Best Student Loan Repayment Plan

Best repayment optionstandard repayment.

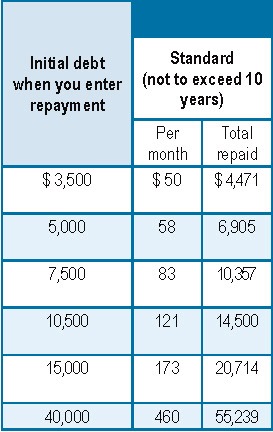

Best student loan repayment plan. The standard repayment plan for federal student loans is designed for you to repay what you owe in 10 years. With interest rates expected to rise and Covid-19 loan forbearance set to end borrowers should prepare to make payments again. This is the default repayment plan chosen by loan servicers unless you enroll in a different plan.

Consolidating or Refinancing Your Federal Student Loans. Extended compensation lets you lengthen your compensation time period to as much as 25 years. Repayment plans are not one size fits all.

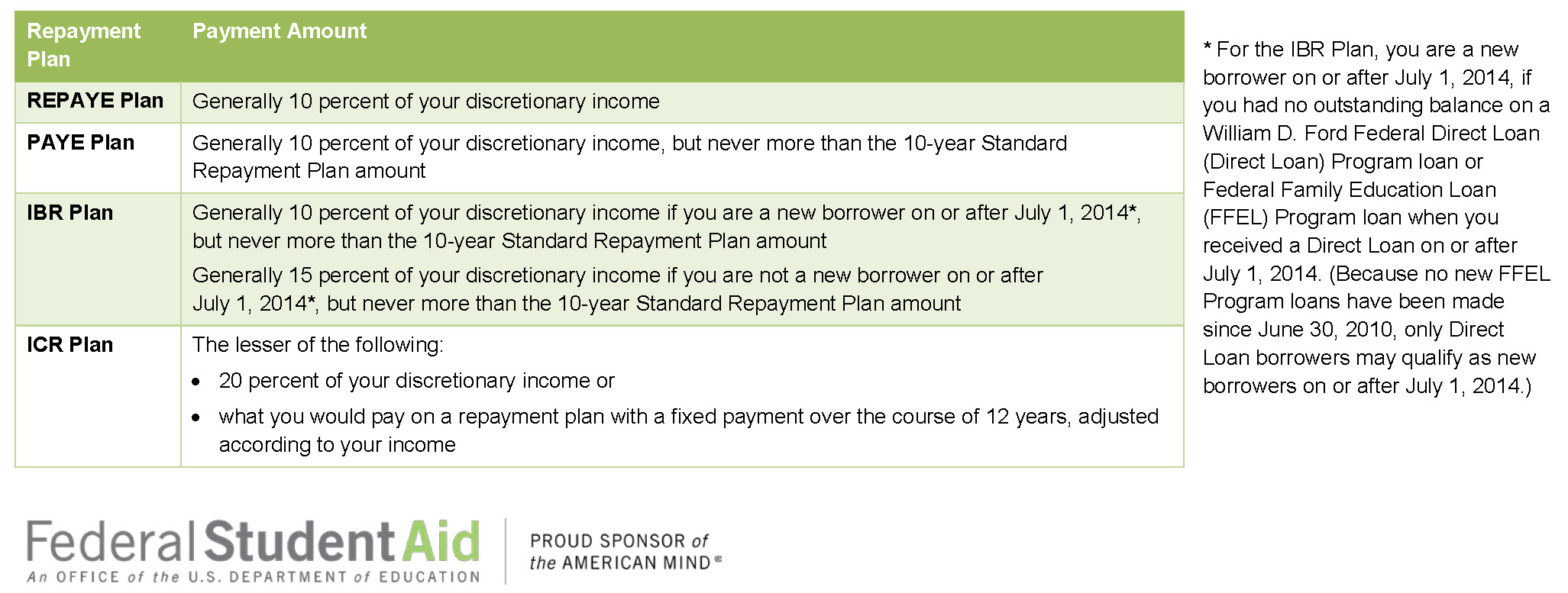

Federal Student Aid. Revised Pay as You Earn or REPAYE is one of the most popular student loan forgiveness programs for federal student loans. Your monthly repayments will increase or decrease based on your annual income.

If you can afford the. An income-driven repayment plan is typically best if youre planning to pursue loan forgiveness. This plan starts off with low payments that gradually increase over time.

Income-Sensitive Repayment ISR Most of the income-driven plans end in loan forgiveness if you havent paid off your balance after 20 or 25 years. If youre expecting your income to get a nice boost in the future then the graduated repayment plan might be a great option for you especially if you want to pay off your debt faster. There are specific factors that are taken into consideration when determining the best repayment payment plan for you like your annual income the total amount of your debt family size and your current.

The graduated repayment plan gives you a period of 10 years to repay your loan. On the standard student loan repayment plan you make equal monthly payments for 10 years. Revised Pay As You.

Extended Repayment Plan. Monthly payment amounts remain the same for the life of the loan and youll be debt-free in a decade. Income-sensitive repayment is one of the best repayment options for student loans for FFEL Plus FFEL Consolidation subsidized and unsubsidized loans.

If you dont request an alternative plan youll make payments on your federal loans under the standard 10-year repayment plan. As previously mentioned consolidating your federal student loans and keeping them with a federal servicer can simplify your monthly payments. So if youre a relatively new borrower PAYE could be the best income-driven repayment plan for you as it lowers your monthly payment to 10 and caps your repayment term at 20 years the other plans can go up to 25.

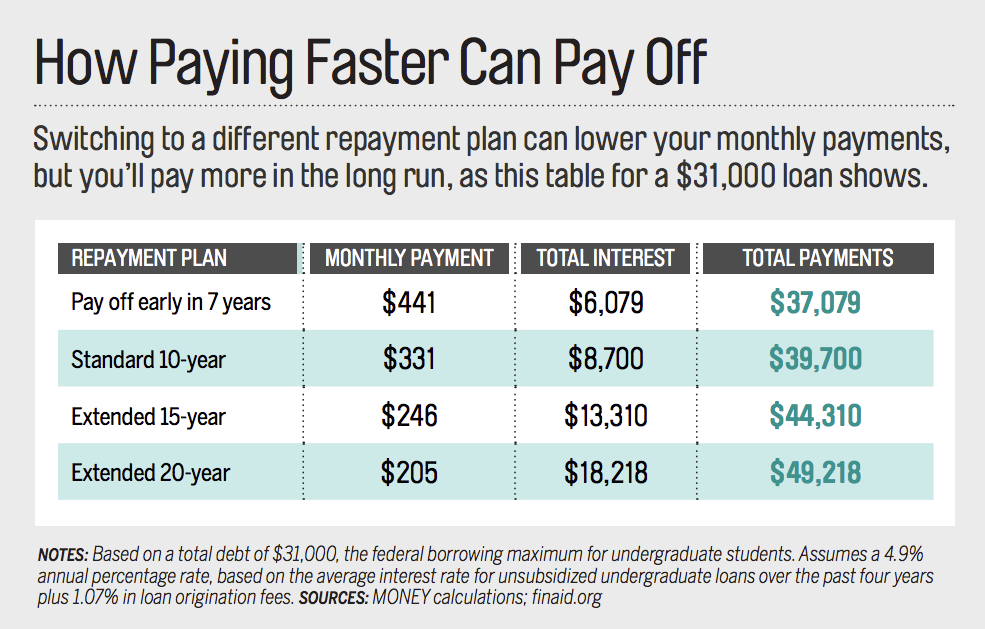

The idea is that you pay a percentage of your discretionary income every month for 20-25 years and then whatever balance remains of your student loans is forgiven the 20th or 25th year. The best federal student loan repayment plan for student loan borrowers is simply a payment plan that works for them. If you want to pay less interest.

To qualify for this plan youll want to have at the very least 30000 in federal student loan debt. Here are our student loan predictions for 2022. The maximum time to complete payment is 10 years.