Wellsfargo Com Retirement Plan

Plan for retirement income Manage money in retirement Go to Retirement Planning.

Wellsfargo com retirement plan. Buy a home Compare your loan options Refinance your mortgage Go to Home Lending. Roll assets to an IRA. Each of the following options is different and has advantages and disadvantages and the one that is best depends on your individual circumstances.

Whether youre just starting to plan for retirement or have been saving for years My Retirement Plan makes it easy to take the next step in planning for retirement. And Legal Services Plan coverage in retirement. They do not guarantee an investment return or the safety of the underlying investment choices.

My Retirement Plan begins by estimating your income at retirement and then uses government data and information you provide eg education level current income retirement age to project your annual income year over year. Use the contact information in the. Please keep in mind that rolling over assets to an IRA is just one option for your qualified employer sponsored retirement plan QRP.

Guarantees are based on the claims-paying ability of the issuing insurance company. Support Available Along. A guaranteed stream of lifetime income from an annuity can be an important part of your overall retirement plan.

To estimate your income needs in retirement My Retirement Plan multiplies your estimated income at retirement by your income replacement. See how we can help you achieve your goals Your homeownership path starts here. Learn about financial aid Find.

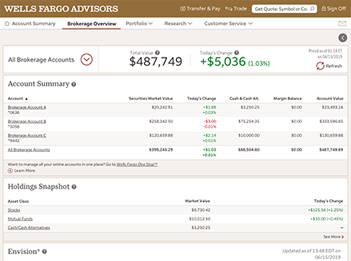

Aug 22 2014 The plan administrator for the Wells Fargo 401k Plan does not have access to or otherwise maintain any information about your participation accrued or vested benefits contributions or any other information about these other third-party employer-sponsored retirement plans. By opening a WellsTrade online and mobile brokerage account youll not only be able to. Leave assets in your former employers QRP if QRP.

While most online retirement planning tools offer a one-size-fits-all approach My Retirement Plan provides a realistic savings goal tailored to you and a realistic plan for pursuing that goal. If you are a participant in another employers retirement plan for which Wells Fargo Bank NA also serves as third. Once you get an idea of how you want to live in retirement and work through your retirement budget you will need to understand your various sources of income to.

In addition to a Wells Fargo IRA and employee-sponsored retirement plans that Wells Fargo services the financial services company also offers other investment options that you may be using to plan for retirement including mutual funds stocks and exchange-traded funds. Guarantees apply to minimum income from an annuity. Individuals at age 65 have a high probability of spending 20 years or more in retirement.

Longevity is a critical factor that is driving these costs. Start with your retirement needs. As a former team member inactive team member or participant who was never employed by Wells Fargo with an account balance in the Wells Fargo Company 401k Plan Wells Fargo 401k.

If youre a Wells Fargo Online. Begin receiving your Cash Balance Plan benefit if you elected to receive your benefit the first of the month after your retirement. Section of this guide to make sure that your contact information and beneficiary designations are up to.

Youll begin your retirement income plan by understanding your retirement dreams and goals and learning about the key risks and concerns to consider. Create an Income Stream.