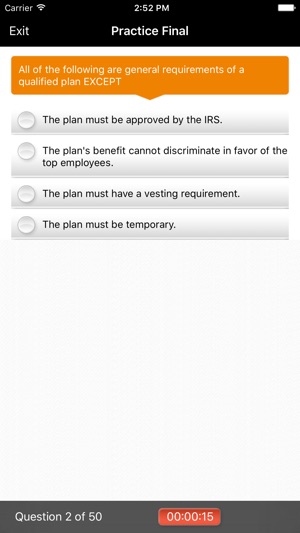

All Of The Following Are General Requirements Of A Qualified Plan Except

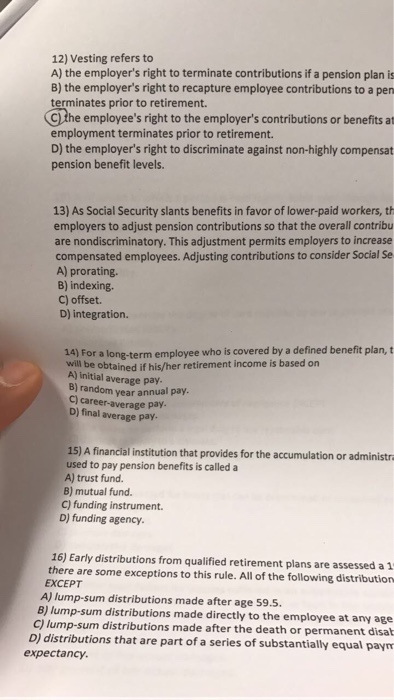

In other words they must vest in the plan participant.

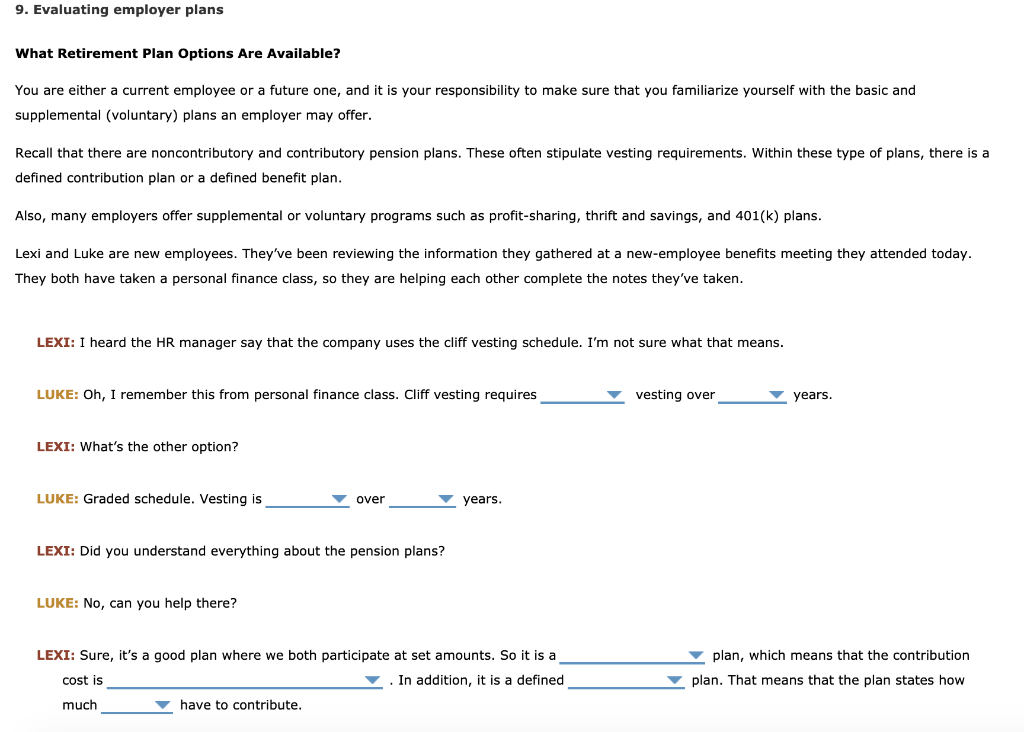

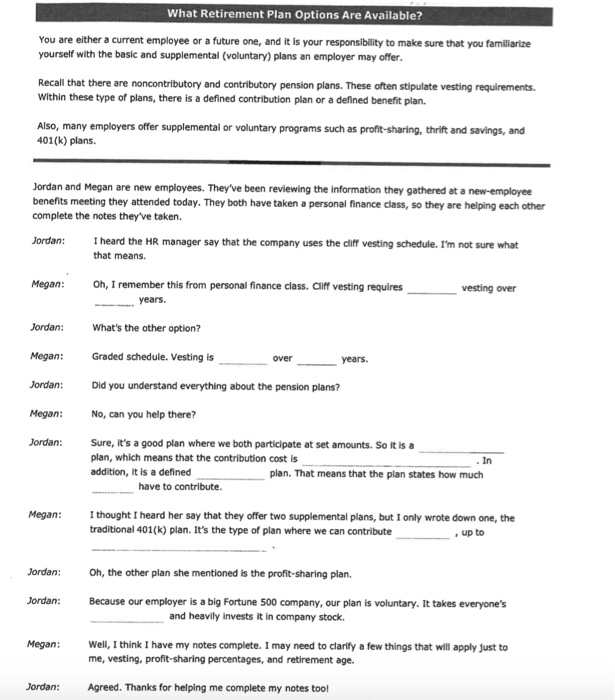

All of the following are general requirements of a qualified plan except. All of the following are general requirements of a qualified plan EXCEPT. Under the eligibility test a plan does not discriminate in favor of HCIs if it meets all of the following requirements. Decode means to translate thoughts or ideas so they can be understood by others.

All of the following are general requirements of a qualified plan EXCEPT. ExceptionWhere the employer demonstrates that site constraints require one or more employees to be under the boom jib or other components when pins or similar devices are being removed the AD director must implement procedures that minimize the risk of unintended dangerous movement and minimize the duration and extent of exposure under the boom. The plan must be permanent written and legally binding agreement.

The insured may choose to convert to term or permanent coverage. Disallowing direct deposit of income tax refunds from the IRS into an IRA. Employer contributions made to a qualified plan.

Acknowledgment means the receiver has received and agrees with the message. D The plan must provide an offset for social security benefits. All of the following employees may use a 403 b plan for their retirement EXCEPT.

The employer has to prepare a plan document. It satisfies all requirements of the Internal Revenue Service for favorable tax treatment. Plan must be for the exclusive benefits of the employees and their beneficiaries.

If she terminated her group coverage which of the following is statements is INCORRECT. Premium are determined by the age sex and occupation of each individual certificate holder. A qualified plan must limit the compensation used to determine benefits under IRC 401a17.

Transmit concerns the method used to convey the message. The CEO of a private corporation. Tap card to see definition.

The plan must provide an offset for social security benefits. All of the following are general requirements of a qualified plan EXCEPT. A defined benefit plan eg a traditional pension plan is generally funded solely by employer.

You are preparing your communications management plan and know that all of the following are true except for which one. Covers for holes in floors roofs and other walkingworking surfaces shall meet the following. Plan must be permanent written and legally binding 2.

Entry Requirement Entry into the plan is not delayed. All of the following are general requirements of a qualified plan EXCEPT A. The purchasing cycle consists of all the following elements except.

Click again to see term. A contribution may be returned to the employer if it was made due to a mistake of fact. One of the hallmarks of qualified plans is the requirement that at some point benefits must be nonforfeitable.

The plan must provide an offset for social security benefits. All of the following are true of the federal tax advantages of a qualified plan EXCEPT. All of the following statements regarding plan qualification under IRC 401a are TRUE EXCEPT.

The plan must be for the exclusive benefits of the employees and their beneficiaries. Tap again to see term. Operation in accordance with the plan document.

Click card to see definition. Individuals covered under the policy receive a certificate of insurance. 5-year cliff vesting or.

All of the following are general requirements of a qualified plan EXCEPT. Plan must be communicated to all employees 4. In general qualified plan benefits must vest at least as quickly as under one of the following two regimes.

The plans must provide an offset for social security benefits. Qualified plans generally must be made available to employees no later than the date on which they reach age 21 and after completing one year of service with the employer. Except as provided in paragraph c4ii of this section safety nets and safety net installations shall be drop-tested at the jobsite after initial installation and before being used as a fall protection system whenever relocated after major repair and at 6-month intervals if left in one place.

B The plan must be for the exclusive benefits of the employees and their beneficiaries. The cost of corrective action taken by the purchaser and chargeable to the supplier under the terms of the contract is. C The plan must be permanent written and legally binding.

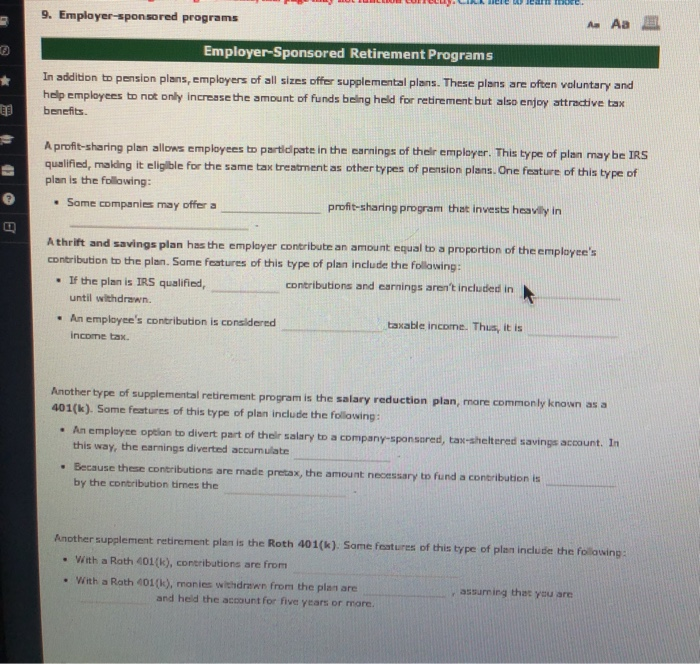

A qualified plan is an employer-sponsored retirement plan that qualifies for special tax treatment under Section 401 a of the Internal Revenue Code. The Pension Protection Act of 2006 requires all of the following EXCEPT. There are many different types of qualified plans but they all fall into two categories.

Employment Requirement The same employment requirement applies to all employees and the plan does not require more than three years of employment to participate. Plan must provide an offset for social security benefits 3. The plan must provide an offset for social security benefits.

At distribution all amounts received by the. All of the following are characteristics of group life insurance EXCEPT. An employee is insured under her employers group life plan.

.jpg)