Free Section 125 Cafeteria Plan Document

Section 125 d Cafeteria.

Free section 125 cafeteria plan document. Section 125 POP plans are governed by Section 125 of the IRS tax code. Only 99 -- always compliant. The Trusted Source of Affordable Benefit Plan Documents for over 20 Years.

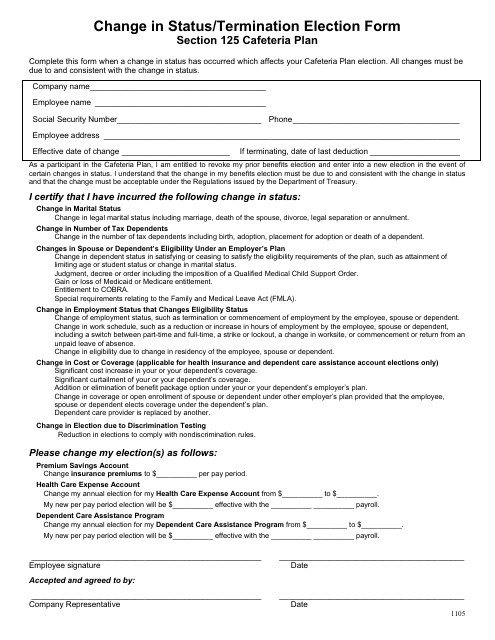

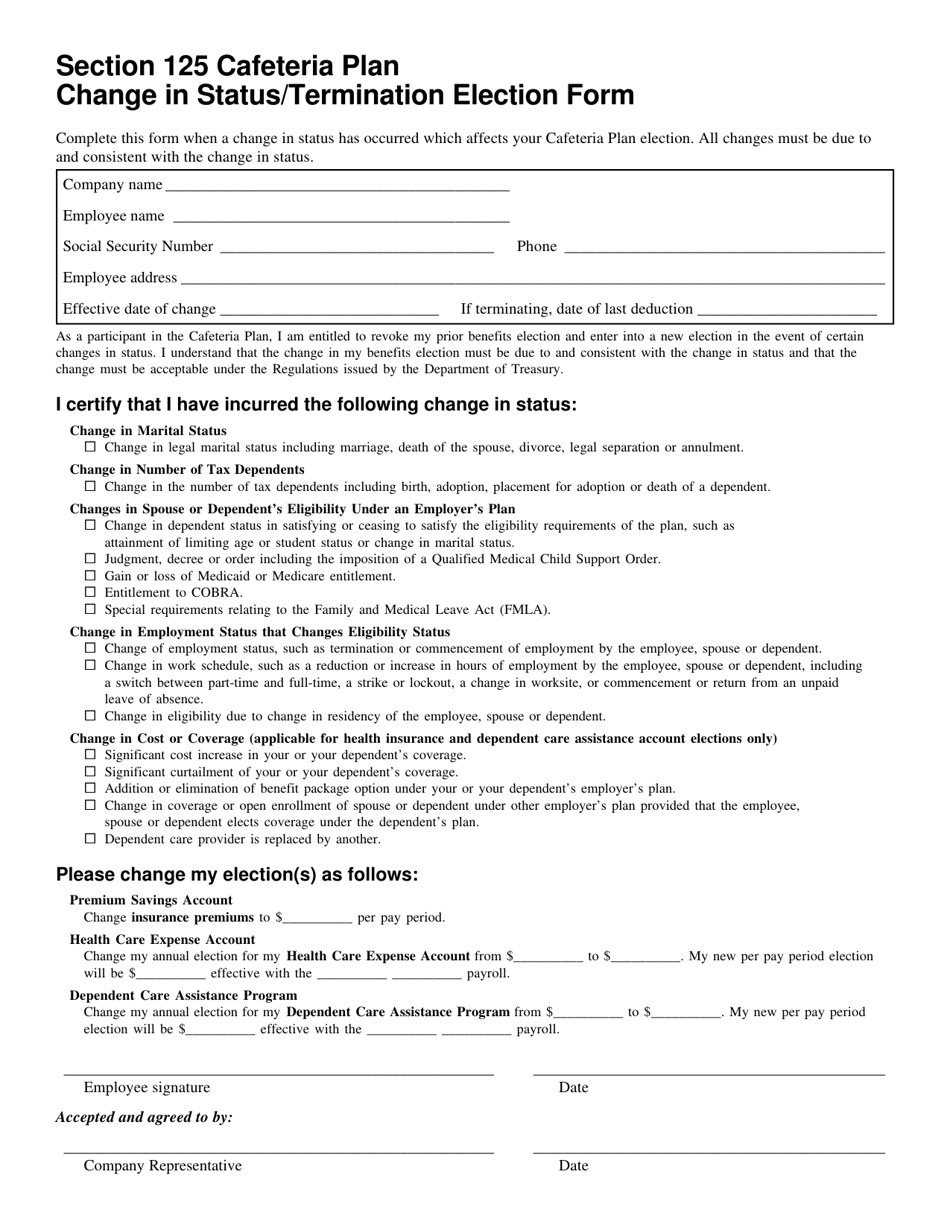

And because the Section 125 Cafeteria Plan reduces employee gross. Section 125 plan documents also need to be restated whenever there is a change in your plan or in the law governing. To download your free Section 125 Premium Only Plan Document log in to the secure employer website.

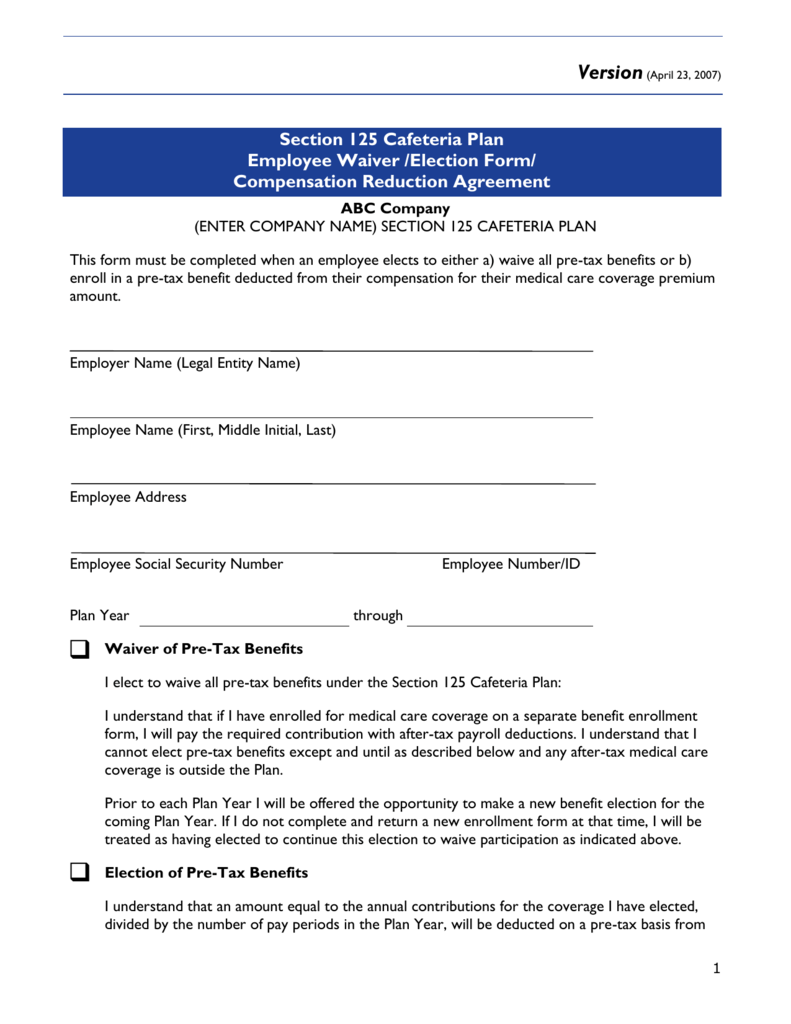

A Premium Only Plan POP Plan is also known as a Cafeteria Plan. Is intended to qualify as a Cafeteria Plan under Section 125 of the Code so that Optional Benefits a Participant elects to receive under the Plan will be eligible for exclusion from the Participants gross income under Section 125a of the Code. Section 125 Plan Document package 99.

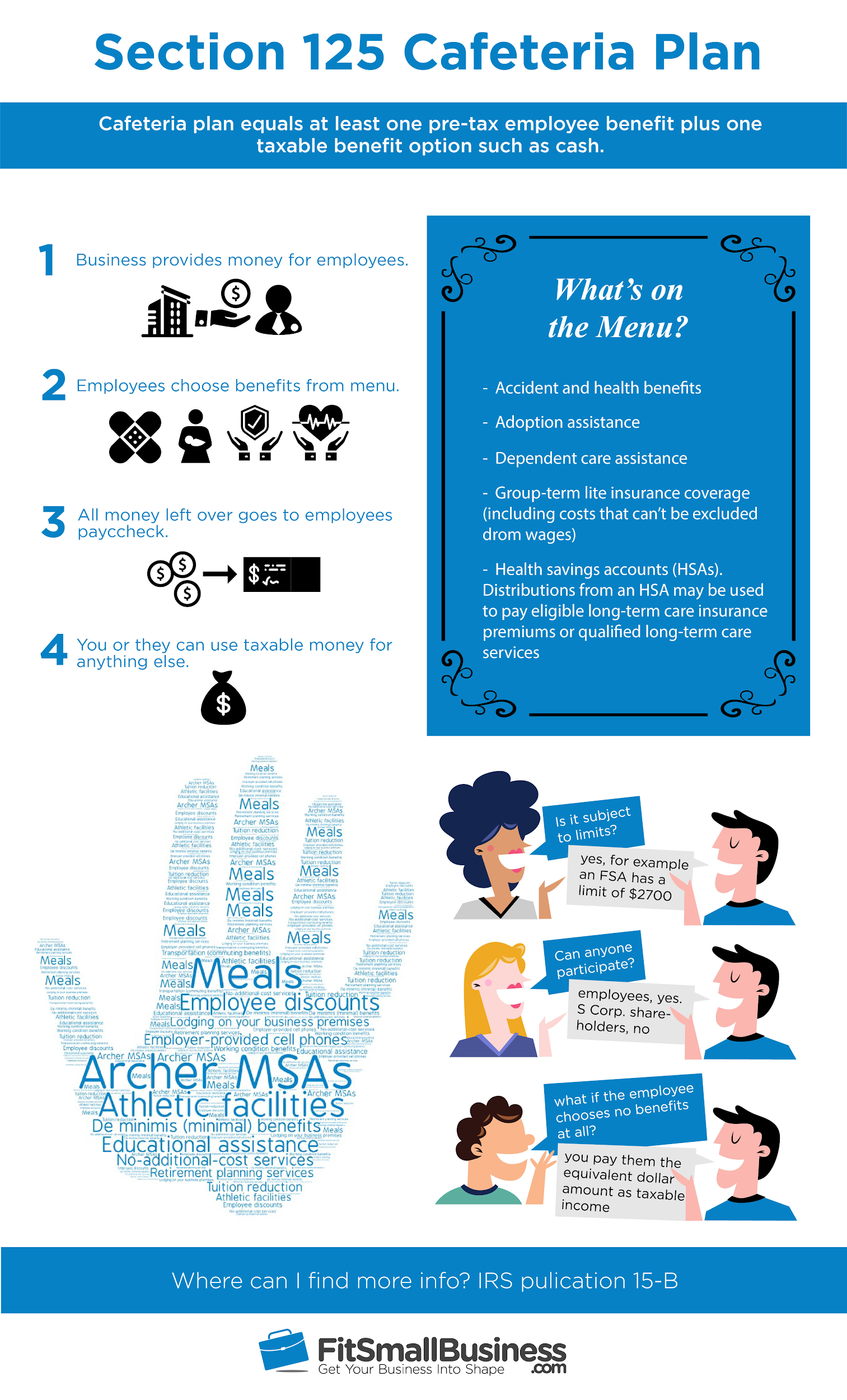

Because Section 125 Cafeteria Plan benefits are free from federal and state income tax an employees taxable income is reduced which increases take-home pay. Has been providing free consulting affordable plan documents and plan updates as needed for Section 125 Cafeteria Plans and Health Reimbursement Arrangements since 1997. Use our convenient Section 125 Online Order Form or download a Free Section 125 Cafeteria Plan Employer Guide with Fax Order Form.

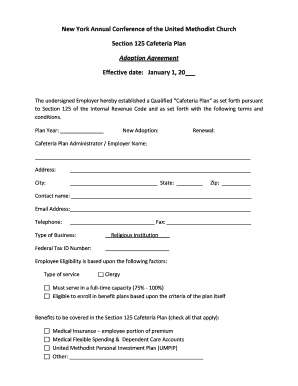

Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a cafeteria plan within the meaning of Code section 125. Sample Plan Documents for current customers. The Section 125 POP plan document package is the first step in building a comprehensive pre-tax cafeteria plan for employees.

As is the case with our sample cafeteria plan. A Section 125 POP or Cafeteria plan is a written plan Section 125 is part of the U. Read our FAQ to find out more.

To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment of premiums and contributions to spending accounts that are excludable from gross. Section 125 POP is an IRS-approved tax-free way to save on your monthly insurance payments. This document is intended as a guide only for use.

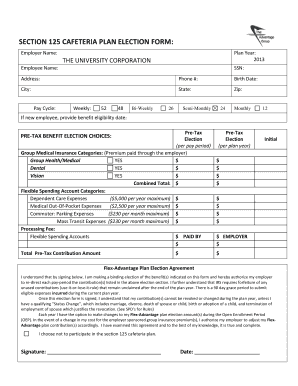

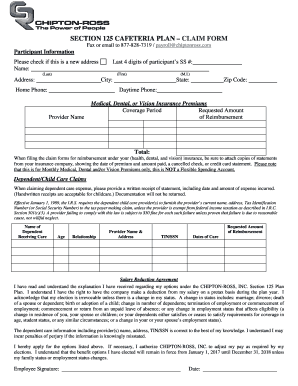

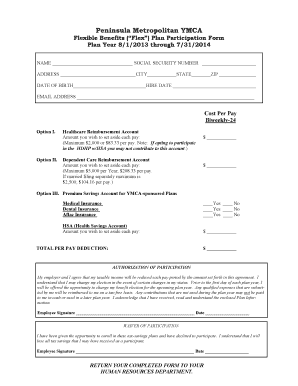

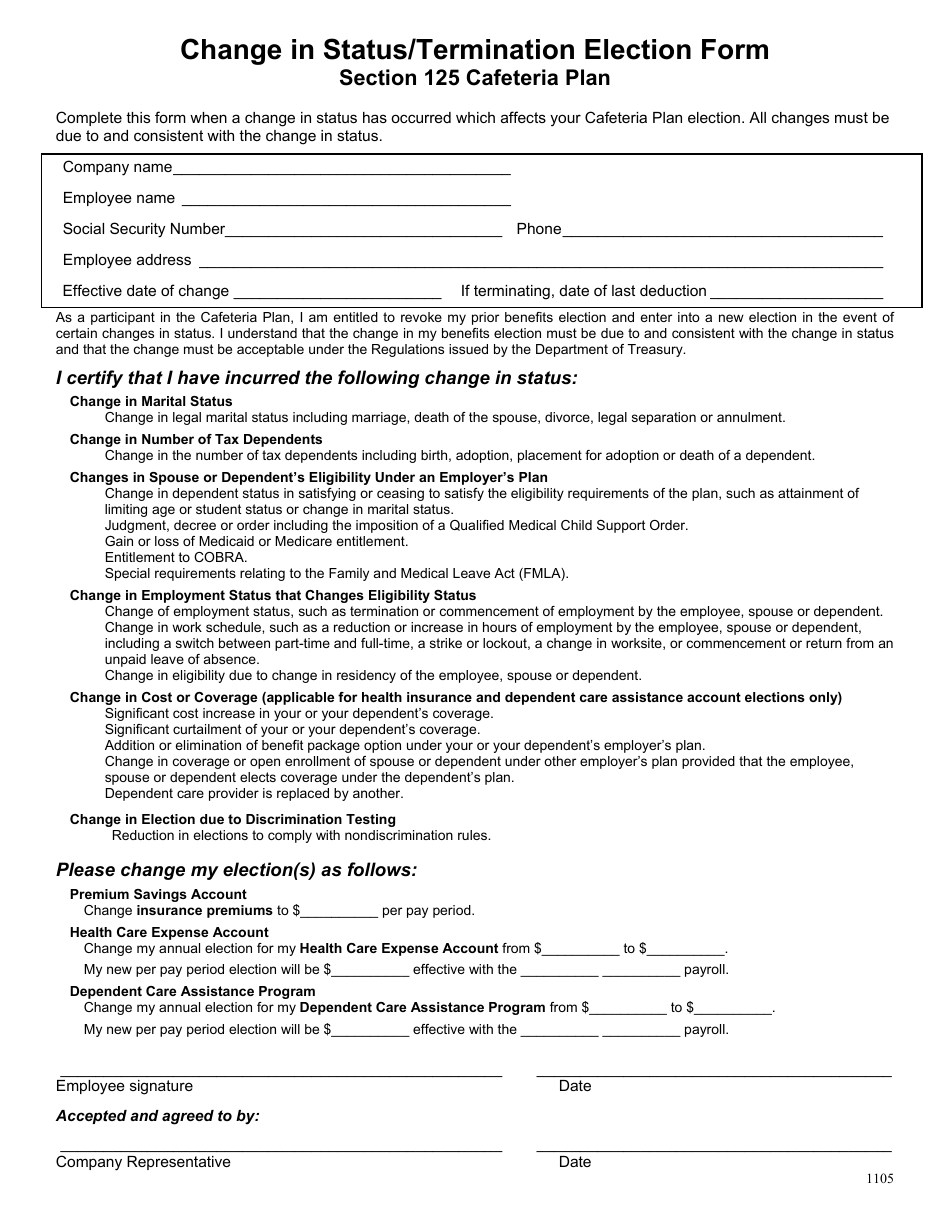

Plan provisions apply uniformly to all Participants. As a benefit of your participation in CBIA Health Connections we can develop a Section 125 Premium Only Plan document for your company at no cost. FSA-Enrollment-Authorization Form This is a generic form call CPA Inc if you need information on your plan specs.

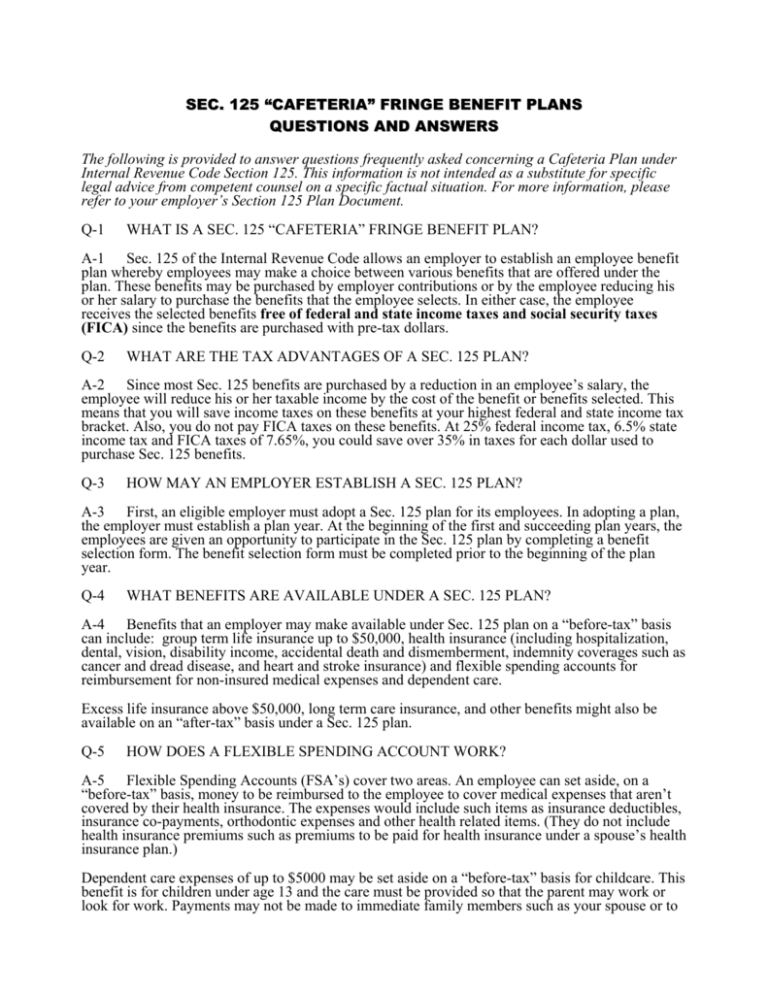

Although most cafeteria plan documents include HIPAA special enrollment rights under Code Section 9801f many plans likely do not allow for a 60-day election period. For questions contact CBIA Health Connections Sales at 8602441900. Code where the Treasury IRS lays out the rules for employers wanting to allow employees the option of pre-tax salary deductions to pay group health and related insurance premiums.

A POP Plan is not just for your monthly insurance payments. Employers can provide additional options like the Health Savings Account HSA health Flexible Spending Arrangement FSA Dependent care plan DCAP and a Transit Parking plan. The IRS requires a Section 125 Plan Document so that employees can pay for health premiums FSA contributions and other group benefits with tax-free payroll deductions.

The Adoption Assistance Account is an. The formal definition of a Section 125 plan to pre-tax benefits says. This means drafting a new document and giving a copy to every employee eligible for the plan.

The Trusted Source since 1997 thousands of satisfied agents and employer groups nationwide rely upon Core. The Health FSA is a medical expense reimbursement plan described in Section 105 of the Code. A 125 cafeteria plan is a written plan that allows employees to elect between permitted taxable benefits such as cash and certain qualified benefits.

To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment for employee portions of medical dental and vision premiums health saving. Only Qualified Employees are eligible to participate in the Plan. FSA-City of Boston Enrollment-Form For OPEN Enrollment Use Only.

Federal law requires all employers to have a 125 Cafeteria Premium Only Plan POP document if offering tax free benefits to their employees. Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a cafeteria plan within the meaning of Code section 125. The DCA is a dependent care assistance plan as described in Section 129 of the Code.

Employers save an average 8 to 10 in payroll taxes too. Cafeteria plan under Section 125 of the Internal Revenue Code. Core Documents is the countrys leading provider of cost-effective tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements.

SAMPLE PLAN DOCUMENT SECTION 125 FLEXIBLE BENEFIT PLAN Version 0117 The attached plan document and adoption agreement are being provided for illustrative purposes only. Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys. We Help You Stay In Compliance Many companies have a Section 125 POP plan document on file but it is out of date.