Maryland Supplemental Retirement Plan

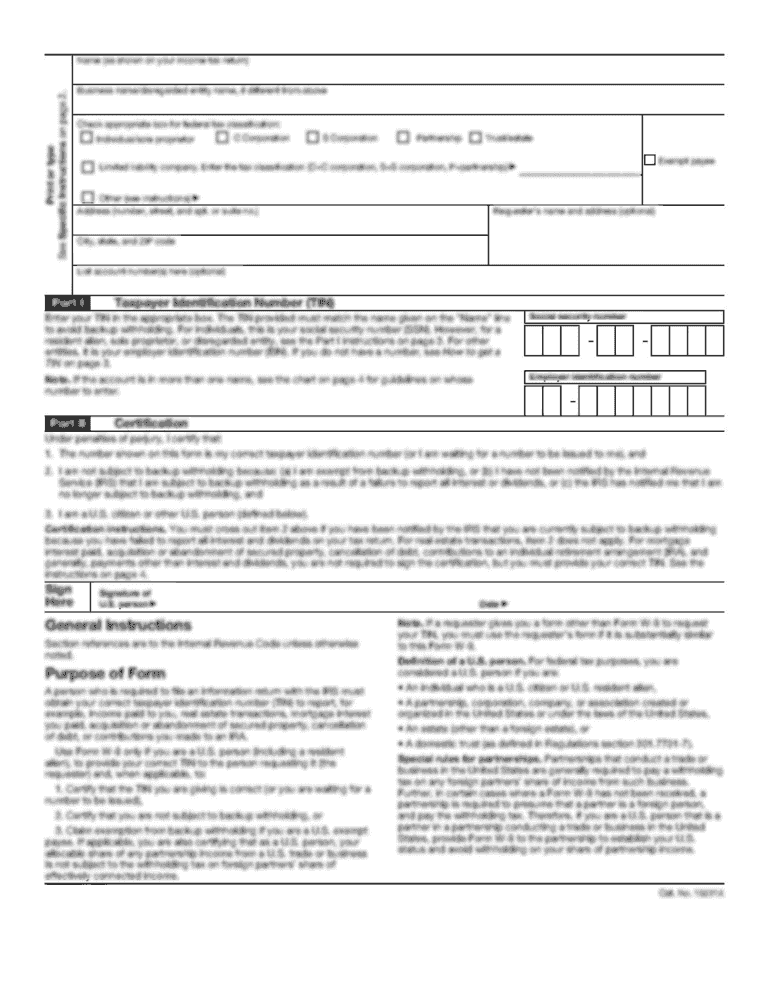

Nationwide Retirement Solutions PO Box 182797 Columbus Ohio 43218 1-877-677-3678 DC-4210-1105 MARYLAND SUPPLEMENTAL RETIREMENT PLAN PAYOUT CHANGE OPTION DESCRIPTIONS PARTIAL LUMP SUM PAYMENT.

Maryland supplemental retirement plan. General Information continued Supporting Documentation and Application Before submitting your completed 401k Hardship Withdrawal Form attach your required supporting documentation. The State of Maryland provides the Maryland Teachers State Employees Supplemental Retirement Plans as an employee benefit. Qualified retirement plans deferred compensation plans and individual retirement accounts are all different including fees and when you can access funds.

The governor selects three members from any of the following departments agencies or boards. Paul St Baltimore MD 21202 - 1608. Employees may participate in more than one plan.

Watch this video to see how it can benefit you. Office of the Attorney General. All employees are eligible to participate in any of the Supplemental Retirement Plans SRA available through the University of Maryland.

Medicare Supplement Plan G is. The Plan reserves the right to amend any of the procedures or plan provisions outlined in this booklet or the Plan Document. Maryland Department of Budget and Management.

MARYLAND SUPPLEMENTAL RETIREMENT PLAN BENEFICIARY or ALTERNATE PAYEE CLAIM FORM Beneficiary Claim check one below OR Alternate Payee Claim Domestic Relations Order check one below r Spouse r Ex-Spouse. There are three vendor choices. Full vesting after 10 years of service.

Nationwide Retirement Solutions and Nationwide Life Insurance Company collectively Nationwide have endorsement relationships with the National Association of Counties the United States Conference of Mayors and the International Association of Fire Fighters-Financial Corporation. Assistant to the Executive Director. We offer a 403b 401k and a 457b plan.

The state of Maryland gives you four ways to be ready for your retirement through the Maryland Supplemental Retirement Plans MSRP. Effective January 1 2022 the Monthly Crediting Rate is 155 annualized. Three plans are offered.

Ronda Butler Bell MPA. At least 500 directly rolled over to the eligible retirement plan or IRA designated below and leave _____ in the account. The Department of Budget and Management the Department of Education the Comptroller of the.

MARYLAND TEACHERS STATE EMPLOYEES SUPPLEMENTAL RETIREMENT PLANS. University System of Maryland offers this plan as part of workplace benefits. If you require assistance in completing this form or need additional information please contact us at 1-800-966-6355.

William Donald Schaefer Tower Suite 200. Y Competitive plan fees. Created in 1985 the Board of Trustees of the Maryland Teachers and State Employees Supplemental Retirement Plans administers the States supplemental retirement plans Chapter 741 Acts of 1985.

Regular full-time and part-time City employees who work a minimum of 500 hours annually participate in the Maryland State Retirement and Pension System MSRPS. Investment Contract Pool ICP Quick Reference 1. These defined contribution plans are available for voluntary participation.

The 457 bDeferred Compensation Plan the 403 b Tax Deferred Annuity Plan and the 401 k Savings and Investment Plan. Maryland Teachers State Employees Supplemental Retirement Plans. Maryland Supplemental Retirement Plan 457b Unforeseeable Emergency Withdrawal Booklet All information contained in this booklet was current as of the print date.

Assets rolled over from your account s may be subject to surrender charges other fees andor an additional 10. Download the My Retirement app for easy access to your retirement plan. Maryland Supplemental Retirement Plan 401k Hardship Withdrawal Booklet.

All the plans offer you the following advantages. Possible options for your money. 2 Maryland Teachers and State Employees Supplemental Retirement Plans Plans with you in mind The MSRP includes three supplemental retirement plans1 the 457b 401k 403b and 401a Match Plan.

The Maryland Supplemental Retirement Plan administered by Nationwide Fidelity Investments and TIAA. Ronda Butler Bell Executive Director Secretary to Board of Trustees. If your plan allows.

These State plans originated from three sources. Learn what plans allow eligible employees to do. Maryland State Retirement and Pension System.

Maryland Supplemental Retirement Plan Incoming Assets Form Please complete all sections of this form. Enrollment packets are available at the University. Maryland Teachers and State Employees logo with text labelling the logo specific to Supplemental Retirement Plans Maryland Teachers and State Employees Supplemental Retirement Plans 1-800-545-4730.

Now is a great time to understand what is offered - think about taking advantage of any opportunities to save and invest for the future. Executive Director Board Secretary. This option provides for a single payment in the amount requested minimum of 2500 from the value of your account.

How does Maryland State Retirement work. The Maryland Supplemental Retirement Plans are administered by a nine-member Board of Trustees appointed by the Governor of Maryland to staggered four-year terms. 37 rows Maryland Medicare Supplement Plan G Comparison Chart.

In 1963 the Board of Trustees of the Teachers Retirement System established the Maryland Teachers. The City makes an additional contribution as calculated by the MSRPS. Details of the plan include.