403 B Retirement Plan

A 403 b also known as a tax-sheltered annuity plan is a retirement plan for employees of public schools nonprofits and other tax-exempt organizations.

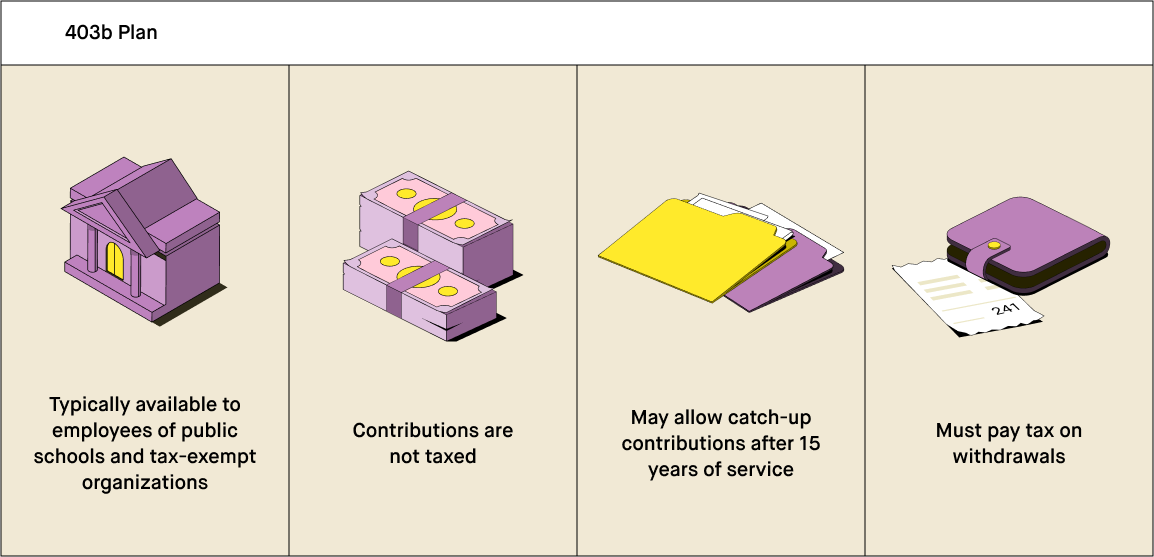

403 b retirement plan. A 403 b plan is a type of retirement fund only 501 c 3 nonprofits or churches and public schools can set up. Employees and their employers can contribute to these plans as they normally would with a 401k. The employer may also contribute to the plan for employees.

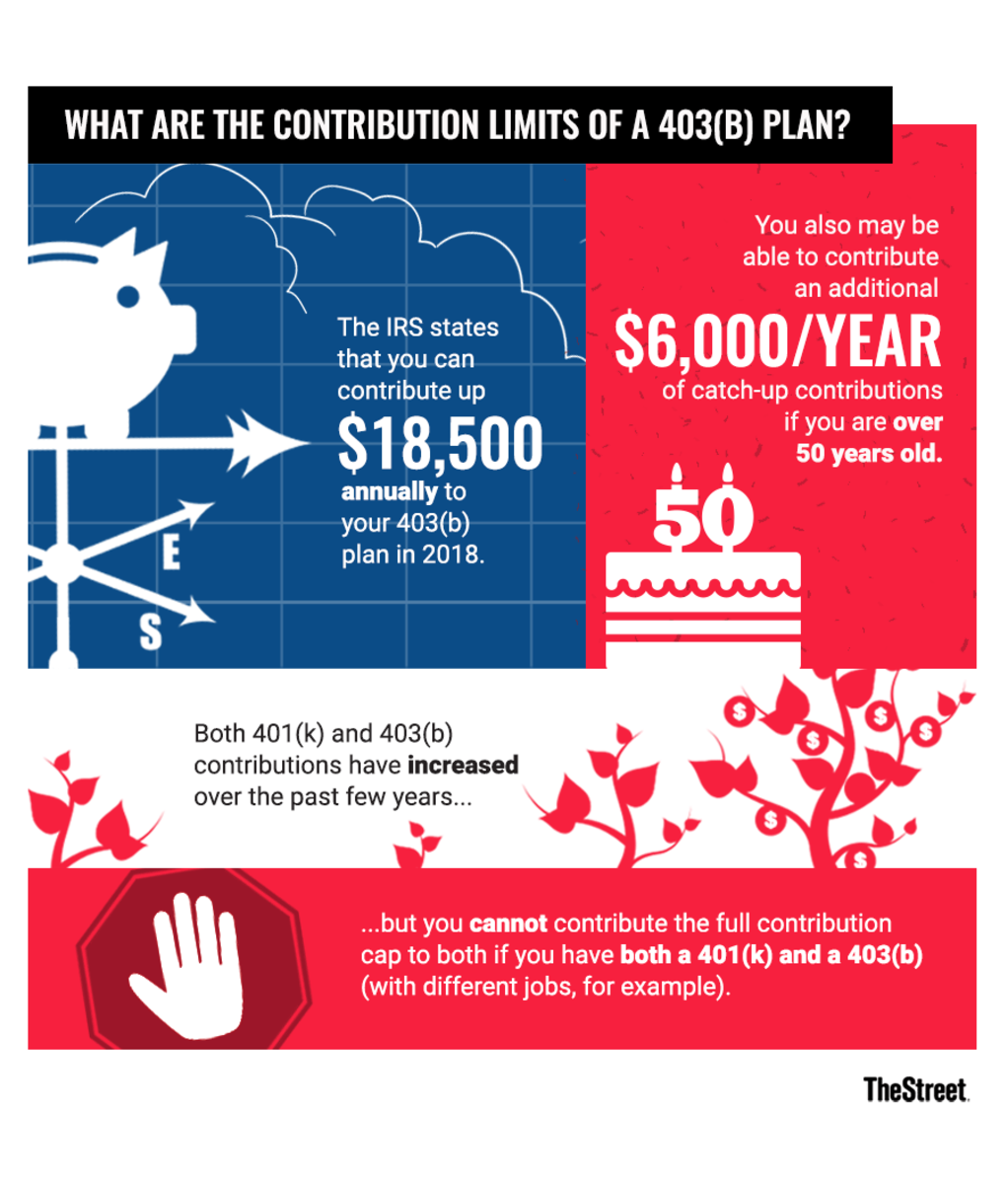

A 403 b retirement plan. A 403 b plan which is like a 401 k for educators and non-profit employees can help supplement your pension or other retirement savings. Investors can also use catch-up contributions to maximize their long-term savings.

A 403b retirement plan is also known as a Tax-Sheltered Annuity or TSA-plan. A 403b plan allows employees to contribute some of their salary to the plan. 403bs were originally introduced in 1958 when Congress passed changes to the tax code.

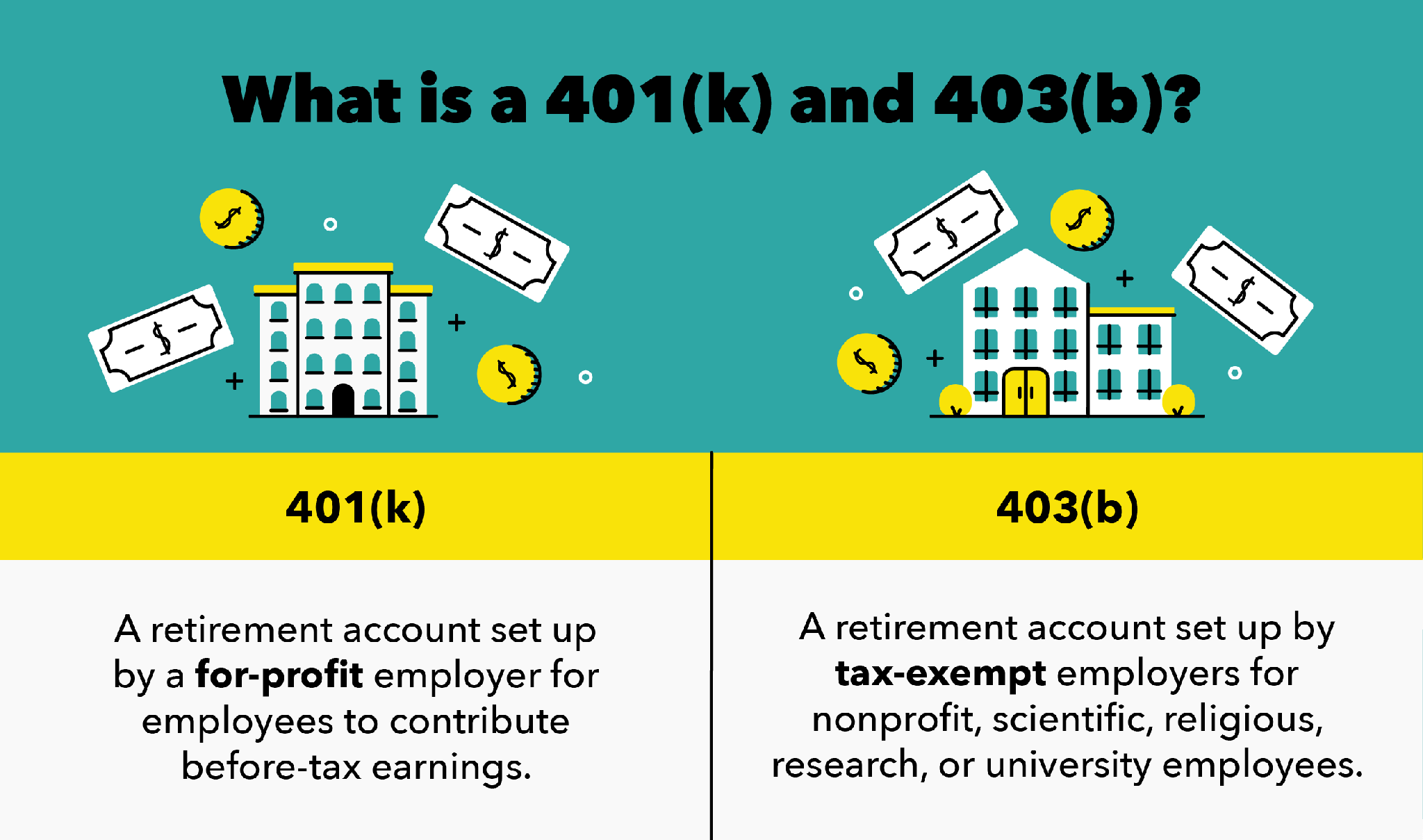

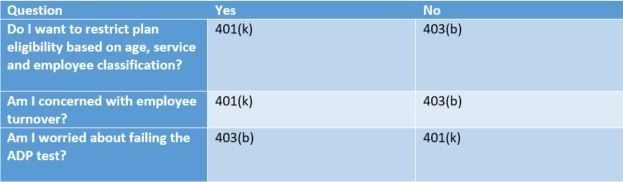

The only difference is while 401 k is for private-sector employees 403 b is for certain employees. A 403b plan is also known as a tax-sheltered annuity plan and the features of a 403b plan are similar to those of a 401k. Madison Wisconsin 53715.

Employer participation in contributions may vary from district to district. These plans are recognized by the IRS and provide certain tax benefits although they may not may not be considered qualified retirement plans depending on whether your employer makes contributions to your plan. 403 b Plan A A 403 b plan also known as a tax-deferred retirement plan is a retirement account available to certain employees including teachers and public school employees.

What Is A 403b Retirement Plan. A 403b plan is considered a defined contribution plan. Defined contribution retirement plan arrangements under Section 403b of the Internal Revenue Code are available to employees.

Your contributions into the plan are made on a tax-deferred basis. Contributions to a 403b plan can lower the federal income taxes withheld from your paycheck each pay period and reduce your annual taxable income. Unlike 401 k plans many 403 bs arent subject to certain plan protections and strict reporting requirements.

There isnt much of a difference between a 401 k and a 403 b. Technically 403bs have fewer investment alternatives than 401ks but if mutual funds are available a 403b can be as flexible as a 401k. The 403 b plan works similarly to the 401 k plan in that it offers tax-deferred increases and high annual contribution limits.

Allows eligible employees to make salary reduction contributions into the plan on a pre-tax andor after-tax Roth basis. A 403b plan is a type of retirement account available to individuals who work in public education employees of certain 501c3 tax-exempt organizations and ministers. A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt organizations and certain ministers.

Is typically established by not-for-profit 501 c 3 employers hospitals self-employed ministers and public education organizations. 403b Supplemental Retirement Program PLAN DOCUMENT. Like 401 k plans 403 bs have an annual contribution limit and allow both employees and employers to contribute.

Amended and Restated Effective January 1 2022. If the contributions are pre-tax earnings within a 403 b. It pays to work with a financial professional Planning for retirement might seem complicated but Equitable Financial can make the process easier and more productive.

Its specifically designed for education and non-profit professionals has the flexibility to adjust as your needs change and can help you turn your salary into a more comfortable retirement. 403 b retirement plan is a retirement account for government employees teachers professors nurses doctors librarians and certain tax-exempt organizations. The 403b plan allows for pre-tax contributions and the maximum contribution limit in 2020 is.

Although this plan is similar to a 401 k its biggest advantage is reducing taxable income. Certain schools religious organizations hospitals and other organizations often offer this plan to employees. UNIVERSITY OF WISCONSIN SYSTEM.