Trump Tax Rate Plan

WASHINGTON April 25 AP.

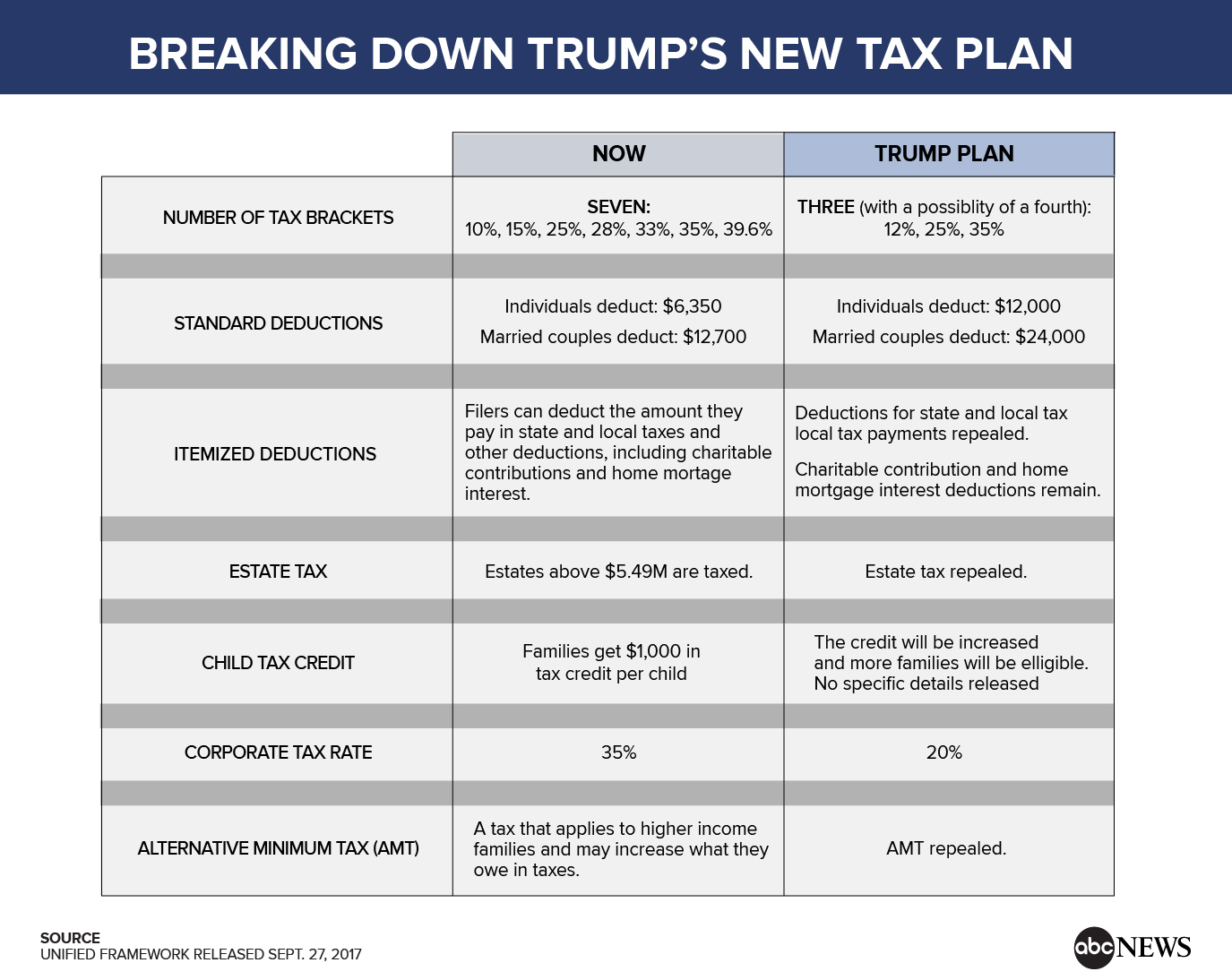

Trump tax rate plan. The recently announced Trump tax plan US Treasury 2017 proposes to cut the corporate tax rate from 35 to 20 and to shift the tax base from a worldwide to a territorial system. Allows firms engaged in manufacturing in the US. The new statutory rate of 20 brings the US corporate tax in line with the average rate of 22 for the other OECD member countries.

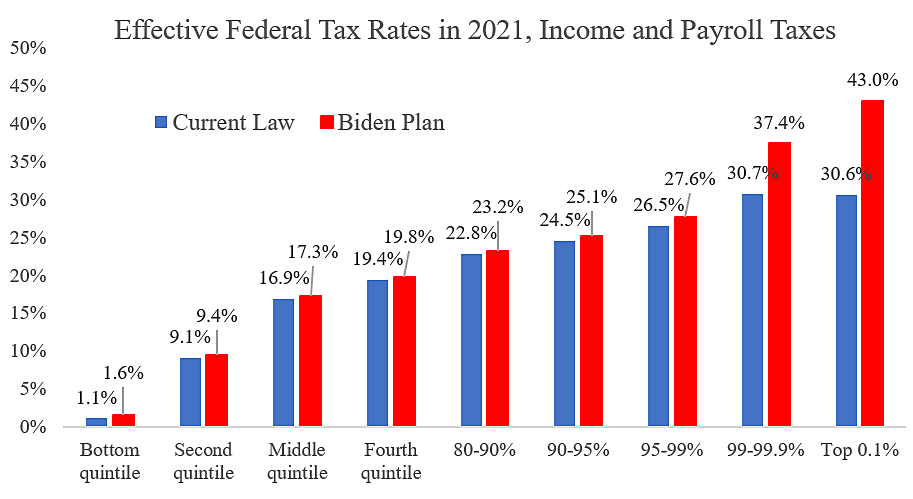

President Joe Biden initially sought to raise the corporate tax rate to 28 from 21 and lift the top individual income tax rate to 396 from 37. The individual tax rates would be 12 percent 25 percent and 35 percent and the plan recommends a surcharge for the very wealthy. Anticipation of these cuts and a deregulatory regime significantly boosted the stock market in 2017.

Job creators as well. Raise the top marginal individual income tax rate for incomes above 400000 to the pre-TCJA rate of 396. 7 rows In his Indiana speech of 2018 Trump said that cutting the top corporate tax rate from 35 to.

Trump tax plan brackets chart. Reduces the corporate income tax rate from 35 percent to 15 percent. From a global to a territorial tax system with respect to corporate income tax.

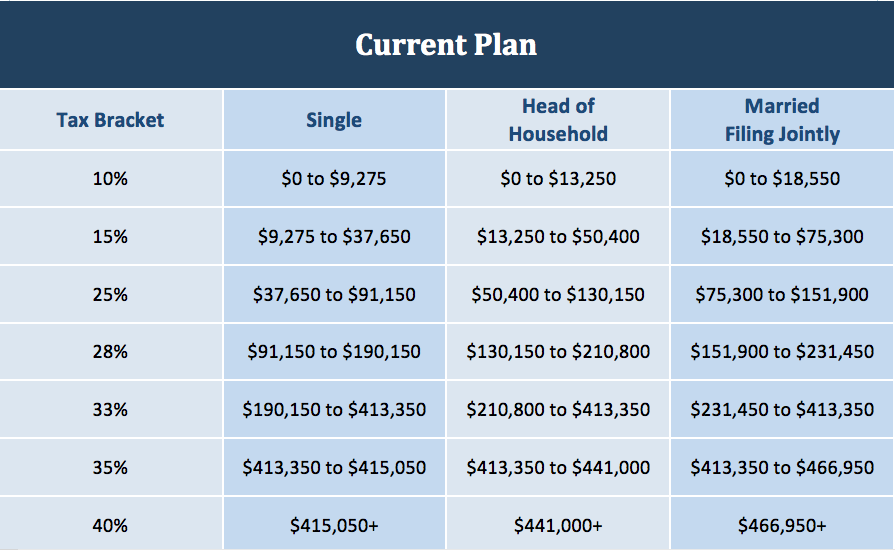

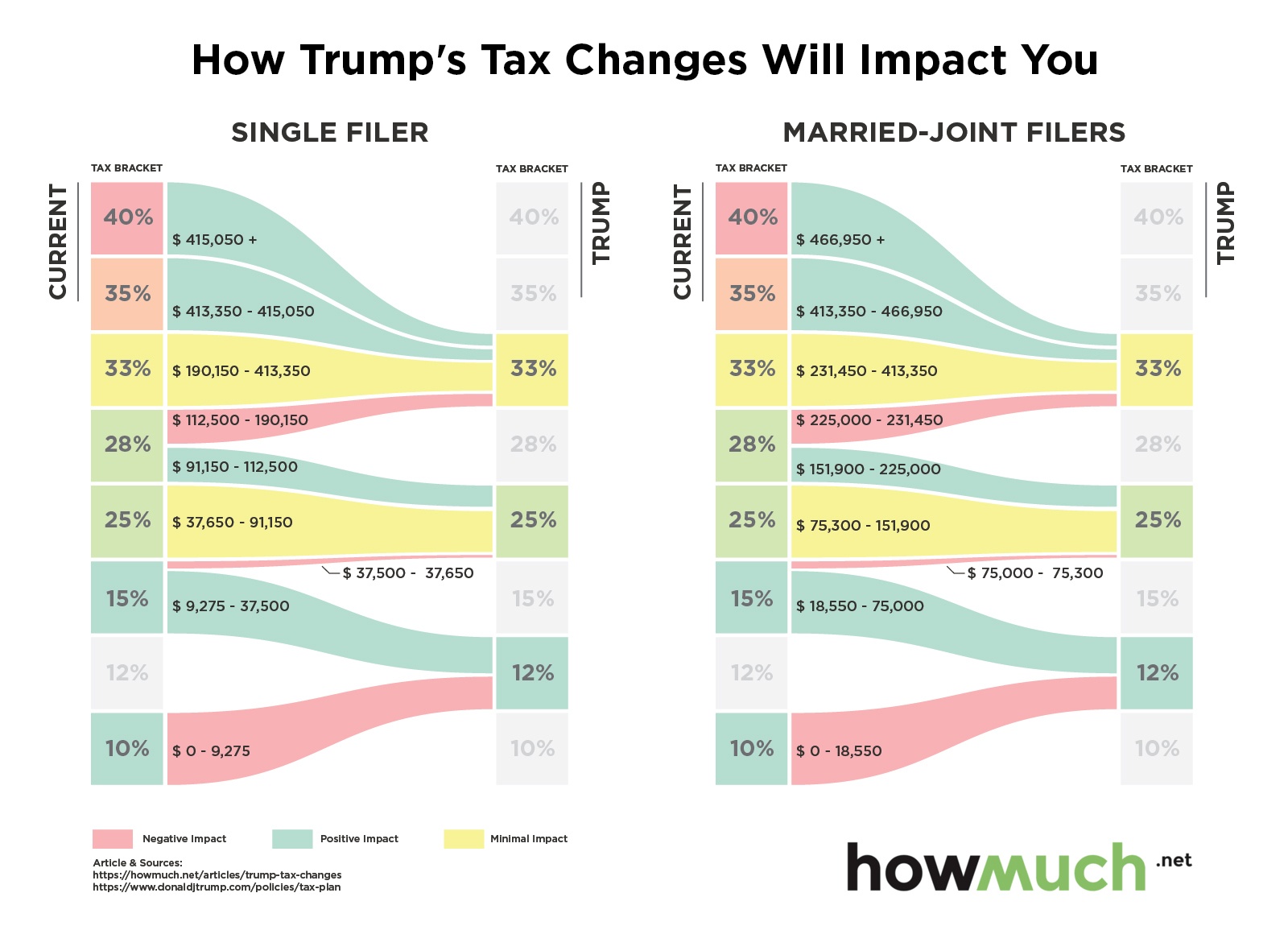

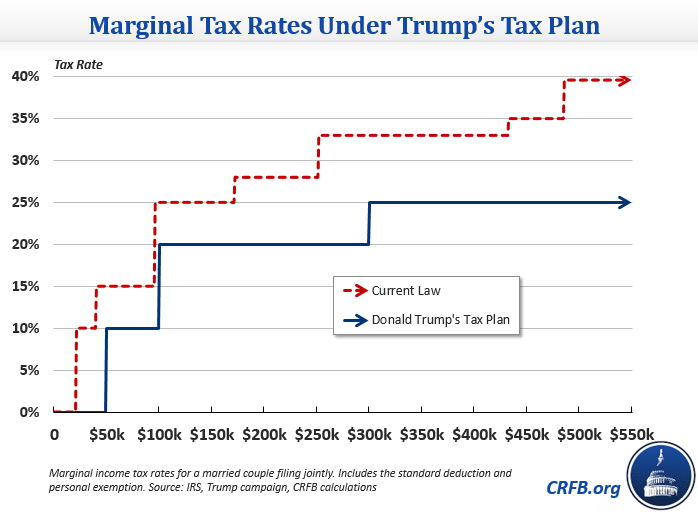

Other changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions. The plan would reduce the number of individual income tax brackets from the current seven brackets to three with rates of 10 20 and 25 percent table 1. It lowered the corporate tax rate to 21 from 35 at the turn of 2018.

THE TRUMP PLAN Businesses. Trump had proposed the idea of lowering this as part of a plan that he said would lower overall middle class tax burdens. Biden meanwhile wants to stop treating capital gains differently from all other income.

Currently these gains are taxed at a rate of up to 20. President Donald Trump plans to stick with his campaign pledge to slash the corporate tax rate from 35 percent to 15 percent but the dramatic cut raises a problematic question for the White House. Eliminates the corporate alternative minimum tax.

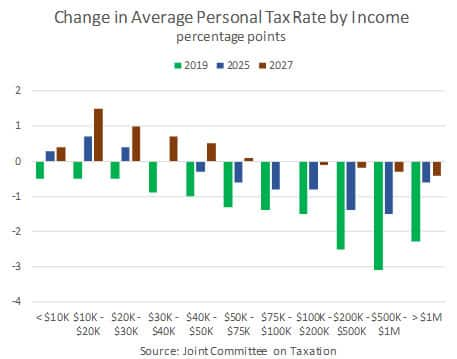

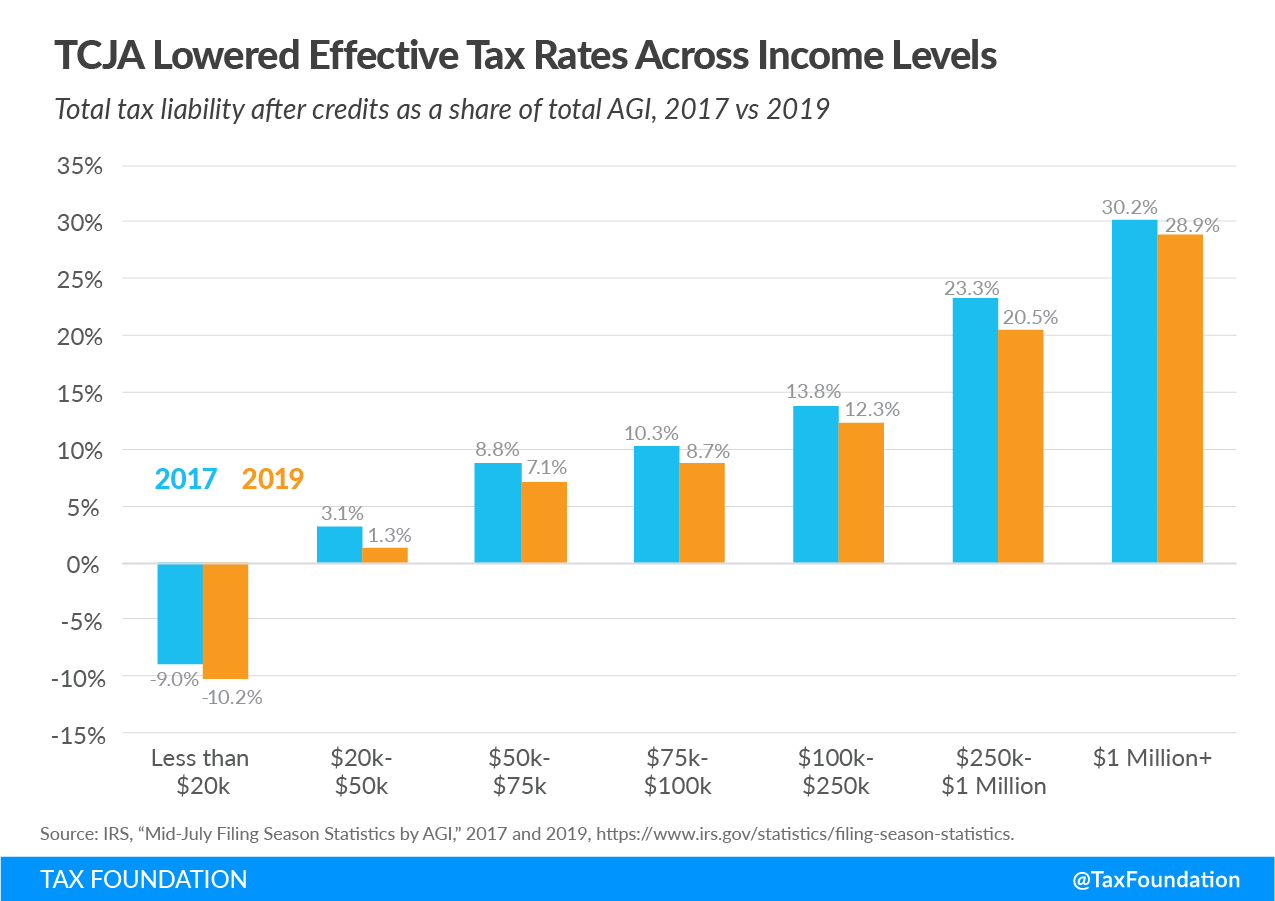

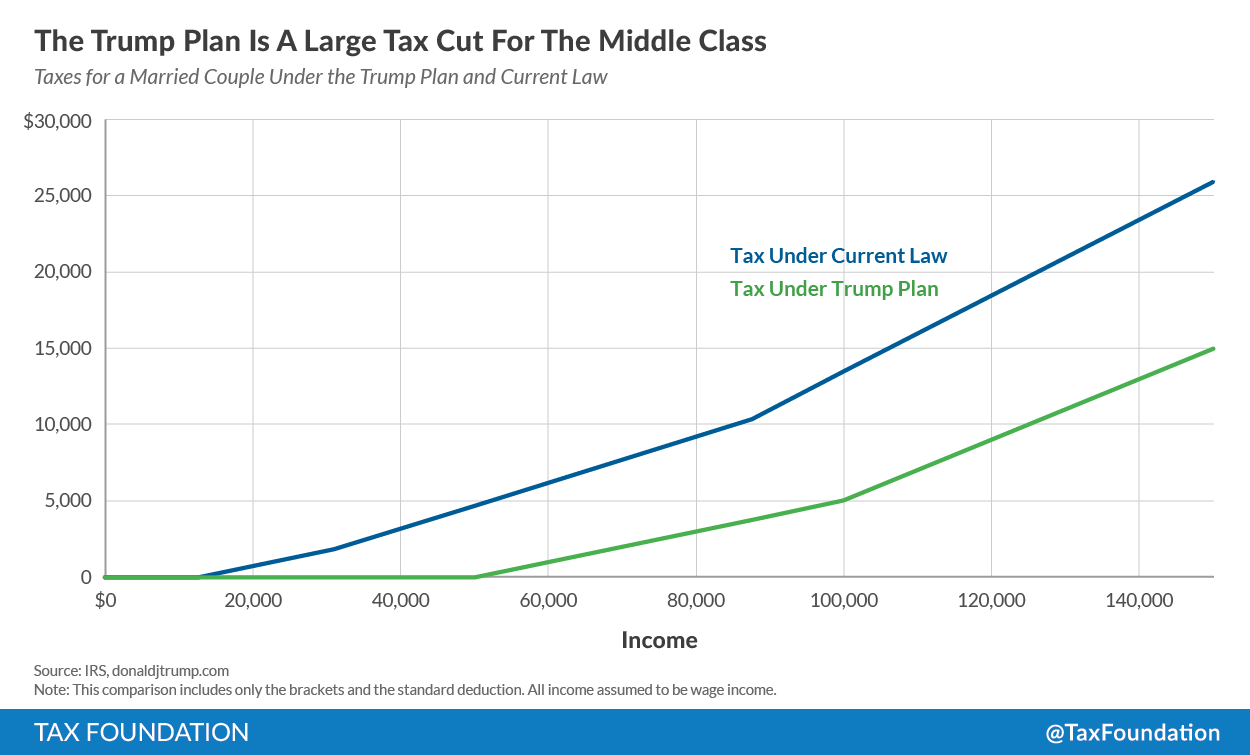

Filers who earned 50000 to 100000 received a tax break of about 15 percent to 17 percent and those earning 100000 to 500000 in adjusted gross income saw their personal income taxes cut by. Those making between 25000. Trump cut statutory corporate tax rates from 35 to 21 effective January 1 2018 as part of the Tax Cuts and Jobs Act.

How can the president deliver the massive tax cut he promised without also blowing a massive hole in the budget. The highest tax bracket is now 37 for big earners. The Act also changed the US.

8 rows The biggest changes under the new Trump tax plan came for those in the middle of the chart. The Tax Cuts and Jobs Act came into force when President Trump signed it. The Trump plan includes a flat 25 percent tax rate for anyone making below the 225000 mark.

But it does not set the income levels at which the rates would apply so its unclear just how much of a tax change there might be for a typical family. The Trump plan addresses this challenge head on with a new business income tax rate within the personal income tax code that matches the 15 corporate tax rate to help these businesses entrepreneurs and freelancers grow and prosper. Those making below 75000 will only have to pay 12 percent.

Trumps plan would lower the rate for all pass-through income to 15 percent. Because taxes on pass-through income are paid at the individual level at individual rates the top rate for such income today is generally 396 percent. These lower rates will provide a tremendous stimulus for the economy significant GDP.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)