Irs Payment Plan Balance

File all required tax returns on time and pay all taxes in-full and on time contact the IRS to change your existing.

Irs payment plan balance. WASHINGTON The Internal Revenue. The IRS offers payment plans for those who cant afford their tax balance when its due which allows people to avoid levies and garnishments. Customer Service and Human Help.

View the amount they owe. The only difference is that an IRS tax payment plan makes the balance easier to. Tina Orem Oct 22 2021.

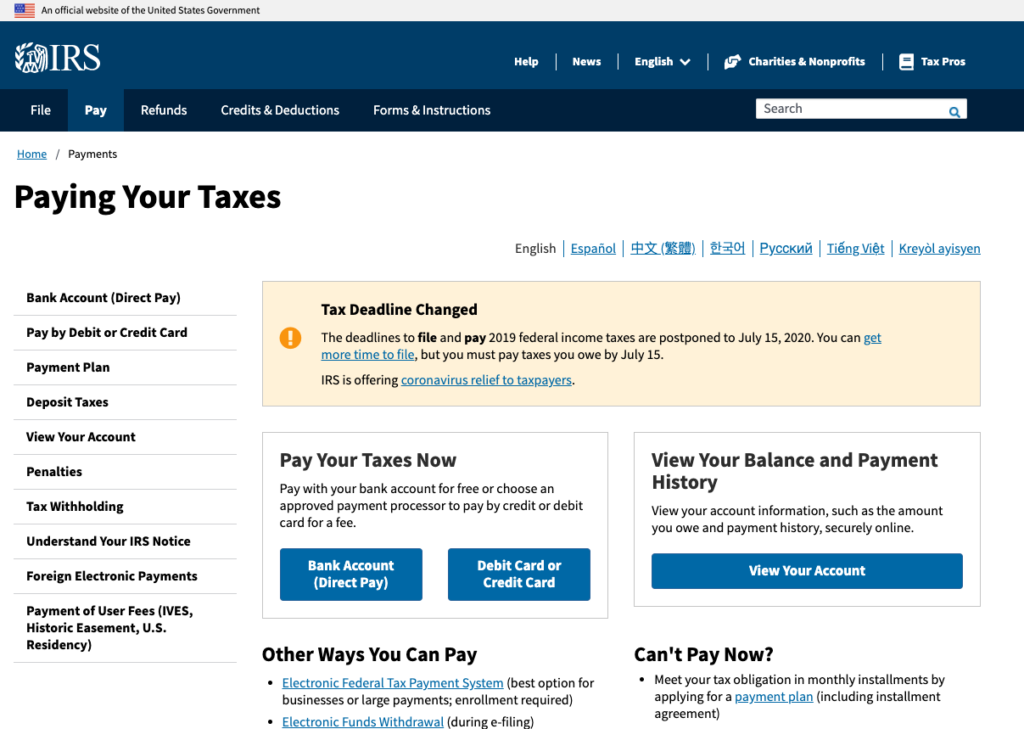

Taxpayers who owe less than 100000 and can pay in 120 days or less may apply for a short-term plan online at IRSgovOPA. If you are a business and cannot obtain a payment plan online call us at 800-829-4933. Log into this app on the IRS website to see your total debt balance for each tax year and the last 18 months of your payment history.

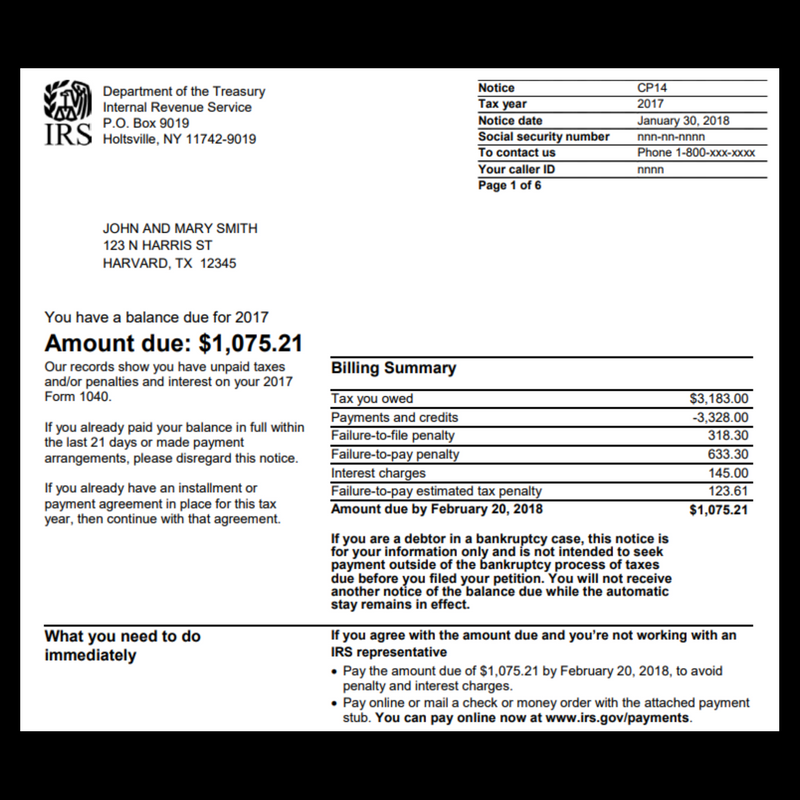

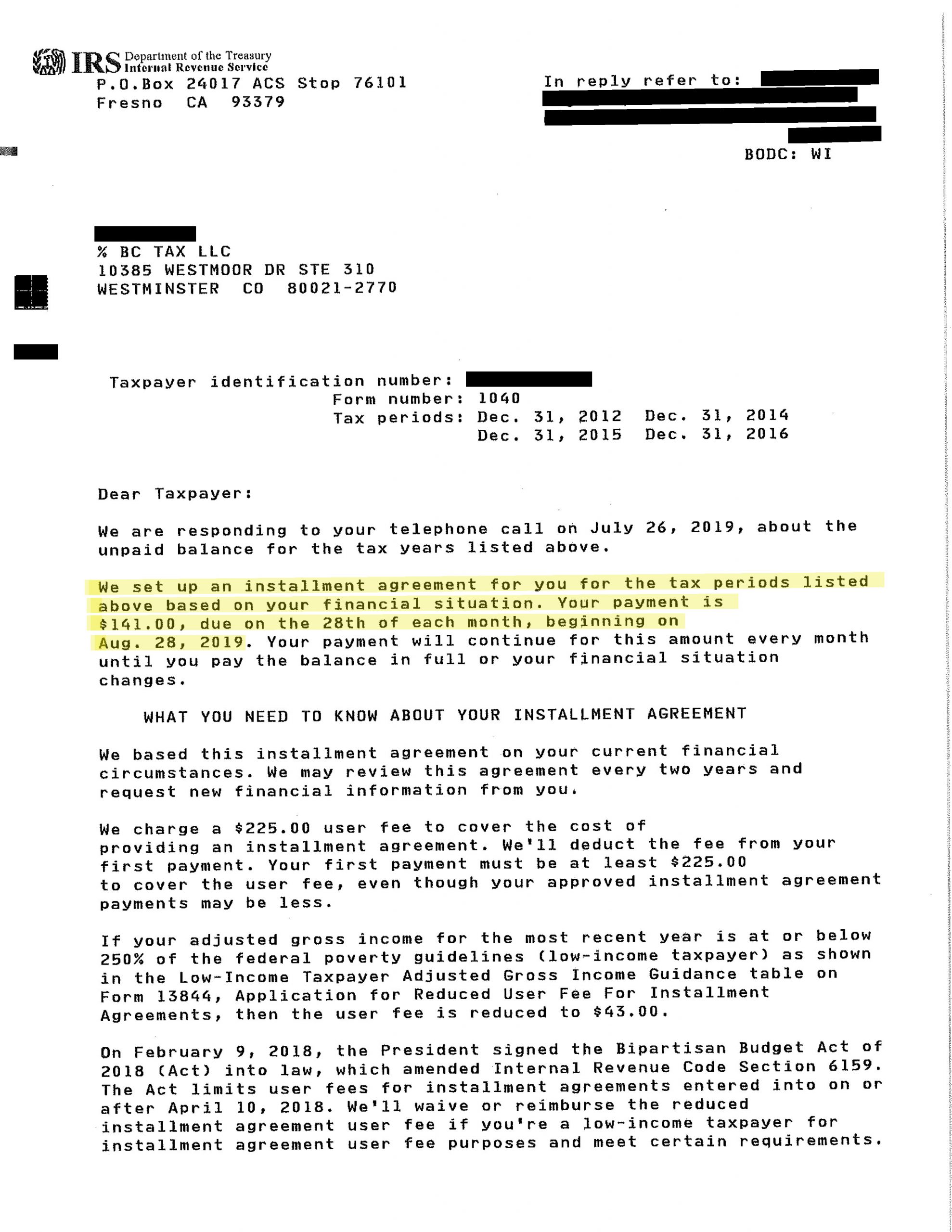

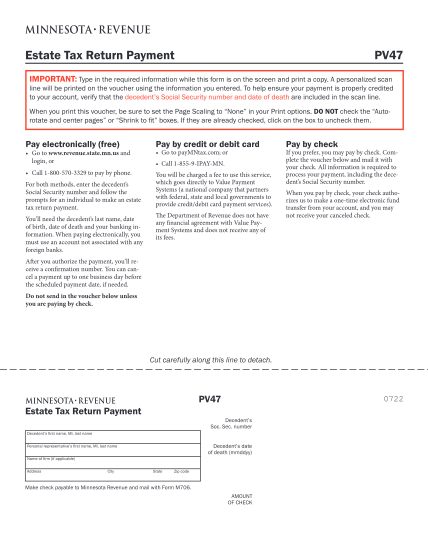

Your IRS payment plan balance indicates the full amount of tax debt interest and penalties on your account which you will pay over time typically no more than 60 months. How do I manage my plan to avoid default. In some cases an IRS payment plan balance can be paid off in as little as four months.

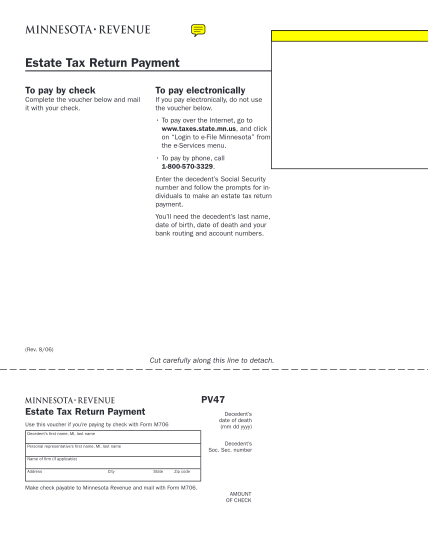

Does the IRS do payment plans. Pay at least your minimum monthly payment when its due. Payment Plan Installment Agreement Electronic Federal Tax Payment System EFTPS POPULAR.

The IRSgovaccount provides individual taxpayers with basic information to file pay or monitor their tax payments. View Your Account. IRS Phone Number.

View or Create Payment Plans. If you are a qualified taxpayer or authorized representative Power of Attorney you can apply for a payment plan including installment agreement online to pay off your balance over time. Your future refunds will be applied to your tax debt until it is paid in full.

If you can borrow money at a lower cost than the IRS interest and penalty rate you could save money by paying. However the IRS still accepts these types of payment plans despite the lack of public notice. Log in to view the amount you owe your payment plan details payment history and any scheduled or pending payments.

What Payment Plan Options are Available and What Are the Fees. The main IRS phone number is 800-829-1040 but these other IRS phone numbers could also get you the help you need. There is another online method to check your IRS payment plan balance and other tax details.

This calculation also requires the CSED to be more than 84 months out. If you just need a little extra time to get the money to pay your. The IRS Online Payment Agreement system lets you apply and receive approval for a payment plan to pay off your balance over time.

Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments. IR-2018-63 March 19 2018. If you dont have an existing IRS username or IDme account have your photo identification ready.

How Do I Check My IRS Payment Plan Balance. An IRS payment plan allows taxpayers to pay their dues over an extended timeframe using a system that best suits their needs. Yes the IRS has payment plans.

However the service only works at certain hours in the day and it takes a few weeks to. Sign in to your Online Account. In addition taxpayers can.

You can set up a short-term payment plan if you can afford to pay off your balance in 180 days or less. Pay online or set up an online payment agreement. More information about identity verification is available on the sign-in page.

IRS Statements and Announcements. If you did not receive the letter option for online access but you received an urgent IRS notice about a balance due or problem with your payment plan please call us at 800-829-1040 individual or 800-829-4933 business. In order to calculate the minimum monthly payment under this program taxpayers need to divide their balance by 84 months instead of 72 months.

View the amount you owe and a breakdown by tax year. IRS online tool lets taxpayers check their account balance. Those who need more time to pay up to 180 days must apply by mail or telephone.

Taxpayers still have to pay the penalties and interest rates that come along with late payments.

/9465-700bb91065234917b8d2866f2306afe9.jpg)

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)