Trump's Tax Plan For Middle Class

The reason no one has answered the question is.

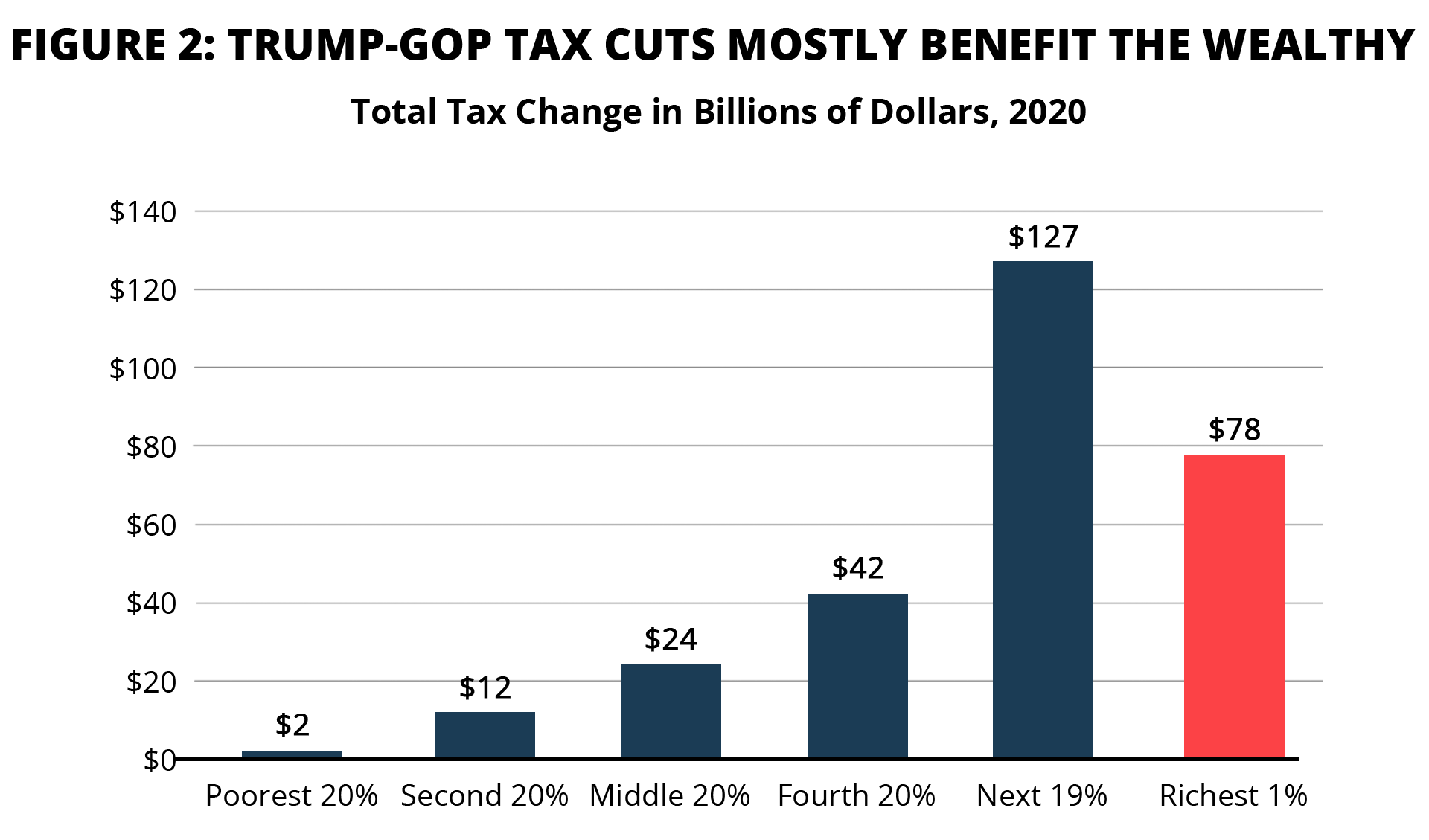

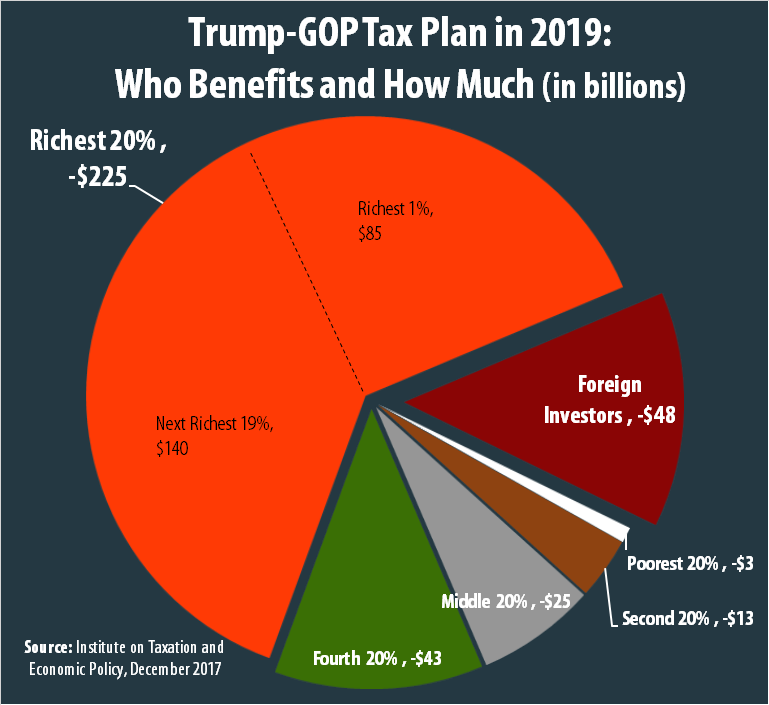

Trump's tax plan for middle class. That means most middle-income and working-class earners enjoyed a tax cut that was at least double the size of tax cuts received by households earning 1 million or more. It wont help at all and will make life more miserable for some of us because by cutting taxes for the wealthy there wont be money for such things as food stamps child medic al care Meals on Wheels and other programs which help. The Trump administration has a dirty little secret.

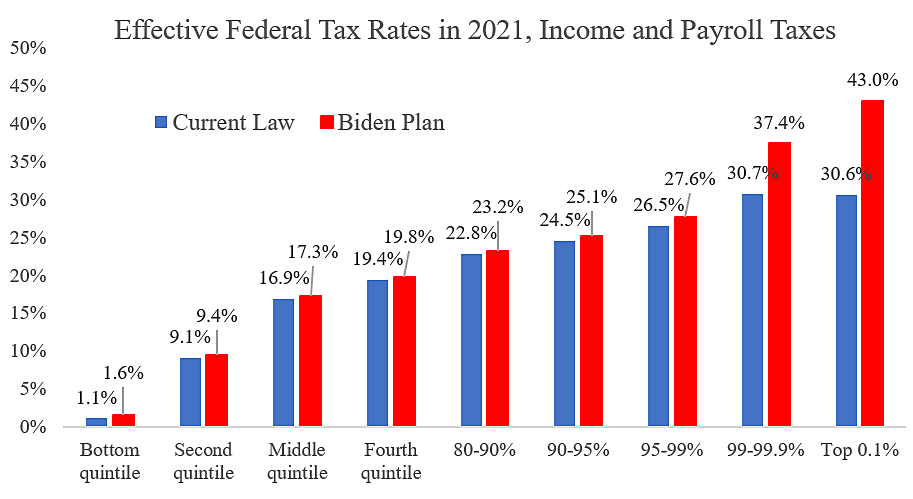

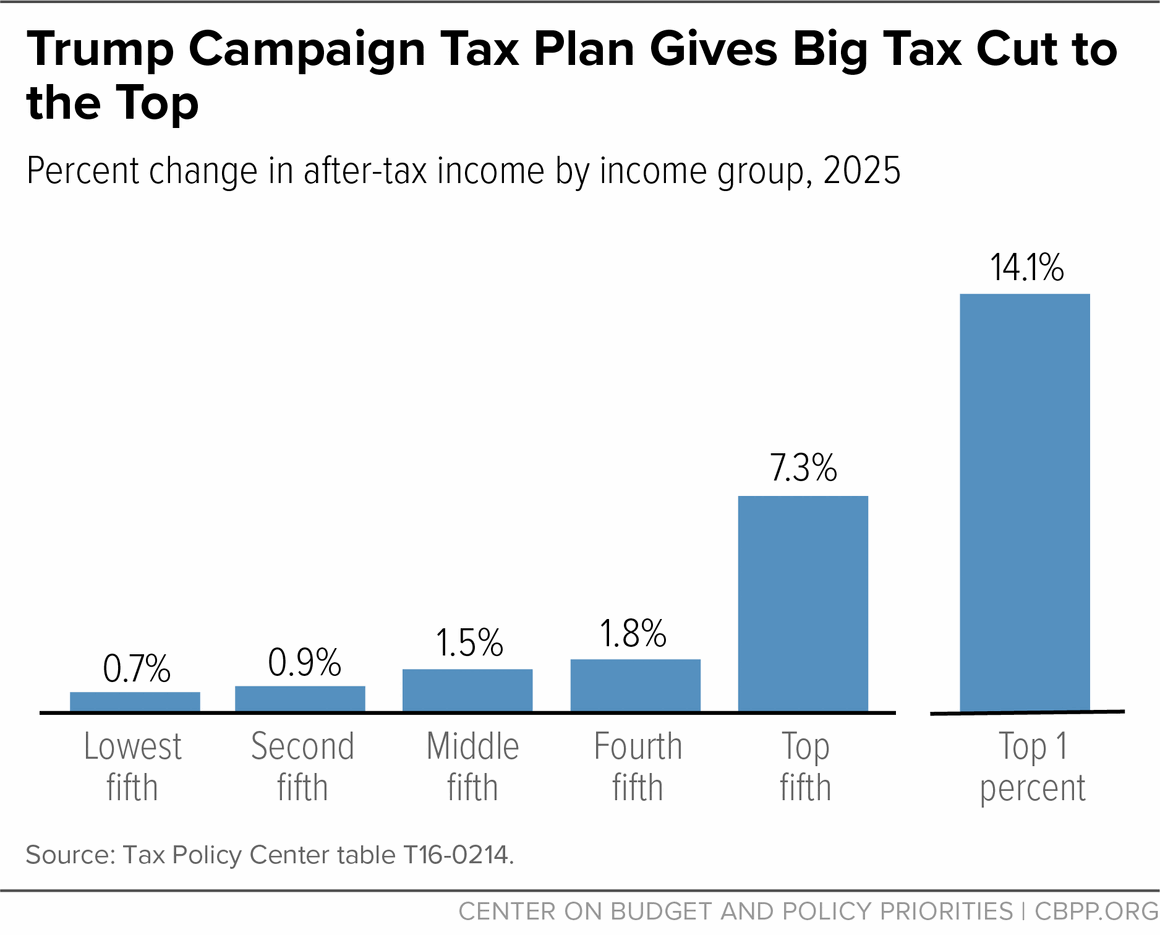

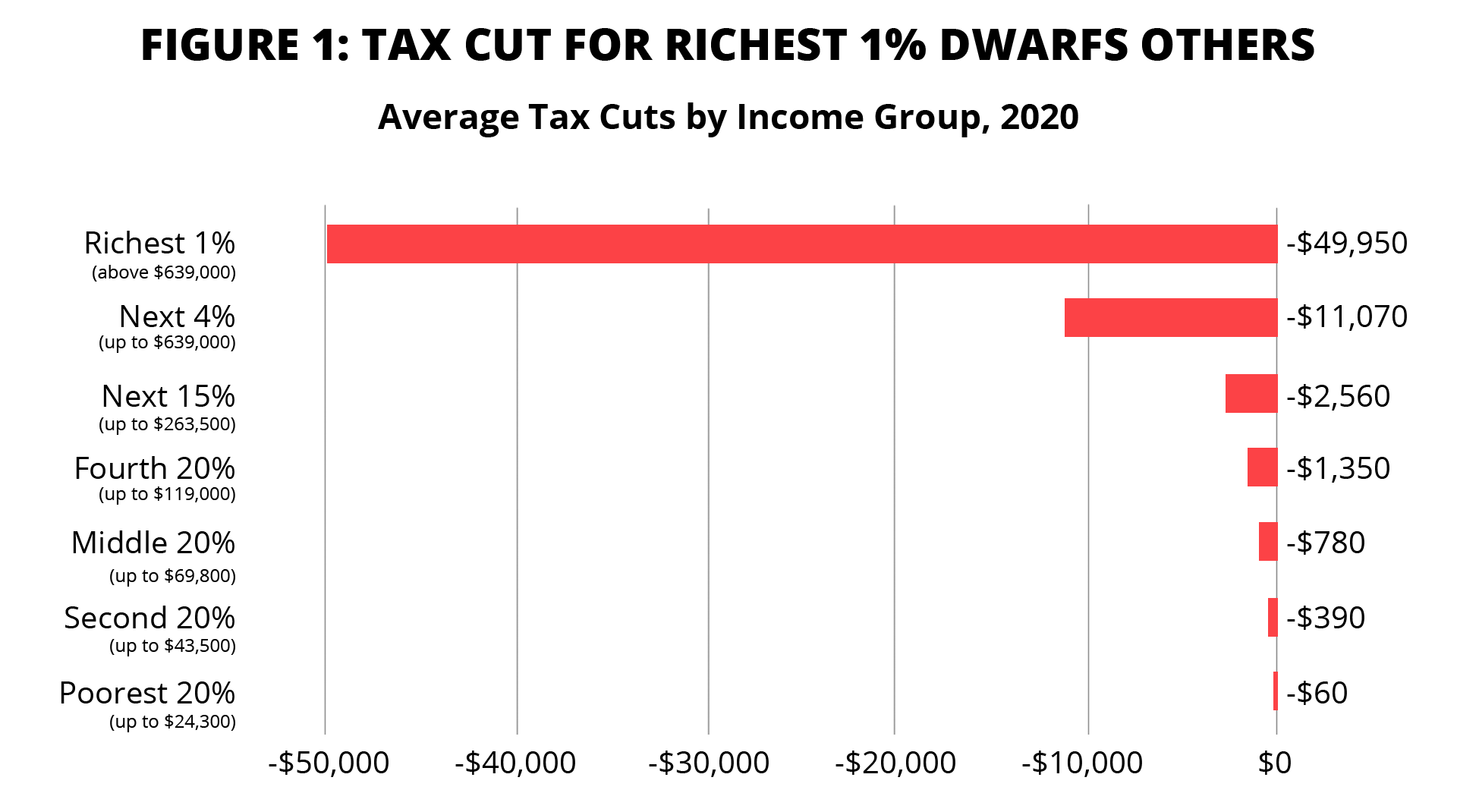

Those in the middle three-fifths of the income scale would have. The highest tax bracket is now 37 for big earners. In addition to these employee benefits Americas middle class is seeing direct tax relief.

That would slash the top rate from the current 396 percent. Its not just planning to increase taxes on most Americans. The largest tax reductions are for the middle class said Trumps Contract With the American Voter released last month.

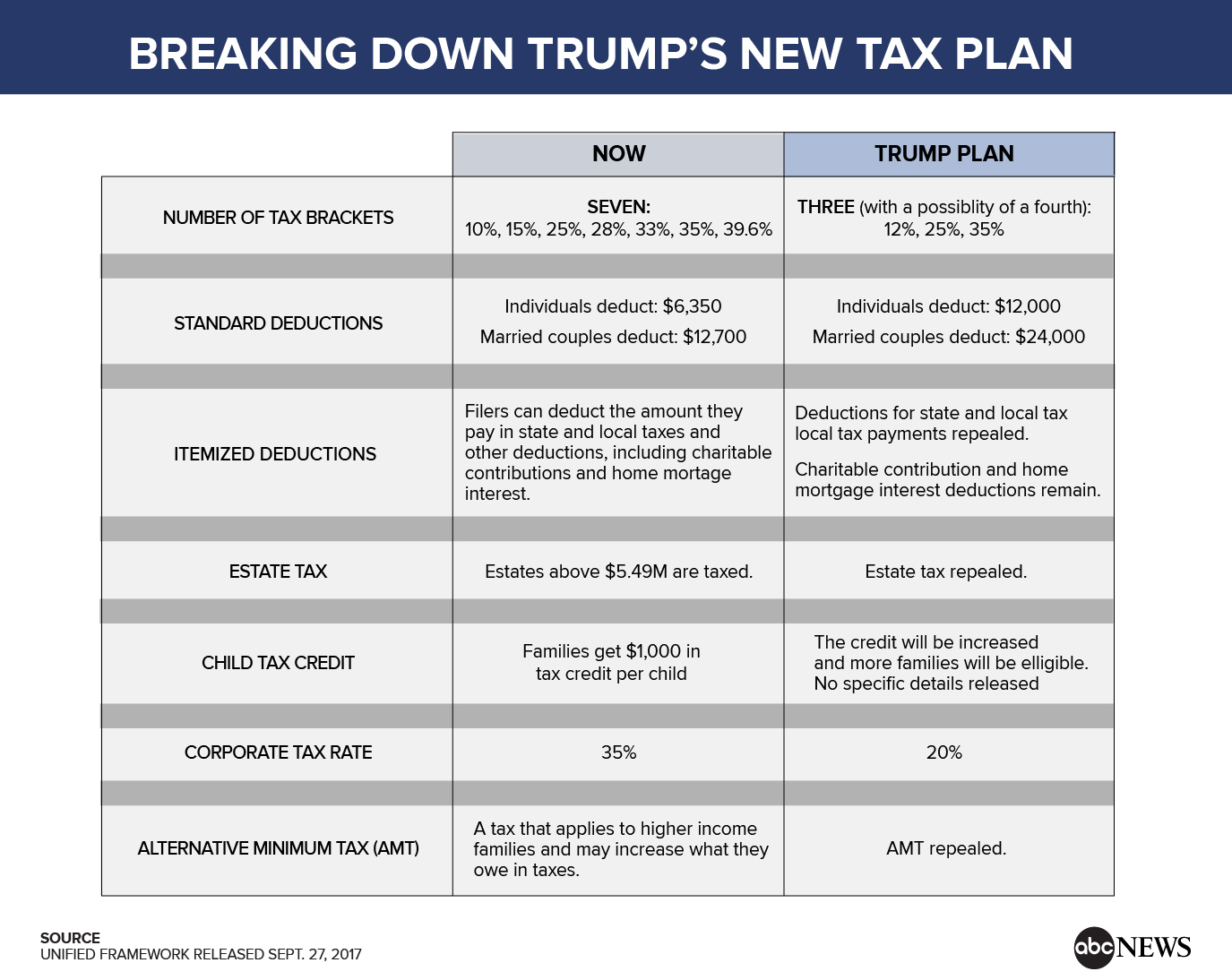

See How Trumps Tax Plan Will Change Things. McConnell said on Nov. The brackets proposed are 12 25 35 and 396.

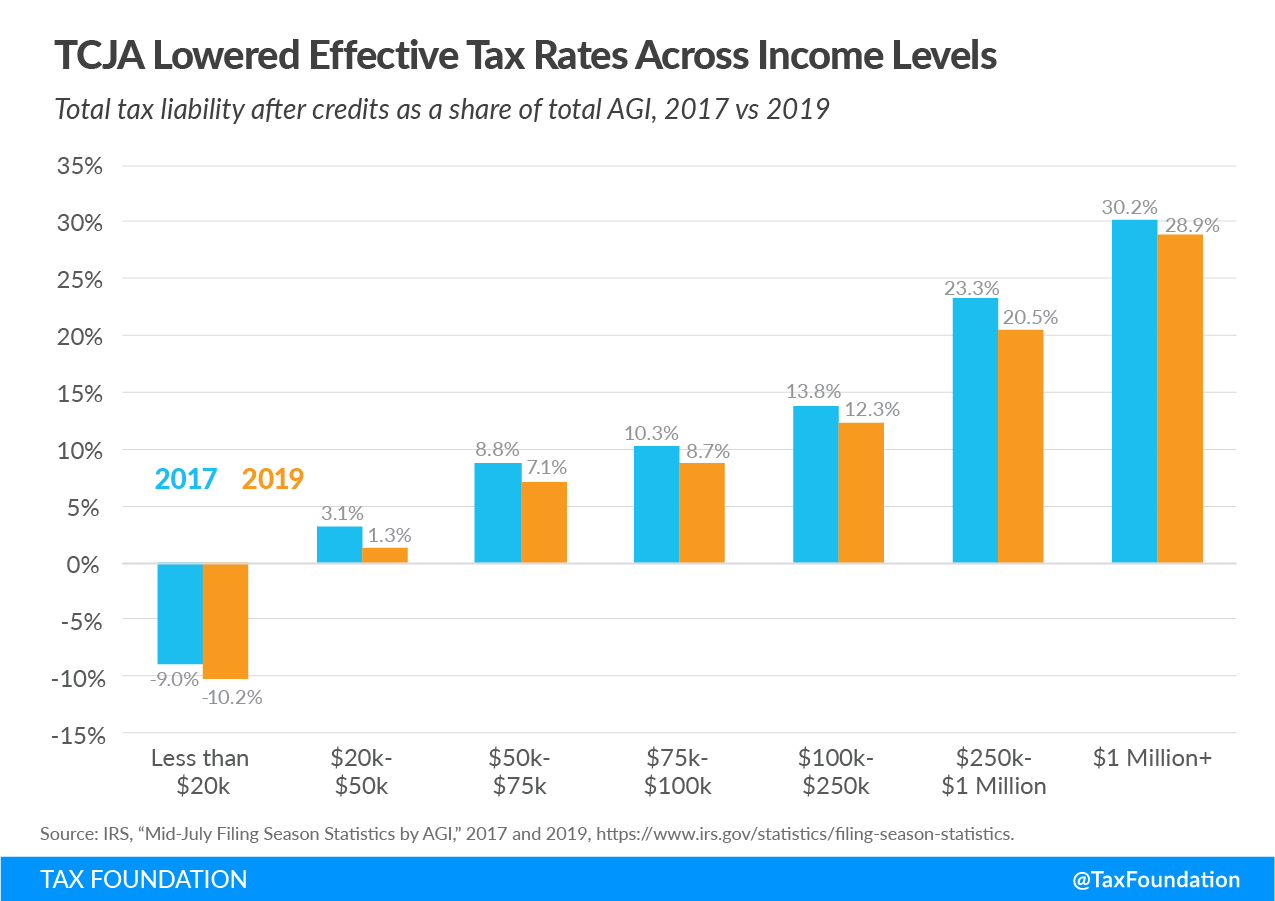

The Trump plan also phases out the tax exemption on life insurance interest for high-income earners ends the current tax treatment of carried interest for speculative partnerships that do not grow businesses or create jobs and are not risking their own capital and reduces or eliminates other loopholes for the very rich and special interests. IRS data proves Trump tax cuts benefited middle working-class Americans most By Justin Haskins Opinion Contributor 120421 0800 AM EST The views expressed by contributors are their own and. Updated on November 15 at 413 pm.

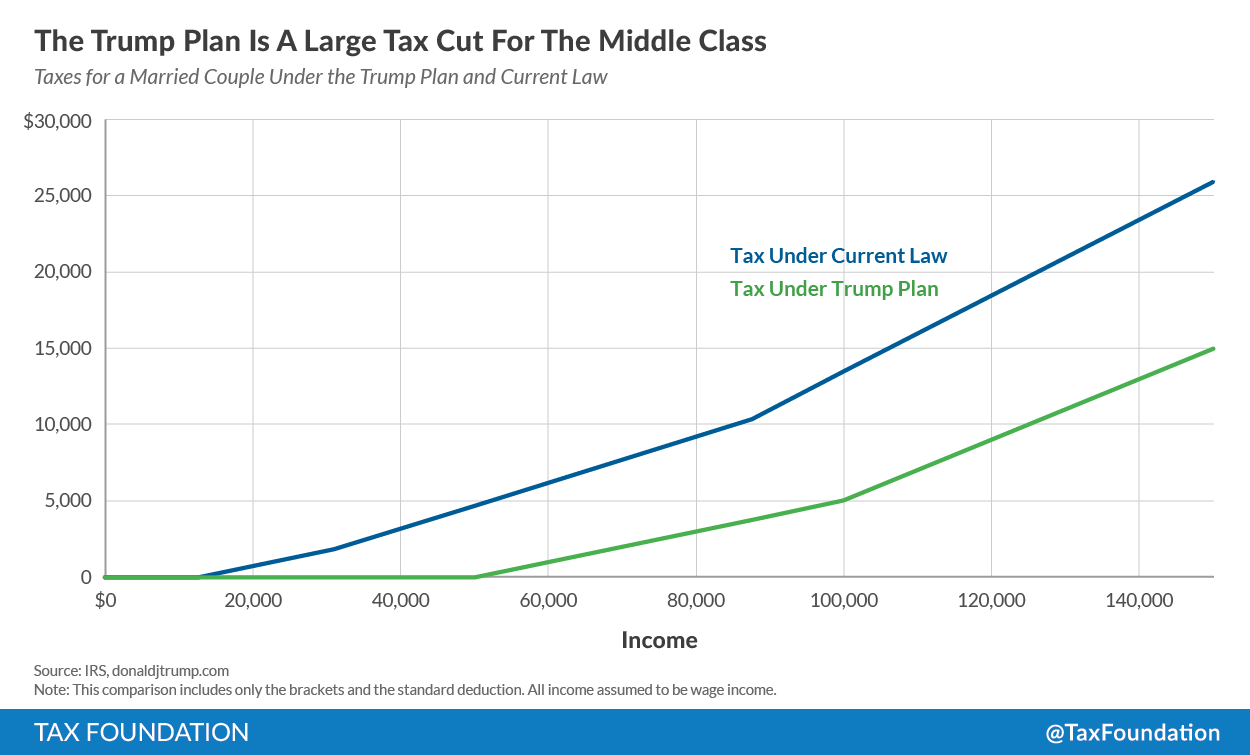

A family of four with annual income of 73000 is seeing a 60 percent reduction in federal taxes. More salient for middle-income Americans are a big boost in the standard deduction from 13000 to 24000 for married couples and a doubling of the credit most families get for each school-age child from 1000 to 2000. He would repeal the estate tax which affects only about 02 percent of estates those worth above 545 million.

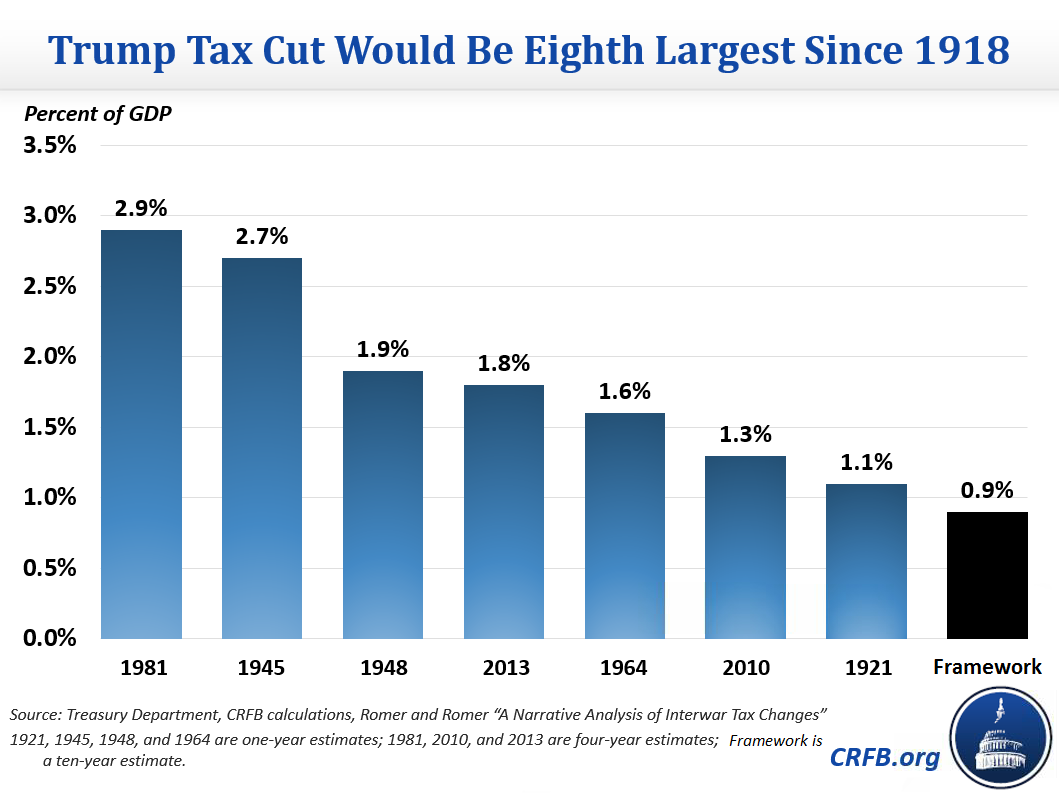

The analysis comes two years after President Donald Trump enacted the Tax Cuts and Jobs Act a major overhaul in the nations tax laws billed by the White House as a boon for the middle class. The tax hikes that would hit single parents and large families would result from Trumps plan to eliminate the personal exemption and the head-of-household filing status. It lowered the corporate tax rate to 21 from 35 at the turn of 2018.

The most obvious way that the Trump tax plan hurts middle-class and working families is that many would actually face a tax increase under the parameters the administration has laid out. He would repeal the estate tax which affects only about 02 percent of estates those worth above 545 million. But what the Tax Act gives middle-income families with one hand it takes away with the other.

4 2017 that no one in the middle class will experience a tax hike. The Tax Cuts and Jobs Act came into force when President Trump signed it. Under Trumps tax plan the corporate tax rate dropped from 35 percent to 21 percent.

Trumps tax plan wont help the middle class. The increase has already been signed sealed and delivered buried in the pages of the 2017 Tax. These reductions and eliminations will.

The Trump plan eliminates the income tax for over 73 million households. A careful analysis of the IRS tax data one that includes the effects of tax credits and other reforms to the tax code shows that filers with an adjusted gross income AGI of 15000 to 50000. President Trump and congressional Republicans have repeatedly insisted that the top priority of their tax reform is delivering relief to the middle class.

Whats more IRS data. See How Trumps Tax Plan Will Change Things. The middle class will get less than Trump had originally planned while the rich will get more.

Lefty economist Joe Stiglitz reports in The New York Times that the middle class is going to face a tax hike next year thanks to Republicans. It would cut the top 396 percent. Says the GOP plan raises middle class taxes by 470 billion.

Other changes include cutting the rates of income tax doubling standard deductions but also cutting. Families Facing Tax Increases Under Trumps Tax Plan Accessed Jan.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9354235/tpc_distribution_big_six.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/13323345/Screen_Shot_2018_10_23_at_9.53.55_PM.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)