529 College Savings Plan Texas

Industry average 529 expense ratio.

529 college savings plan texas. Rowe Price TIAA-CREF and Vanguard. Vanguard managed approximately 987 billion in 529 plan assets as of March 31 2020. Like most 529 plans the Texas 529 plans have state tax benefits that mirror the federal tax benefits.

Both the Texas direct-sold 529 plan Texas College Savings Plan and the advisor-sold plan Lonestar 529 Plan are managed by Orion Advisor Solutions Inc. Orion is the plan manager and the Plan is distributed by Northern Lights Distributors LLC NLD and administered by Gemini Fund Services LLC Gemini. Texas has two 529 college savings plans the Texas College Savings Plan and the.

Formerly known as NorthStar Financial Services Group LLC and offer investments from a diverse selection of firms. Citizens and permanent resident aliens 18 years of age or older can open and contribute to a LoneStar 529 Plan account. Texas 529 College Savings Plans.

Enrollment is easy the plan is flexible and you call the shots. The Texas College Savings Plan is established and maintained by the Texas Prepaid Higher Education Tuition Board. The Texas College Savings Plan is a tax-advantaged 529 college savings plan designed to help families and individuals nationwide save for qualified higher education expenses.

41 rows T. Be confident with a 529 College Savings Plan. Dont rely on luck alone.

Previously known as NorthStar Financial Services Group LLC offers two age-based investment options and seven static options using underlying investments managed by Artisan DFA Dodge Cox Dreyfus Invesco T. Citizens and permanent resident aliens 18 years of age or older can open and contribute to a Texas College Savings Plan account. The Vanguard 529 offers a premier education savings plan to help you invest at your best in the Lone Star State.

Age 0-6 High Equity. Texas does not have a personal state income tax. The LoneStar 529 Plan is a tax-advantaged 529 college savings plan designed to help families and individuals nationwide save for qualified higher education expenses.

Texas offers three tax-advantaged 529 plans. The Texas Prepaid Higher Education Tuition Board. Let the professionals with Texas Trusts Investment Services help you understand how a tax-advantaged 529 Plan can help improve the odds when it comes to saving for your loved ones college education.

Rowe Price and TIAA. Texas College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Rowe Price College Savings Plan.

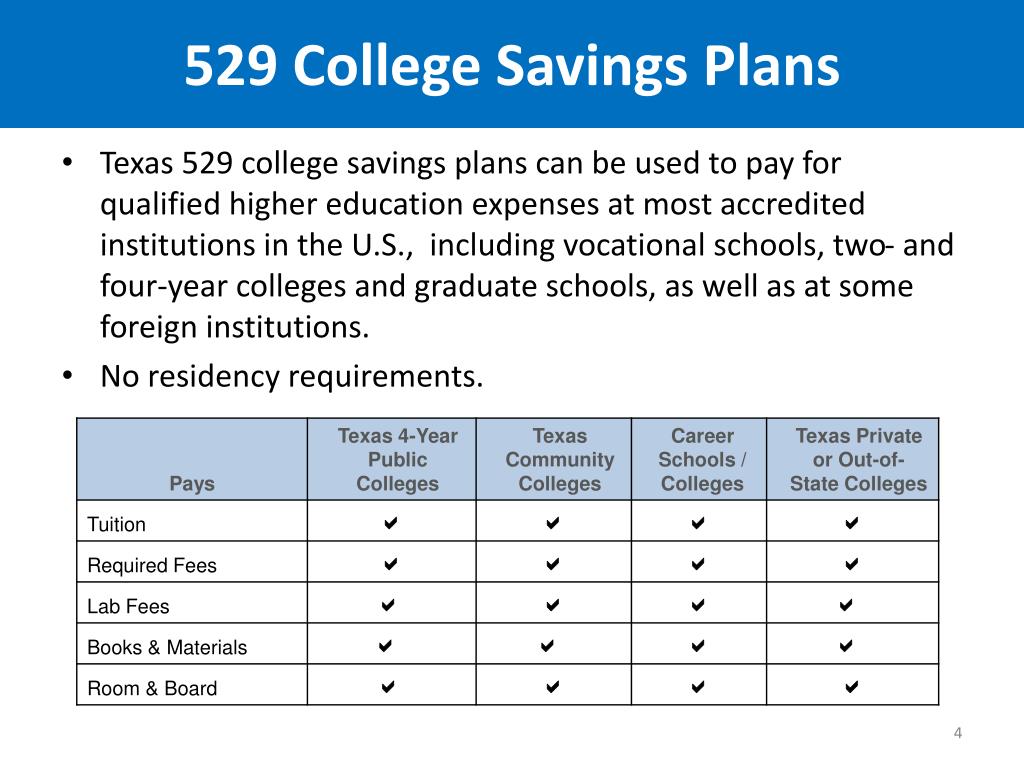

Get started with us Just about every state offers a 529including Texasbut you can enroll in any 529 plan to save for K 12 through college and beyond at schools worldwide. Vanguard average 529 expense ratio. The Texas College Savings Plan is the name of Texas 529 Plan.

To get started you can deposit 25. The plans are known as 529 plans because they are authorized by Internal Revenue Code Section 529. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer.

This plan allows you to. Direct this 529 plan can be purchased directly from the state. Texas 529 plans offer the standard federal and state tax benefits but do not offer any special state income tax benefits on contributions to the Texas College Savings Plan or Lonestar 529 Plan.

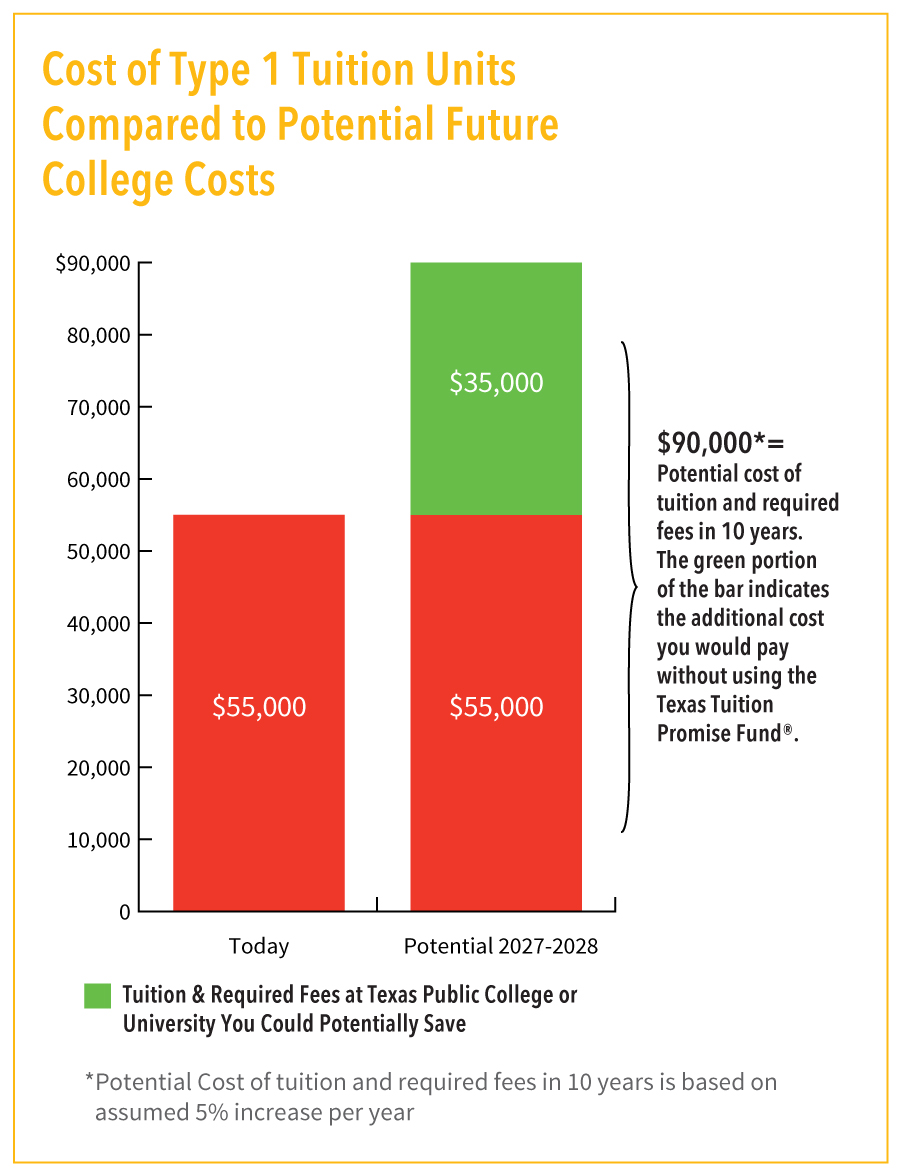

The Texas College Savings Plan TCSP and the LoneStar 529 Plan LS529 both college savings plans and the Texas Tuition Promise Fund TTPF a prepaid tuition plan. Earnings on 529 plans are tax-free if used for qualified. Texas offers two types of 529 Plans 529 Plan A 529 plan is an education savings plan operated by a state or an educational institution and designed to help families set aside funds for college.

3 rows The first Texas 529 plan is the Texas College Savings Plan. This plan offers a variety of investment options including age-based portfolios that become more conservative as the child approaches college and static investment fund options. The Texas College Savings plan managed by Orion Advisor Solutions Inc.

The funds offered include VanguardT. Orion Advisor Solutions Inc.