How To Set Up A Payment Plan With The Irs

Make monthly payment by check money order or debitcredit card.

How to set up a payment plan with the irs. 4 Form 433-D for setting up direct debit can be found here. 43 setup fee which may be reimbursed if certain conditions are met. Short-Term Payment Plans Be advised that a short-term payment plan is not an installment agreement.

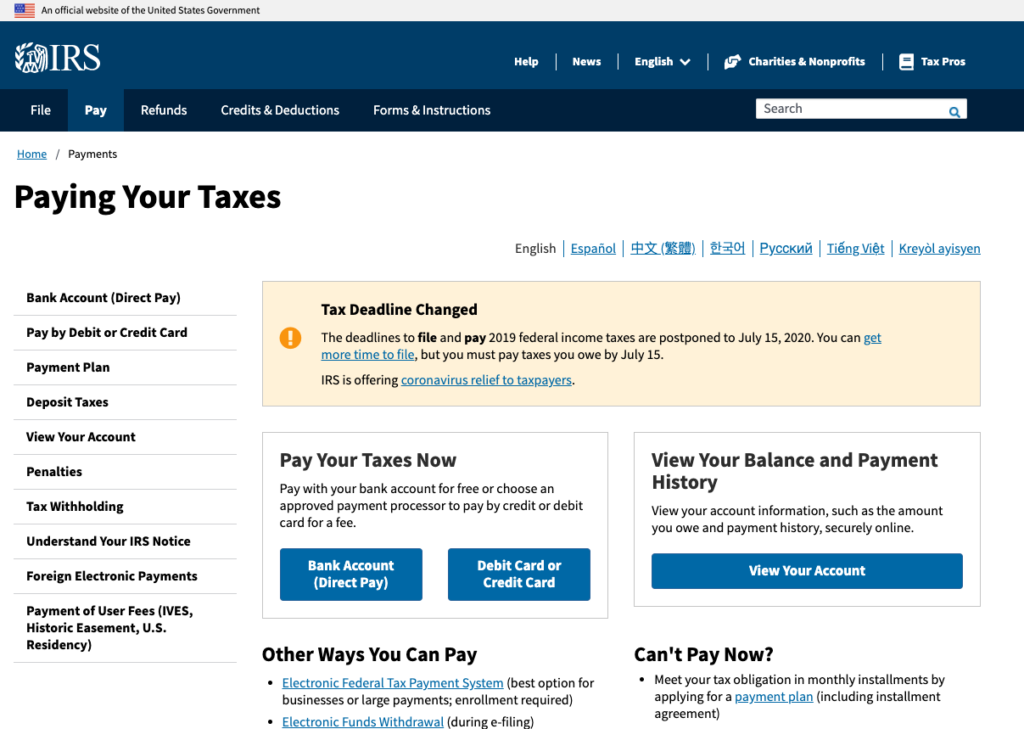

There are two kinds of IRS payment plans. Apply for an Installment Agreement Online. Apply online by phone or in-person.

On the first page you can revise your current plan type payment date and amount. Fees apply when paying by card. Find out how much tax debt you owe.

The IRS offers several payment plans for taxpayers depending on the amount of tax debt owed. The first step to setting up a payment plan is figuring out exactly how much you owe in unpaid taxes. A phone application is available by calling 800-829-1040.

There are several ways to check your IRS balance. Offers in compromise OIC IRS Payment Plans for Individuals and Businesses. The cost of applying online is 37 if you plan to pay by direct debit.

Apply by phone mail or in-person. The IRS will require that you set up automatic monthly payments by direct debit from your bank account if the balance you owe is greater than 25000. Taxpayers can apply for an installment agreement using the Online Payment Agreement Application tool.

Your monthly payment depends on how much tax debt you owe. Under this plan you will pay back your debt through automatically scheduled increments. In any case the important thing is to get started.

These can be set up as automatic payments from your checking account or you can also pay by check money order debit card or credit card. An IRS payment plan is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time. You can apply by submitting Form 9465 or by calling the IRS if youre not eligible to set up a plan online.

File Your Tax Return. Individuals and businesses can apply for payment plans online over the phone by mail or in person. You can also submit Form 9465 Installment Agreement Request at an IRS office or through the mail.

Individuals applying for an IRS payment plan need to. Long-term IRS payment plans are plans that take longer than 120 days to settle your tax debt. Complete IRS payment plan application.

Aug 15 2019 Learn more about the process of arranging a payment plan with the IRS below. Long-term payment plans. 5 Steps to Set Up a Payment Plan with the IRSTax debt relief is in sight.

Log in to the Online Payment Agreement tool using the ApplyRevise button below. Any application for a partial payment plan will require a collection information statement IRS Form 433-A and a written request on how much the taxpayer. The fee is 149 if you plan to pay through other methods.

Payment options include full payment a short-term payment plan paying in 120 days or less or a long-term payment plan installment agreement paying in more than 120 days. Httpwwwirsgovpubirs-pdff433dpdf In order for partial payment plans to be set up the taxpayer will need to contact the IRS to request one. You have to pay a setup fee when establishing the plan.

In this plan you will agree to payment installments and will pay. How to Set Up a Payment Plan with the IRS Your unique tax situation will determine if you are eligible for a payment plan agreement with the IRS. Even if you decide to consult with a tax relief company read this article to prepare yourself before setting up a payment plan with the IRS.

Short-term and long-term. Potential options include the following. Then submit your changes.

120-Day Short-Term Payment Plan.

/9465-700bb91065234917b8d2866f2306afe9.jpg)

/IRSTaxPaymentPlans_GettyImages-1210924086-7d6e90b1b80c4b4a87206466768c33ac.jpg)