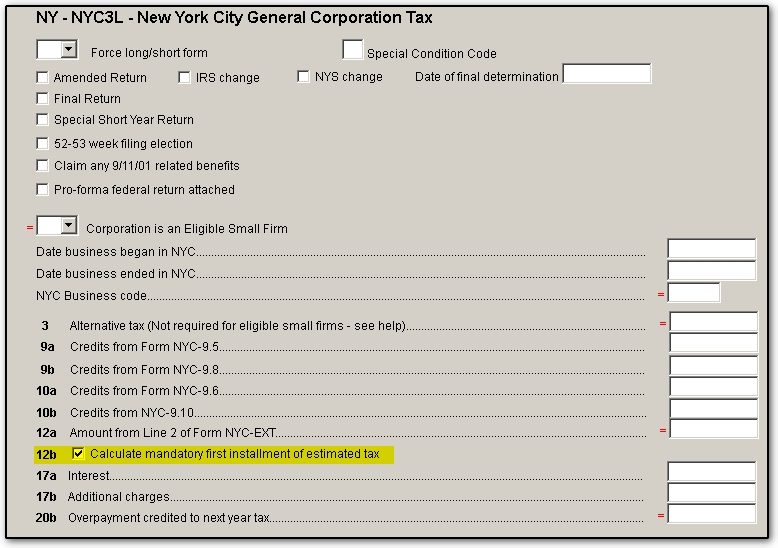

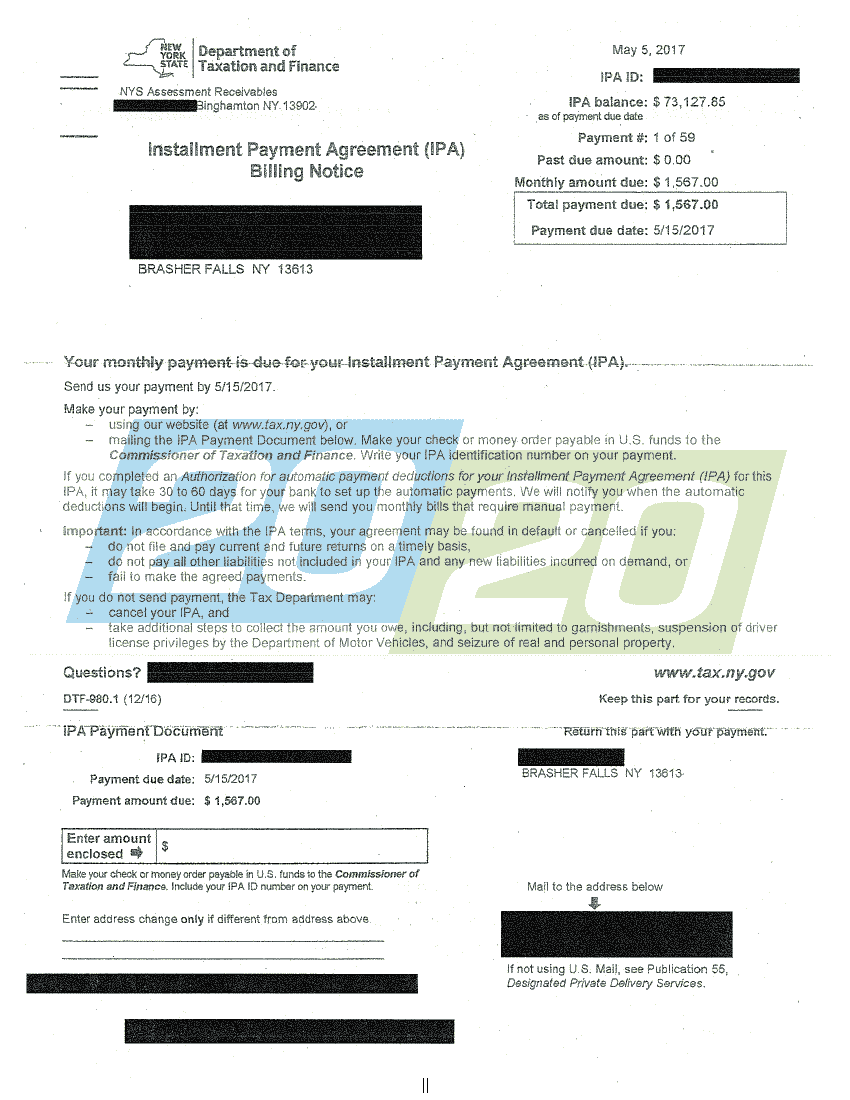

If you do not qualify for an Offer in Compromise or hardship but are not able to pay the debt in full a payment plan is the best option. Establish an account on the DTF website. Installment Payment Agreement IPA is the official name DTF uses to refer to a monthly tax.

If you cannot pay your state taxes and want to request a payment plan take one of these options. Log in then select Payments and Bills and Notices. Call 518-457-5434 to speak to a DTF representative.

New York States Department of Tax and Finance DTF offers tax payment plans. If your debt is 900 or less your minimum monthly payment will be 25. If youre unable to pay your tax bills in full you may qualify for an installment payment agreement IPA.

However this option helps taxpayers who cannot afford to pay their taxes in full. Neither the NY 529 Direct Plan the State of New York Ascensus Broker Dealer Services Inc nor Vanguard or any of their respective affiliates takes responsibility for content. Youll see options to request the plan online or call to set it up.

Such portion of the IRA distribution would be subtracted from federal adjusted gross income when computing Petitioners New York adjusted gross income for the taxable year. Currently one can deduct up to 5000 per year for single filers and 10000 per year for joint filers. A plan can include up to 36 monthly payments.

If youre unable to pay your tax bills in full you may qualify for an installment payment agreement IPA. A plan can include up to 36 monthly payments. A state of New York tax payment plan is available to any taxpayer owing 20000 or less.

This page summarizes current. Before you file your New York State income tax return be sure to review your tax account balance in your Individual Online Services account to ensure you are reporting the correct amount on your return. Waiting until the last minute to request a withdrawal.

The instructions to how to request an installment agreement can be found here. You can schedule payments in advance save your bank account information for future use and update your business information. The NYS tax payment plan option can vary by the term and whether the taxpayer must disclose financial information.

Yes residents in the state of New York can deduct contributions to 529 plans from their New York state taxable income. If you have a payment plan payments must be received by the 15th of each month. Any estimated tax payments made using software from your online services account or with Form IT-2105 Estimated Tax Payment.

Once accepted your account will still accrue all penalties and interest on your unpaid balance for the full life of your IPA. Avoid these traps that could delay your payments or increase your taxes. New York state income tax brackets and income tax rates depend on taxable income and filing.

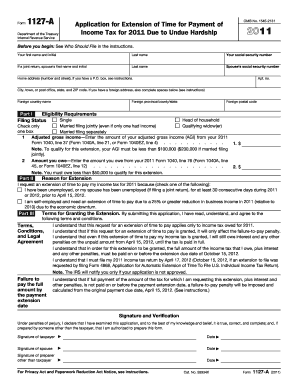

Generally NY will offer a 36-month tax payment plan but under a hardship situation they can approve up to a 60-month plan. New York Tax Installment Agreement. Yes if you are eligible for a payment plan.

This amount is cumulative of the assessed balance along with penalties and interest. The fastest and easiest way to request an IPA is through your Online Services account. Contribution is a return of the IRC 403b plan contribution and is exempt for New York State purposes pursuant to section 13-561 of the New York Administrative Code.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates which may impact estimated tax payments.

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)