Did You Receive Any Distributions From A Retirement Plan After 2014?

The IRS requires that all retirement plan distributions not including direct rollovers be subject to a 20 withholding even if you intend to roll it over later.

Did you receive any distributions from a retirement plan after 2014?. Certain retirement payments or distributions a taxpayer receive from a retirement plan or IRA can be rolled over by depositing the payment into another retirement plan or IRA within 60 days of the date of distribution. ERISA consultants at the Retirement Learning Center Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs qualified retirement plans and other types of retirement savings and income plans including nonqualified plans Social Security and Medicare. Form 1099-R also reports profit-sharing and pension plan distributions payments resulting from insurance contracts survivor benefits and those received from.

Generally speaking you have 60 days from the date you receive a distribution to roll it over into another plan or IRA. Received by a qualified individual from an eligible retirement plan on or after August 25 2005 and before January 1 2007 are permitted to be treated as Katrina distributions. Secondly if you have a non-governmental 457f planwell take plan documents home and plan to waste several hours trying to figure that puppy out.

Retirement benefits are basically an extension of compensation arranged by the employer and employee. Additionally if you took a loan from your retirement plan and allowed the outstanding loan balance to become a taxable distribution due to untimely payments or because you left your job before the loan. You must report the distributions as income in the year you take them.

TurboTax asks for this information in the Retirement Savings Contributions Credit section of the interview because distributions made in 2015 2016 2017 or in 2018 through the due date of your tax return reduce dollar for dollar the amount of each spouses 2017 retirement contributions considered for the credit. If you received a distribution from your retirement plan amounting to 10 or more during the previous tax year you can expect to receive a copy of Form 1099-R. The annual contribution eligible for the credit may have to be reduced by any taxable distributions from a retirement plan or IRA that you or your spouse receive during the year you claim the credit during the 2 preceding years or during the period after the end of the.

By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you. Cash rollovers from qualified employer plans or IRAs to a traditional IRA are tax- and penalty-free. However if the retirement plan account is an IRA or the account owner.

Moreover there are many more flavors of Non-Qualified Deferred-Compensation NQDC plans in the world. Look closely and discover. Again it is important to review the plan document to.

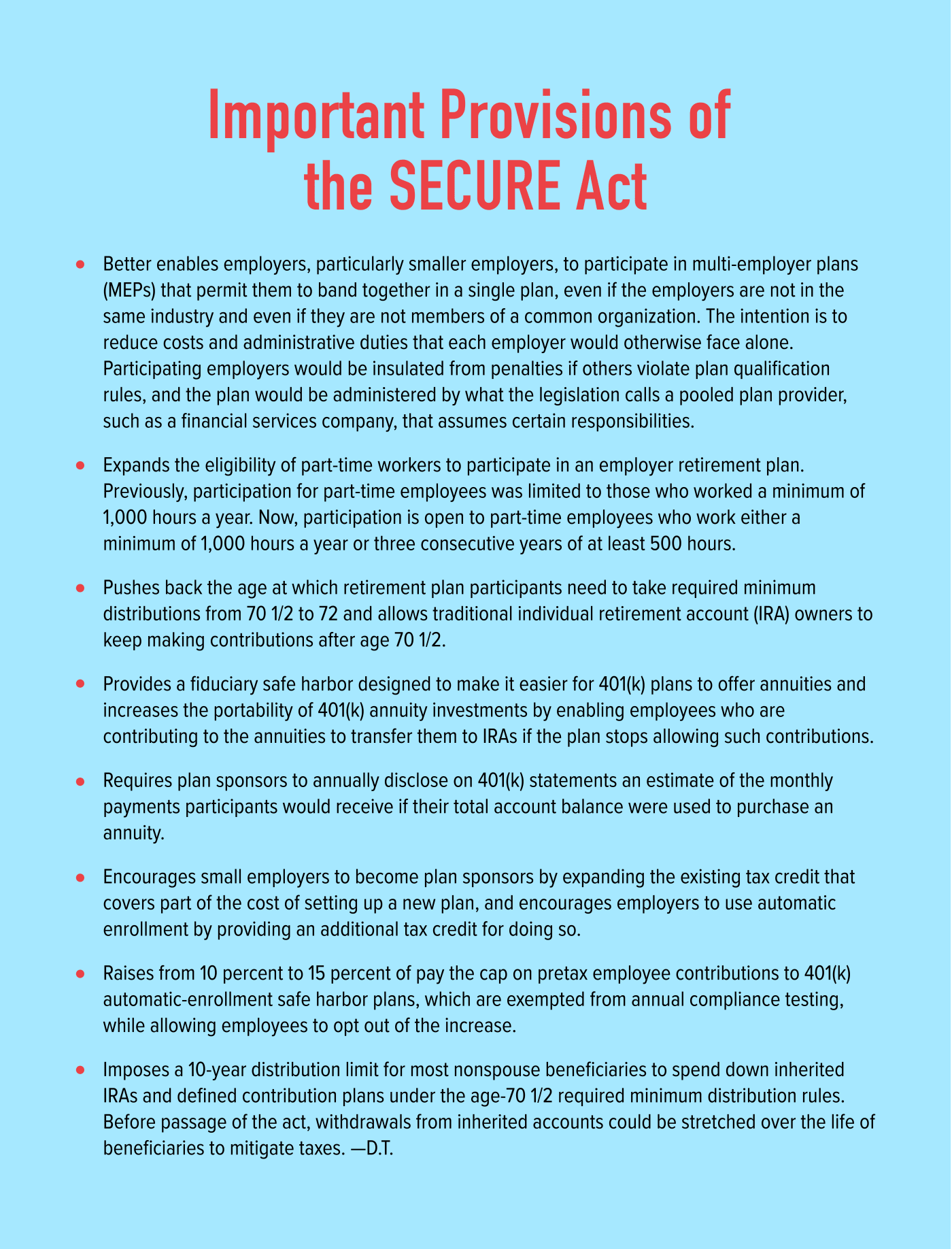

Required Minimum Distributions RMDs generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 70 ½ if you reach 70 ½ before January 1 2020 if later the year in which he or she retires. Pension and annuity payments. If your distribution came from a railroad retirement account you should receive Form RRB-1099-R.

Were only talking about distributions that - Answered by a verified Financial Professional. You can expect a 1099-R if you received money from an individual retirement account rolled over funds from another retirement account such as a 401k or 403 b plan or converted a traditional IRA to a Roth IRA. The age 55 exception to the 10 penalty only applies to distributions made from a plan if you separate from service in the year you turn 55 or older.

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. So youll receive a 1099-R when and if you take distributions from any of your traditional retirement savings plans. Ill get into some detail on the differences between the 457b vs.

IRA rollover of a cash distribution. Similar rules apply. Retirement plan to receive the distribution a qualified plan must pay the distribution to that eligible retirement plan in a direct rollover.

This item discusses the 2020 changes to retirement plan distributions and loans made by the CARES Act as well as tips to take the most tax-efficient advantage of those changes. Did or receive any distributions from a retirement plan after 2014. After 60 days that money is considered to be taxable income and subject to.

We use cookies to give you the best possible experience on our website. If you receive a cash distribution from a qualified retirement plan or IRA you have 60 days to roll over part or all via a deposit to an IRA. If your distribution in 2016 was greater than or equal to.

Of any taxable distribution received by the taxpayer or by the taxpayers spouse if the taxpayer. The CARES Act creates and describes a specific kind of distribution from qualified retirement plans called a. Normally you report distributions from retirement plans as taxable income once you retire and start receiving payments although there are exceptions.

/GettyImages-973099588-67d2e83fc430468b93c7ec4be85aeca9.jpg)