Gop Tax Plan Details

Details of GOP tax reform framework revealed.

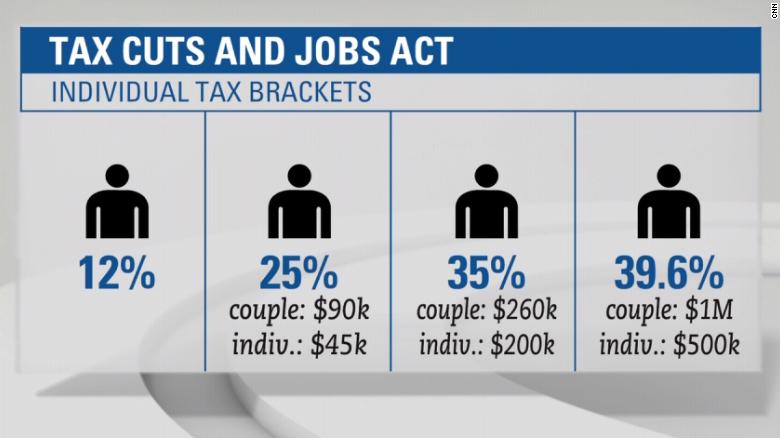

Gop tax plan details. The plan would also create a new 25 percent rate for so-called pass-through businesses that are currently taxed at the individual rate. It would cut the top individual income tax rate from 396 percent to 35 percent and slash the corporate rate from 35 percent to 20 percent. A repeal of the.

Drastically lower rates for businesses. The plan sets a 25 percent tax rate starting at 90000 for married couples with a 35 percent rate beginning to bite at 260000 - which means many upper-income families whose top rate is 33. Since 1986 the last time a major tax overhaul became law the body of federal tax lawbroadly definedhas swollen from 26000 to 70000 pages according to the House GOPs 2016 reform proposal.

A Republican groups TV ad falsely claims that President Joe Bidens tax plans would force the sale of family farms passed on to children due to burdensome taxes. It would drop the corporate tax rate to 21 percent from the current 35 percent. WASHINGTON DC - NOVEMBER 29.

Ali Velshi and Stephanie Ruhle break down the key differences between the House and Senate GOP tax plans and tells us how the bills would impact the Middle. This week the Republican led Senate is. Marco Rubio tweeted that the 600 proposed child tax credit increase in the Houses tax.

GOP leaders unveil key details in new tax plan. Capitol cast a reflection on November 29 2017 in Washington DC. September 29 2017.

Under the House GOP tax plan any portion of current wages that could avoid payroll tax would save 29 percent and if not part of reasonable compensation another 8 percent the difference between the 33 percent top ordinary income tax rate and the 25 percent pass-through tax rate for a total of 109 percent. House Republicans are unveiling key details and the text behind their tax legislation Thursday but not without some reservations from rank-and-file members. Kim Reynolds and the GOP-run Legislature already have implemented a plan to phase out federal deductibility to lower tax rates and compress taxable income brackets.

It would go to 12000 for an individual or 24000 for a family. President Trump unveiled the GOP Tax Reform plan at a speech in Indianapolis on Wednesday. The change would take effect next year.

The following outlinedirectly from the GOP proposal entitled THE UNIFIED TAX REFORM FRAMEWORK provides a summary. The top corporate income tax rate would fall from 35 percent to 25 percent. The Trump Administration the House Committee on Ways and Means and the Senate Committee on.

Fewer income tax rates for individuals. In advance of the bills release some Republicans were already criticizing the details.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758221/picture1_24.png)

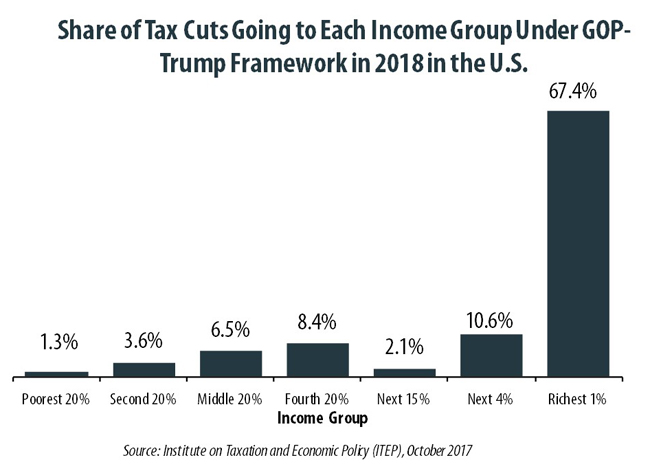

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9693345/tpc_graph1.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10285019/tcja_chart1.png)