When Would Trump's Tax Plan Go Into Effect

President Trump signed the Tax Cuts and Jobs Act of 2017 TCJA into law on December 22 2017.

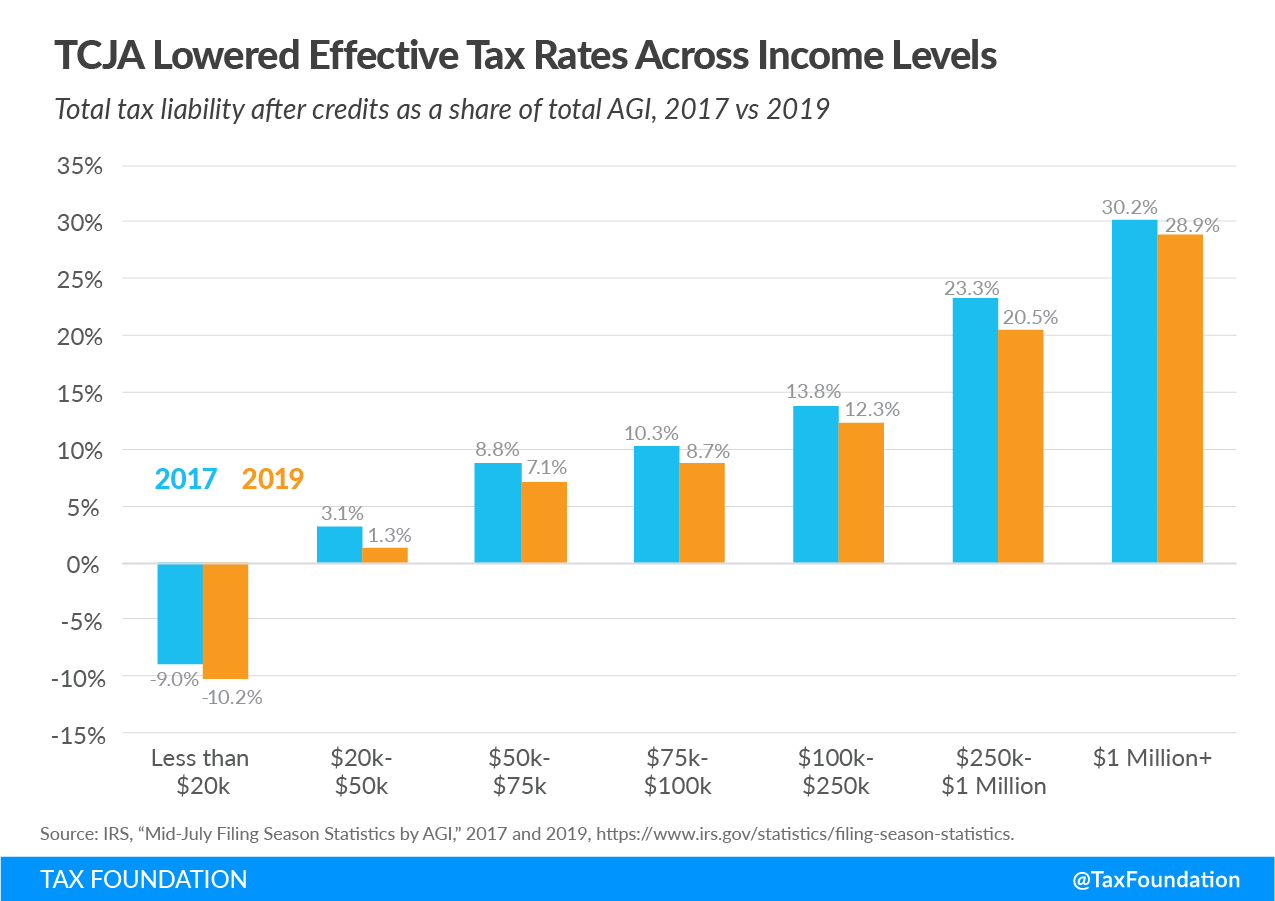

When would trump's tax plan go into effect. The right-leaning Tax Foundation released an analysis Monday that said Trumps campaign would shrink federal revenues by as much as 59 trillion over 10 years. The tax hike was planned all the way back in when President Donald Trump passed the 2017 Tax Cuts and Jobs Act which lowered taxes for most Americans at the time. The analysis comes two years after President Donald Trump enacted the Tax Cuts and Jobs Act a major overhaul in the nations tax laws billed by the White House as a boon for the middle class.

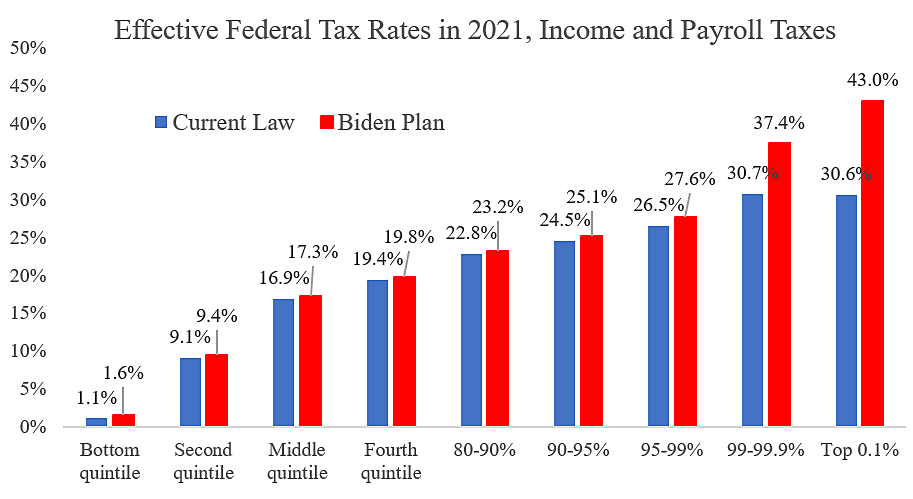

Most of the changes took effect on January 1 2018. It lowered the corporate tax rate to 21 from 35 at the turn of 2018. According to a new report by The New York Times taxes will go up for many Americans starting in 2021 and the Republicans are to blame.

His former plan would have done so. Further the House Republicans under Paul Ryan also have an alternative tax plan which while also looking to cut corporate and personal taxes is not as aggressive as the proposed Trump tax plan. The law created new income tax brackets that changed what many Americans pay in taxes.

Most changes went into effect on Jan. 22 2017 bringing sweeping changes to the tax code. The Tax Cuts and Jobs Act came into force when President Trump signed it.

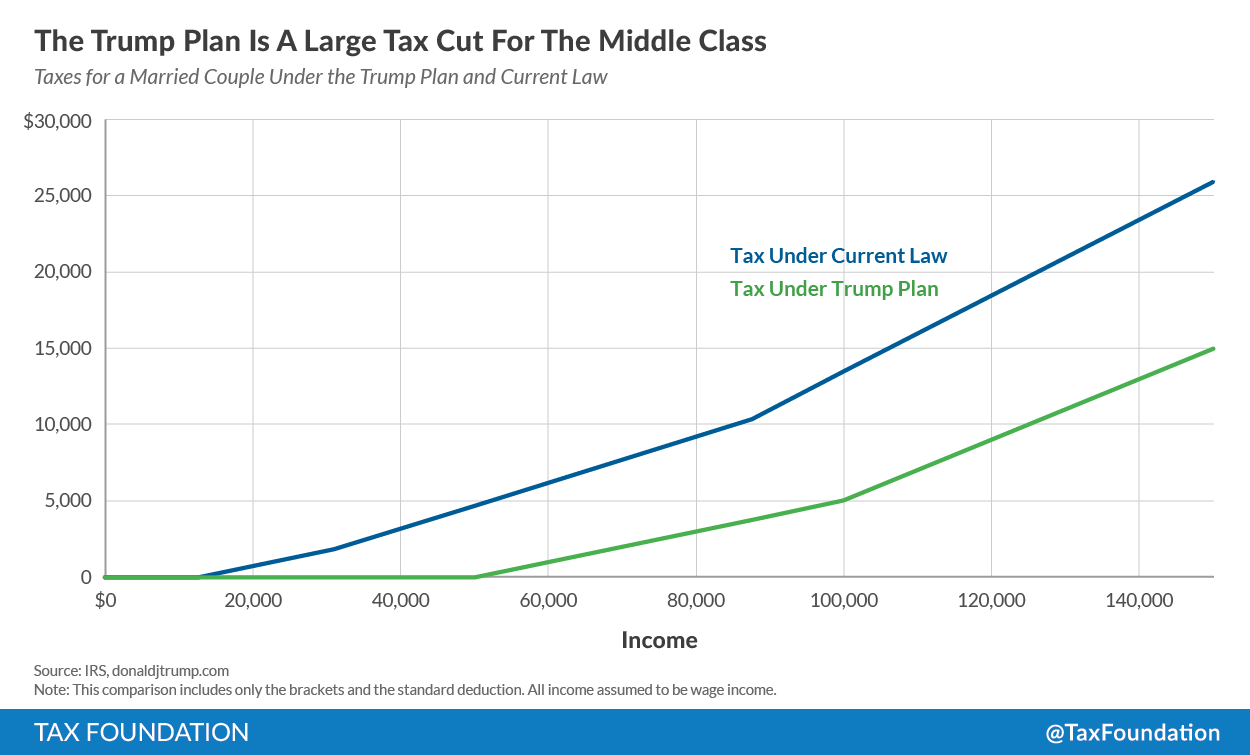

REUTERSJonathan ErnstFile Photo. Trumps proposal to streamline the tax system into three brackets of 12 percent 25 percent and 33 percent is similar to the tax plan of House Speaker Paul Ryan said Scott Greenberg an analyst. If President Donald Trump signs it before the end of the year the new tax plan will take effect on January 1 2018.

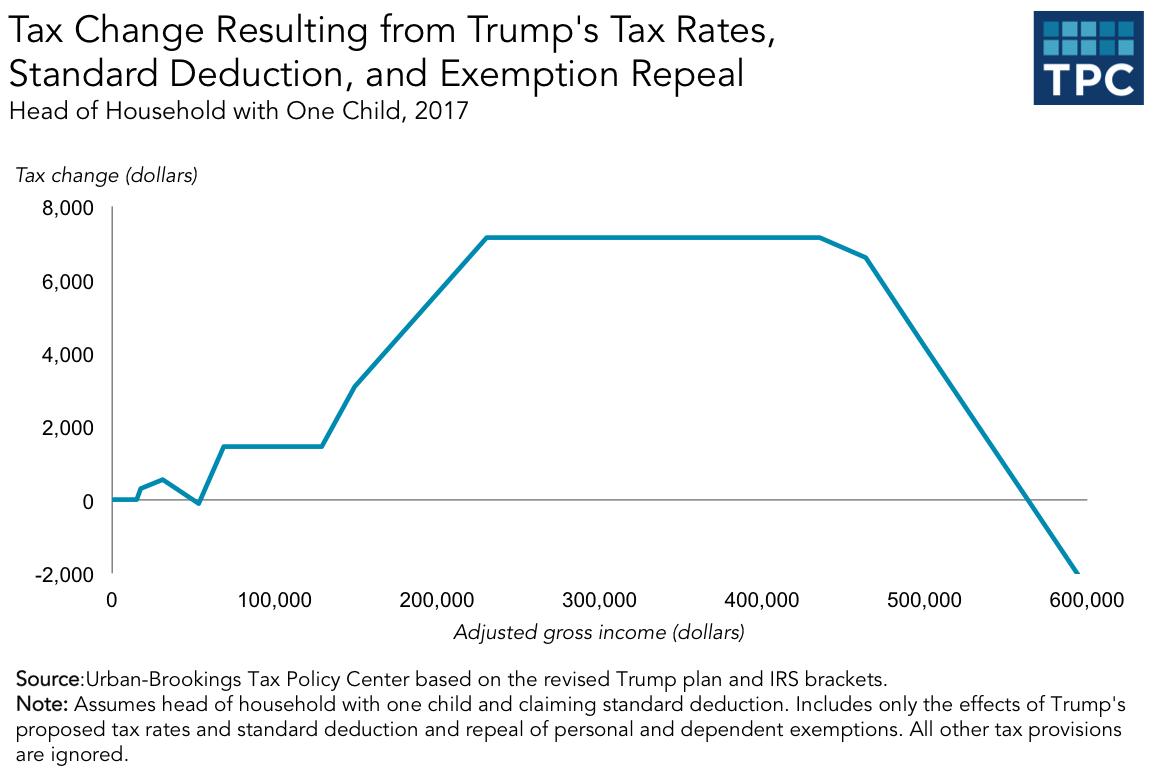

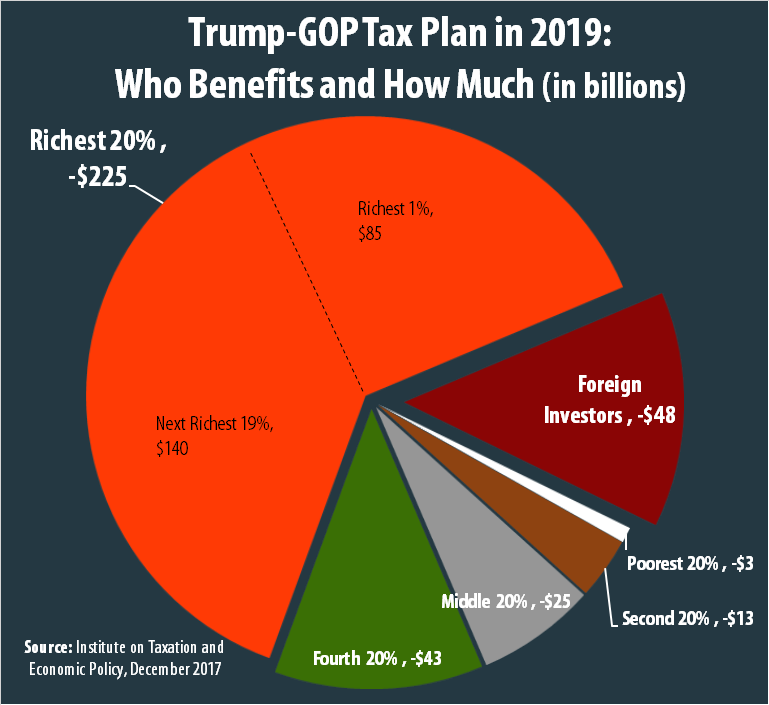

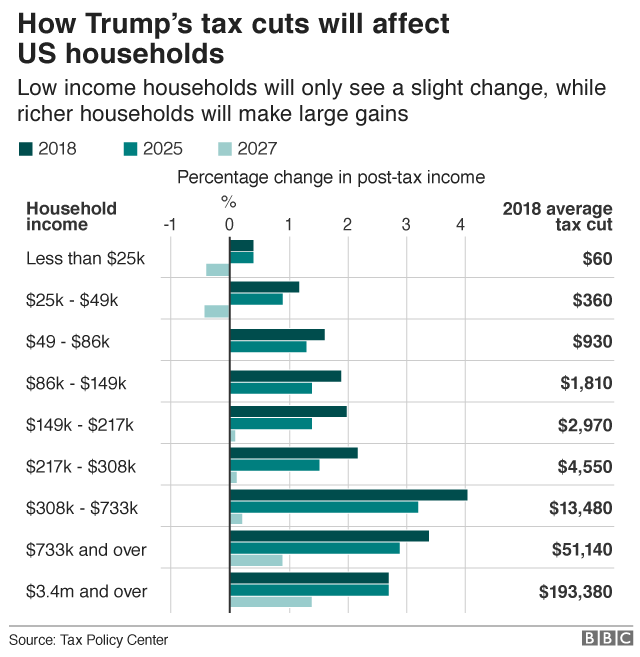

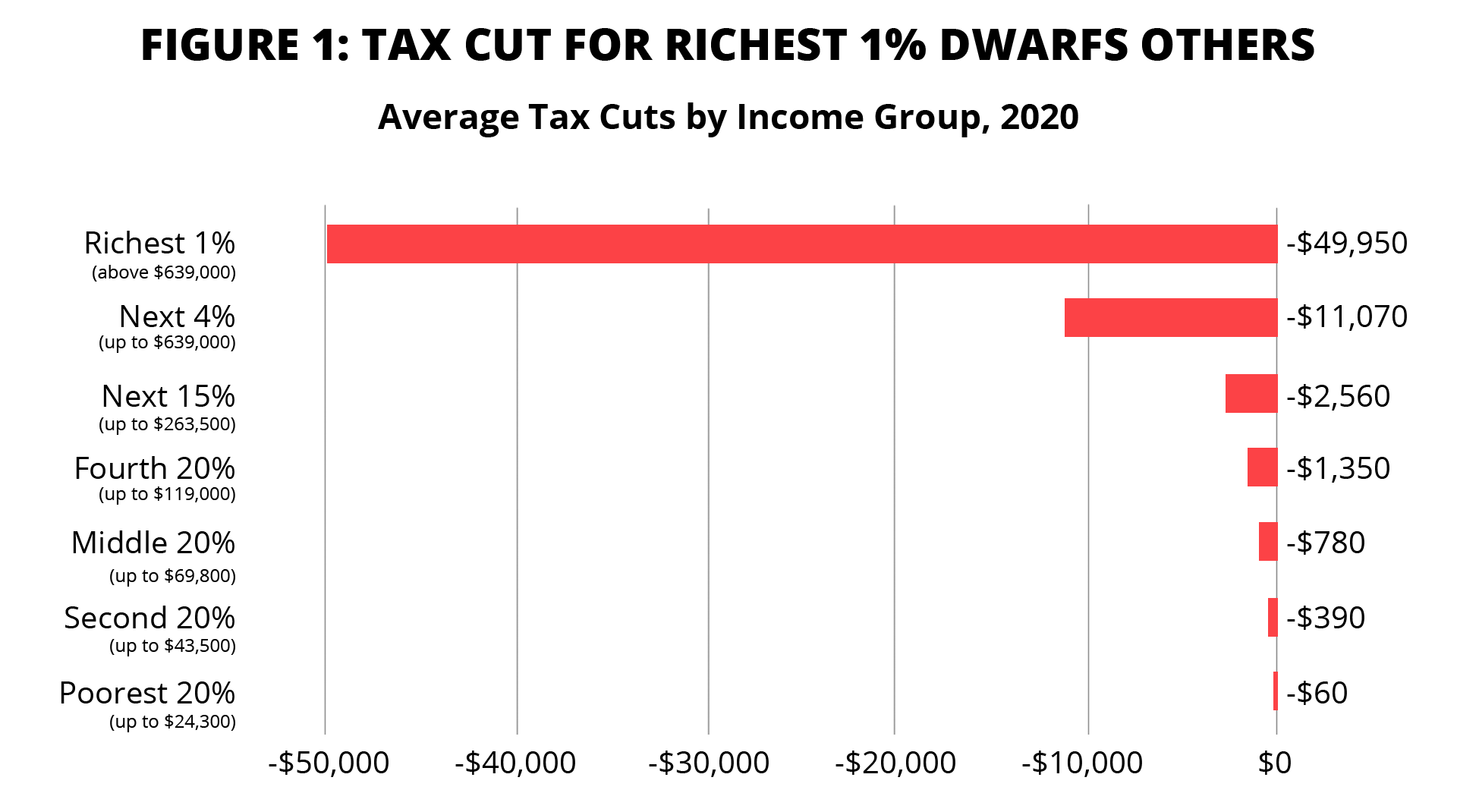

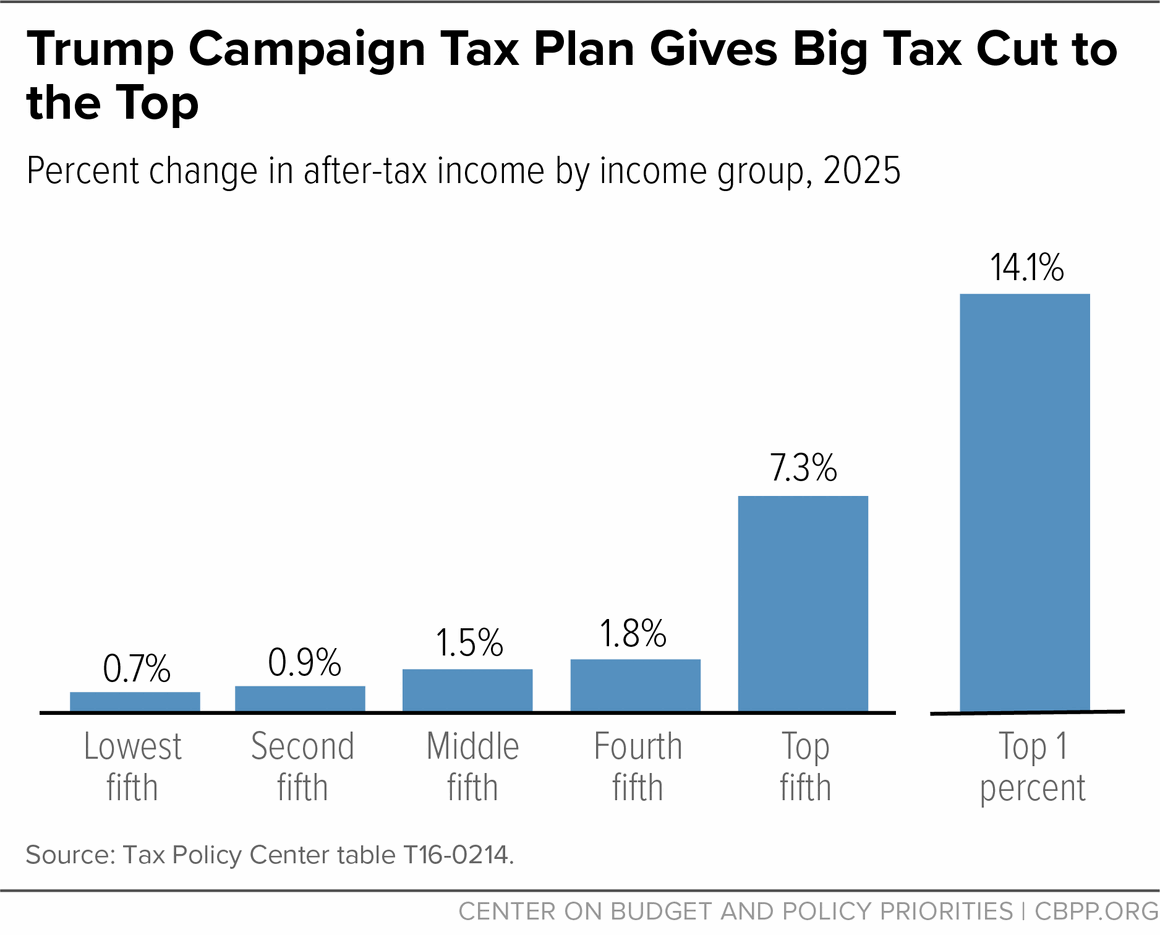

How exactly the Trump tax plan affects you depends on your income your current filing status and the deductions you take. Yet the biggest winners under Trumps plan would be well people just like Trump. Taxes Going up in 2021 Due to GOP-Passed Bill.

Other changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions. This bill largely didnt affect individual income taxes until the 2018 tax year which you filed in early 2019. Its model estimates that Trumps plan could add an additional 11 in 2018 relative to current law.

Trump Vows Lower Tax Rates Deep Spending Cuts. How people felt in principle about the 15 trillion overhauls. By Derek Major August 31 2020.

Trumps Payroll Tax Plan Goes Into Effect But Employers Are Cautious. However some TCJA provisions went into effect in. President Donald Trump signed a law that dramatically overhauled the US.

President Trump signed the Tax Cuts and Jobs Act TCJA into law on Dec. Tax code in December 2017. While they may get passed by Congress a lot of Trumps tax changes wont go into effect until 2018 since 2017 tax rates and brackets have already been established.

President Trump signed the Tax Cuts and Jobs Act into law in December 2017. But by 2024 that positive effect is erased and by 2027 it could lower GDP by 078. Lets take a look at the 2022 tax.

1 2018 and did not affect your tax return until the 2018 tax year which you filed in 2019.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9354235/tpc_distribution_big_six.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/cdn.vox-cdn.com/uploads/chorus_asset/file/8839137/trump_distribution.png)