Canada Canada Pension Plan

Have made CPP contributions.

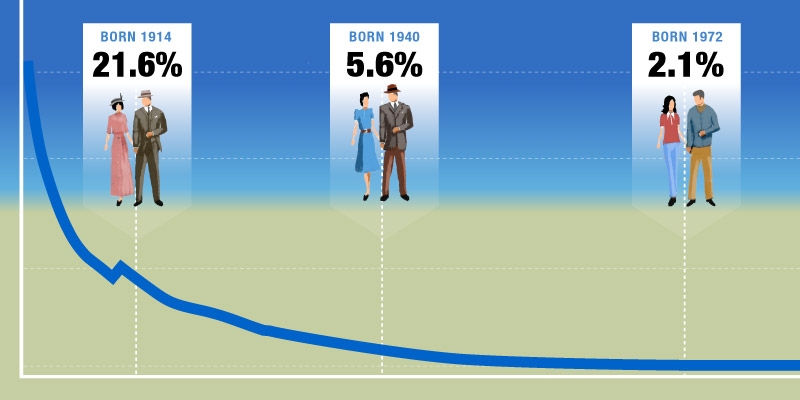

Canada canada pension plan. Canada Pension Plan RSC 1985 c. The Canada Pension Plan or CPP is a retirement pension fund set up in Canada. Laws in French and English Department of Justice httplawsjusticegcca Canada PDF of Act current to 6112017 consulted on 2011-02-07 Establishes a comprehensive program of old age pensions and supplementary benefits in Canada payable to and in respect of contributors.

Here are the maximum benefits at age 65. Contact the Pension Centre. Check your application status.

Get Help Designing Your Plan. Date of birth Year Month Day Important. Full name at birth if different from above 4.

Social Insurance Number 2. The maximum pensionable earnings under the Canada Pension Plan CPP for 2022 will be 64900up from 61600 in 2021. In November the Canada Revenue Agency announced a 53 increase to the yearly maximum pensionable earnings for 2022.

Sharing retirement pensions may result in tax savings. 13 rows Canada Pension Plan pensions and benefits - Monthly and maximum payment. Canada Application for a Canada Pension Plan Retirement Pension 1.

You have to deduct CPP contributions from an employees pensionable earnings if that employee meets all of the following conditions. When you call you can also use self-service options to. Canada Pension Plan CPP January 1 2022 It pains me to tell you that the image of Canada is severely damaged damning testimony in a new book reveals the horrific record of Canadian mining companies in Guatemala.

By Jordan Press The Canadian Press Posted December 29 2021 449 pm Jan. Confirm your monthly payment amount and date. The Canada Pension Plan CPP retirement pension is a monthly taxable benefit that replaces part of your income when you retire.

Have a Canadian address. How do I contact Canada Pension Plan. To qualify you must.

The new ceiling was calculated according to a CPP legislated formula that takes into account the growth in average weekly wages and salaries in Canada. You do not need to provide proof of birth with your application. It replaces a part of your income when you eventually come to an age where you decide to retire.

Atlantic Time Telephone Teletype TTY. It is a monthly taxable benefit that works the same as any other pension. Mail the form or drop it off at a Service Canada office.

It is available 24 hours a day 7 days a week. Include certified true copies of the required documentation. Working on behalf of 20 million Canadians youll be part of a high-performing.

I would like to call on the people and politicians of Canada and the United States to reflect seriously on your way of life in your so. Your Local Time Outside Canada and the United States. Heres what we know.

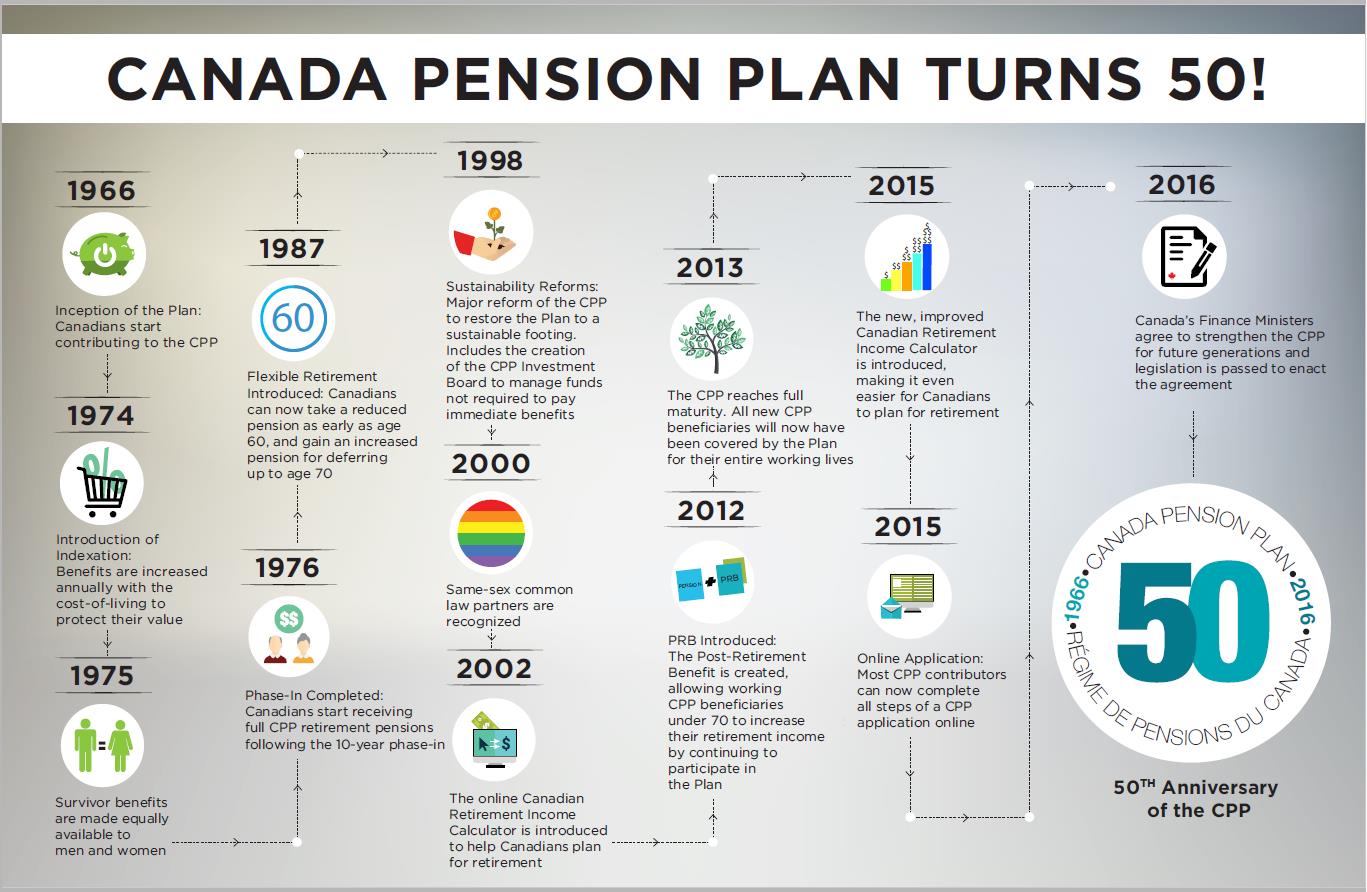

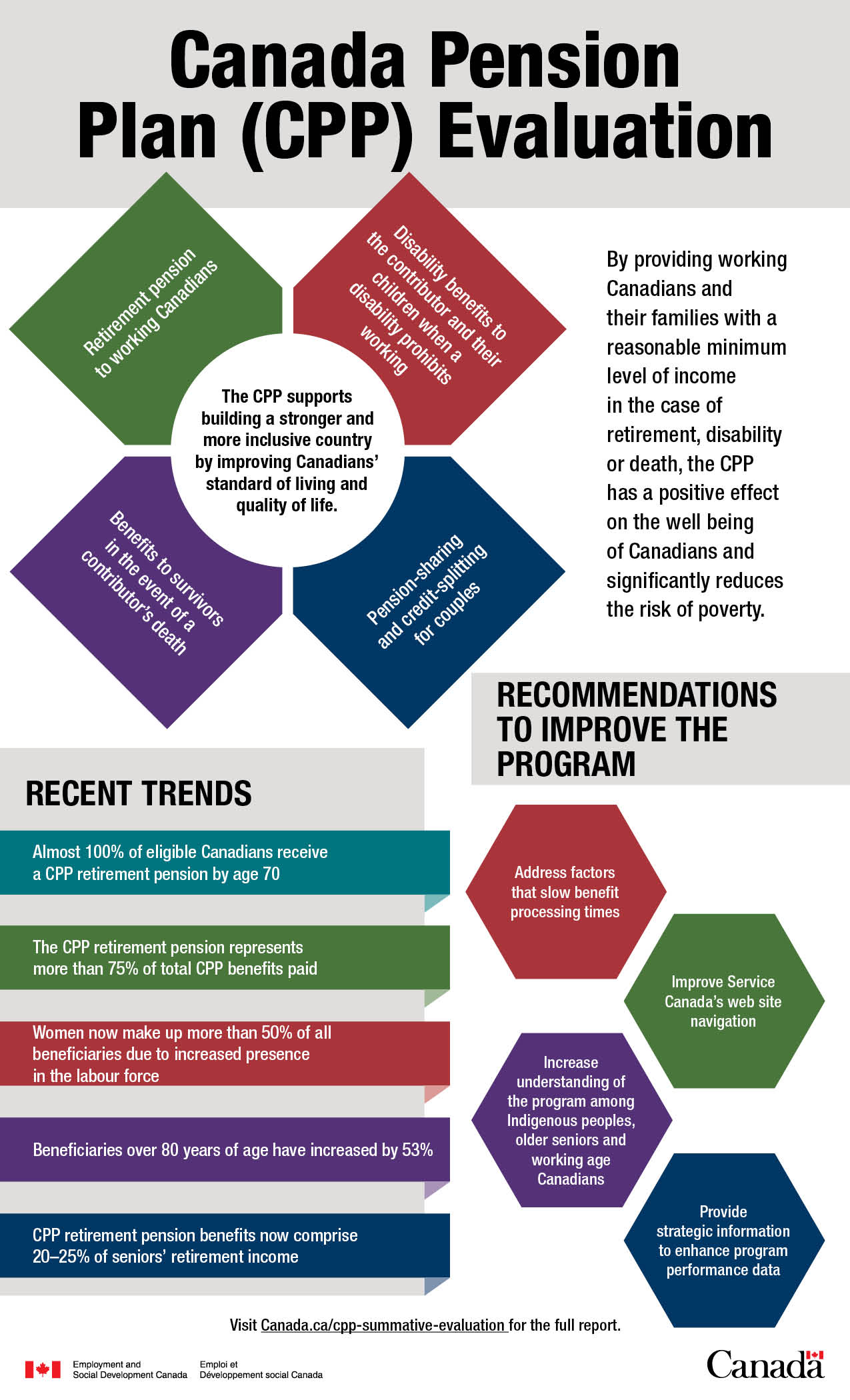

It has played a critical role in many. Pensions in Canada can be public private and collective or come from individual savings. The Canada Pension Plan CPP is a social insurance plan that is funded by the contributions of employees employers and self-employed people as well as the revenue earned on CPP investments.

If you qualify youll receive the CPP retirement pension for the rest of your life. The basic exemption amount of 3500 is still the same. Each spouse or common-law partner pays income tax on the amount they each received.

Canada Pension Plan CPP Changes to the rules for deducting Canada Pension Plan CPP contributions. The Canada Pension Plan CPP is a social insurance plan that is funded by the contributions of employees employers and self-employed people as well as the revenue earned on CPP. Collect calls accepted Monday to Friday.

Service Canada offers an automated telephone service that provides general information about Canada Pension Plan CPP benefits including how to apply. The employee is in pensionable employment during the year. Complete the Application for a Canada Pension Plan Retirement Pension.

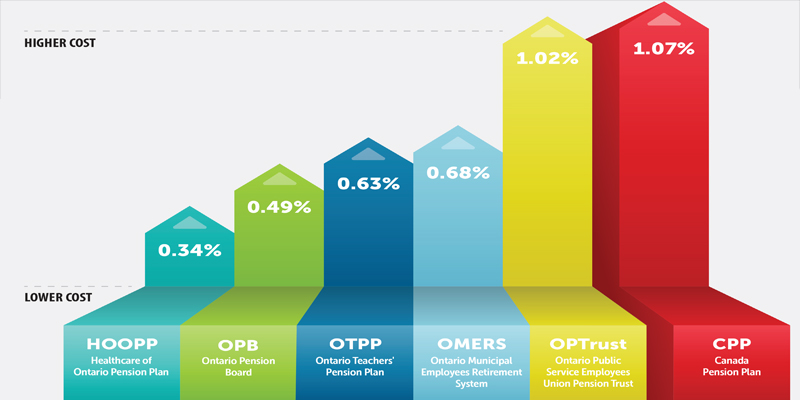

Apply for CPP disability benefits. The CPP covers virtually all employed and self-employed people in Canada excluding Quebec which operates its own comprehensive plan the Quebec Pension Plan. However the Canada Pension Plan has the.

Miss Your given name initial and family name 3. Have made at least one valid contribution to the CPP. Canada Pension Plan or Quebec Pension Plan and are receiving a CPP retirement pension that pension can be shared with the spouse or common-law partner who does not have valid contributions.

Be at least 60 years old. If you qualify youll receive the CPP retirement pension for the rest of your life. The Canada Pension Plan CPP forms the basic state pension system.

The Canada Pension Plan CPP retirement pension is a monthly taxable benefit that replaces part of your income when you retire. Have made at least one valid contribution to the CPP. Be at least 60 years old.

In all provinces and territories except Quebec these plans are administered by Employment and Social. To apply online you must. All those employed aged 18 or older must contribute a portion of their income to a pension plan.

Be over the age of 18 and younger than 66 years. November 1 2021.

/GettyImages-945783260-307cedc3fc7944fc9980e03ec0be90c9.jpg)