Deferred Profit Sharing Plan

The purpose of a DPSP is to permit an employer to share business profits with its employees.

Deferred profit sharing plan. Employees may only withdraw from their profit-sharing accounts under certain conditions such as termination or retirement. FAQ on Deferred Profit-Sharing Plan Basics of Registered Retirement Savings Plans. Register a deferred profit sharing plan.

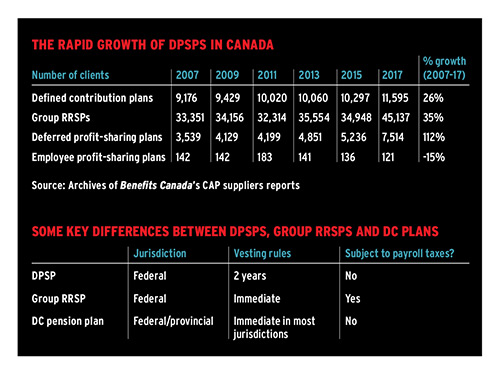

A deferred profit sharing plan DPSP is an employer-sponsored Canadian profit sharing plan that is registered with the Canadian Revenue Agency. Dividend Reinvestment Plan DRIP DifficultyHard Gradableautomatic Kapoor - Chapter 14 35 Learning Objective4 36. Defined Contribution Pension Plan DCPP C.

Dpsp - deferred profit sharing plan acronym business concept background - download this royalty free Vector in seconds. The DPSP operates like most other pensions and retirement plans but instead of placing a set dollar amount into the accounts it places profits. A DPSP is a type of tax-sheltered retirement plan that is set up by an employer for the benefit of its employees.

It is similar to a group RRSP. What to do if changes are made to plan terms after registration has been approved. Amend a deferred profit sharing plan.

A Deferred Profit Sharing Plan DPSP is a combination of a pension and retirement plan sponsored by employers to help workers save for retirement. The Registered Retirement Savings Plan is a standard part of pension and. A deferred profit sharing plan DPSP is an employer-sponsored profit sharing plan that is registered with the Canada Revenue Agency CRA.

Filing and reporting obligations for employers and trustees. This kind of plan is often combined with a group RRSP. Reporting and filing a deferred profit sharing plan.

Requirements to register a deferred profit sharing plan under the Income Tax Act. On a periodic basis the employer shares the profits made from the business with all employees or a designated group of employees. Deferred Profit Sharing Plan A pension plan in which an employer distributes a set percentage of the companys profits into accounts for the employees participating in the plan.

The plan can be set up for all employees or a certain group of employees. The amount of money in the DPSP account is not taxed until the. They cannot be used for emergencies since withdrawal before completion of the vesting period is not permitted unless.

Employers sponsor a deferred profit-sharing plan DPSP that combines a pension with a retirement plan to help employees prepare for retirement. Defined Benefit Pension Plan DBPP E. An employee who owns 10 or more of the employers shares or is related to such a person cannot become a member of a DPSP.

With a DPSP you can share a portion of your companys profits with your employees. Deferred profit sharing plan. A DPSP is created when a company distributes part of their profit into their employees DPSP account.

Deferred Profit Sharing Plans are defined as an employer-sponsored Canadian profit sharing plan that is registered with the Canadian Revenue Agency. It is a business-supported Canadian profit-sharing arrangement that is enlisted with the Canadian Revenue Agency which is fundamentally the Canadian rendition of the Internal Revenue Service IRS in the United States. A Deferred Profit Sharing Plan DPSP is a retirement savings plan set up by employers to share company profits.

The disadvantages of Deferred Profit Sharing Plans are as follows. Summary A Deferred Profit Sharing Plan DPSP is a compensation plan wherein employers share a part of their profits with. Group Registered Retirement Savings Plan Group RRS D.

An employee savings plan ESP is a general investment account provided by an employer to set aside some. Pensions Part 3 Deferred Profit Sharing Plans What is a DPSP. Contributions to DPSP are equal to pension adjustments and can potentially reduce overall pension income.

Deferred Profit Sharing Plan DPSP B.