Safe Harbor 401k Plan

There are several types of 401 k plans available to employers - traditional 401 k plans safe.

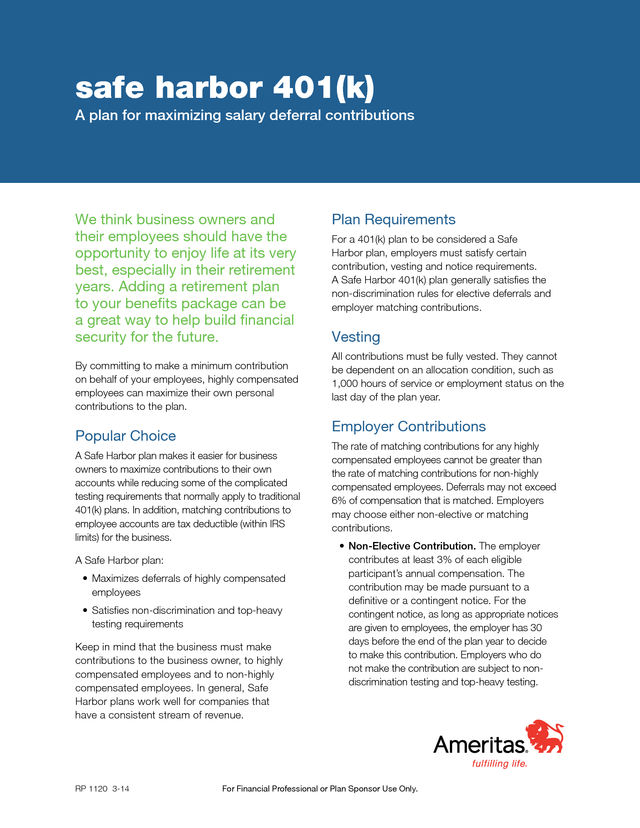

Safe harbor 401k plan. Pros and Cons of a Safe Harbor Plan. Employer contributions are deductible on the employers federal income tax return to the extent that the. A Safe Harbor plan is a special kind of 401k that automatically satisfies most nondiscrimination testing.

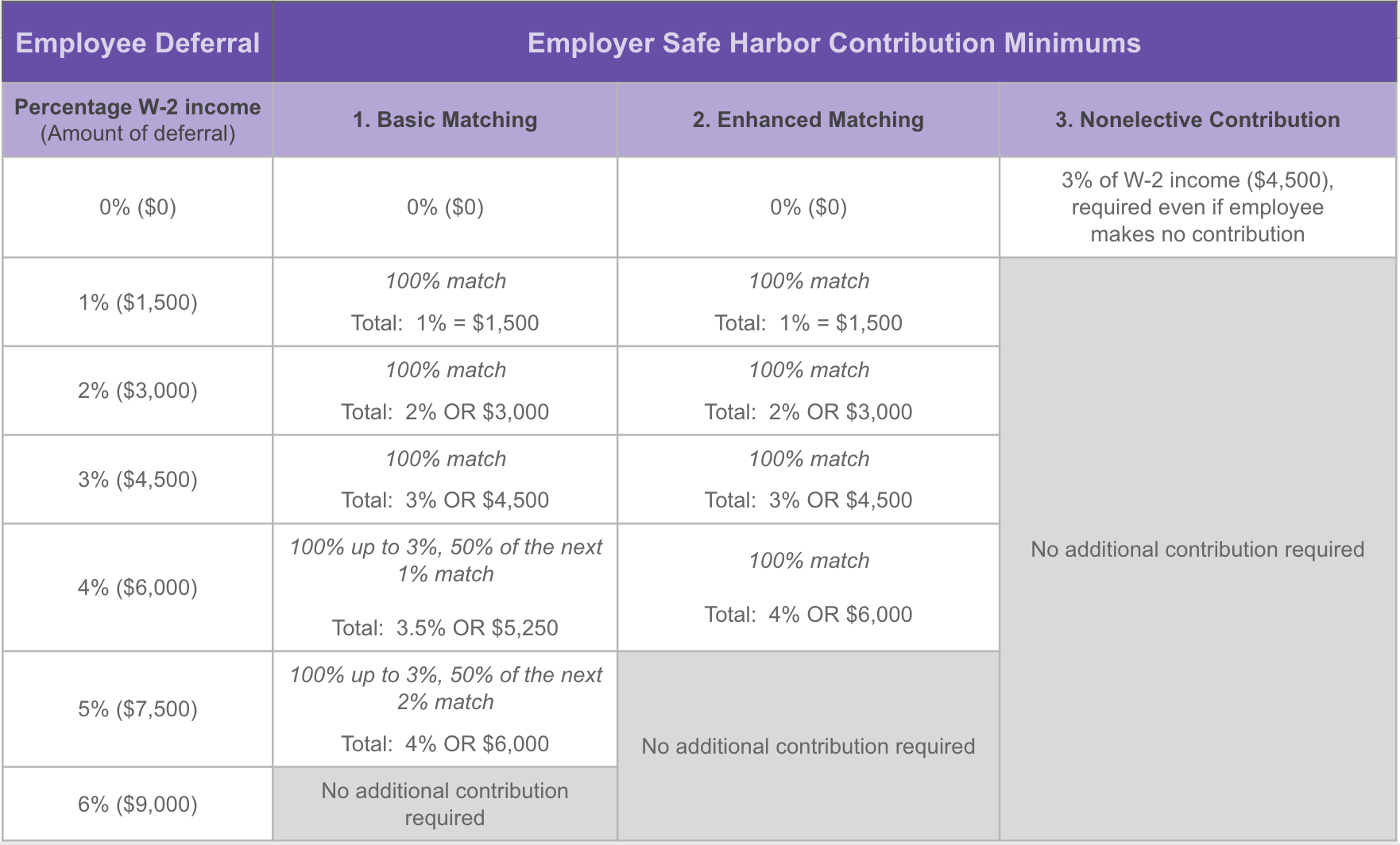

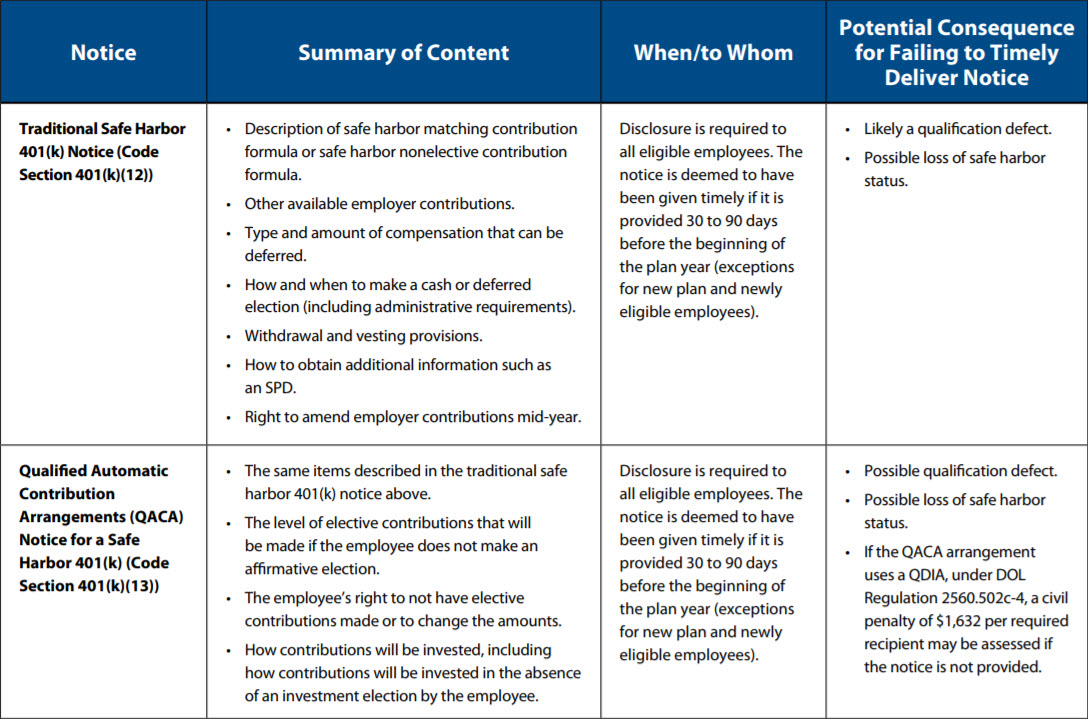

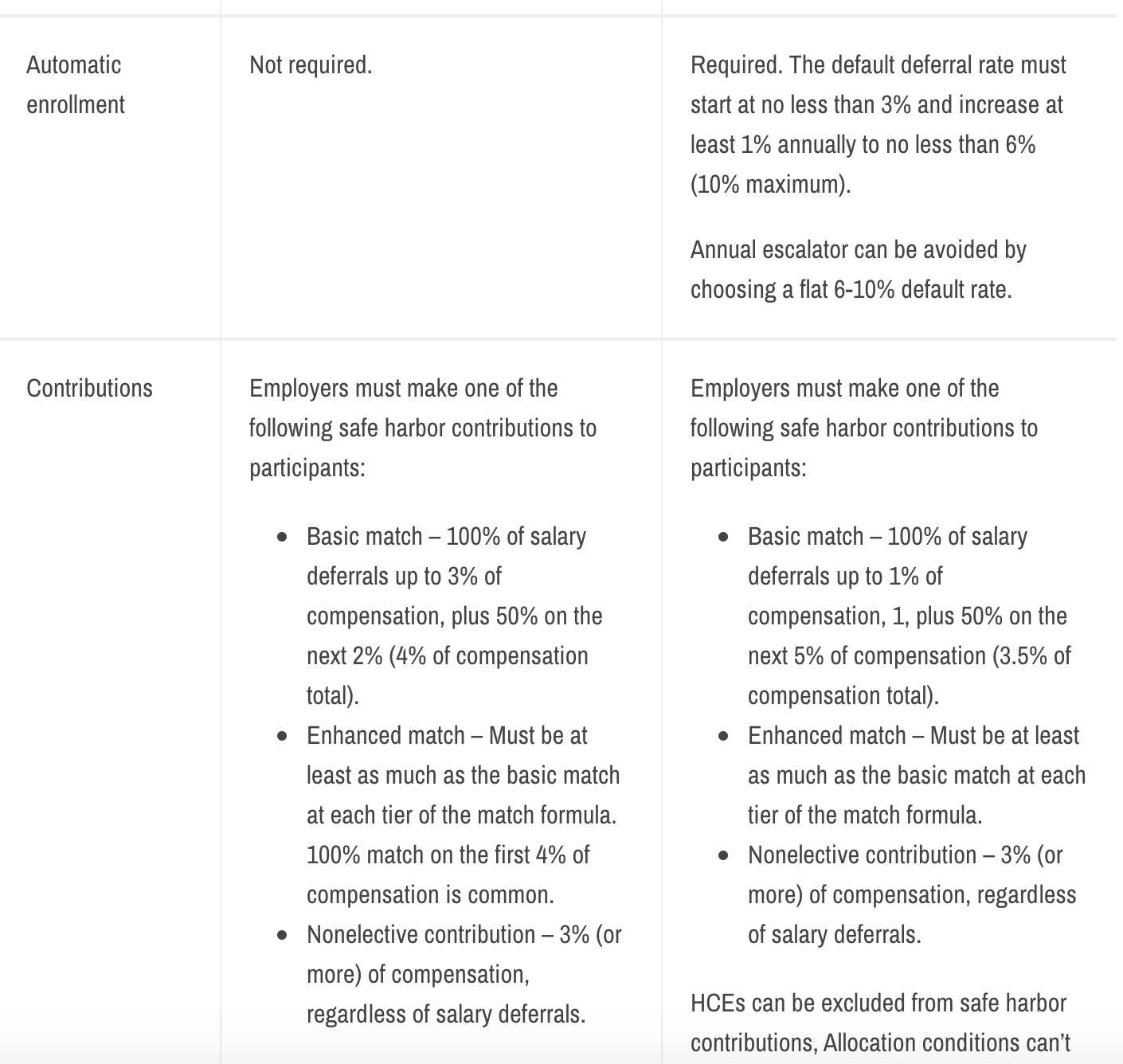

See Sections 604a1i and 604a1ii. A Safe Harbor Contribution may be a Safe Harbor Matching Contribution or a Safe Harbor Employer Contribution. Safe Harbor is a type of employer contribution that is added to a 401 k plan in order to help the plan pass compliance testing.

If the amendment will affect the content of the safe harbor notice provided before the start of the plan year you must. This type of plan offers three options to ensure the average contributions of highly compensated employees dont exceed. Safe harbor 401k plans are the most popular type of 401k used by small businesses today.

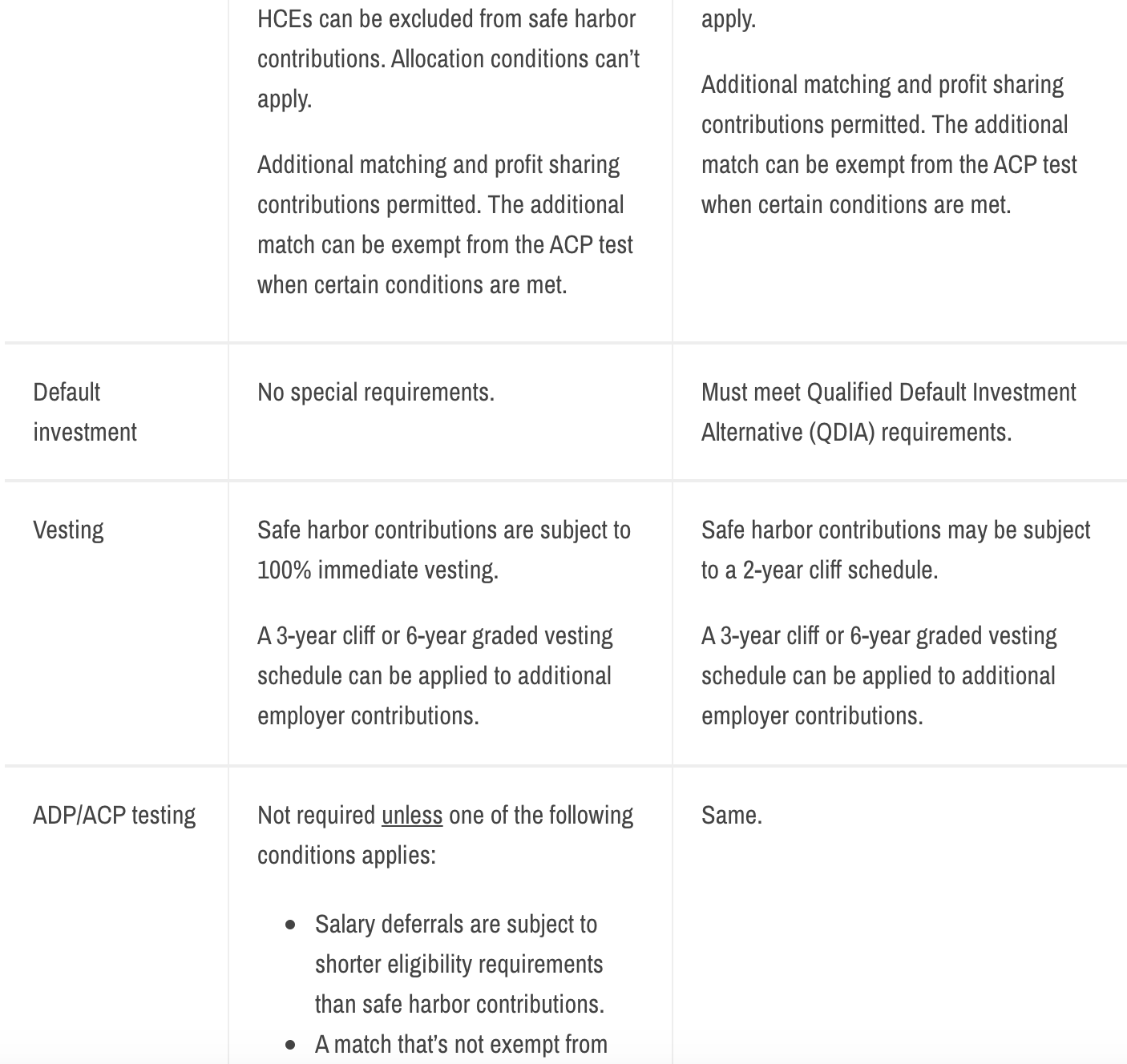

Maximum 401k safe harbor plan for 2021 Maximum 401k safe harbor plan for 2021. What is a Safe harbor 401k plan. In exchange for avoiding nondiscrimination eg actual deferral percentage ADP and top-heavy testing plan sponsors of safe harbor 401k plans have to make mandatory employer contributions and provide an annual written notice to.

Share More sharing options. You can amend a safe harbor 401 k plan mid-year when all of the following conditions are met. This is a major benefit for employees.

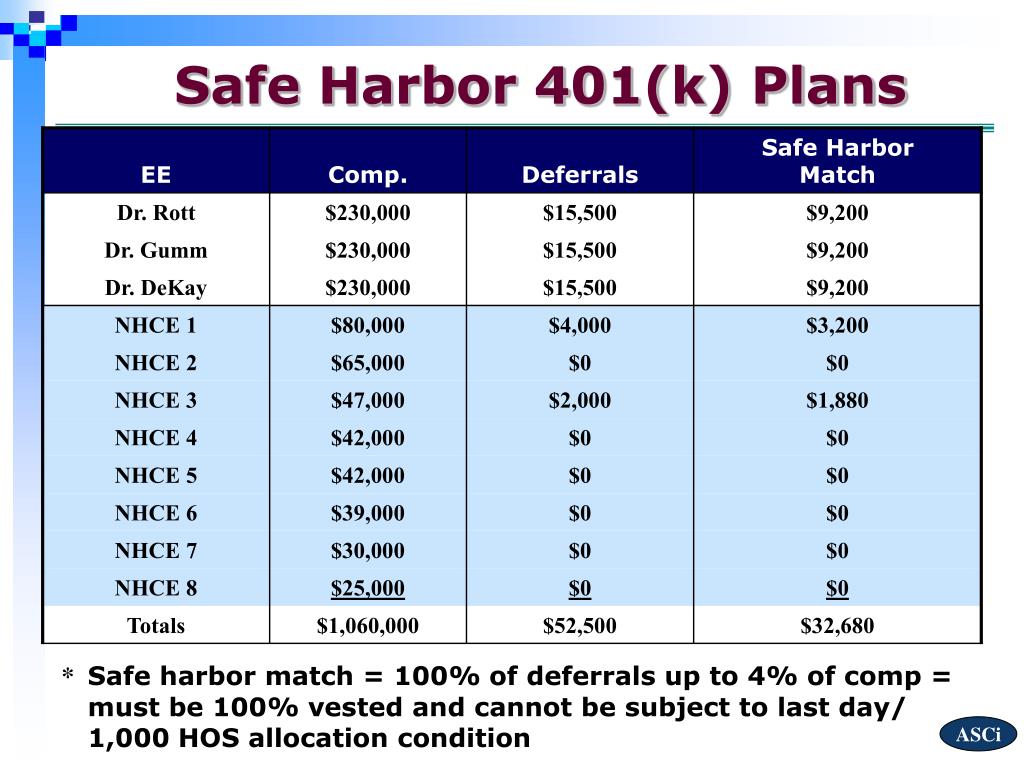

An enhanced safe harbor 401 k plan is an even simpler form of employer contribution matching. It has certain built-in elements that are intended to help employees save by requiring companies to contribute to their employees 401k accounts. A Safe Harbor 401k is similar to a traditional 401k in that pre-tax deferrals are made by employees but in this instance employers are required to make contributions to employees 401k plans and employer contributions are fully vested when made.

Posted 3 hours ago. Employers must match employee. There are types of contributions an employer can choose from.

Distribute a new notice to eligible employees 30-90 days before the effective date. Traditional 401 k plans. Safe harbor plans require mandatory employer contributions and immediate vesting for employees that means all employer contributions given to employees belong to the employees the moment those.

But heres the catch. This type of plan is also called an elective safe harbor plan. Easy online set-up and management.

401 k Plan Overview Tax advantages. A safe harbor 401k is a type of retirement plan that allows small-business owners to avoid the IRSs annual nondiscrimination testing. Ubiquity Retirement Savings has been an affordable provider of retirement solutions including Safe Harbor 401 k plans designed for small businesses start-ups and solopreneurs since 1999.

127 Safe Harbor Contribution. May a 55 year old participant earns 200000 sole participant May his. Safe harbor 401k provisions The safe harbor 401k was created as part of the Small Business Job Protection Act of 1996.

The employer makes a 11 match of any money the employee contributes but the employer contribution wont exceed 4 of the employees earnings for the year. Unlike a traditional 401k plan they automatically pass the ADPACP and top heavy nondiscrimination tests when mandatory contribution and participant disclosure requirements are met. With a safe harbor 401 k plan everyone can contribute up to the 19500 maximum in 2021 and 20500 in 2022 and those age 50 and older can make an additional 6500 in catch-up.

Key Takeaways A safe harbor 401 k plan is one thats set up to give employers some flexibility regarding IRS nondiscrimination rules. Safe Harbor Matching Contribution Notice 2022 Plan Year The Arnold Group 401k Plan If you are an eligible participant in the The Arnold Group 401k Plan the Plan you may make contributions called Salary Deferrals directly from your paycheck into the Plan. Streamlined flat-fee plans starting at 90month.

By Egold 3 hours ago in 401k Plans. The ability to make Salary Deferrals provides you with an easy. A Safe harbor 401k plan allows a plan sponsor to automatically pass certain annual tests to ensure compliance with IRS regulations if specific contribution vesting and participant notification requirements are met Safe harbor plans generally dont require the following compliance tests.

Employers of any size can use Safe Harbor 401k plans and they can. A contribution authorized under AA 6C-2 of the Profit Sharing401k Plan Adoption Agreement that allows the Plan to qualify as a Safe Harbor 401k Plan.

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)