When Will The New Tax Plan Take Effect

It lowered the corporate tax rate to 21 from 35 at the turn of 2018.

When will the new tax plan take effect. The highest tax bracket is now 37 for big earners. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower. Here is a quick breakdown of the tax law changes that will most likely affect you and when they go into effect.

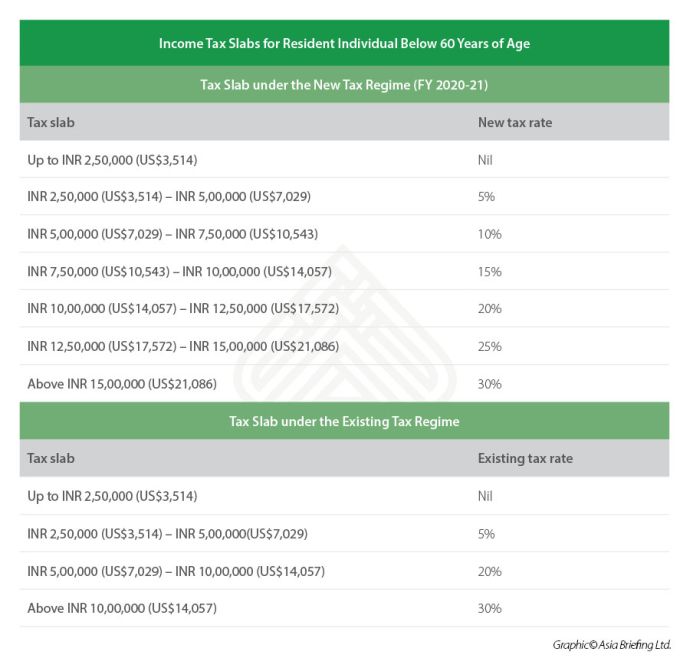

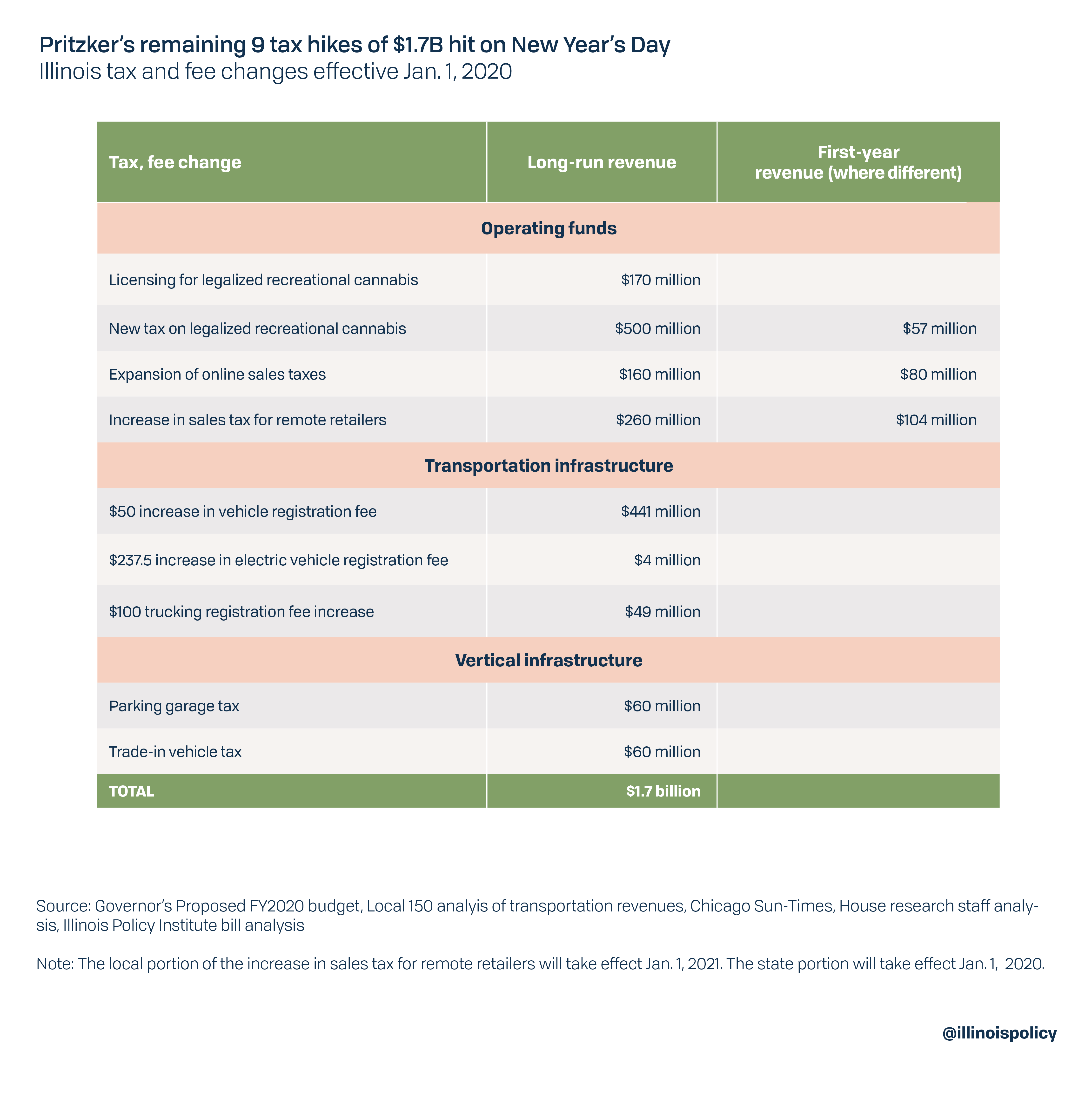

The following Income Tax slab rates are notified in new tax regime vs old tax regime. November 5 2021. That said advisors should be prepared to act quickly as many of the major proposals in the legislation are set to go into effect on January 1 2022 and some will take effect as soon as the legislation is enacted which may leave just weeks or even days to act if Congress proceeds.

The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031. Most of the tax reform changes took effect January 1 2018. Other changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions.

Bidens key tax policies and proposals. Biden proposed in May would take effect at the end of December and revert the top tax rate to what it was before Republicans passed their 2017 tax cuts. November 22 2021.

That means the changes didnt affect many 2017 tax returns you filed 2017 taxes in early 2018. President Joe Bidens massive social welfare and climate change bill his Build Back America plan would raise taxes on the lower- and middle- classes while giving lucrative breaks for the super wealthy. It was recently passed by the House of.

Increase tax rate from 37 to 396 for households earning 400000 or more. Most of the tax changes in the TCJA went into effect in January 2018 for the 2018 tax year. The law raised the standard deduction to 24000 for married couples filing jointly in 2018 from 12700 12000 for single filers from 6350 and to 18000 for heads of.

If President Donald Trump signs it before the end of the year the new tax plan will take effect on January 1 2018. Revenue effects of the proposal depend on how unrealized capital gains are treated at death. That means they will affect the tax return you file in 2019.

Under the current-law regime where investors have numerous avenues to avoid capital gains taxes we estimate that raising the top statutory rate on capital gains to 396 percent would decrease revenue by 33 billion over fiscal years 2022-2031. November 3 2021 Tax. Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US.

Increase child tax credit from 2000 to 3000 3600 for those under the. The Tax Cuts and Jobs Act came into force when President Trump signed it. President Bidens Build Back Better social spending and tax bill is slowly working its way through Congress.

The Finance Minister introduced new tax regime in Union Budget 2020 wherein there is an option for individuals and HUF Hindu Undivided Family to pay taxes at lower rates without claiming deductions under various sections. There has been a lot of speculation about the new Biden tax plan and whether it will be enacted with retroactivity causing the new legislation to take effect on January 1 2021. Thats according to a new study by the left-leaning Tax Policy Center TPC a.

Catherine Mortensen November 16 2021. The start date matters because high net worth individuals are looking for ways to maximize the federal estate tax exemption allowed under the Trump administration. 0 386 4 minutes read.

And again the White House chose not to say at the time that the taxes would be retroactive leading reasonable investors to make decisions under the assumption that any hikes would take effect. Employees didnt see changes in their paycheck withholding until February 2018.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

/reaganomics-did-it-work-would-it-today-3305569-FINAL-5bc4c49a46e0fb0026b4a44a.png)