2016 Retirement Plan Contribution Limits

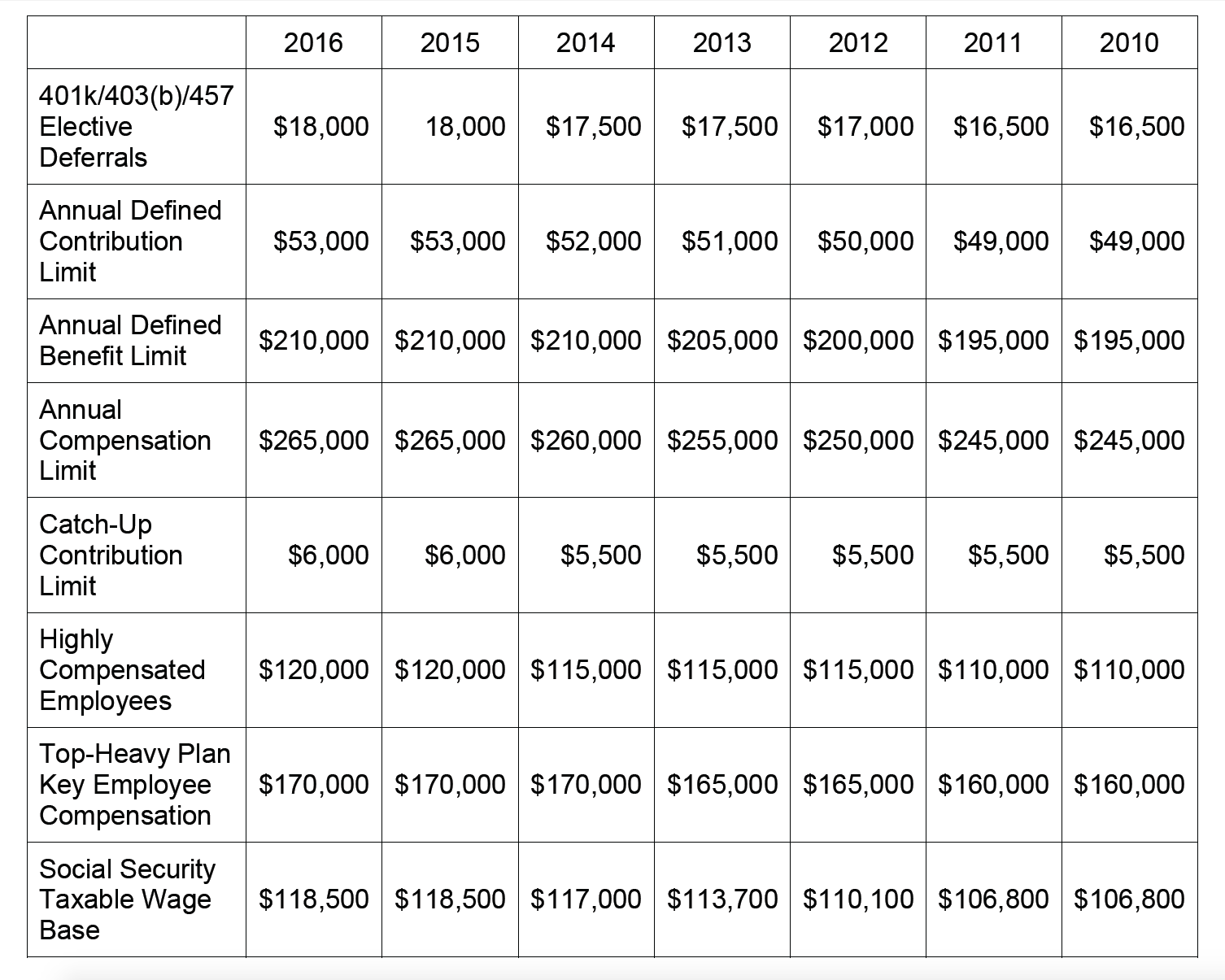

18000 Calendar Year Limit 17500 Calendar Year Limit 401K403B GOVERNMENTAL 457B CATCH-UP CONTRIBUTIONS FOR PARTICIPANTS OVER AGE 50.

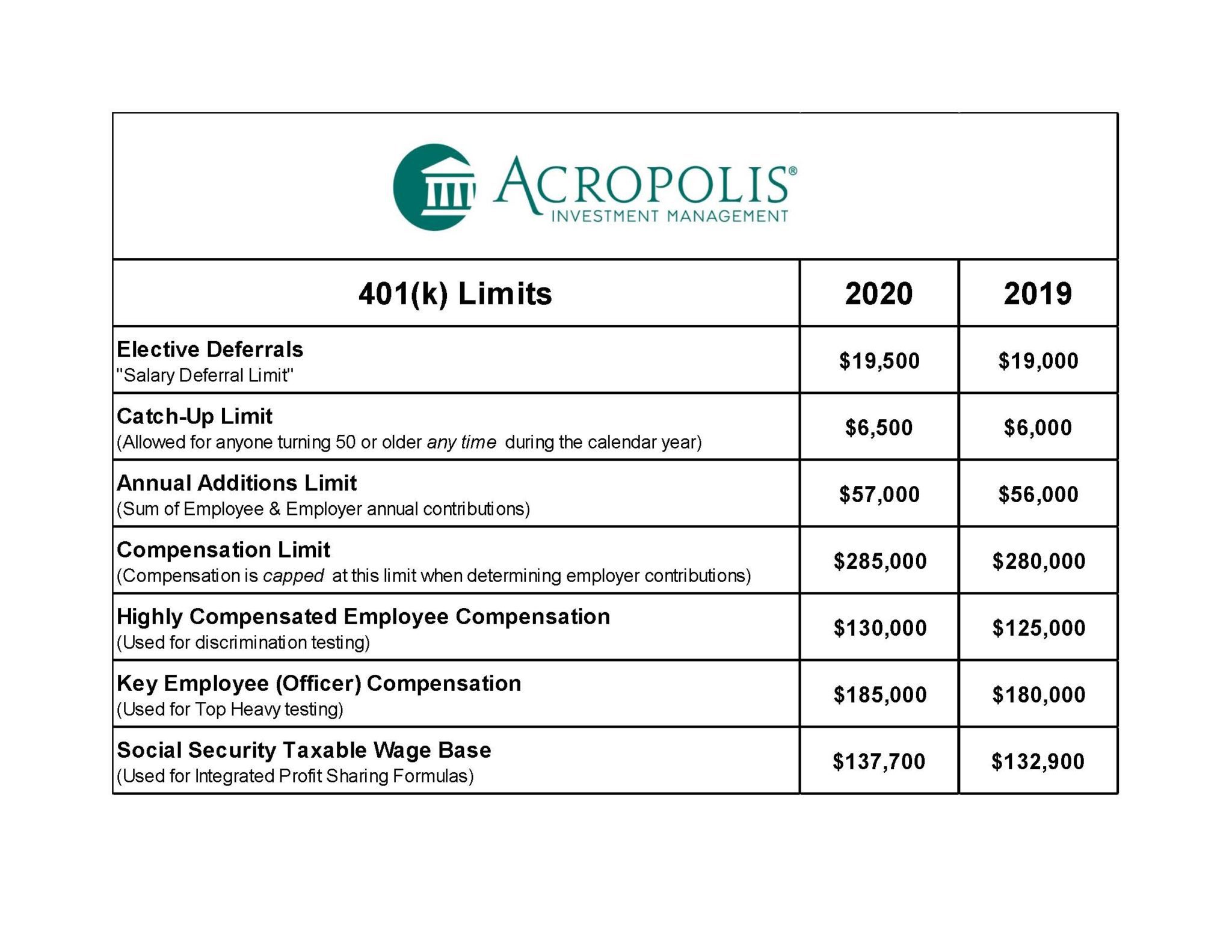

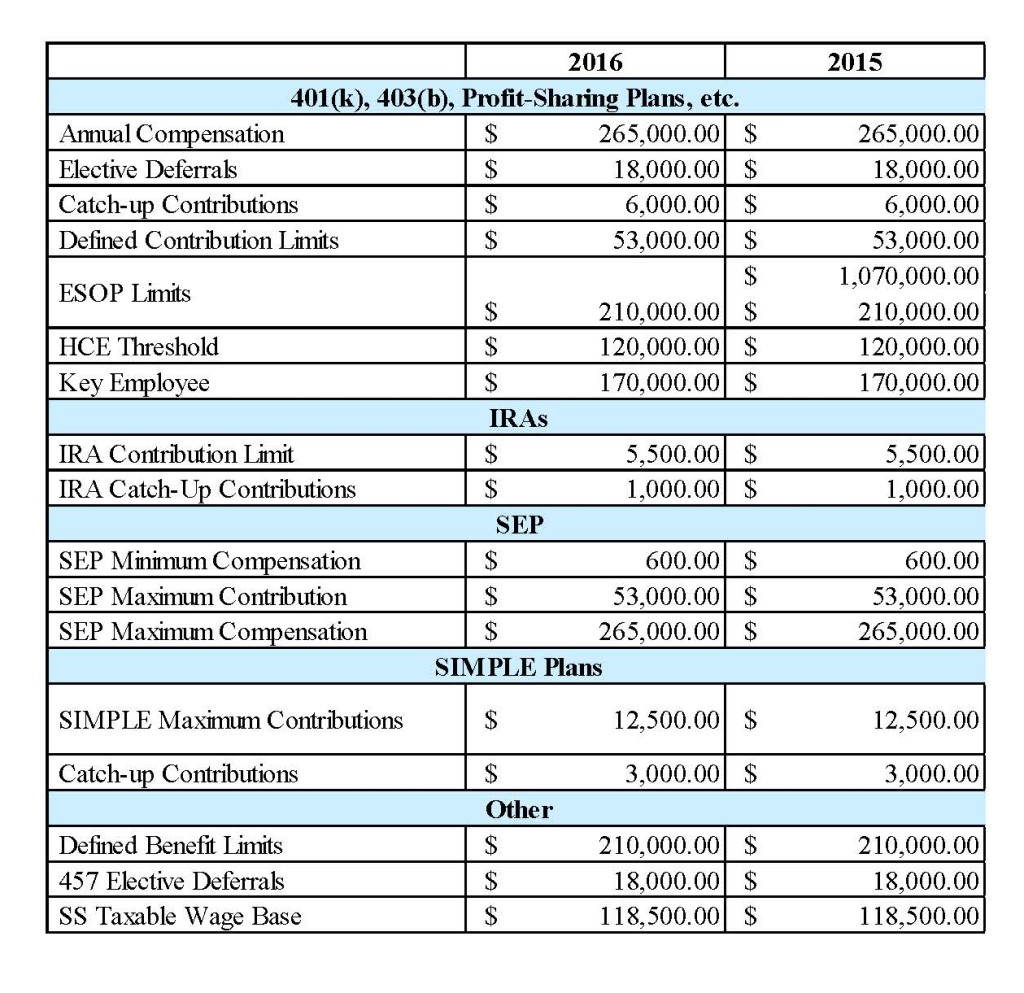

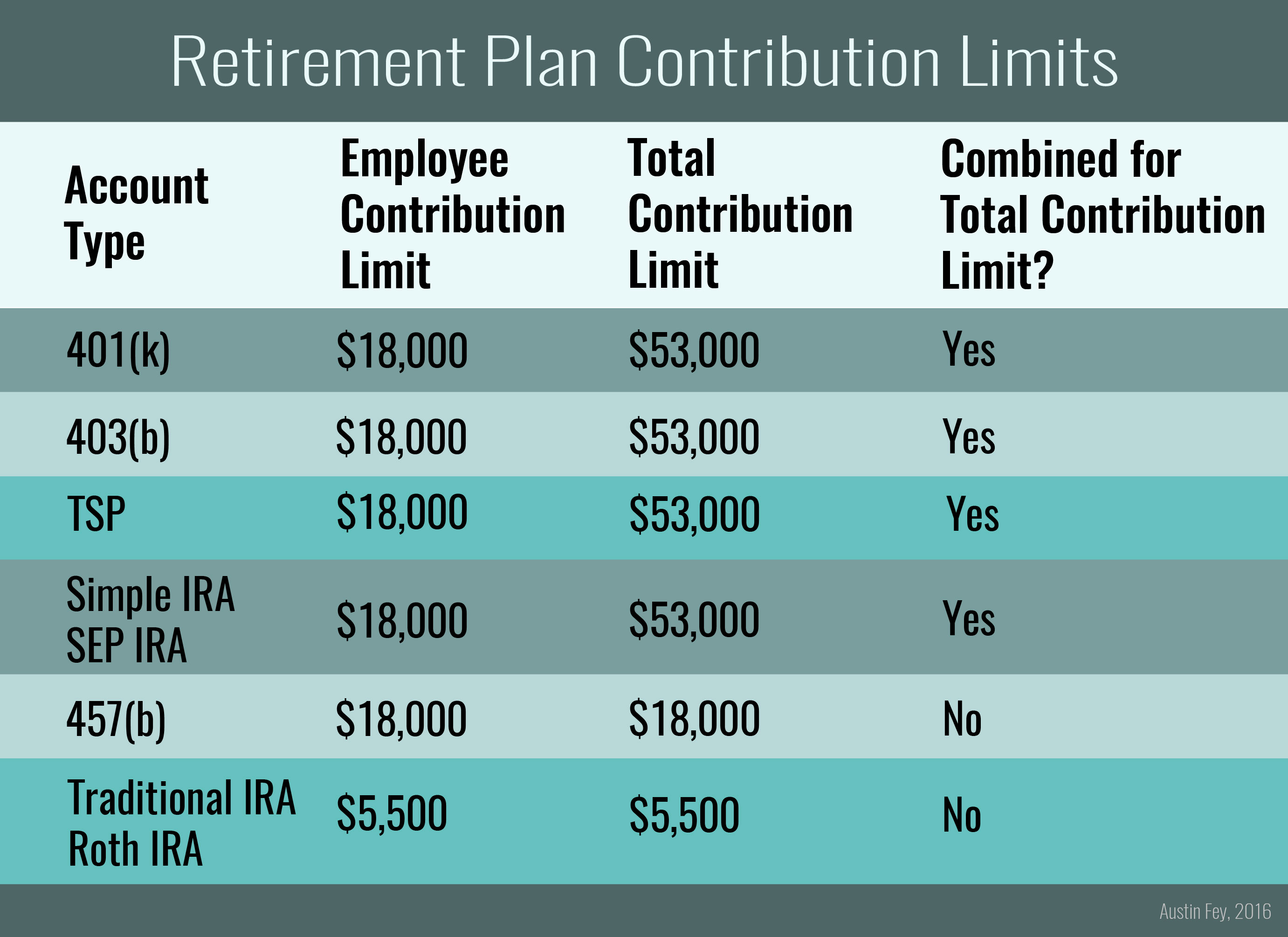

2016 retirement plan contribution limits. Savers will be able to defer up to 18000 into these plans in 2016 with an additional catch-up contribution of. 2016 Pension Plan Limitations. 401k 403b 457 Thrift Savings Plan contributions not.

401 k 403 b. 7 rows Contribution Limits 2015 2016. Heres a great cheat sheet of retirement plan contribution limits for 2016.

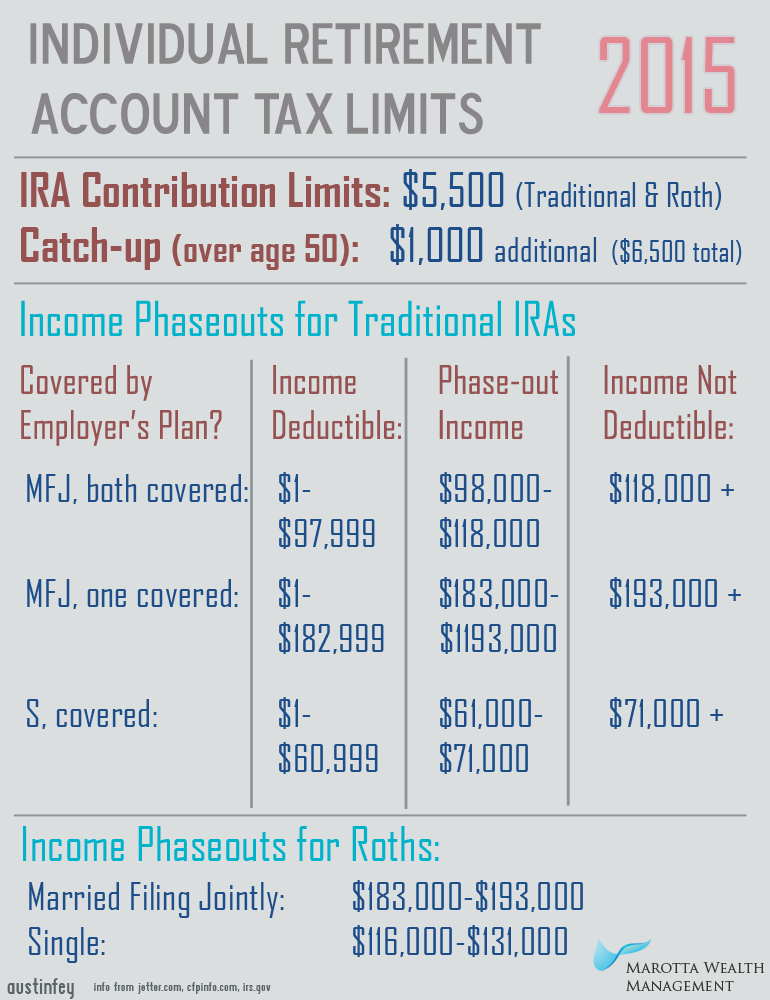

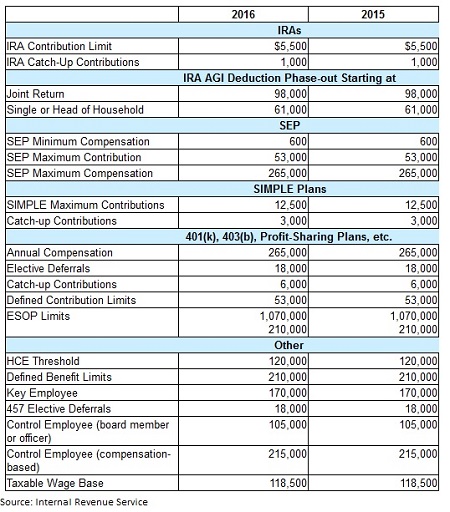

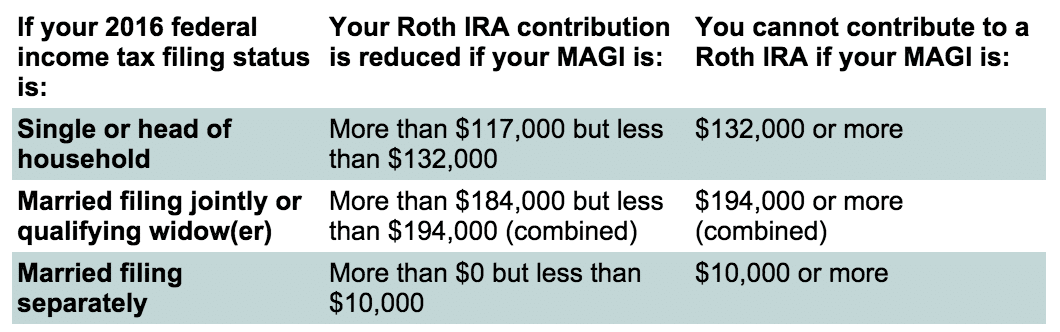

The Roth IRA income limits will be. Those 49 and younger in 2016 can contribute up to 5500 to their IRAs while those 50 and older will be able to contribute 6500². Now that you have the basics its time to get busy saving.

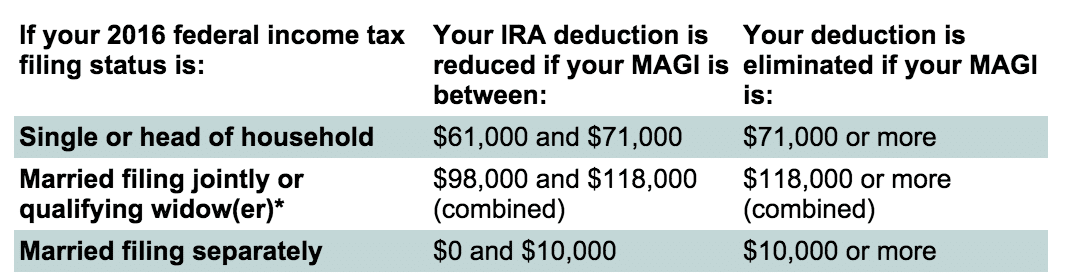

Whatever you do make sure youre saving as much as possible before its too late. Plan your finances accordingly because its either an opportunity gained or an opportunity lost. Singles and heads of household who are covered by a workplace retirement plan 61000 to 71000.

IRA maximum contributions arent changing either. Single savers will be able to make up to 30750 and married savers will be able to make up to 61500 in 2016 and still be eligible for the credit. WASHINGTON The Internal Revenue Service today announced cost-of-living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2016.

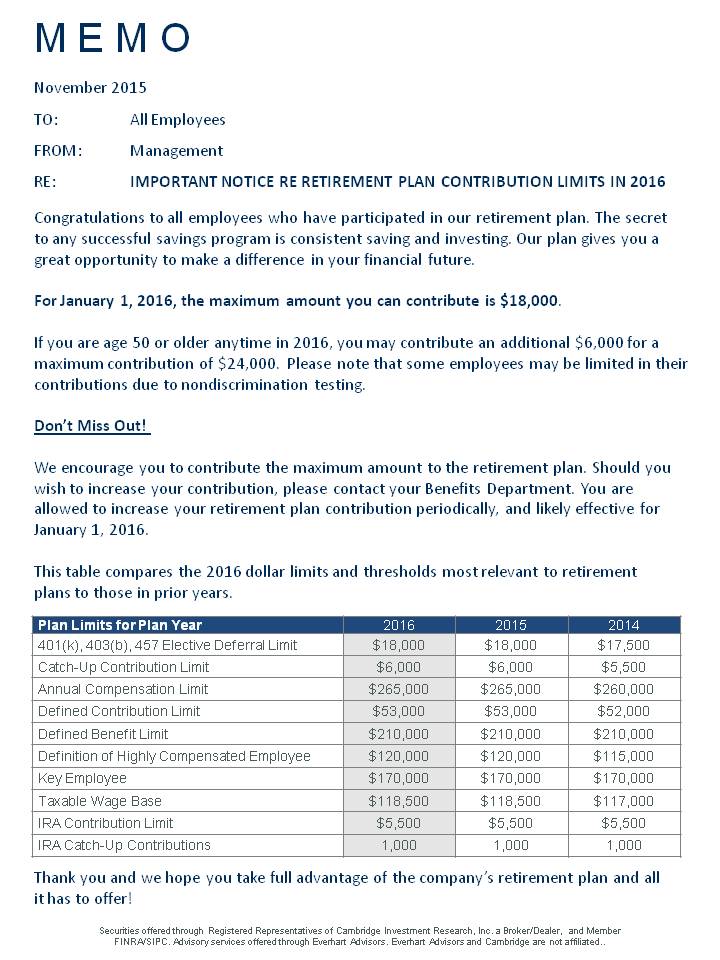

Married individual filing a separate return who is covered by a workplace retirement plan 0 to. The catch-up contribution limit of 6000 also remains the same. 401k Contribution Limit Remains Unchanged at 18000 for 2016 401k and Retirement Plan Limits for the Tax Year 2016 Plan limits for 2017 can be found here.

8 rows The IRS highlighted the following adjustments taking effect on Jan. In general the pension plan limitations will not change for 2016. 2 401k 403b 457 TSP annual contribution limits are also unchanged.

Contribution Limit Remains Unchanged at 18000 for 2016. 401k 403b 457 TSP annual contribution limits are also unchanged. You will be able to contribute up to 5500 to an IRA in 2016 plus an extra 1000 if youre 50 or older.

Roth IRA traditional IRA contribution limits stay the same for 2016. 6000 Calendar Year Limit 6000 Calendar Year Limit 5500 Calendar Year Limit INCLUDIBLE COMPENSATION 265000 265000 260000. Heading into 2016 many key numbers will stay the same according to the IRS including the headline-grabbing 18000 limit on annual 401 k 403 b most 457 plans and the federals governments Thrift Savings Plan contributions.

The income limit for the Retirement Savings Contribution Credit will increase in 2016. However an employers deduction for contributions to a defined contribution plan profit-sharing plan or money purchase pension plan cannot be more than 25 of the compensation paid or accrued during the year to eligible employees participating in the plan see Employer Deduction in Publication 560 Retirement Plans for Small Business SEP SIMPLE. The IRS has issued the contribution and benefit limits in effect for 2016.

Most of these. Those 49 and younger in 2016 can contribute up to 5500 to their IRAs while those 50 and older will be able to contribute 6500. Married couples filing jointly in which the spouse who makes the IRA contribution is covered by a workplace retirement plan 98000 to 118000.

%20contribution%20limits.png)