Nys Tax Payment Plan

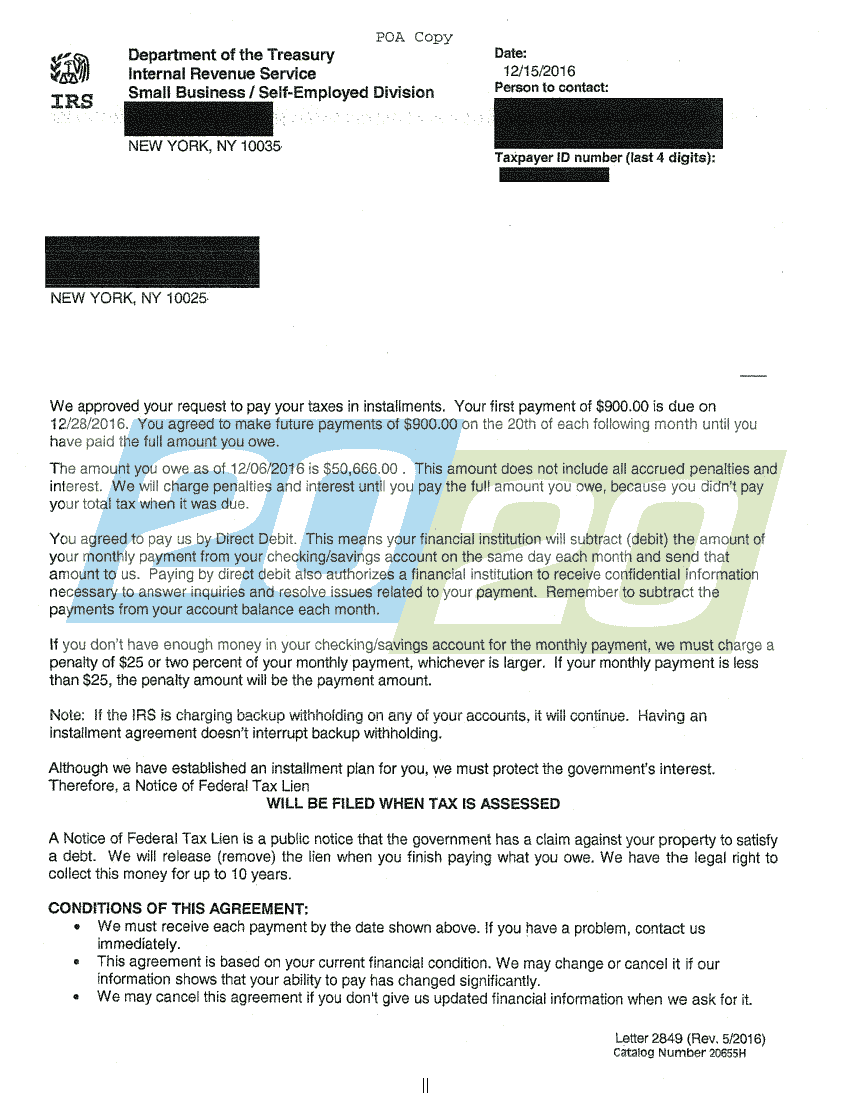

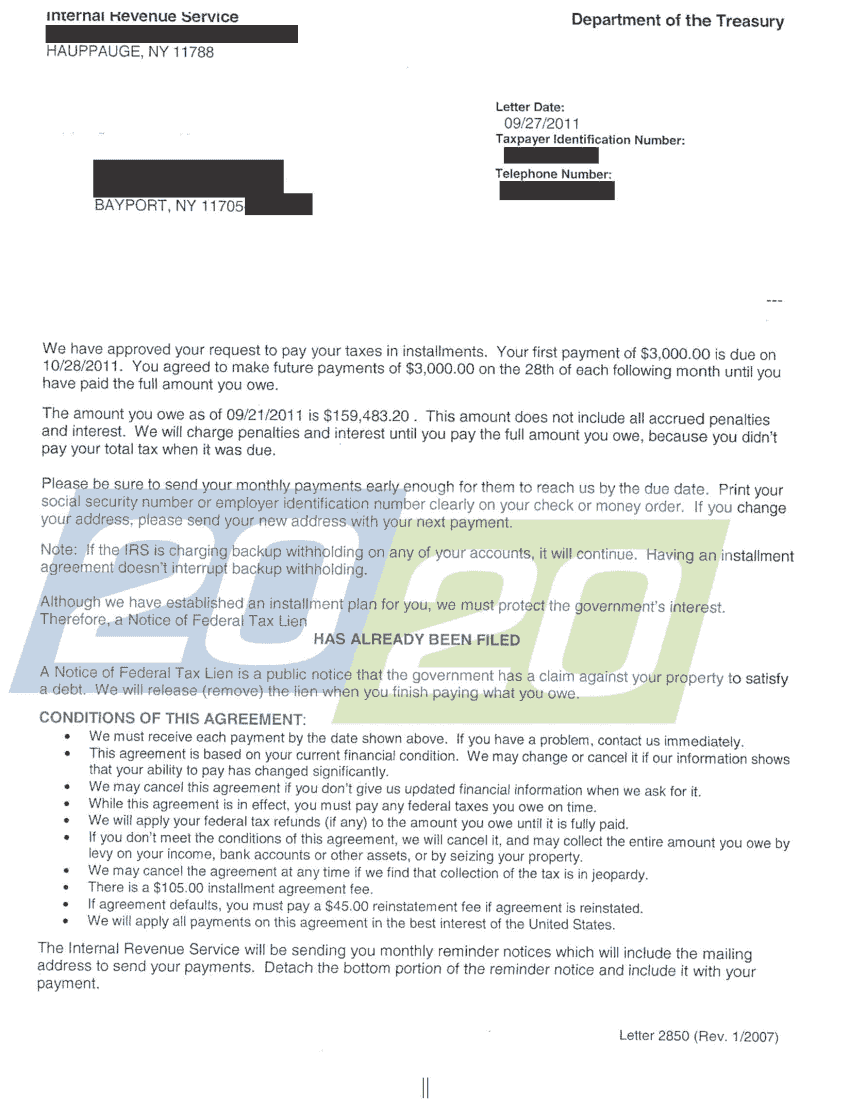

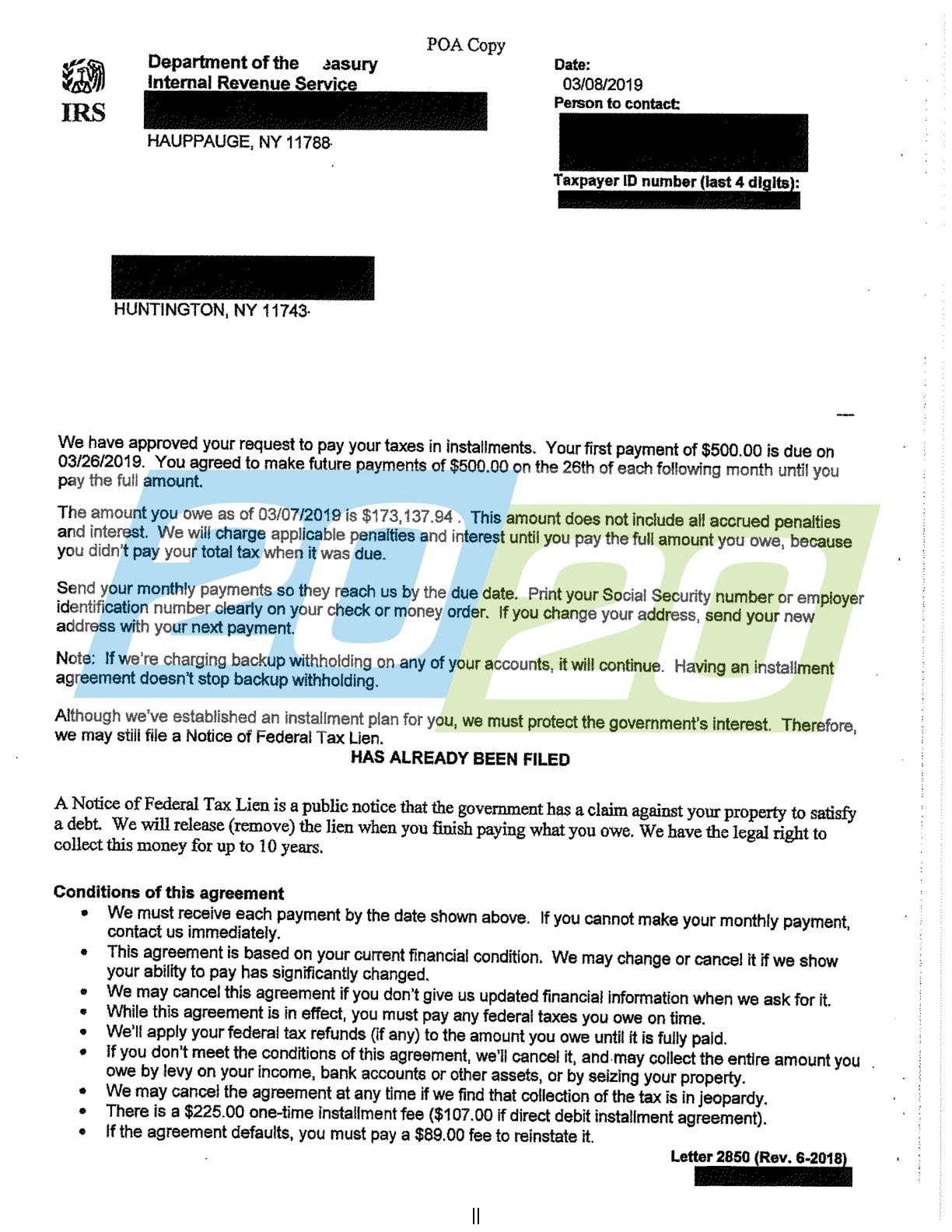

Once accepted your account will still accrue all penalties and interest on your unpaid balance for the full life of your IPA.

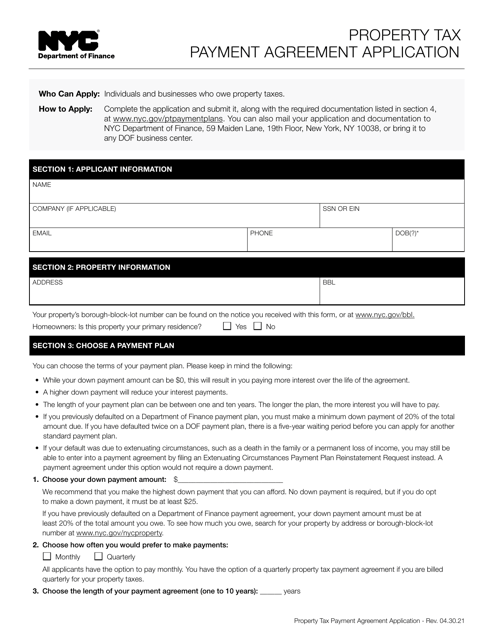

Nys tax payment plan. You must provide your taxpayer ID number usually your Social Security number and the four-digit PIN from your tax bill. Payment plans can be used for property taxes and many other property charges. It will probably be several months before the IRS is back to normal.

The debt is not a forever debt. However you are generally safe from collections efforts as long as you are locked into a payment agreement. Resolving NYS Tax Collections Issues.

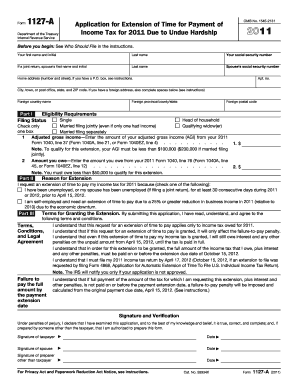

If you cannot pay your state taxes and want to request a payment plan take one of these options. If you can demonstrate to NYS that you only have 120 available each month you may be able to get them to agree. The NYS tax payment plan option can vary by the term and whether the taxpayer must disclose financial information.

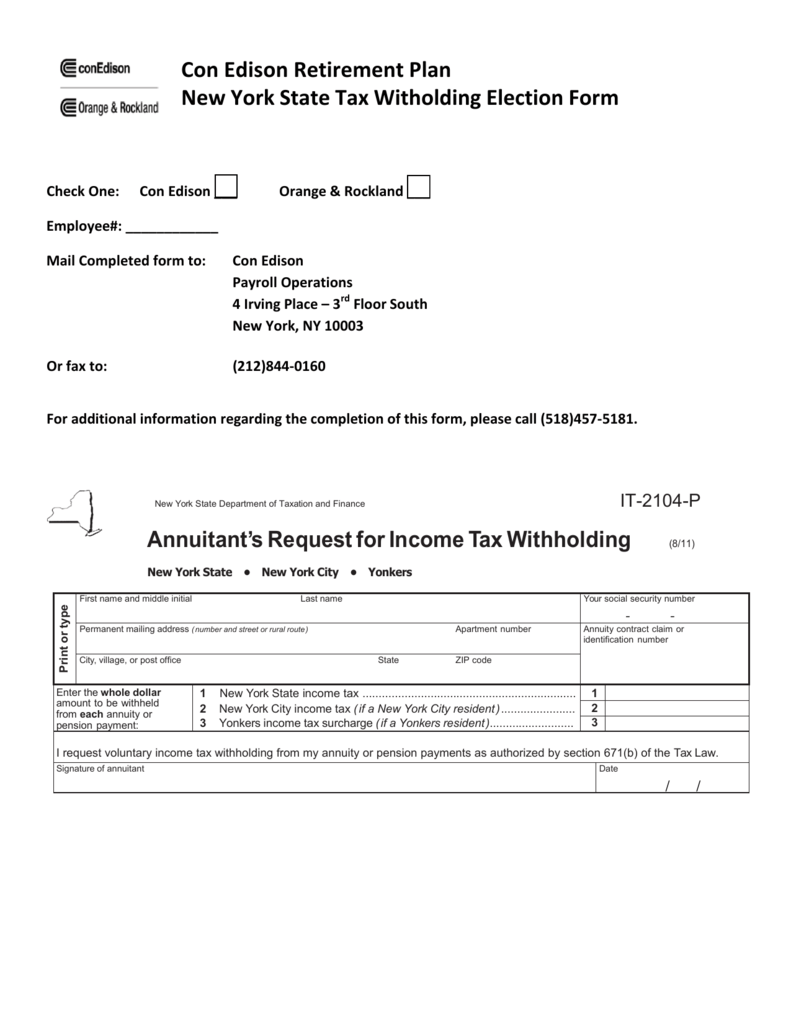

New Yorks income tax rates were last changed one year prior to 2020 for tax year 2019 and the tax brackets were previously changed in 2016. The deadline to apply for the Property Tax Interest Abatement Program was. Establish an account on the DTF website.

Other options are available to help financially strapped taxpayers settle for less than they owe. The NY State Department of Taxation and Finance DTF has a reputation for being consistent and reliable. By January 1 2022 you must post certain itemsprominently and conspicuouslyat every location where you provide tax preparation or facilitation services.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates which may impact estimated tax payments. New York States willingness to accept a payment of only 120 per month will turn on how much you owe and how much you can afford to pay. However this option helps taxpayers who cannot afford to pay their taxes in full.

GET TAX HELP 516-620-5944. Help with IRS NY Tax Matters. Select Payments bills and notices and then Installment payment agreement from the drop-down menu.

New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. Call us at 518-457-5434 during regular business hours and speak to a. Read valuable tips and learn your options on how to solve your defaulted IRS payment plan and how to put your back tax problems behind you.

A plan can include up to 36 monthly payments. For your 2020 taxes which youll file in early 2021 only individuals. If your property is at risk for a lien sale or in rem action you can still enter into a payment plan.

Before making or scheduling an estimated tax payment review Estimated tax law changes to determine if your 2021 estimated tax payments are affected by. If you have missed payments on your property tax bills and you have an outstanding balance you can enter into a payment plan. However you cannot enter into a payment plan with the Department of.

Through your account you can request an IPA for a balance of 20000. Make a payment. New York Income Taxes.

NYS has 20 years to get it in most cases. Some of the tax programs available help taxpayers pay off their balance over time. Call 518-457-5434 to speak to a DTF representative.

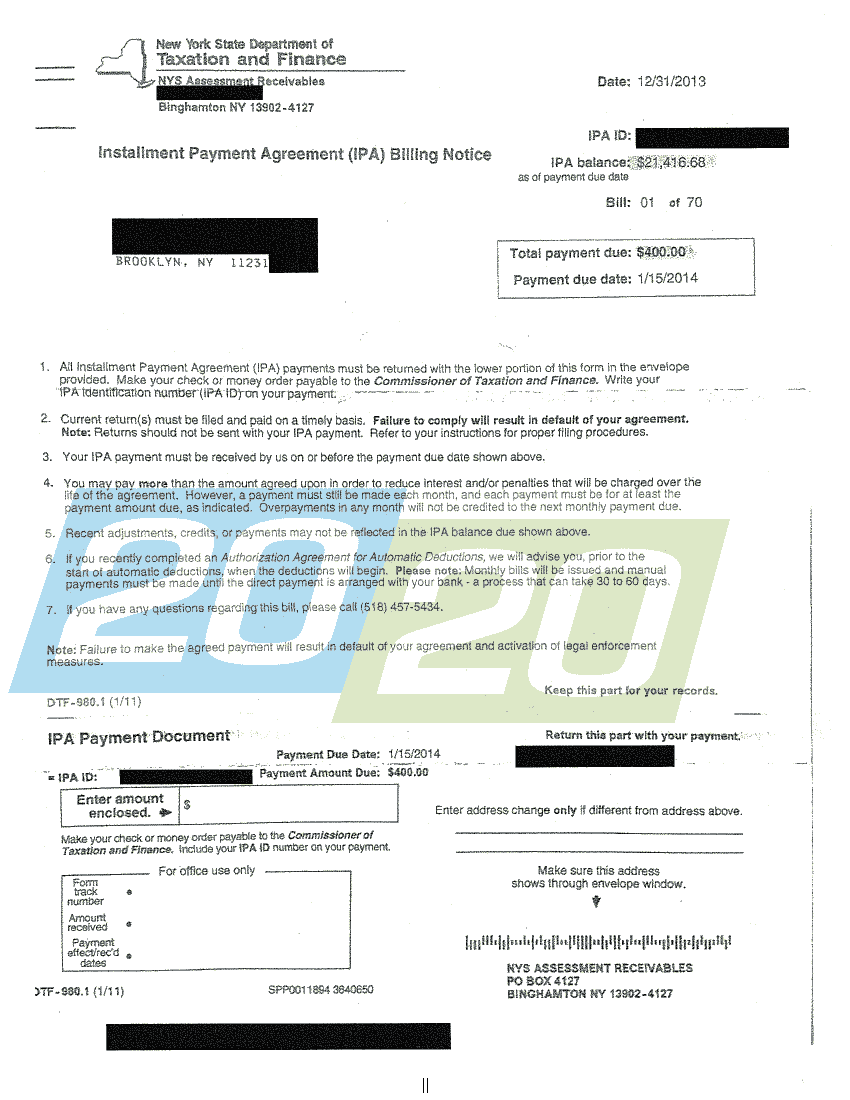

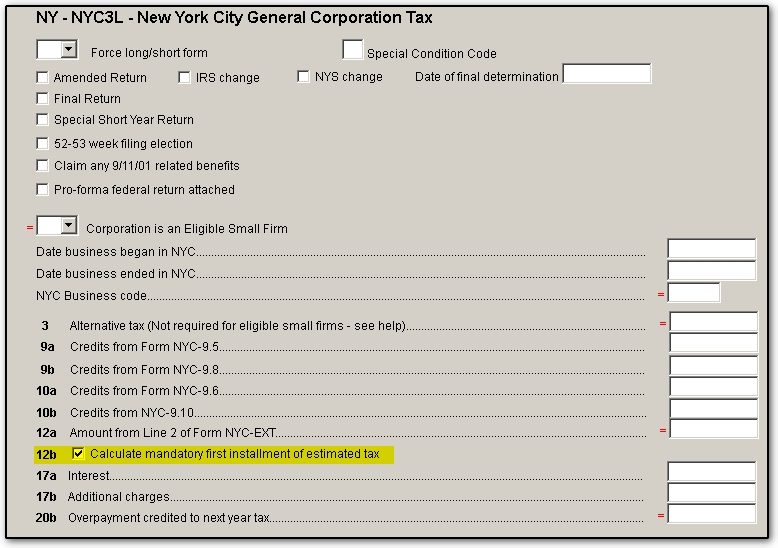

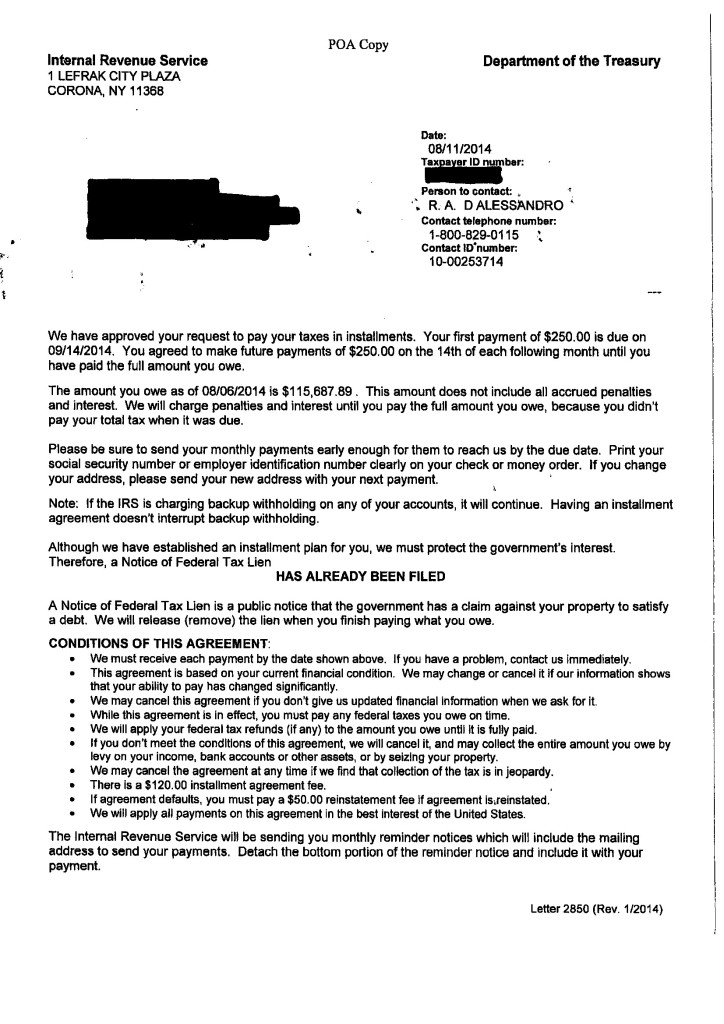

As Dana Atchley pointed out you would have to produce all of your financial back-up information to show your. Installment Payment Agreement IPA is the official name DTF uses to refer to a monthly tax payment plan. We can assist you regardless of location.

The state applies taxes progressively as does the federal government with higher earners paying higher rates. New York state has a tax resolution framework for taxpayers struggling with back taxes. Deferred payment agreement was the previous name for the IPA.

Posting requirements for tax return preparers and facilitators. Answer 1 of 4. These payment plans are commonly called Installment Payment Agreements IPAs The government may require a significant amount of corporate and personal financial disclosures prior to agreeing to an.

If youre unable to pay your tax bills in full you may qualify for an installment payment agreement IPA. Request an IPA Note. If you need to request an IPA for a balance greater than 20000 or that requires more than 36 scheduled monthly payments you need to make your request by phone.

When you do get a hold of someone its likely that they wont know what to do and transfer you to someone else until you get an answer that could be wrong. If youre a tax return preparer facilitator or both you have new posting requirements. If you truly have a zero balance then the system would.

If you are a property owner who had unpaid New York City property taxes and you were impacted by COVID-19 the Property Tax Interest Abatement Program reduced or completely waived up to six months of late payment interest charges on property tax payments due July 1 or October 1 2021. Each marginal rate only applies to earnings within the applicable marginal tax bracket. The worst thing you can do is nothing and the best thing you can do is have tax attorneys get you the best result possible.

Sales Tax Payment Plans IPA If you owe the government money for unpaid sales and use taxes it is possible to get a payment plan with them. The fastest and easiest way to request an IPA is through your Online Services account. Under the agreement youll make monthly payments toward your unpaid tax balance.