Financial Plan Business Plan

Reviewing your cash flow.

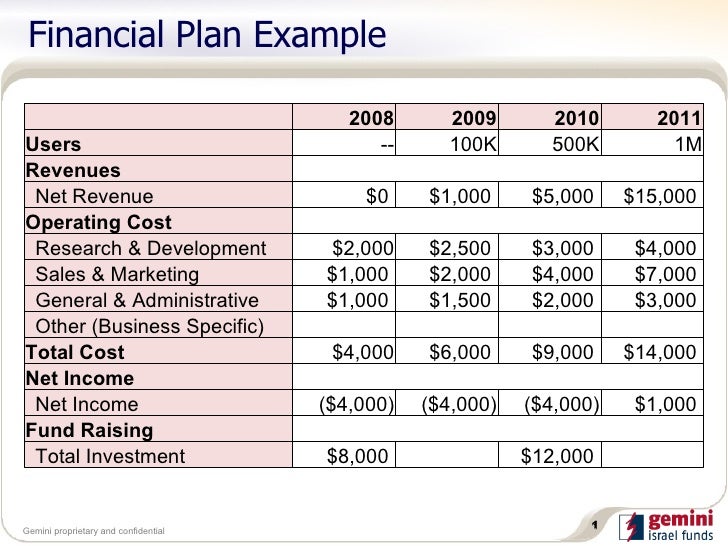

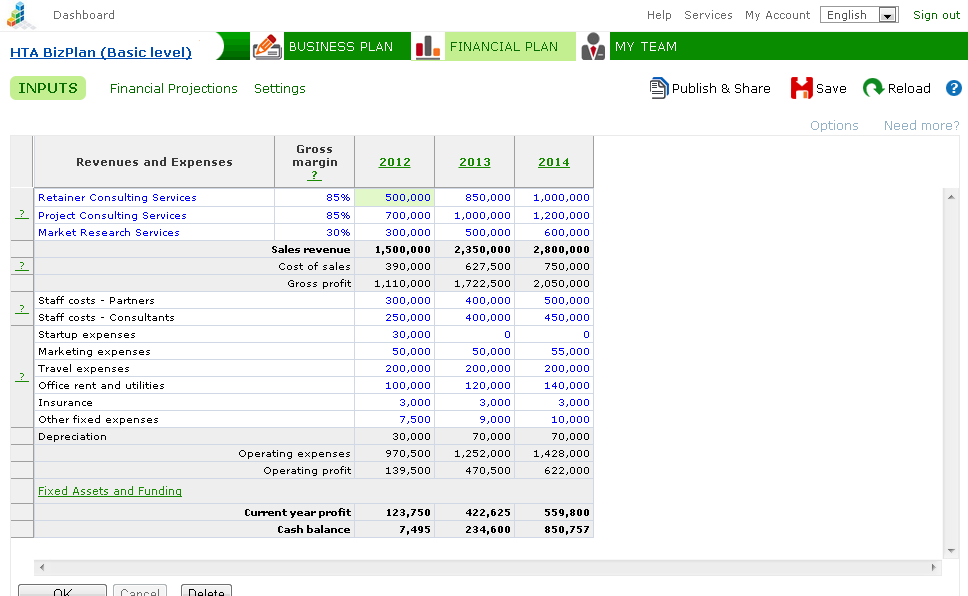

Financial plan business plan. The financial section of a business plan is one of the most essential components of the plan as you will need it if you have any hope of winning over investors or obtaining a bank loan. Moreover it can give you an idea on where your money is going and whether you are efficient enough when it comes to allocating using and saving your financial resources. The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions investors or venture capitalists.

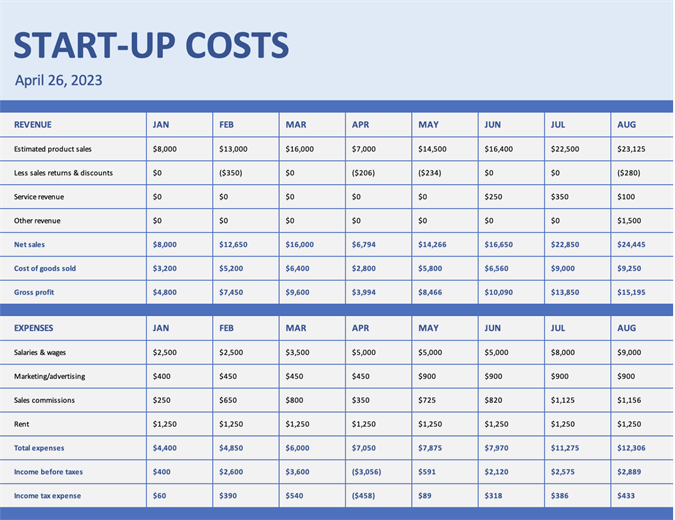

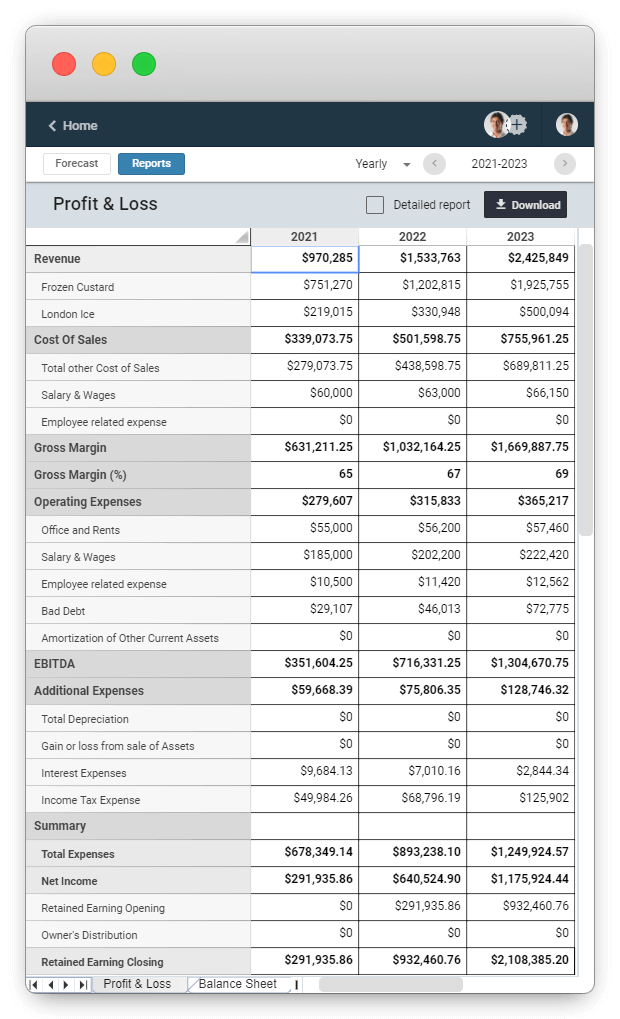

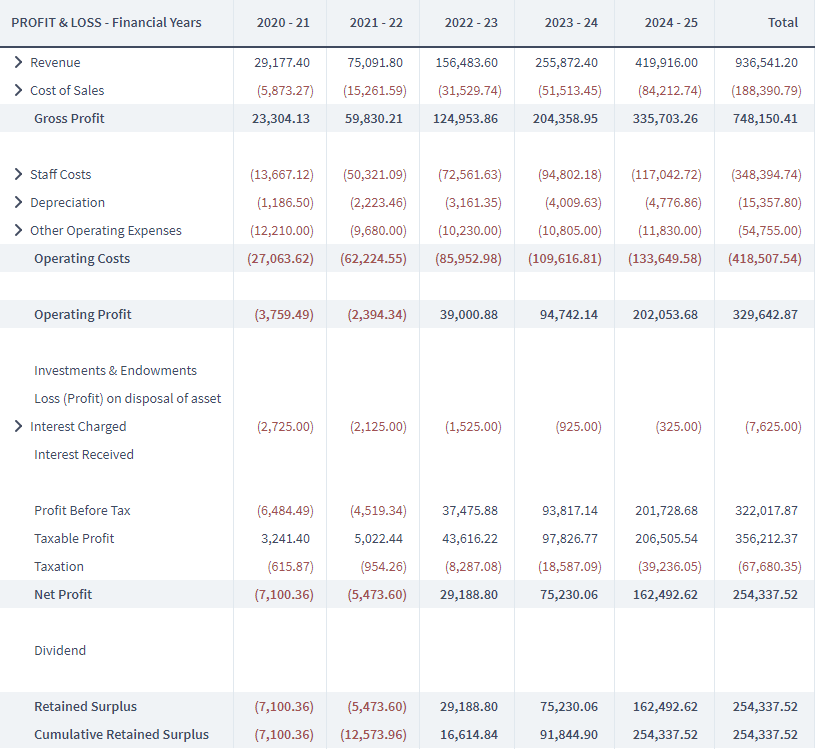

This business plan will show how a total investment of only 101500 could yield cumulative net profits in excess of 600000 over a five-year period and average monthly sales of 72000 while maintaining adequate levels of liquidity. Your business plan provides some guideposts in running your. A financial plan for a small business needs a cash flow statement.

When Bill Carter 69 graduated from Texas AM University he resolved that he would give back to his profession to Texas AM and to his community. The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The purpose of this plan is to secure additional funding from an investor and a bank.

The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan. Usually an organization creates a financial plan immediately after. The Best Financial Plan for a Small Business Review Your Cash Flow.

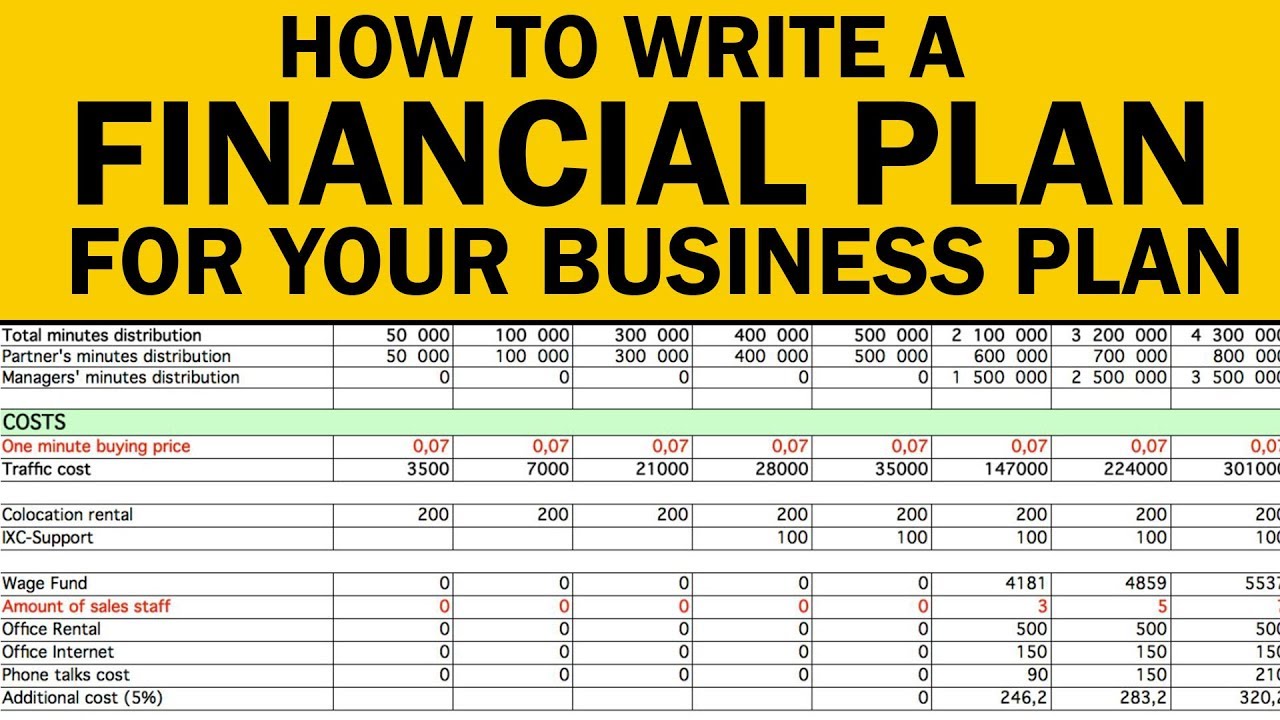

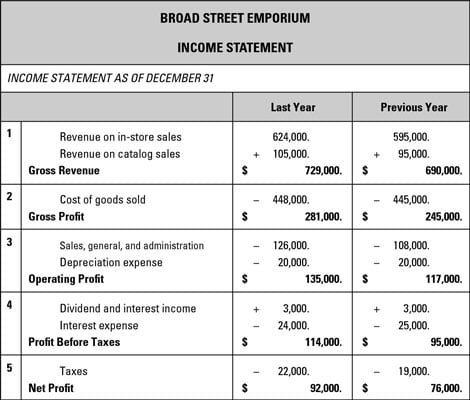

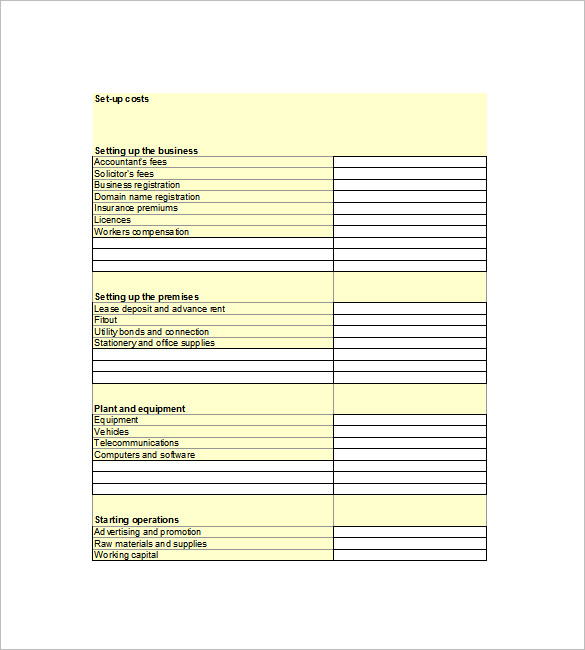

The financial section is composed of four financial statements. Apart from this break-even analysis might also be asked by investors to. Whether your organization is a startup a small business or an enterprise the financial plan is the cornerstone of any business plan.

A business financial plan can make you become more aware of the current financial status of your business and the analysis of your current condition as a corporate entity in terms of your finances. The business plan is a communications tool to inform and influence the reader towards some action providing a loan extending credit or investing in your business. That includes 10 of the past 11 years for example including 2021s 2871 jump.

Start your own business plan. Small business budgets limit your expenditures. Financial planning for a business is the task of determining how the organization will afford to achieve its strategic goals.

The income statement the cash flow projection the balance sheet and the statement of shareholders equity. Financial planning takes a mind for business and a heart for people Bill and Fran Carters gift supports Financial Planning Program at College of Agriculture and Life Sciences. These three important statements are the bird view of the financial stats of your organization.

20 rows Start your own financial planning business plan. Financial plans are usually physical documents to ensure that it is concrete and final. A budget keeps you in line and prevents you from.

Many people combine their financial plan with an investment plan as investing is often part of what will help you save for the future. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations.