Profit-sharing Plan

Profit Sharing Profit sharing is a workplace compensation benefit that helps employees save for retirement by paying them a portion of.

Profit-sharing plan. Download this editable and ready-made template through which you can acknowledge that under the profit-sharing plan and trust you are entitled to the benefits at the time of your. They share the same structure in that a standard profit sharing is generally an investment portfolio holding a mix of mainstream securities assets. Profit-sharing plans are different from other retirement plans like 401k plans because employees do not put any of their own money into the plan.

Businesses of all sizes can offer profit sharing plans. Many businesses offer profit sharing as a retirement benefit for employees. Profit sharing plans have additional advantages.

A profit-sharing plan is a kind of retirement plan that allows employees to partake in a companys profits. A profit sharing plan is a type of retirement savings plan that enables workers to share in their companys profits. In publicly traded companies these plans typically amount to allocation of shares to employees.

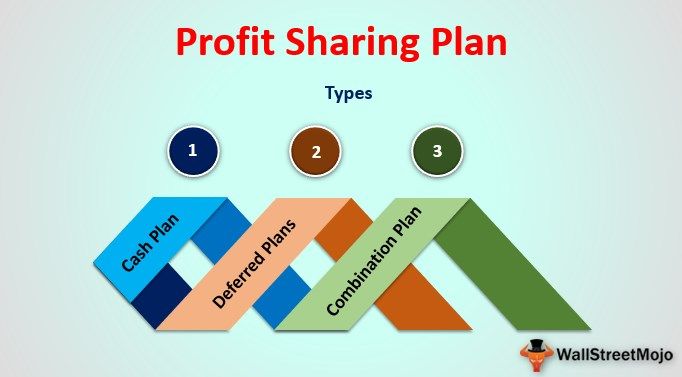

With a profit-sharing plan PSP employees receive an amount based on the companys earnings over a specific period of time eg a year. These plans fall into two types. A profit sharing plan is a type of plan that gives employers flexibility in designing key features.

It allows you to choose how much to contribute to the plan out of profits or otherwise each year including making no contribution for a year. N Can help attract and keep talented employees. A profit-sharing plan takes a percentage of the companys profits and shares it with the team on top of their compensation plan.

Generally an employee receives a percentage or dollar amount of the businesss profits either in cash or company stock. Profit sharing refers to various incentive plans introduced by businesses that provide direct or indirect payments to employees that depend on companys profitability in addition to employees regular salary and bonuses. Its a great way to give your team extra money without creating entitlement because its directly tied to their hustle.

One of the earliest pioneers of profit sharing was. Employers start a profit sharing plan for additional reasons. A profit sharing plan is usually structured to give a percentage of the profits to employees based on the companys earnings.

An employee earns a percentage of a companys profits based on quarterly or annual earnings under this type of plan known as a deferred profit-sharing plan. In profit sharing the company contributes a part of its profits into a pool of funds to be distributed among eligible. Like 401k plans profit-sharing plans are tax-advantaged retirement accounts that an employer runs for their employees.

A profit sharing plan is a type of plan that gives employers flexibility in designing key features. A profit-sharing plan can also be termed as a deferred profit-sharing plan and that will give employees a share from the profits earned by the company that is based on the companys earning. Profit sharing plans may.

The difference is in how contributions are made. It allows the employer to choose how much to contribute to the plan out of profits or otherwise each year including making no contribution for a year. T here are different types of profit-sharing plans you can use to incentivize and reward your employees.