Trump And Tax Plan

Here are the key parts of what would be the biggest overhaul of the US tax code in more than 30 years.

Trump and tax plan. Child Tax Credits Saw Big. Reducing or eliminating most deductions and loopholes available to the very rich. IRS data proves Trump tax cuts benefited middle working-class Americans most.

December 4 2021 500 AM 3 min read. The Tax Cuts and Jobs Act came into force when it was signed by President Trump. The Trump Tax Plan Is Revenue Neutral The Trump tax cuts are fully paid for by.

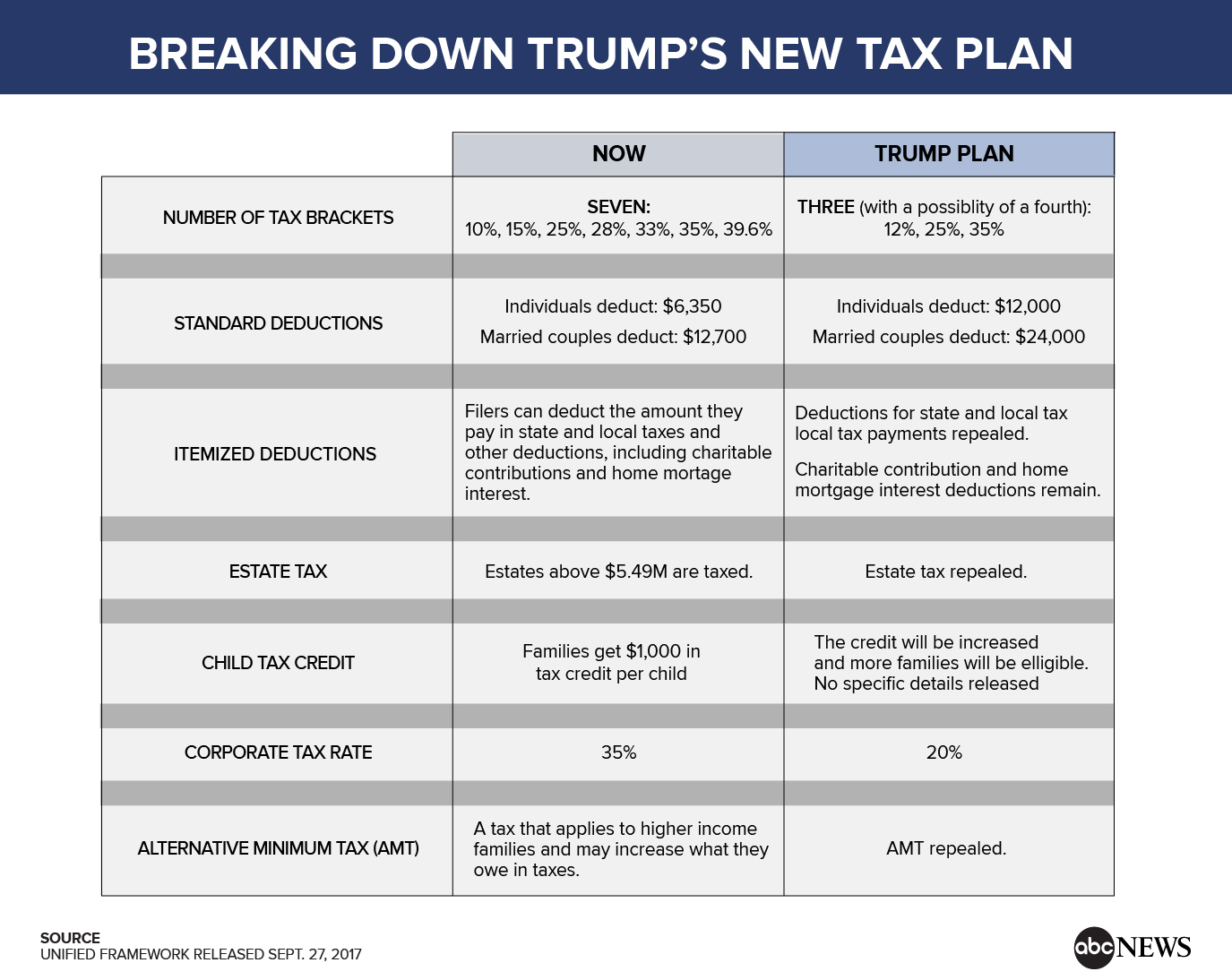

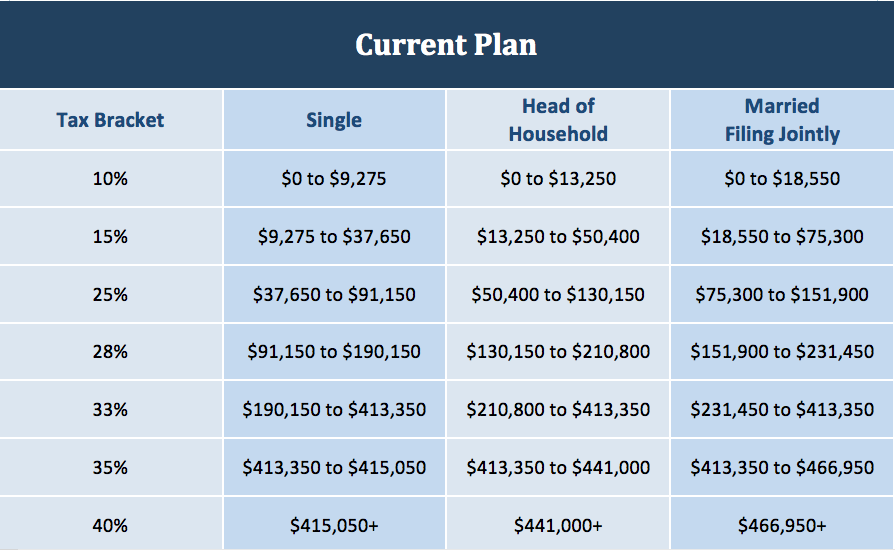

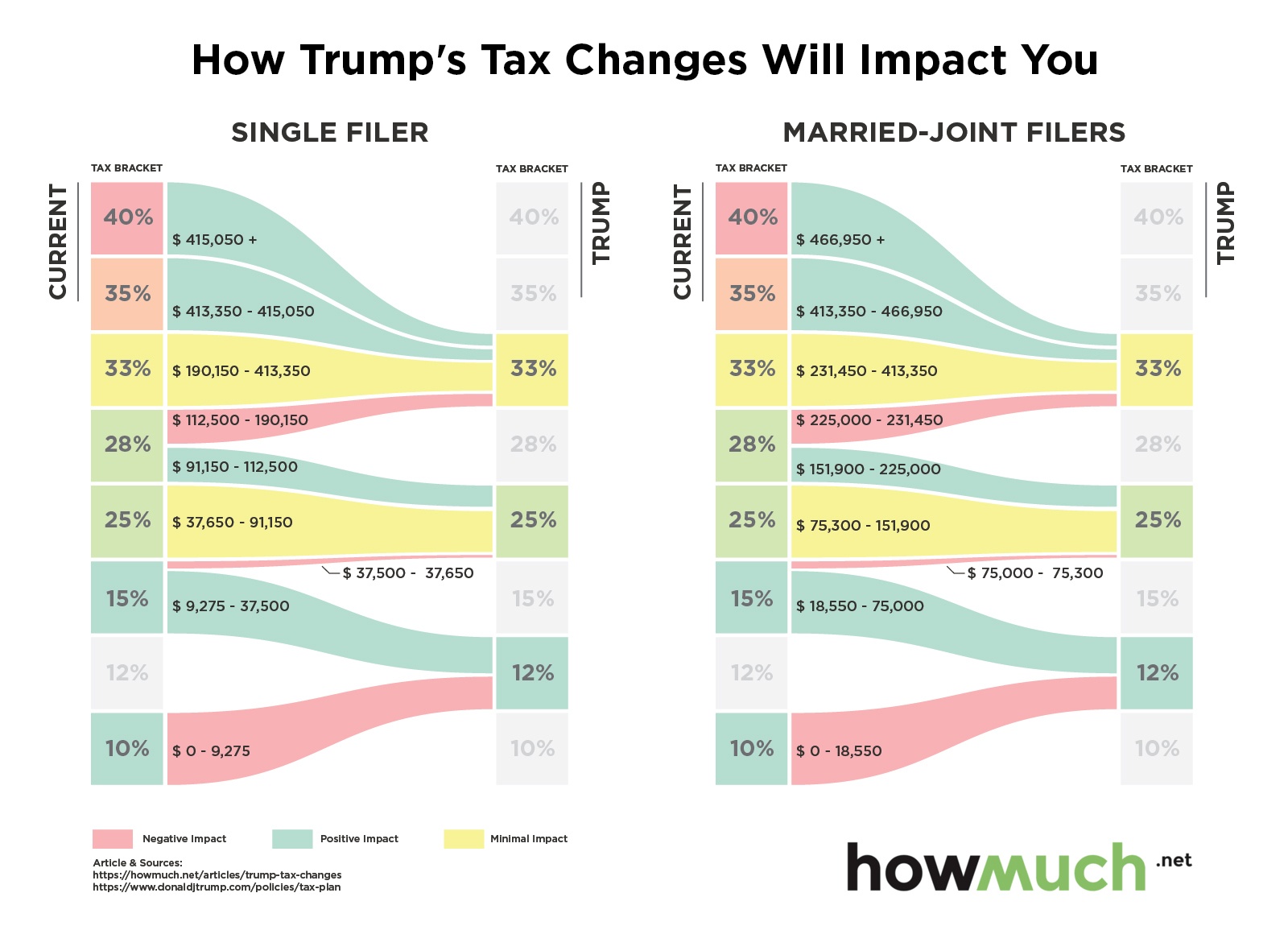

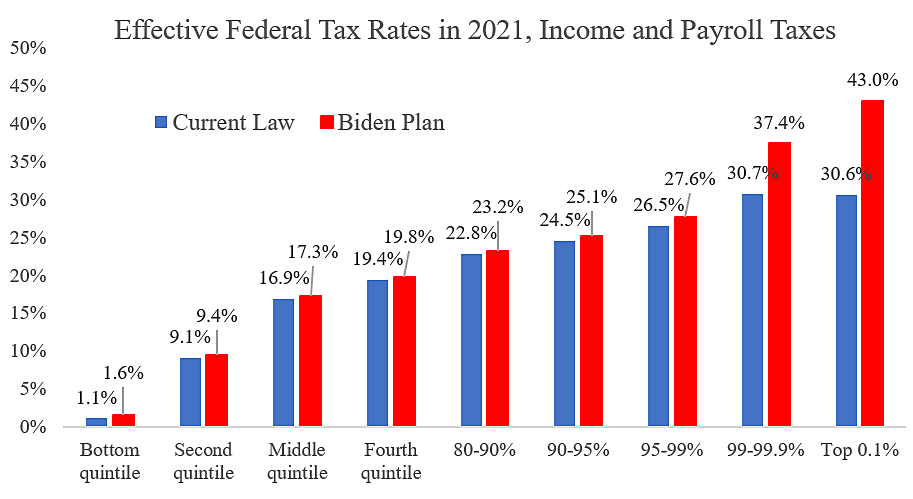

Changes to the Tax Code. President Biden and congressional Democrats Build Back Better BBB Act is now in the hands of the Senate. He wants to reduce the number of individual tax bands from seven to three.

42 million households that. The key points from the final bill. It was focused on reducing tax cuts on job creators.

Federal Income Tax Bracket for 2020 filed in April 2021. President Trump signed the Tax Cuts and Jobs Act TCJA into law on Dec. Trumps plan which has huge tax cuts for business and the rich emphasizes growth.

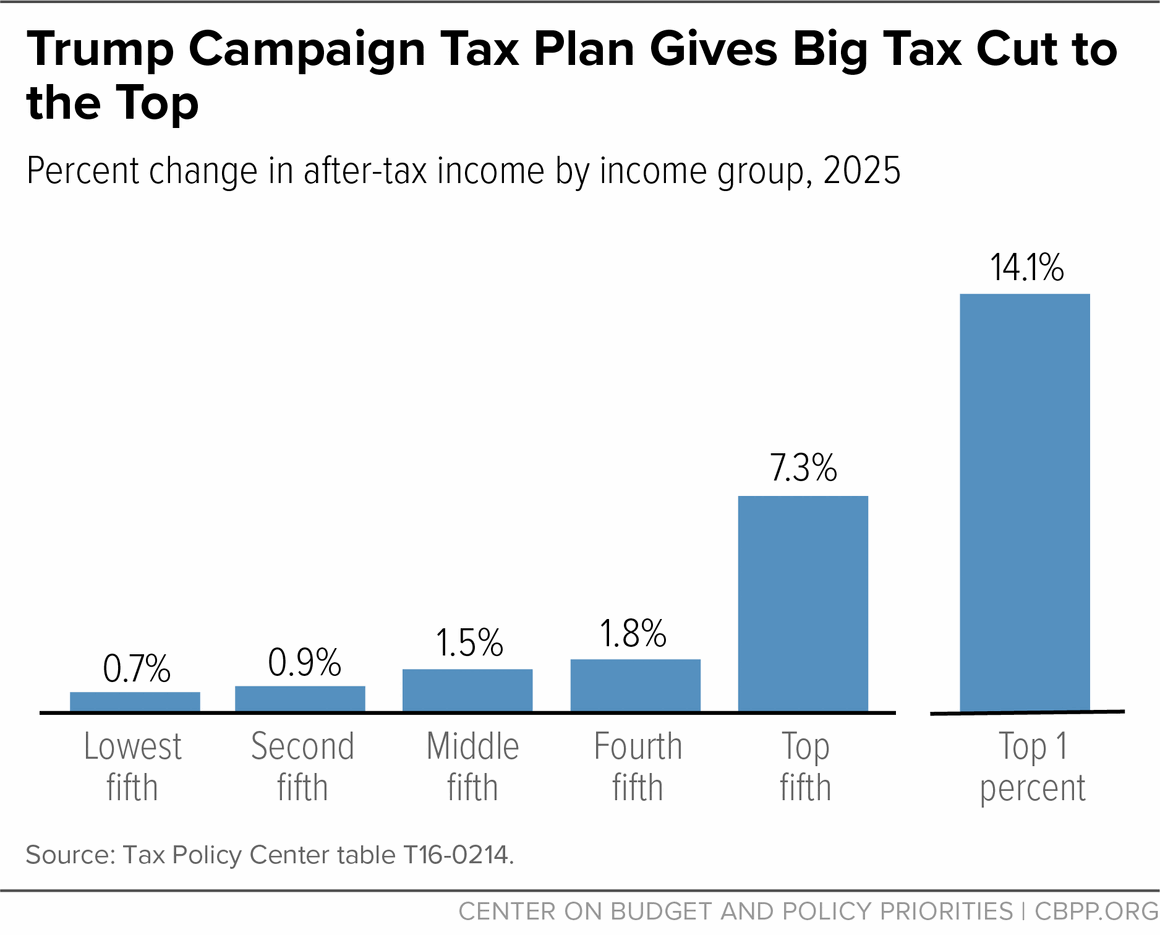

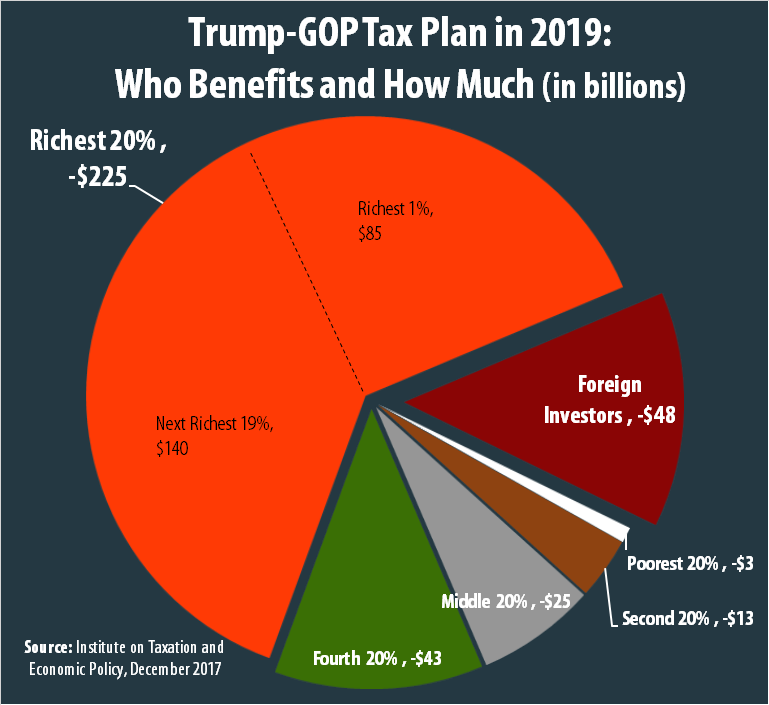

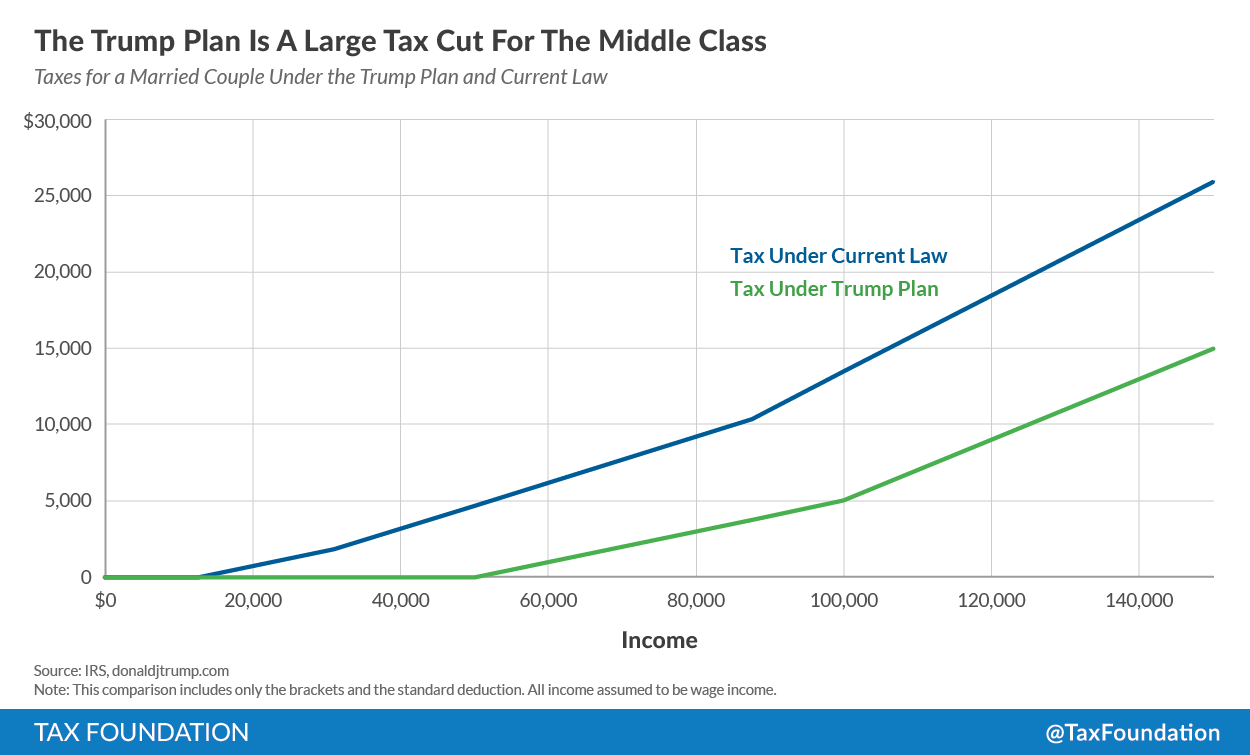

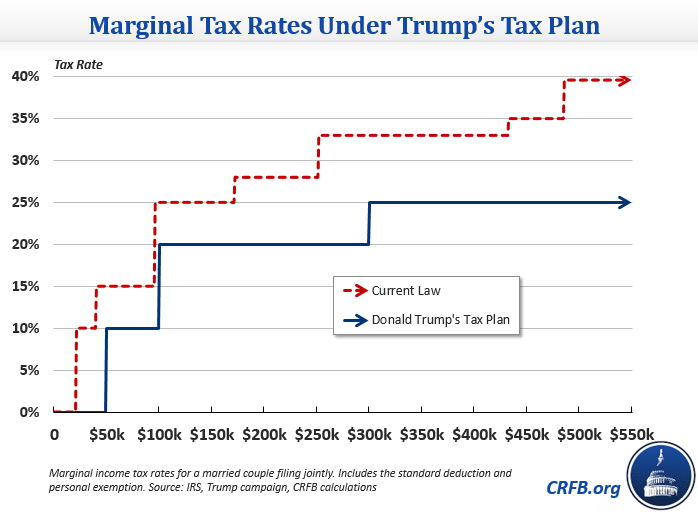

In 2015 thenpresidential candidate Donald Trump declared tax reform a central plank of his campaign platform making a number of claims that subsequently fell by the wayside. One of the major victories for the Trump administration over the past four years is the tax plan that passed Congress and was signed by the President in 2017. Higher income earners like Trump would still pay the highest taxes but they would also receive the most significant.

Trumps tax reform plan was signed into law in December 2017 which included substantial tax cuts for higher income taxpayers and corporations as well as repeal of a key Obamacare element the individual mandate. Trump Tax Plan Changes to the Mortgage Interest Deduction. The Tax Cut and Jobs Act of 2017 TCJA is a congressional revenue act of the United States signed into law by President Donald Trump which amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for businesses and individuals increasing the standard deduction and family tax credits eliminating personal exemptions and.

It would inject 4-6 trillion into the economy over 10 years mostly by means of business tax cuts. While light on detail the agenda includes a few tax policy items like expanding existing tax breaks creating credits for specific industries and activities and unspecified tax cuts for individuals. The Joint Committee on Taxation JCT reported that the Tax Act would marginally increase the size of the economy and boost job creation.

Trump tax plan. A one-time deemed repatriation of corporate cash held overseas at a significantly discounted 10 tax rate followed by an end to the deferral of taxes on corporate income earned abroad. How people felt in principle about the 15.

The Trump Tax Plan. Small business owners who are setup as S. It lowered the corporate tax rate to 21 from 35 at the turn of 2018.

22 2017 bringing sweeping changes to the tax code. Well sure ones good for the economy ones terrible for the economy Cruz told Squawk Box If you look at the 2017 tax cut that tax cut was focused on jobs. The development of the Trump tax plan was the embodiment of the man himself.

The Republican National Convention is underway this week and President Trumps campaign released a second term agenda outlining his policy vision in broad strokes. House approves tax bill as Trump moves. In order for BBB to.

A moving target vaguely defined constantly changing and sometimes reversing itself abruptly. Or redundant by the new lower tax rates on individuals and companies. The views expressed by contributors are their own.

Trumps plan is also tough to compare with Rand Pauls which institutes a 145 percent flat tax on ordinary and investment income which is a bigger cut than Trump proposes alongside a 145. 10 12 22 24 32 35 and 37. If youre married filing separately your limit is 375000 in mortgage interest.

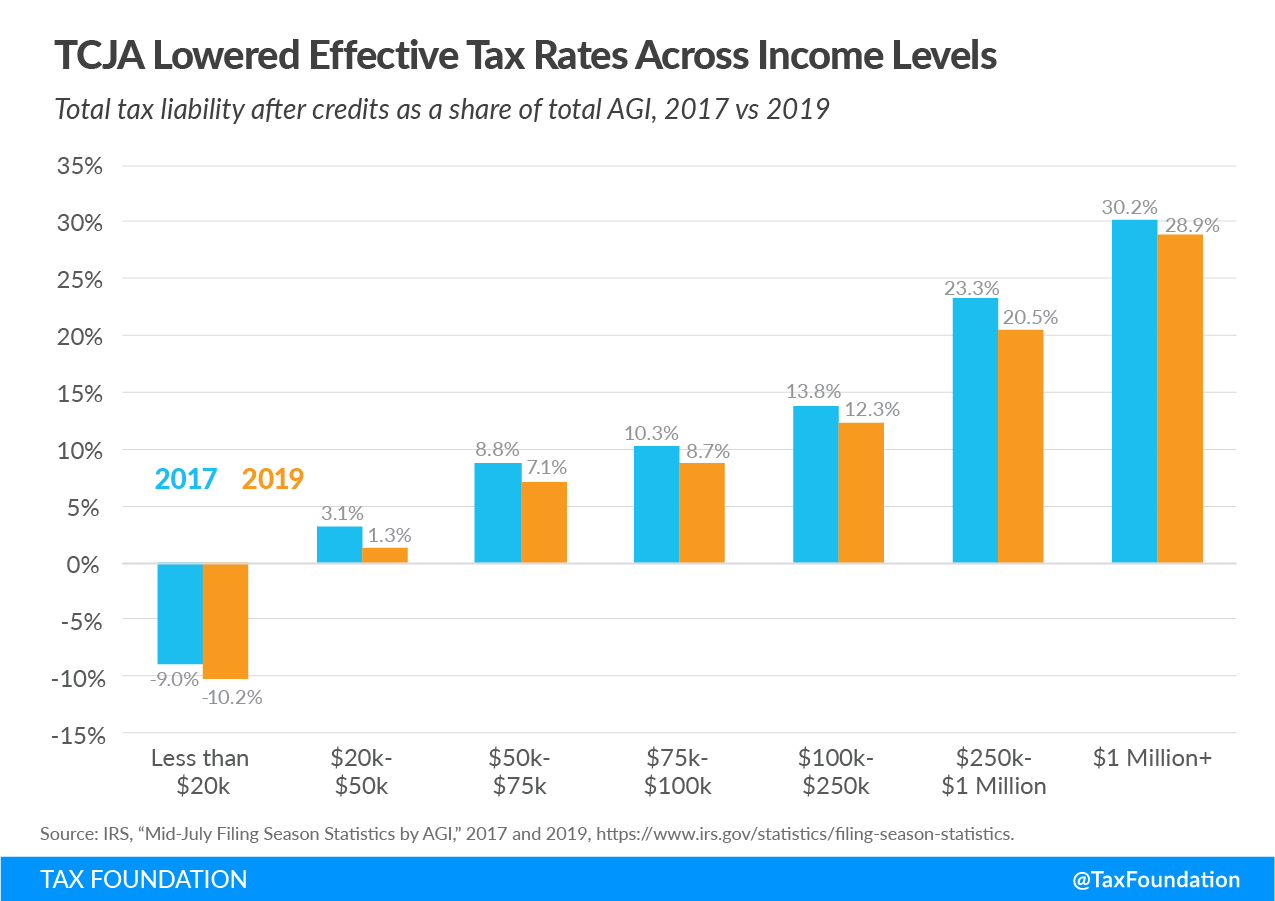

IRS data proves Trump tax cuts benefited middle working-class Americans most. For tax year 2017 homeowners who itemized their deductions could deduct their mortgage interest payments on mortgages up to 1 million. He addressed Democrat accusations that the tax cuts under Trump werent paid for and that Republicans are too tax friendly toward wealthy Americans.

For 2018 and beyond the limit on this deduction is 750000. That legislative bodys 50-50 partisan split will undoubtedly make the bills passage difficult. Other tax reform plan changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions.

It lowered the corporate tax rate to 21 from 35 at the turn of 2018. By Justin Haskins Opinion Contributor 120421 0800 AM EST.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9354235/tpc_distribution_big_six.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/4103508/Screen%20Shot%202015-09-28%20at%2010.29.21%20AM.png)