Did You Contribute To A Qualified Retirement Plan In 2017?

The distribution is made from an eligible retirement plan after 2015 and before 2018 ie anytime during 2016 or 2017.

Did you contribute to a qualified retirement plan in 2017?. Spouses amounts in. Riley participates in his employers 401k plan. A high AGI employee who does not contribute to any qualified retirement plan.

You can contribute to your retirement account Traditional and Roth IRAs for last year up until May 17 no extensions even if you file earlier. Immediate 75 return on your investment in the Plan every time you contribute from 3 to 6 of your eligible pay. By April 1 2017 B.

If married filing jointly include. The earnings of the retirement trust fund are tax-free. Voluntary employee contributions to a qualified retirement plan as defined in section 4974c including the federal TSP.

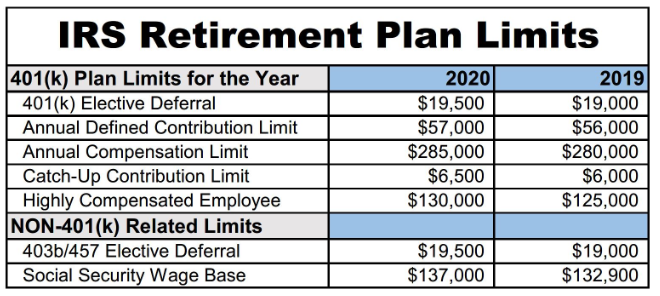

If you were hired before March 1 2017. Some distinct tax advantages of a tax-qualified plan as prescribed by RA 4917 are as follows. 2021 and 2020 the additional elective deferrals is 6500.

A Guide to Common Qualified Plan Requirements A Guide to Common Qualified Plan Requirements More In Retirement Plans. 5500 6500 age 50 or over 1000. Contributions to the retirement fund are a tax-deductible expense for the company.

The amount of the credit is. The savers credit works by offsetting part of the first 2000 singles or 4000 married workers voluntarily contributions to tax advantaged retirement plans such as IRAs and employer sponsored workplace plans. Eligible retirement plans are IRAs qualified retirement plans QRPs.

What exactly do we mean when we refer to retirement plan contributions. You answer Yes to this question only if you contributed to another plan such as a Traditional IRA or Roth IRA. Also if you can contribute more to your retirement it could save you.

That amount is 1000 more than the 2017 limitation and it includes employer contributions employee 401k contributions and. By April 1 2018 C. Return to List of Requirements Did your plan limit.

And how can benefits managers use new savings tools and employee benefits available today to help their employees retire smarter happier and more financially secure. By April 1 2019. There are several types of plans including defined-contribution plans and.

Up to 50 of the contribution can be claimed as a credit making the maximum credit 1000 2000 if married filing jointly. The maximum annual contribution to an individuals account in a defined contribution plan a money-purchase profit sharing andor 401k plan cannot exceed the lesser of 100 of the individuals compensation or 55000. Do you andor your employer make contributions to a retirement plan such as an IRA 401k 403b SIMPLE or SEP plan.

Retirement benefits paid to qualified employees are tax-exempt subject to certain conditions. For business retirement plans SEP-IRA SIMPLE IRAs and Solo 401K contributions must be made by the return due date including extensions. The due date including extensions of your 2020 tax return see instructions.

Contributions to a 501c18D plan. Maximum Retirement Plan Contributions. Qualified plan loan offset amounts Tax Cuts and Jobs Act of 2017 Section 13613.

Even though 84 percent contribute to. If you were hired or rehired on or after March 1 2017 you are eligible to receive the Company Match as soon as you begin contributing to the Plan. Your 401 k is a qualified retirement plan.

5500 6500 age 50 or over 1000. 6000 in 2015 2016 2017 and 2018 and 2019 subject to cost-of-living adjustments in later years. After 2017 and before the due date including extensions of your 2020 tax return from any of the following.

Qualified plan loan offset amounts as defined in IRC Section 402c3Cii may be rolled over by the due date including extensions for filing the tax return for the taxable year in which such amount is treated as distributed from a qualified employer plan. See instructions for an exception. For each eligible dollar that you contribute the Company contributes 75.

Traditional or Roth IRAs 401k 403b governmental 457 501c18D SEP or SIMPLE. How and why did this change over time to put more of the responsibility on employees to save through defined contribution plans such as 401ks. However your contributions are already reported on your form W-2 in box 12 code D.

Qualified retirement plans are any plans that meet the specifications laid out in Section 401 a of the US. He turns 70 years of age on February 15 2017 and he plans on retiring on July 1 2019.

/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/401k-8ec897cc1d2643e7b2f84e578487f316.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

/GettyImages-1353850562-5a09f8cd494ec9003739b86b.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

:strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/GettyImages-119717074-ea43b342d01b4b859bfbe159201fbcc2.jpg)

/GettyImages-1282134164-a0b026af1e594323aa89b1d572af5a60.jpg)