Trump Tax Plan Analysis

On April 26 Trump released a one-page outline of his plan for Tax Reform for Economic Growth and American Jobs He claims that it is the biggest individual and business tax cut in American history This is actually Trumps third tax plan.

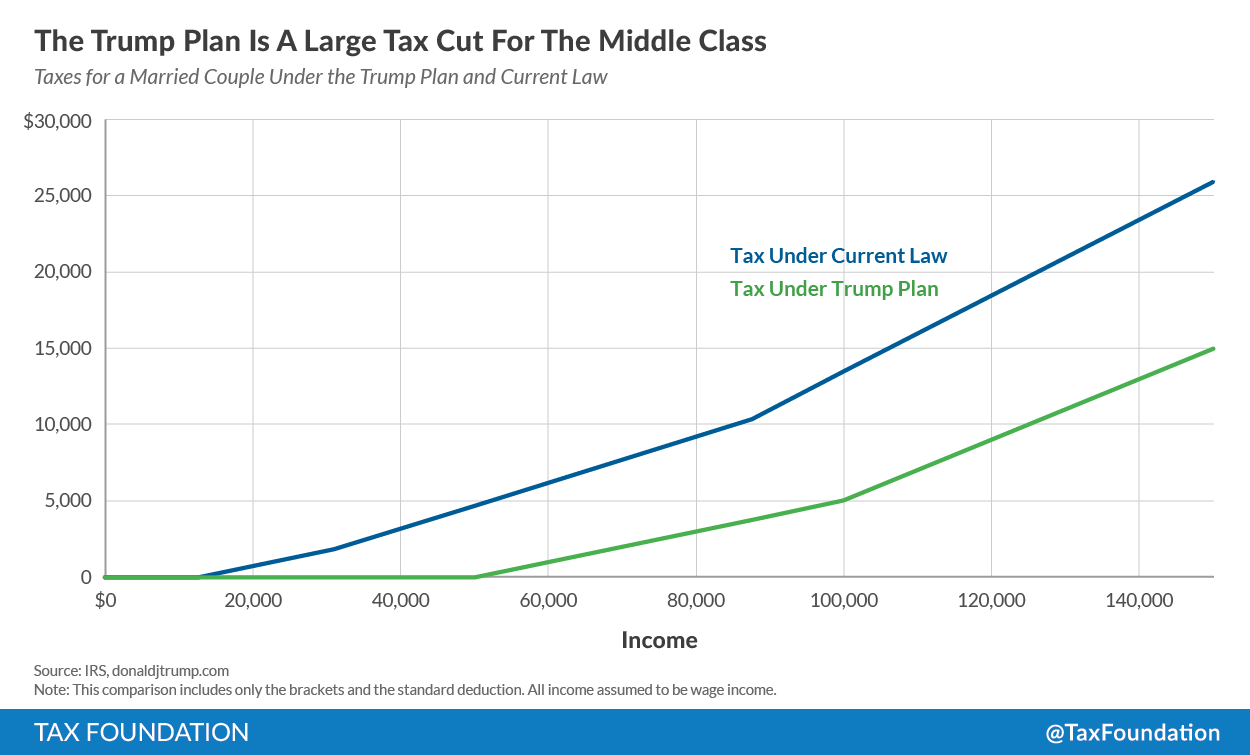

Trump tax plan analysis. Enter the password to open this PDF file. Donald Trumps tax plan costs 12 trillion according to analysis. A careful analysis of the IRS tax data one that includes the effects of tax credits and other reforms to the tax code shows that filers with an adjusted gross income AGI of 15000 to 50000.

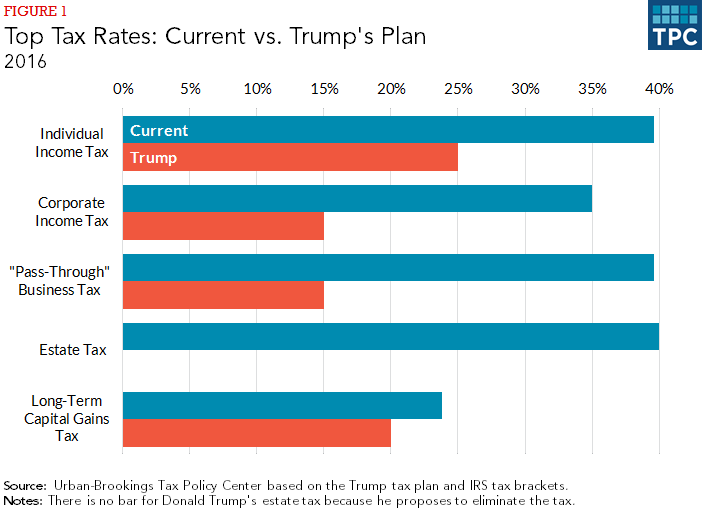

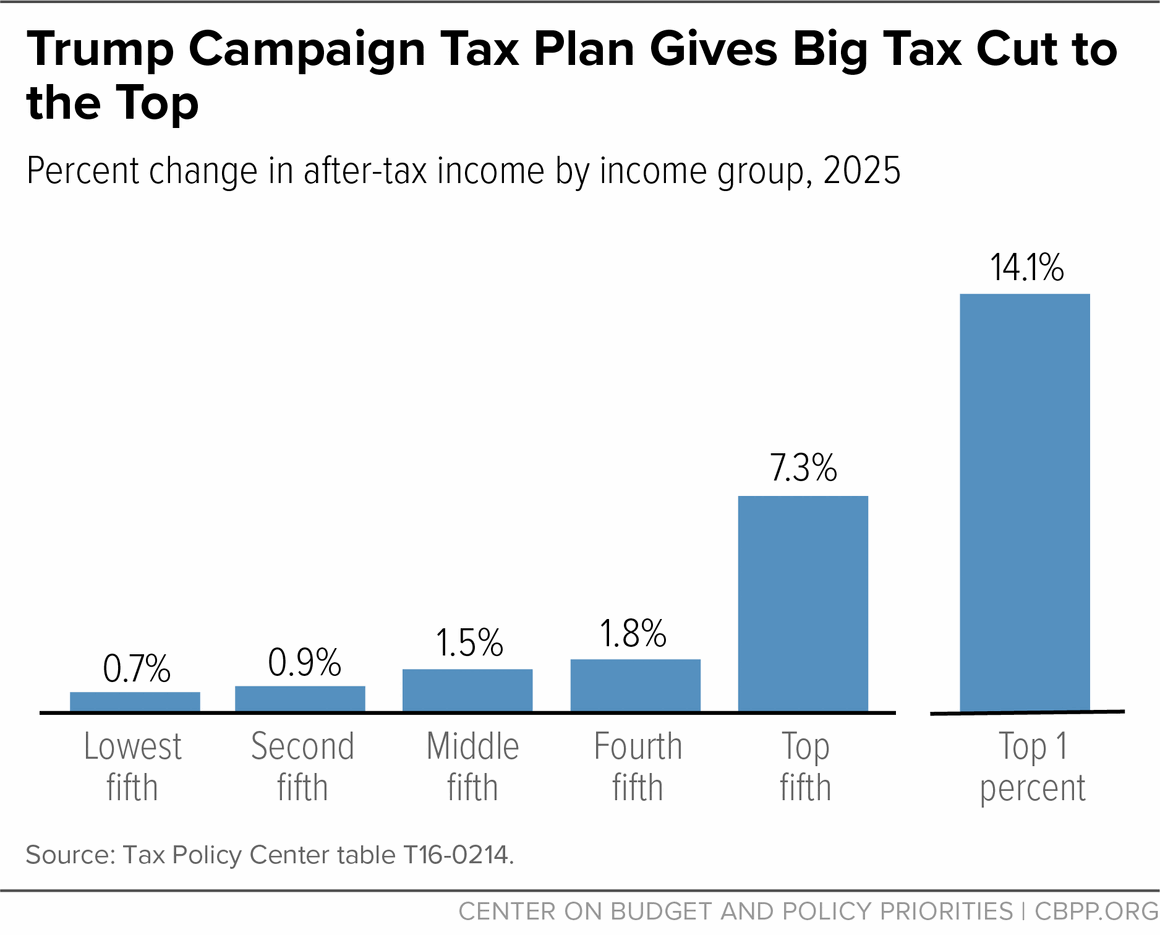

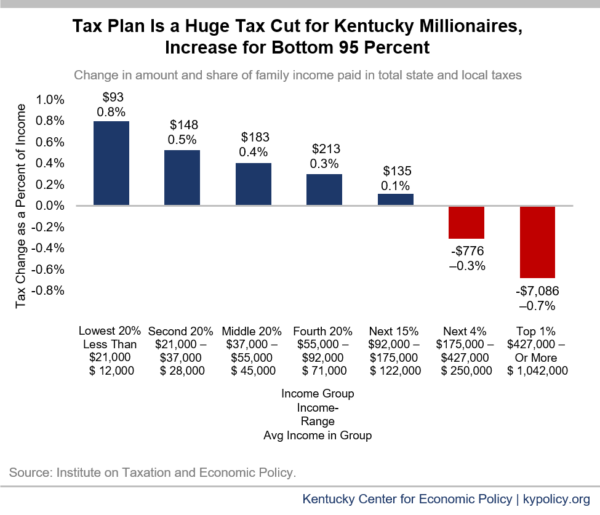

Tax Plan Targets Biggest Tax Cuts for the Best-off Americans. Making many assumptions about the plan including that the brackets apply to the same income as the Trump campaigns plan that its 25 percent pass-through rate contains guardrails so it only applies to active business income and that the limit on interest makes up about half the revenue lost from expensing we estimate the plan has about 58 trillion over. Each of them was.

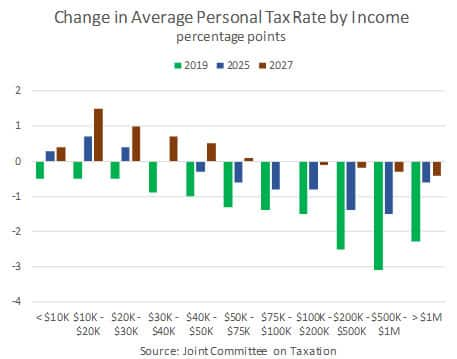

The first was released in September of 2015 and the second was released in September of 2016. The plan would reduce the number of individual income tax brackets from the current seven brackets to three with rates of 10 20 and 25 percent table 1. A new analysis confirms it.

Trump tax plan brackets chart. Indictments of firm and top executive test Trumps charmed life. However the tax cut added 600 billion in growth and savings.

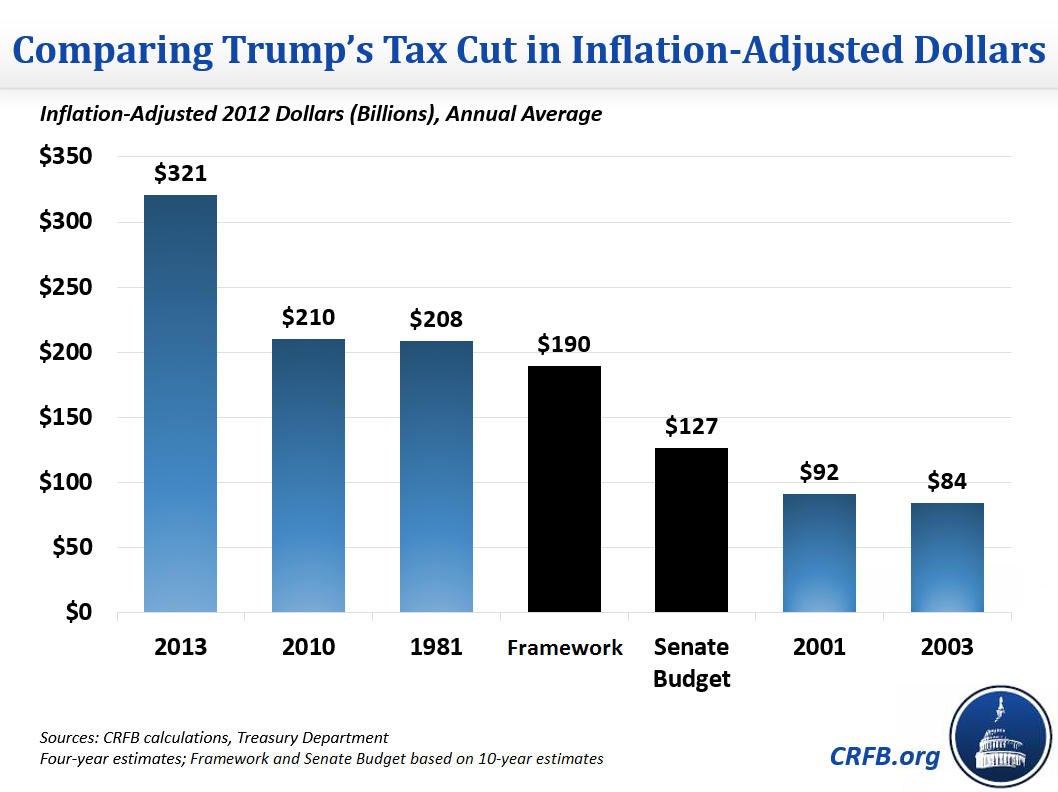

Trump tax cuts could increase deficits by about 19 trillion over 11 years. Donald Trump claims his tax plan wont increase the deficit but a new estimate pegs the cost at an incredible 12 trillion. Analysis of Donald Trumps Tax Plan.

His proposal would cut taxes at all. Those making between 25000. Prosecutors charge Trump Organization with a 15-year tax scheme.

Raise the top marginal individual income tax rate for incomes above 400000 to the pre-TCJA rate of 396. Burman Jeffrey Rohaly Joseph Rosenberg. Trumps plan would reduce the current seven tax brackets to four with a 0 percent rate applying to all those making less than 25000 50000 for married couples.

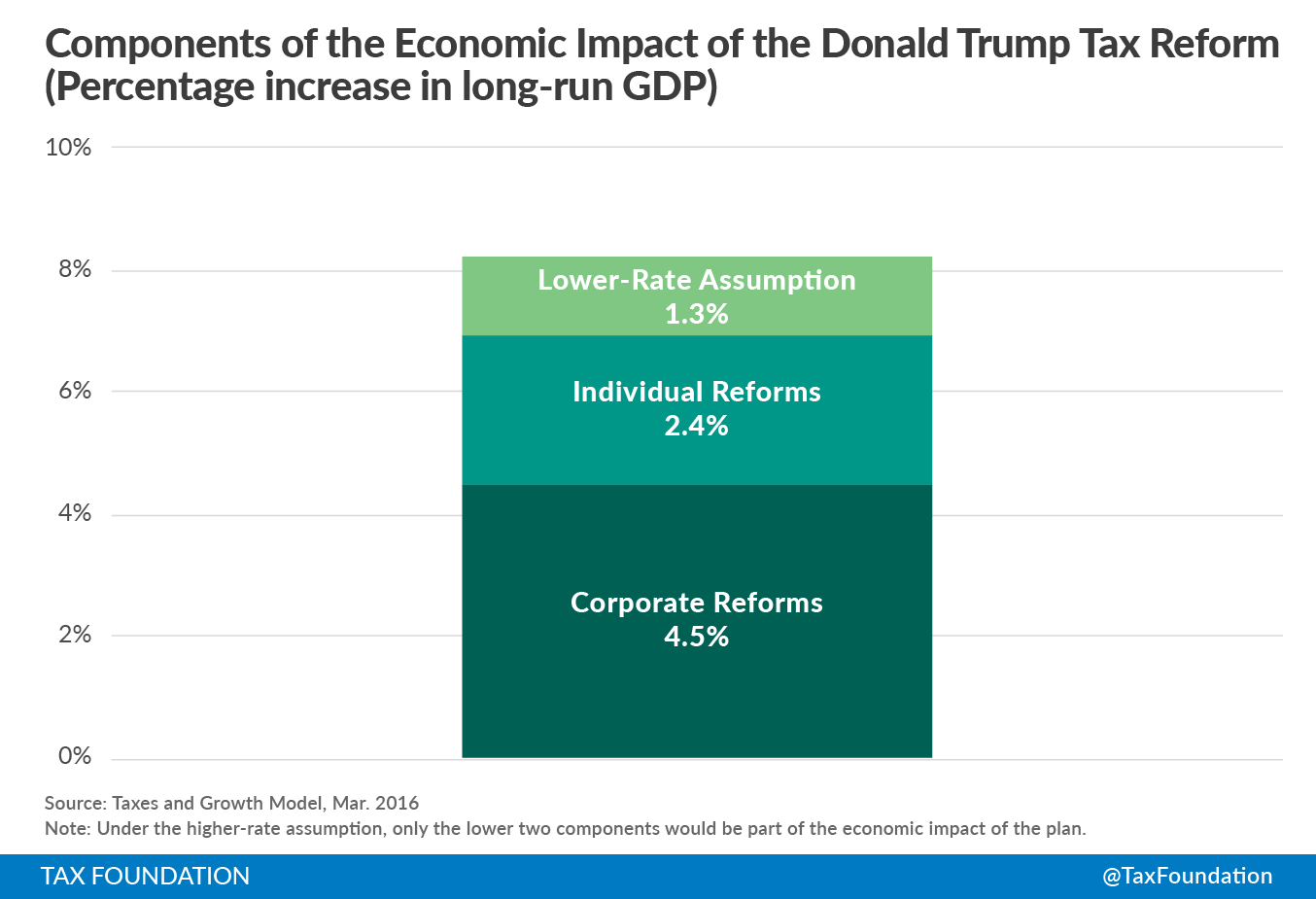

This paper analyzes presidential candidate Donald Trumps tax proposal. His plan would significantly reduce marginal tax rates on individuals and businesses increase standard deduction amounts to nearly four times current levels and curtail many tax expenditures. T rump and House committee still at loggerheads over tax.

More than one-third of these tax cuts 44 trillion would go to the top one percent of taxpayers. Preparing document for printing. This paper analyzes presidential candidate Donald Trumps tax proposal.

How much did Trump tax cuts cost the government. Trump tax cuts cost the government 147 trillion dollars in revenue. The Trump tax plan is much worse than you thought.

His plan would significantly reduce marginal tax rates on individuals and businesses increase standard deduction amounts to nearly four times current levels and curtail many tax expenditures. Deductions on itemized vs. An updated Citizens for Tax Justice analysis of presidential candidate Donald Trumps tax plan reveals that it would add 120 trillion to the national debt over a decade.

An Analysis of Donald Trumps Revised Tax Plan.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9354235/tpc_distribution_big_six.png)