Non-qualified Retirement Plan

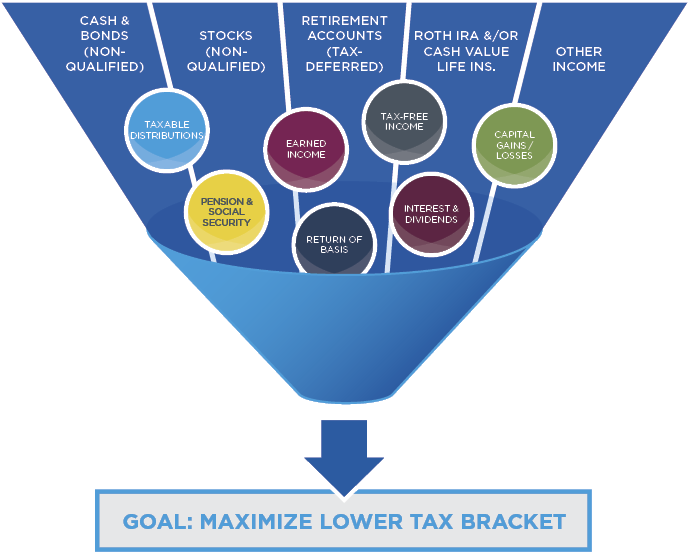

This means that you will not have to pay a tax on the earnings.

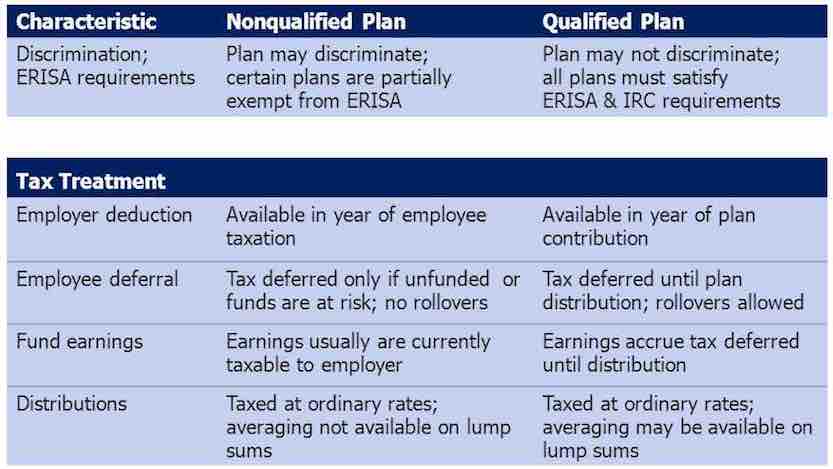

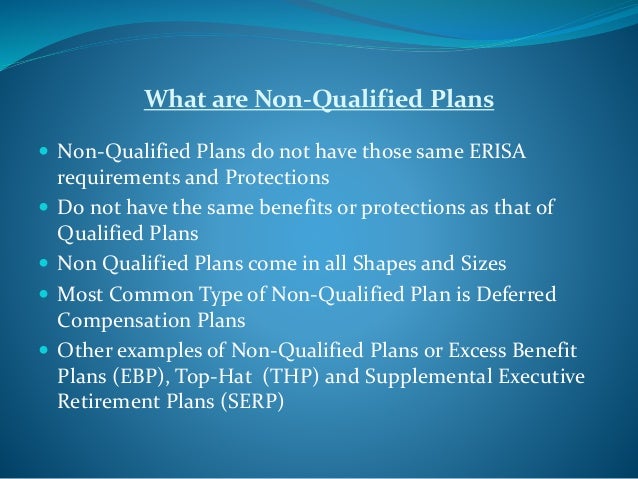

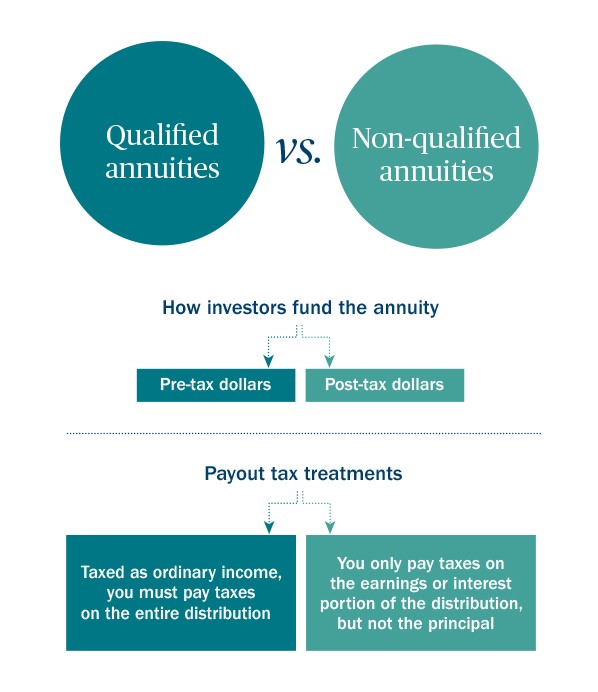

Non-qualified retirement plan. To avoid falling within the requirements of ERISA some non-qualified plans must meet the definition of a top-hat plan which provides deferred compensation for a select group of management or highly compensated employees. The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. Contributions to nonqualified annuities are made with after-tax dollarspremiums are not deductible from gross income for income tax purposes.

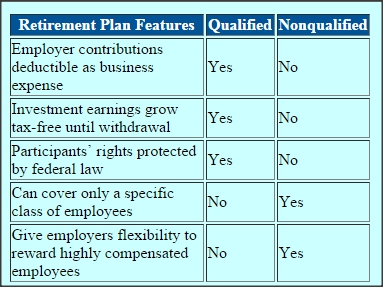

Employers view these plans as a valuable employee retention tool for key executive and management personnel. You are taxed when you withdraw. A non-qualified retirement plan is essentially whatever a qualified plan is not.

Nonqualified plans are generally used to provide high-paid executives with an additional retirement savings option. Non-qualified plans do not have any ERISA protection. The employer is charged with the responsibility of maintaining the deferred income in a special fund until the employee retires or otherwise leaves the company.

Non-qualified plans are not subject to most of the requirements of the Employee Retirement Income Security Act of 1974 ERISA. Key Takeaways Nonqualified plans are retirement savings plans. Alternatively any annuity not used to fund a tax-advantaged retirement plan or IRA is considered a non-qualified annuity.

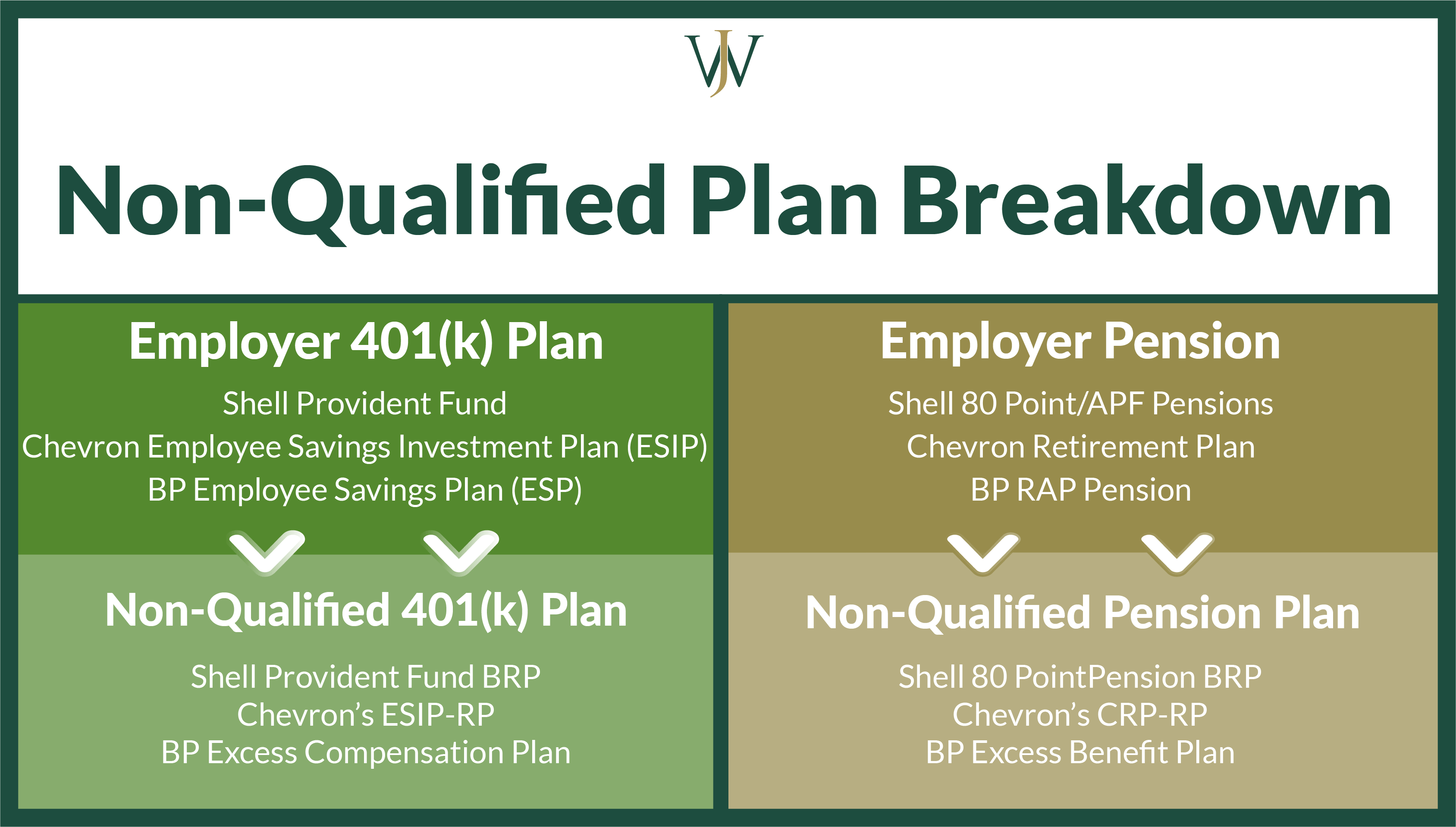

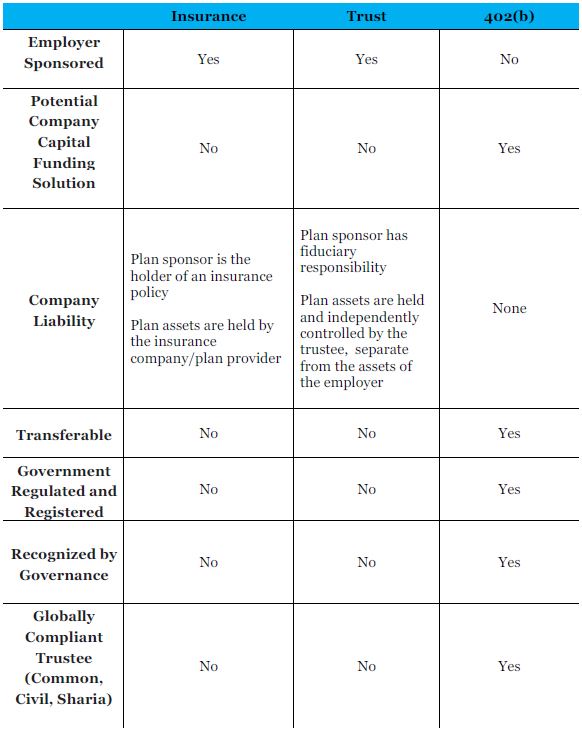

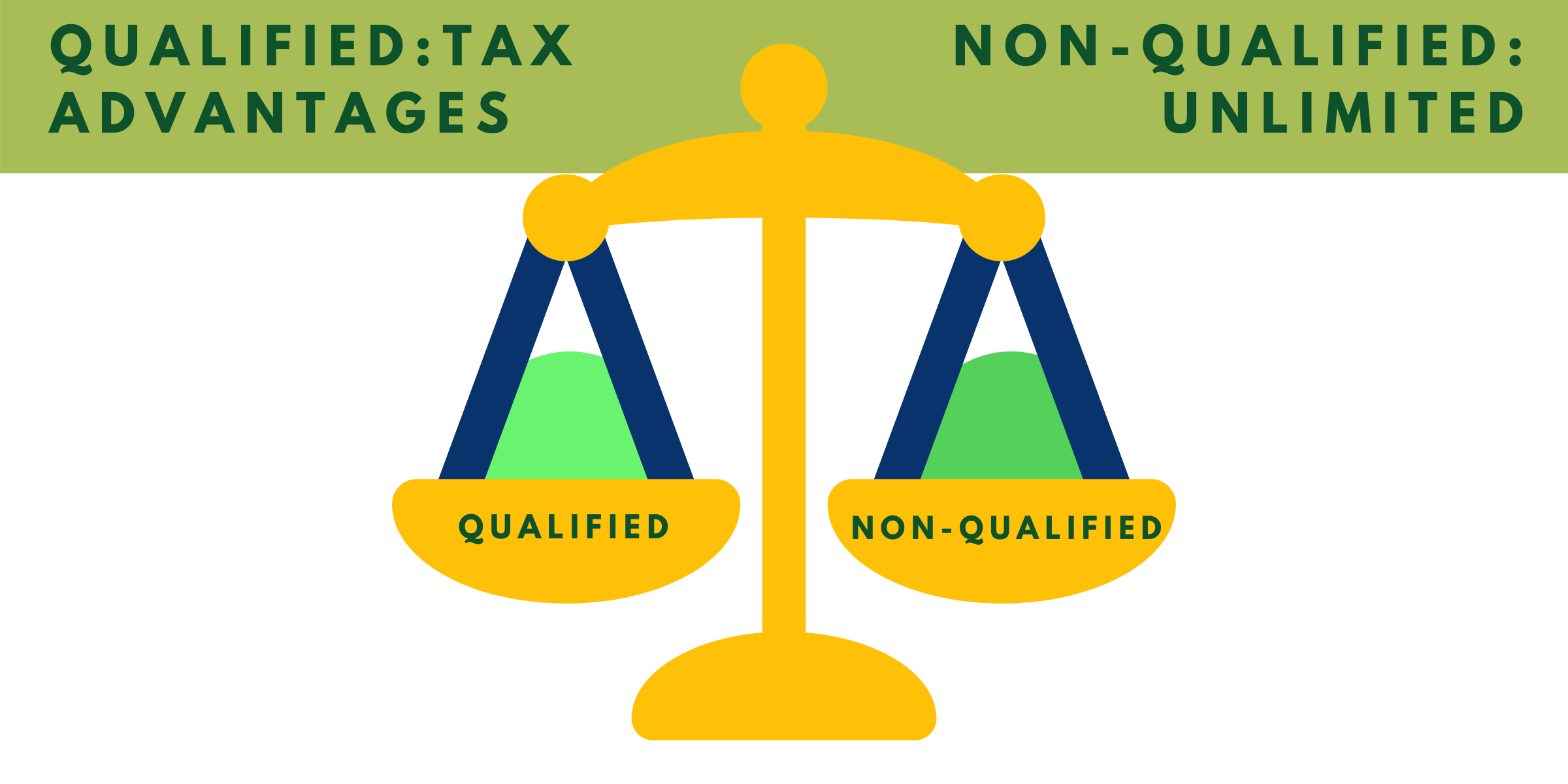

At a very basic level qualified plans are protected through ERISA. Non-Qualified Retirement Plans Deferred compensation plans Executive Bonus Plans Group Carve-out plans Split-dollar life insurance plans. So what does that mean in.

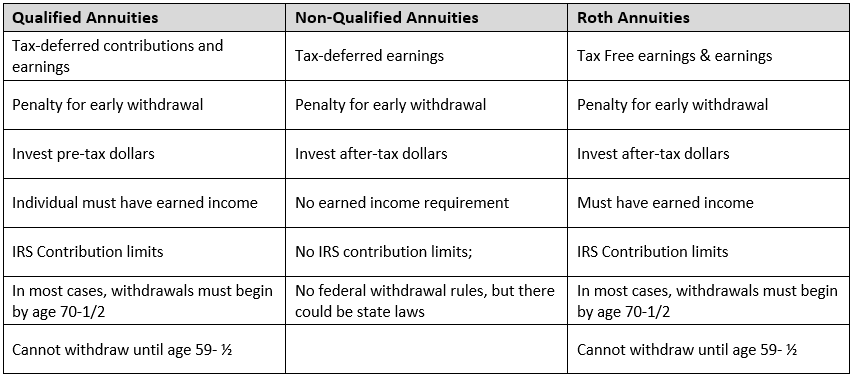

One popular type of Non Qualified Retirement Plan is an annuity. They are called nonqualified because unlike qualified plans they do not adhere to Employee Retirement Income Security. 4 rows Nonqualified retirement plans are employer-sponsored retirement plans that arent subject to.

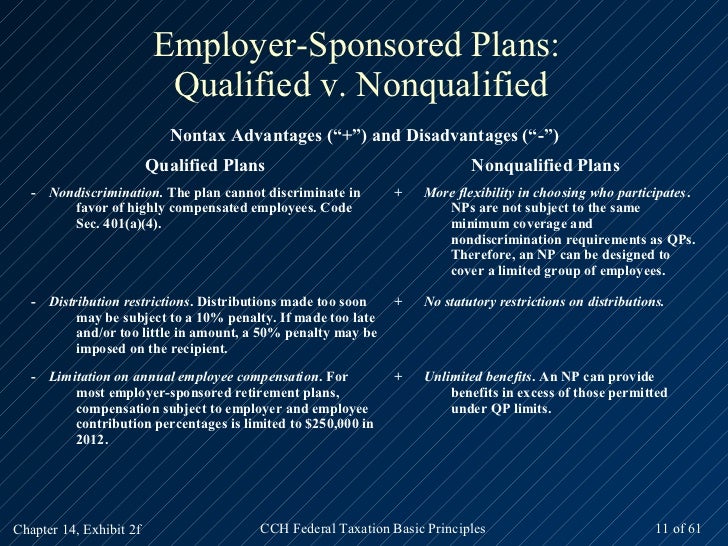

A nonqualified plan is a tax-deferred employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act guidelines. They are non-qualified because they fall outside the Employee Retirement Income Security Act ERISA guidelines and are exempt from the testing required with qualified retirement savings plans. So what is the difference between a qualified plan and a non-qualified plan.

An annuity can be classified as Non Qualified money but can grow tax deferred just like Qualified money. Often used by employers as an attraction and retention vehicle an NQDC plan is more like an agreement between you and your employer to defer a portion of your annual income until a specific date in the future. Depending on the plan that date could be in 5 years 10 years or in retirement.

Non-qualified retirement plans are frequently offered to highly compensated employees and executives as a way to supplement beyond the limitations and restrictions on the qualified retirement plans. Taxation of the Account When Monies are Withdrawn. Qualified VS Non-Qualified Retirement Plans.

This is a federal law that was enacted in 1974 to help protect workers retirement plan savings. In other words all of your earnings on an Non Qualified annuity will NOT trigger an annual 1099 tax form from the annuity company. In other words if the plan does not meet the myriad of exact requirements the Internal Revenue Code section 401 a and the Employee Retirement Income Security Act of 1974 ERISA the retirement plan is non-qualified.