Federal Taxes Payment Plan

5329 - Retirement Plans - Tax Year 2021 Business Tax Payments Form 940 Series - Employers Annual Federal Unemployment Tax Return PAY.

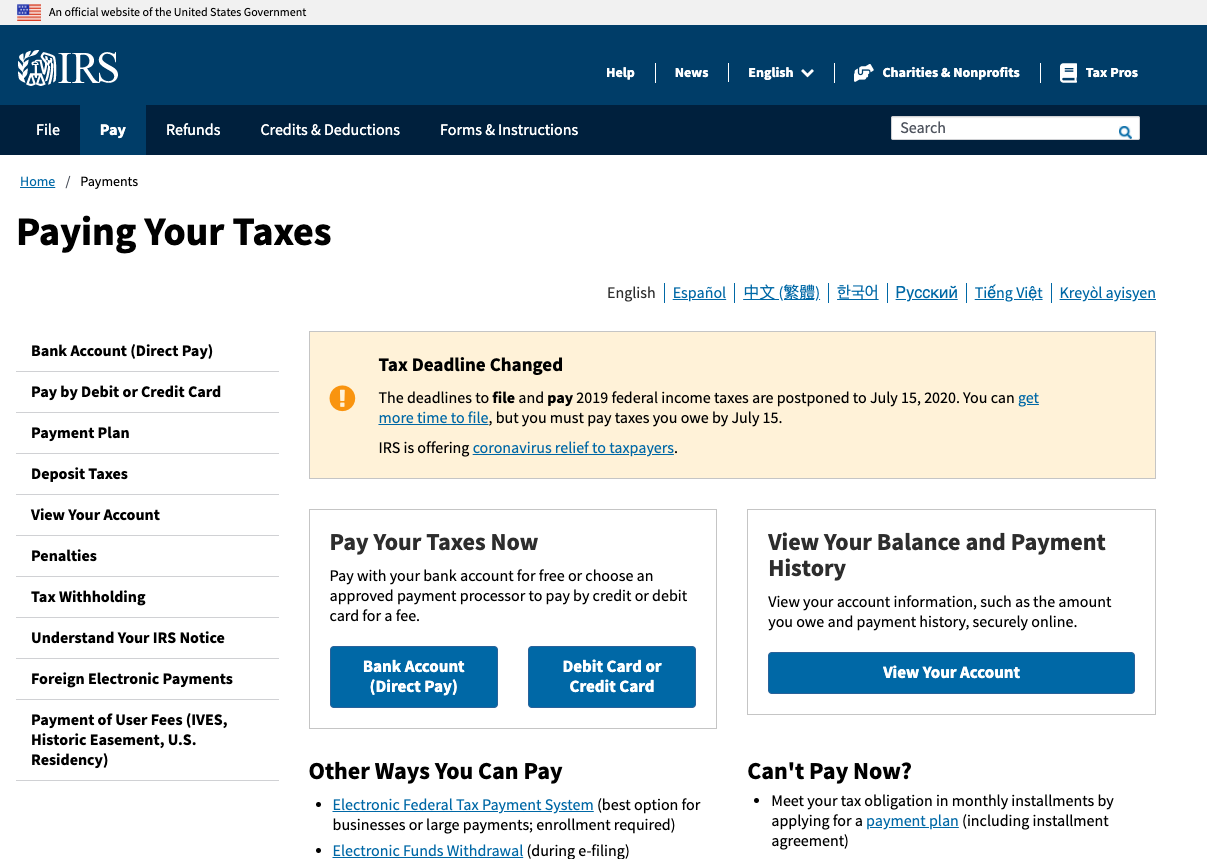

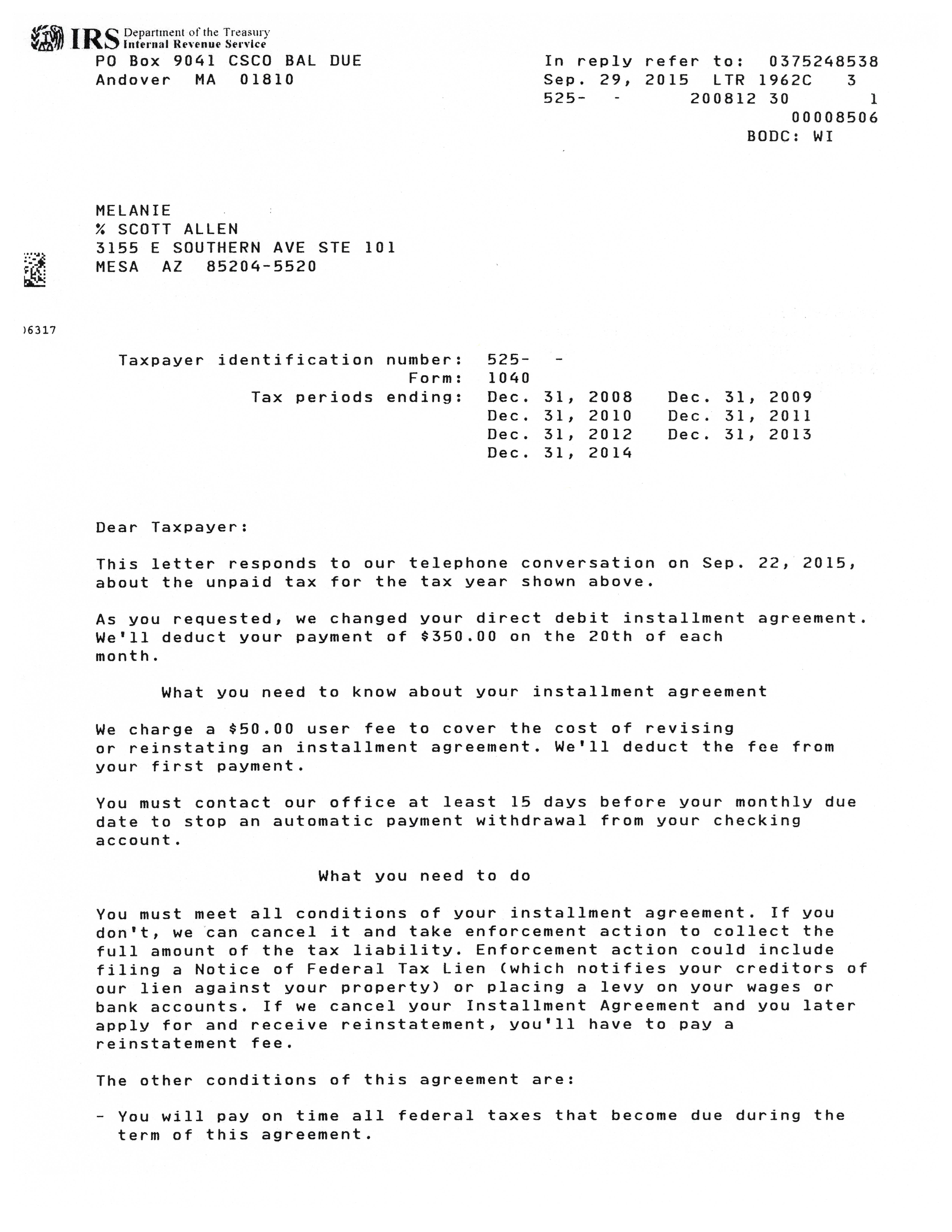

Federal taxes payment plan. Those with balances between 10000 and 50000 may be approved for repayment. Taxpayers should file or request an extension of time to file and pay any taxes they owe by the May 17 deadline to avoid penalties and interest. Short-term IRS payment plans must be paid within 120 days or less this is now extended to 180 days under the Taxpayer Relief Initiative.

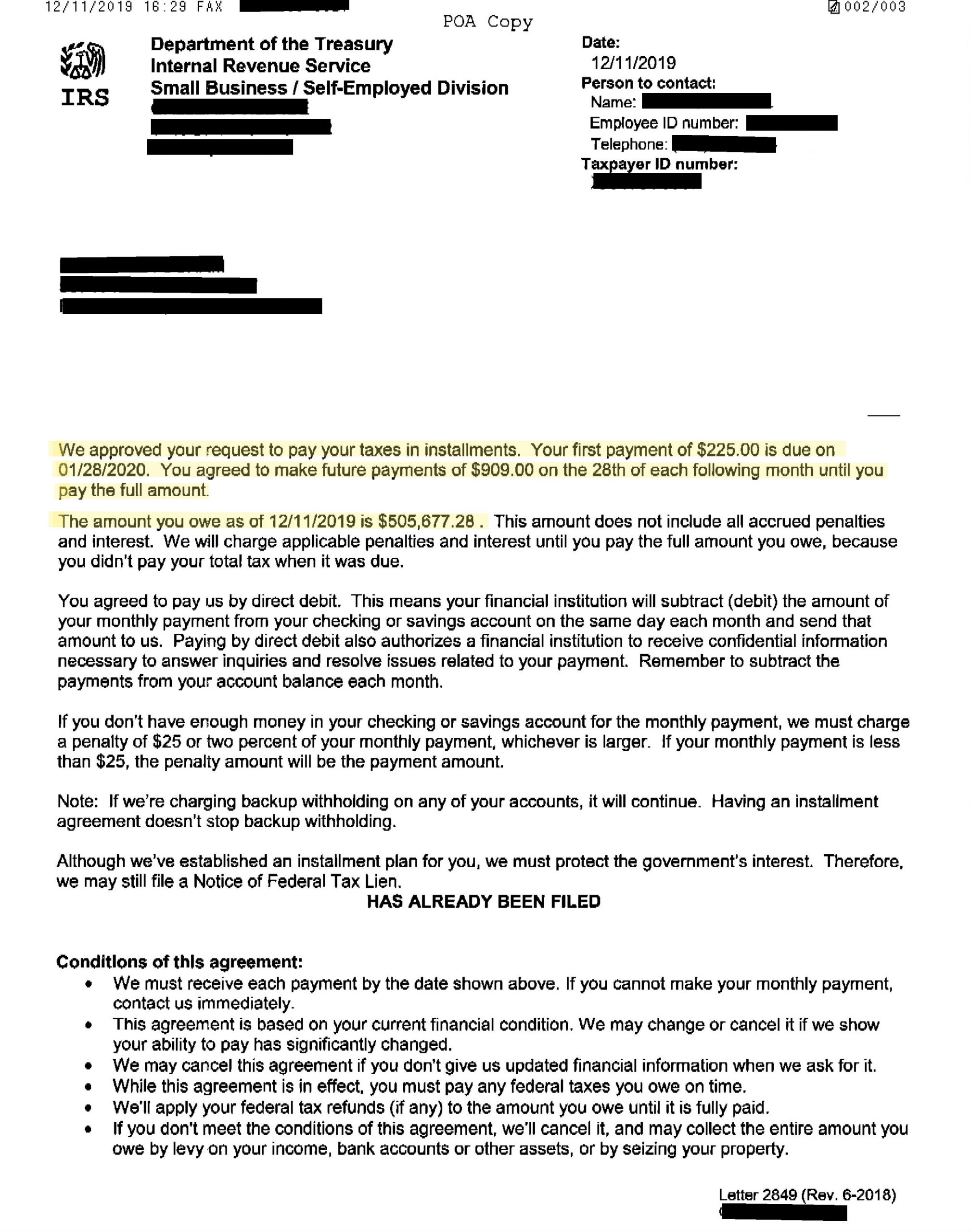

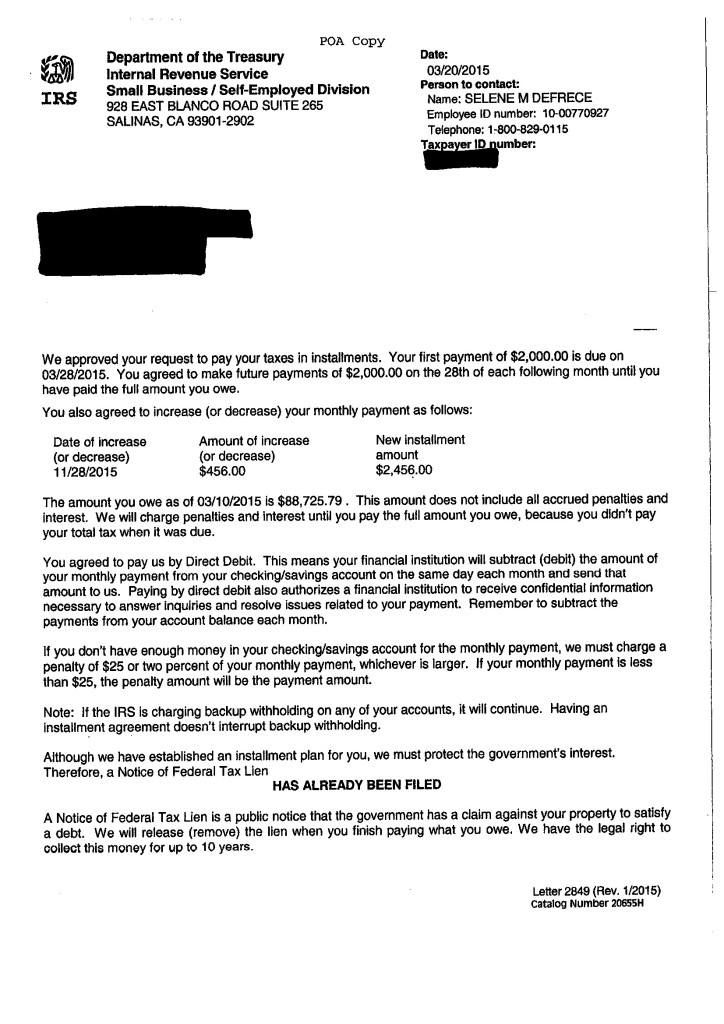

The IRS interest rate is currently 4 per year compounded daily on the unpaid tax and penalties. Even if the IRS does not verify current taxes taxpayers should. This is an agreed settlement between the taxpayer and the IRS based on the National standards to determine what amount the taxpayer will be paying the IRS each month but allowing the taxpayer to afford food housing clothing medical and transportation.

An IRS payment plan is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time. You can file the form with your tax return online or even over the phone in some. After all if a.

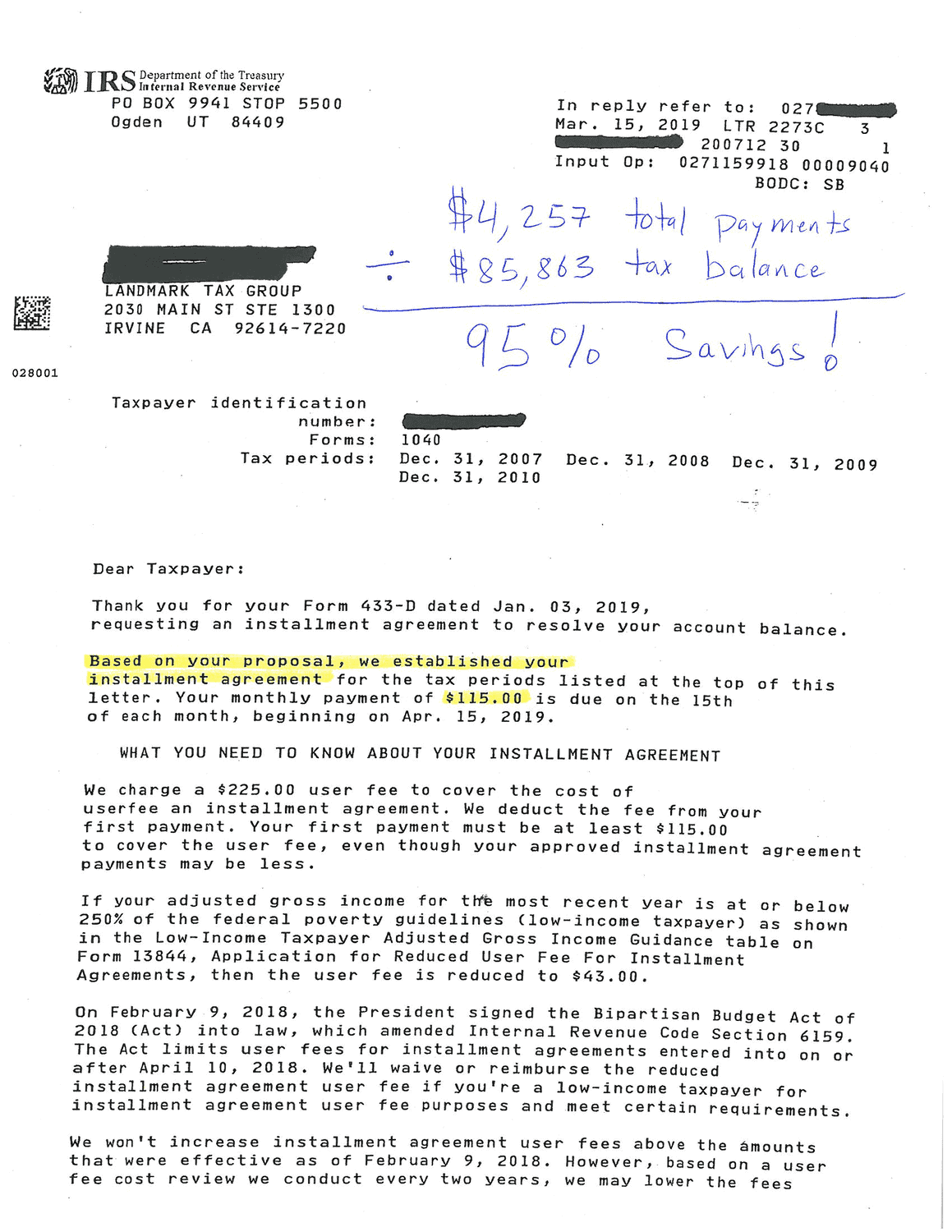

For those owing over 10000 but less than 25000 we highly recommend using a Tax Professional to assure you obtain an affordable payment plan but one that fits into IRS Collection Guidelines. 1 The IRS adjusts its. File their tax return or request.

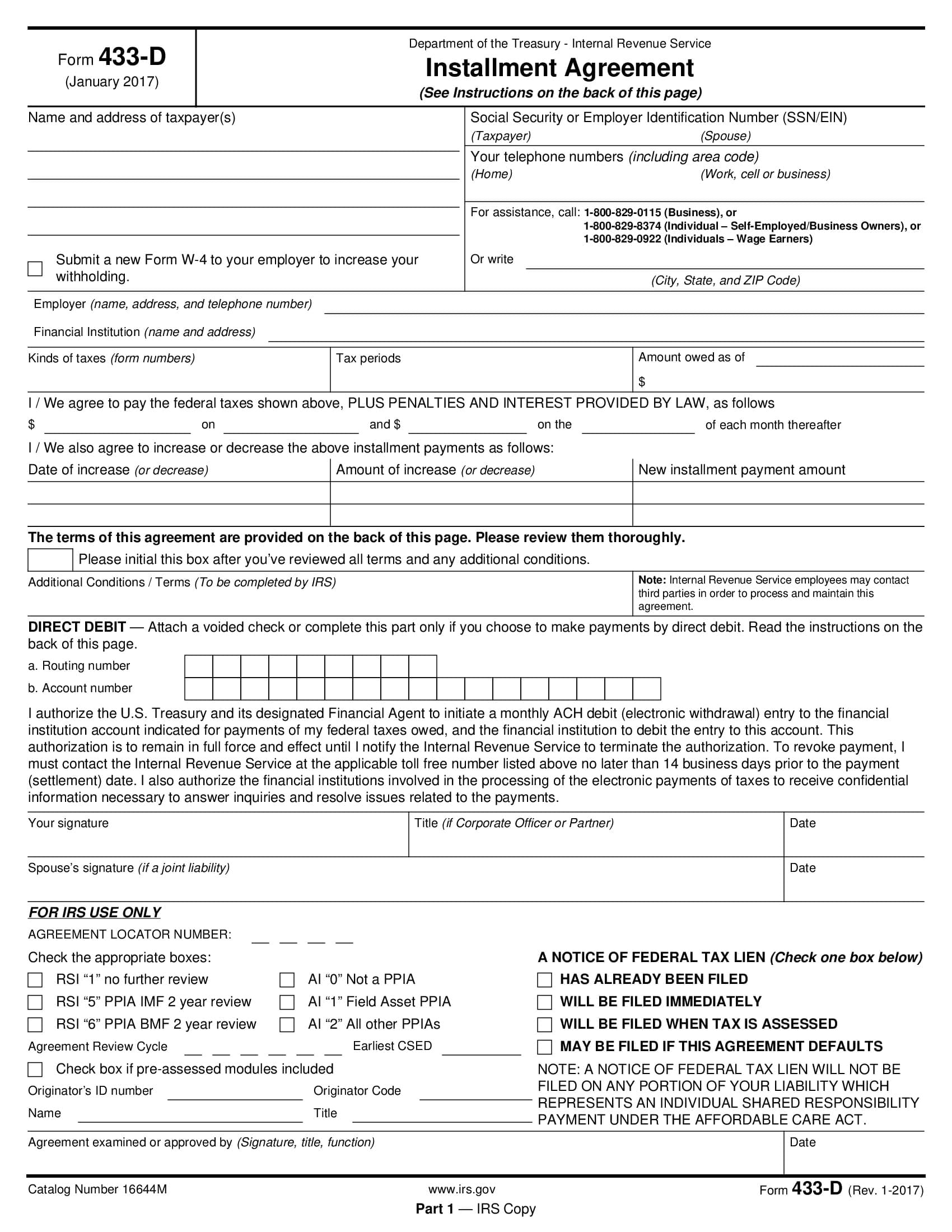

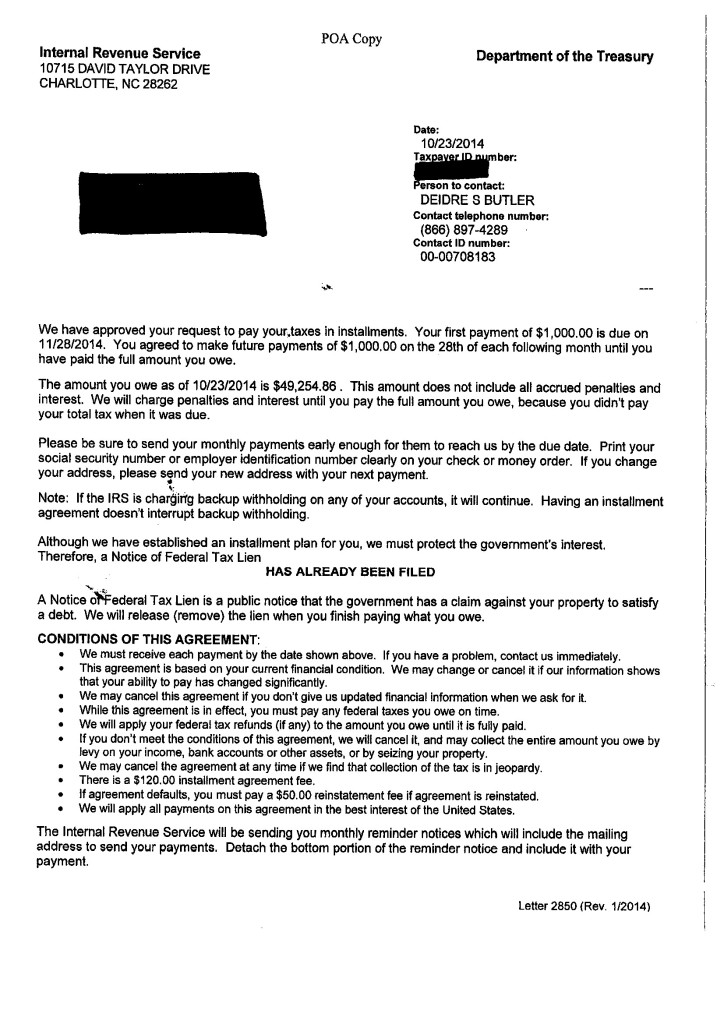

The filing and payment deadline for most 2020 federal tax returns is here. Long-Term Payment Plan Installment Agreement pay monthly Pay monthly through automatic withdrawals. If there is no Federal Tax Lien to contend with you will need to supply detailed documentation of the IRS payment plan to Fannie Mae.

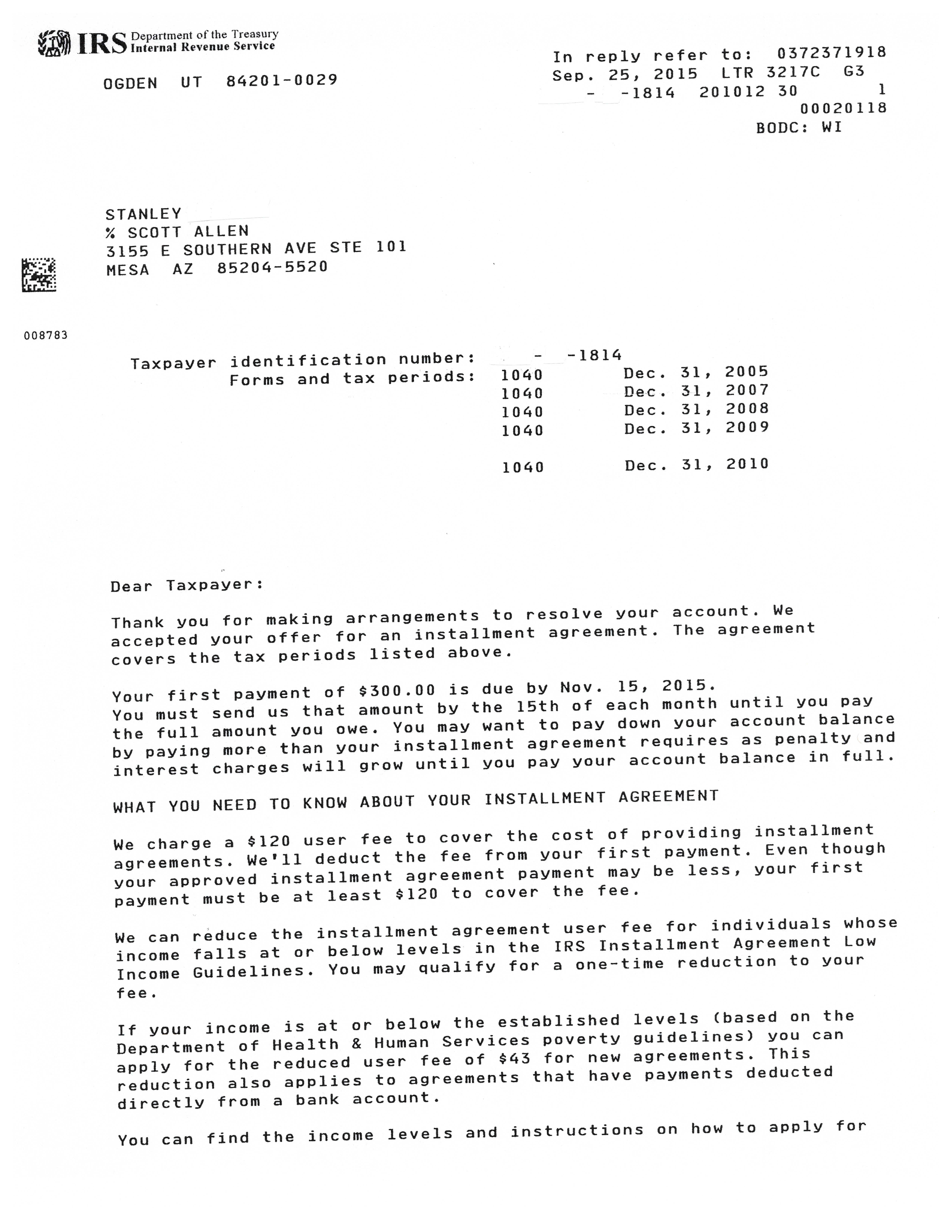

If you dont qualify for the IRSs Offer In Compromise program a Payment Plan may be the way to resolve your problem. Depending on how much you owe you can opt into a short-term or long-term payment plan for owed taxes. For individuals only.

Youll avoid collection actions such as tax liens and tax levies by setting up a plan. Short-term and long-term. Pay amount owed in full today electronically online or by phone using Electronic Federal Tax Payment System EFTPS or by check money order or debitcredit card.

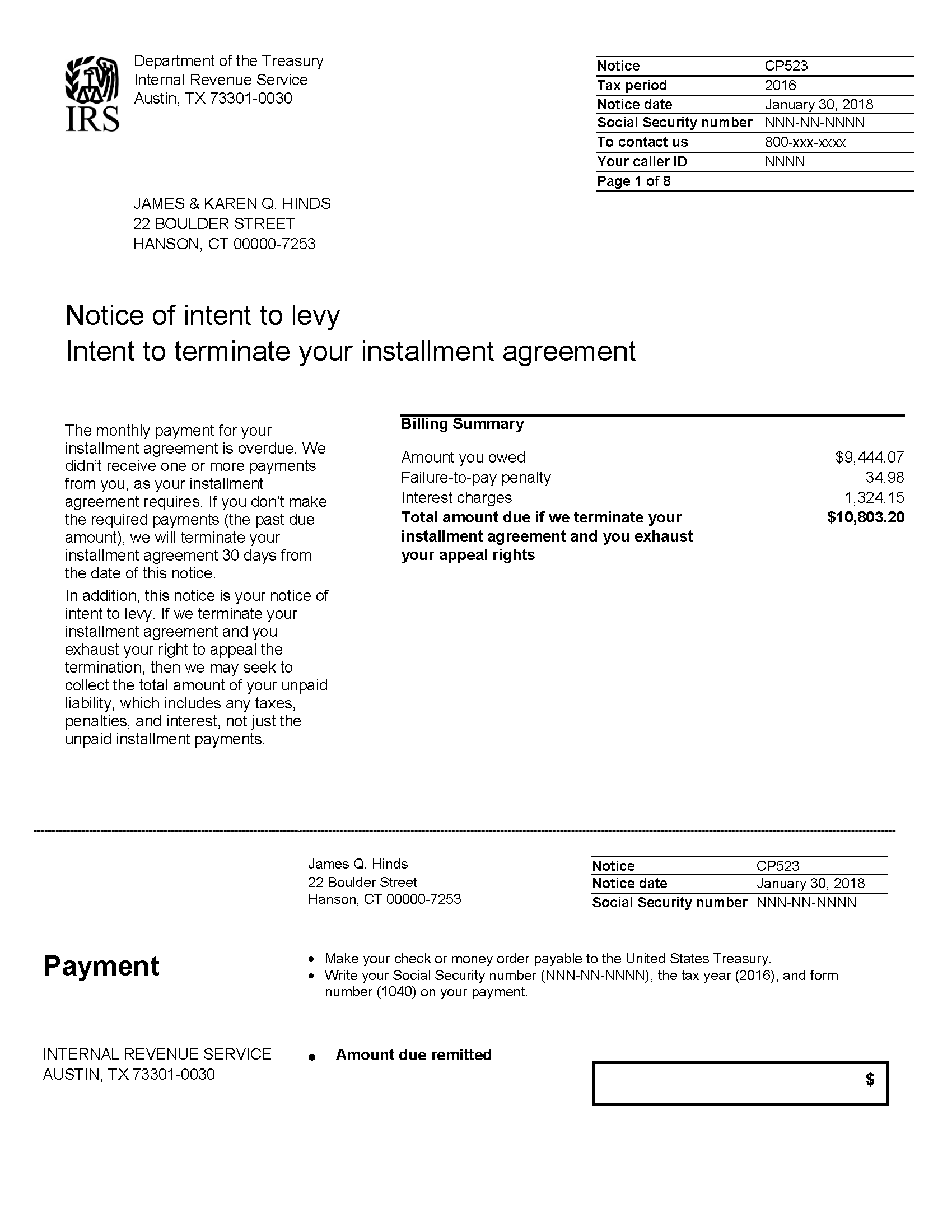

Log in to view the amount you owe your payment plan details payment history and any scheduled or pending payments. The Failure To Pay penalty accrues at 05 of the tax per. An IRS payment plan is an agreement to pay a federal tax debt within a specific timeframe.

The best thing you can do is file and pay taxes on time to avoid paying stiff late penalties to the IRS. There are two kinds of IRS payment plans. The interest rate can be increased or decreased on a quarterly basis.

Long-term payment plans will vary based on the amount of taxes you owe. Taxpayers who owe less than 10000 typically have up to three years to pay. If you dont have the money and cant pay taxes due when you file but will be able to pay soon you can.

There are several IRS payment options and payment plans for you to pay your federal taxes over time if you miss the deadline. Most recently the short-term rate was listed at 272 percent in January 2019 with a rate of 6 percent for IRS installment agreements. The IRS will want the tax debt paid most of the time in a 36 month period of time.

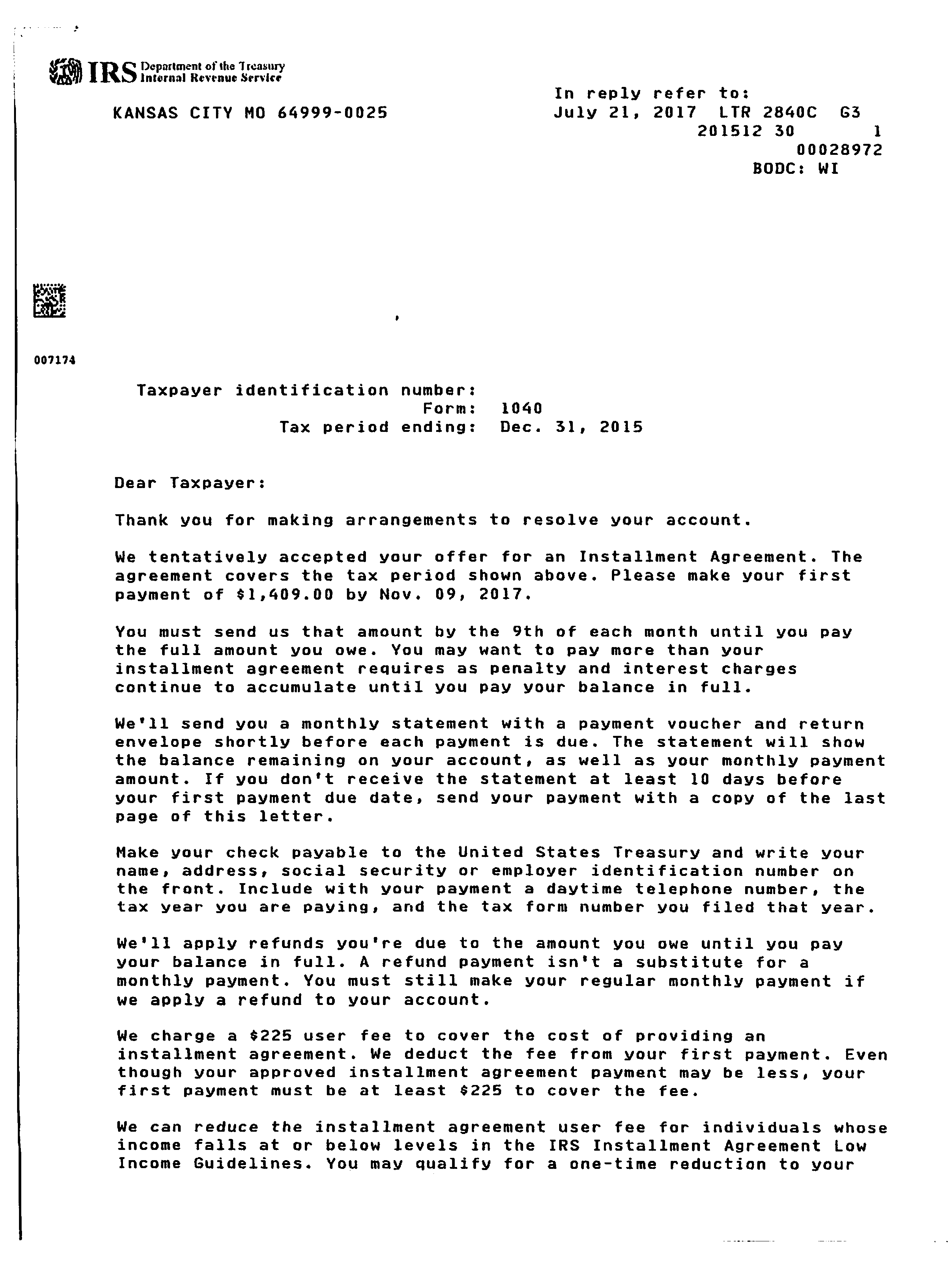

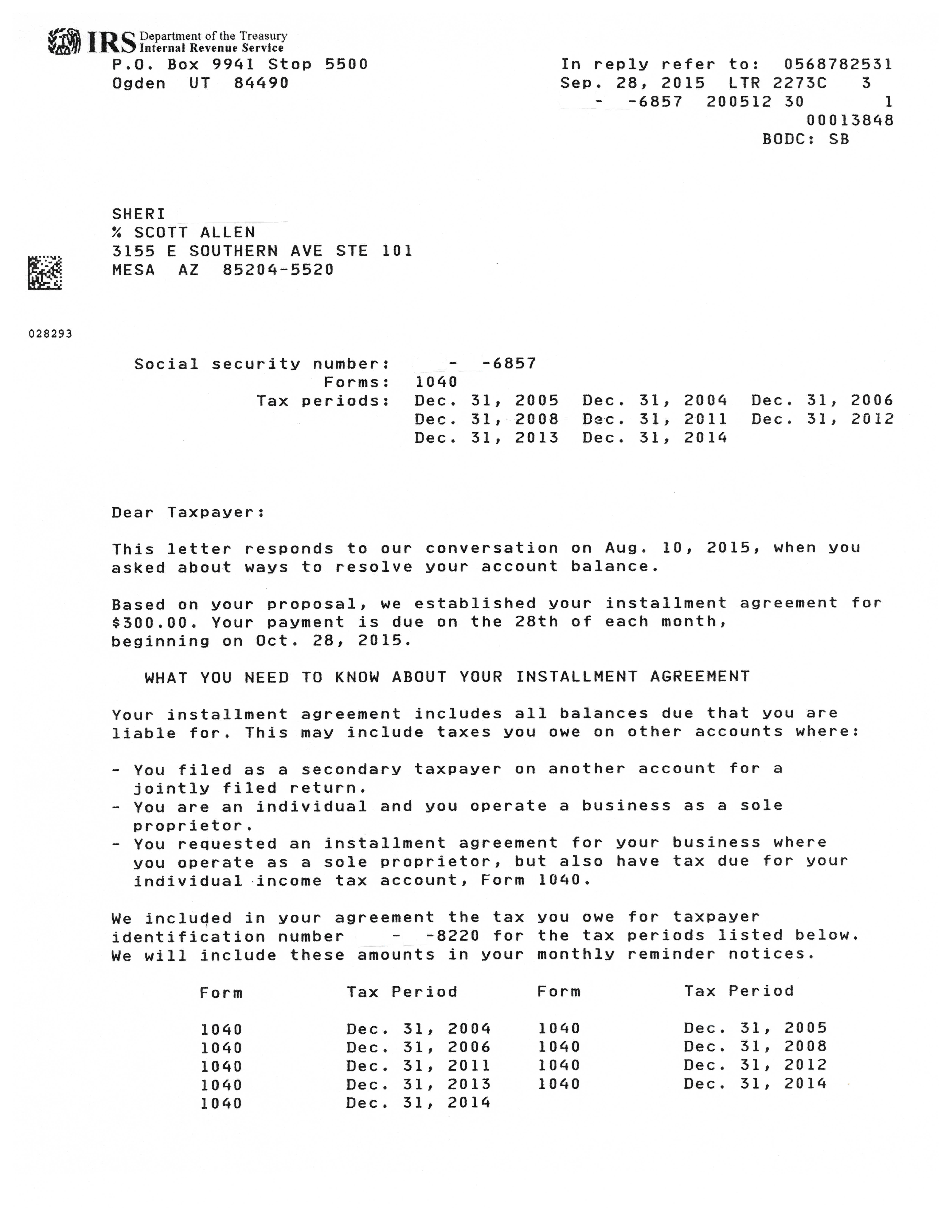

An IRS payment plan is an agreement that gives you an extended period of time to pay off the taxes you owe. When you fall behind on your income tax payments the IRS may let you set up a payment plan called an installment agreement to get you back on track. This will assure you of a IRS Tax Resolution that works for you.

The IRS payment plan interest rate equals the federal short-term rate which is established by the agency as a minimum interest rate for loans plus 3 percent rounded to the nearest whole percentage. In order to do so the IRS will typically verify whether current tax payments have been made depending on the type of installment agreement you qualify for. Here are some tips for taxpayers who owe tax but who cant immediately pay their tax bill.

Short-Term Tax Payment Plans. An IRS payment plan protects you from enforced collections actions such as wage or bank levies or in most cases a Notice of Federal Tax Lien. Current Year - Tax Year 2021.

It is up to you however to take that first step and make a request for the installment agreement which you can do by filing Form 9465. If a Federal Tax Lien is in effect Fannie Mae will require you to have the delinquent taxes paid in full prior to or at closing even if you have an IRS payment plan in place. Fees apply when paying by card.