2017 Tax Reform Plan Pdf

For its part the White House has offered a one-page summary of its tax-reform plan that does not spell out.

2017 tax reform plan pdf. 2017 Tax Reform for Economic Growth and American Jobs The Biggest Individual And Business Tax Cut In American History Top Line. Tax relief for middle class Americans. This tax plan directly meets these challenges with four simple goals.

There are too many uncertainties to predict the details of any final tax reform legislation. TAX REFORM THAT WILL MAKE AMERICA GREAT AGAIN The Goals Of Donald J. August l 2017 President Donald Trump The White House 1600 Pennsylvania Avenue NW Washington DC 20500 The Honorable Mitch McConnell Majority Leader United States Senate Washington DC 20510 The Honorable Orrin Hatch Chairman Committee on Finance United States Senate Washington DC 20510 Dear President Trump Leader McConnell and.

The House Tax Cuts and Jobs Act. 10963 TAX REFORM FOR ACELERATION AND INCLUSION TRAIN Disclaimer. Too many political disagreements The lack of details in most of the Plan The struggles over the budget impact of any final bill.

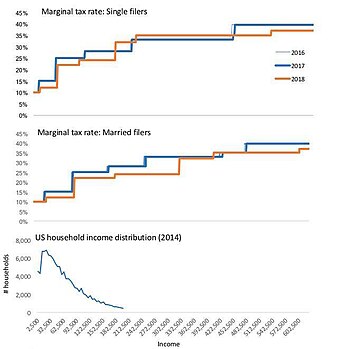

Maximum rate on business income of individuals. Reduction and simplification of individual income tax rates and modification of inflation adjustment. All opinions are strictly those of the authors.

Tax code has faced nearly 6000 changes more than one per day. Simplification and Reform of Rates Standard Deductions and Exemptions. In order to achieve.

Increase in standard deduction. All information presented here are based on the limited. Note the particular goals Relief for the Middle class Not the.

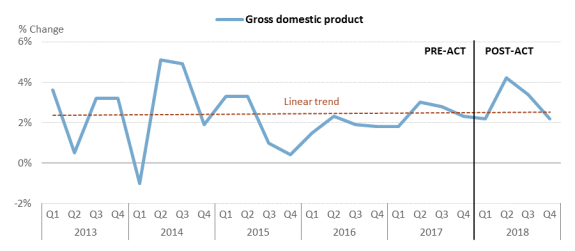

Secretary of the Treasury Steven Mnuchin and National Economic Director Gary Cohn revealed the details of President Trumps plan for tax reform. The two most important changes are deleting both the cash flow element and the destination based element of the House Blueprint. The Made In America Tax Plan I 1 Executive Summary and Introduction Last week President Biden proposed the American Jobs Plan a comprehensive proposal aimed at increasing investment in infrastructure the production of clean energy the care economy and other priorities.

Reduction and simplification of individual income tax rates. Combined this plan would direct approximately 1 percent of GDP towards these. June 21 2017 We thank The Goodman Institute the Burch Center for Tax Policy and Public Finance The Fiscal Analysis Center Boston University Economic Security Planning Inc.

Tax Insights April 26 2017 Trump Releases Plan for Tax Reform April 27 2017. November 6 2017. TITLE ITAX REFORM FOR INDIVIDUALS Subtitle ASimplification and Reform of Rates Standard Deduction and Exemptions Sec.

O Since 2001 the US. On April 26 2017 the Trump administration unveiled a one page tax reform outline the Trump Plan that differs significantly from the tax reform plan proposed in June 2016 by the House Republicans the House Blueprint. Under current law a taxpayer generally determines his regular tax liability by applying the tax rate schedules or the tax tables to taxable income.

Download View Cpat Reviewer- Train tax Reform 1 as PDF for free. 02 In 2016 it is estimated that personal income taxes. CPA in Transit Reviewer.

O Taxpayers spend nearly 7 billion hours and. Enhancement of standard deduction. TAXATION Guide and Reviewer on RA.

Development of a medium-term income tax reform plan for consultation with the Oireachtas by July 2016. At the time of this writing Republican leadership had yet to introduce tax-reform legislation in the 115. The world would require a plan that either cuts spending or raises other taxes in ways that are deficit-neutral.

And the Sloan Foundation for research support. The Impacts on Jobs and Incomes by State. Title I Tax Reform for Individuals Subtitle A Reform of Rates Standard Deduction and Exemptions Sec.

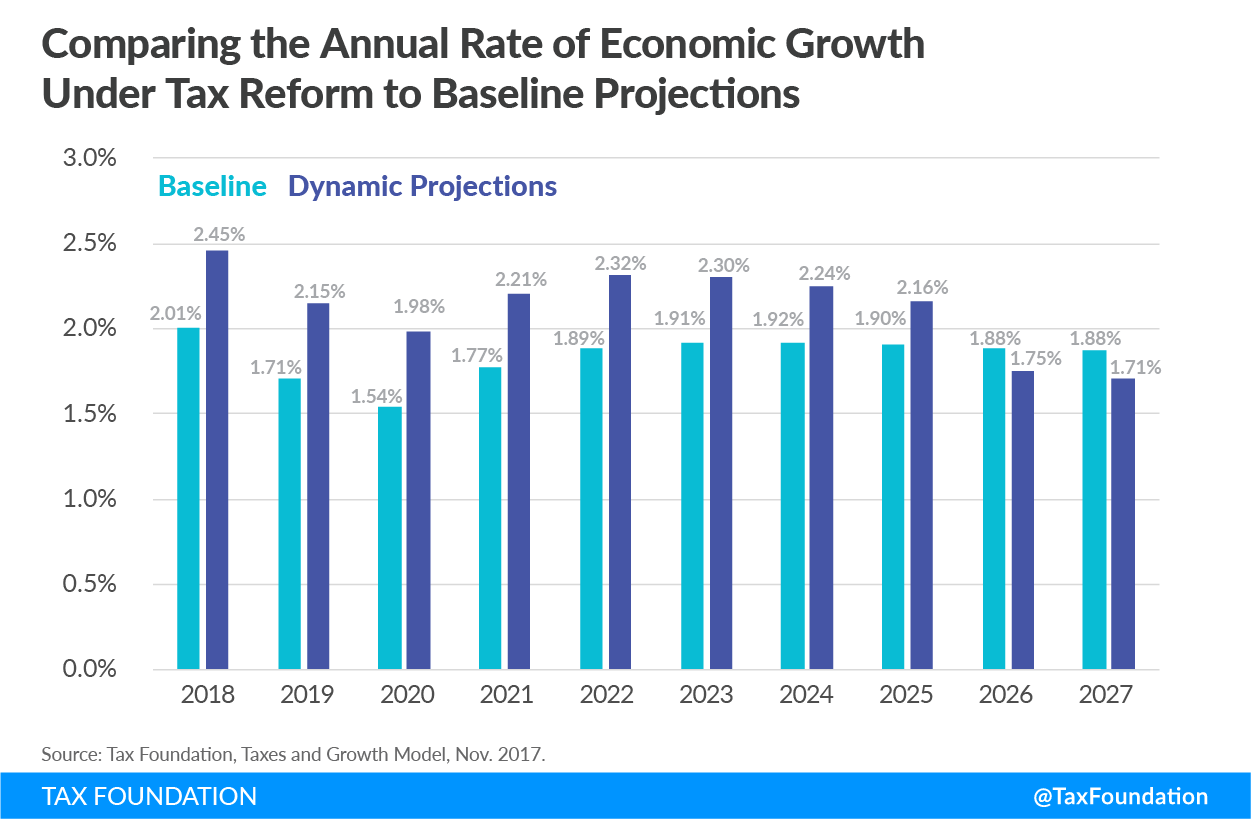

According to the Taxes and Growth model the House Tax Cuts and Jobs Act should increase after-tax income by 45 percent for those in the second-lowest quintile and by 46 percent for those in the middle quintile. Trumps Tax Plan Too few Americans are working too many jobs have been shipped overseas and too many middle class families cannot make ends meet. The opinions and analyses expressed herein are subject to change at any time.

Repeal of deduction for personal exemptions. The highlights of the. United Framework for Fixing our Broken Tax Code was released on Wednesday September 27 2017.

We thank John Goodman Jane Gravelle Jack Mintz Jeffrey Sachs and Donald Schneider for. Corporate Tax Reform. The purpose of the plan is to review Irelands system of personal taxation as a whole to consider the socio-economic impacts of personal taxation and to examine options for future reform within the personal tax system.

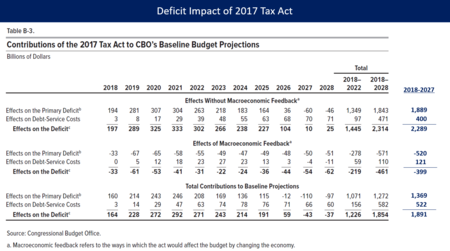

Repeal of the deduction for personal exemptions. Any suggestions contained herein are general and do not take into account an individual s or entity s speci c circumstances or applicable governing law which may vary from jurisdiction to jurisdiction and be subject to. Issues for Congress In 2017 the corporate tax rate was cut from 35 to 21 major changes were made in the international tax system and changes were made in other corporate provisions including allowing expensing an immediate deduction for equipment investment.

The Biggest Individual And Business Tax Cut In American History --- Goals For Tax Reform Grow the economy and create millions of jobs Simplify our burdensome tax code Provide tax relief to American familiesespecially middle-income families Lower the business tax rate from one of the highest in the world to. Treatment of Business Income of Individuals. Reduction and simplification of individual income tax rates.

Trump Releases Plan for Tax Reform At a press conference held on April 26 US. Tax code is overcomplicated and fails to create enough jobs or provide relief to middle class families. 2017 Tax Reform for Economic Growth and American Jobs.