Trump Tax Reform Plan

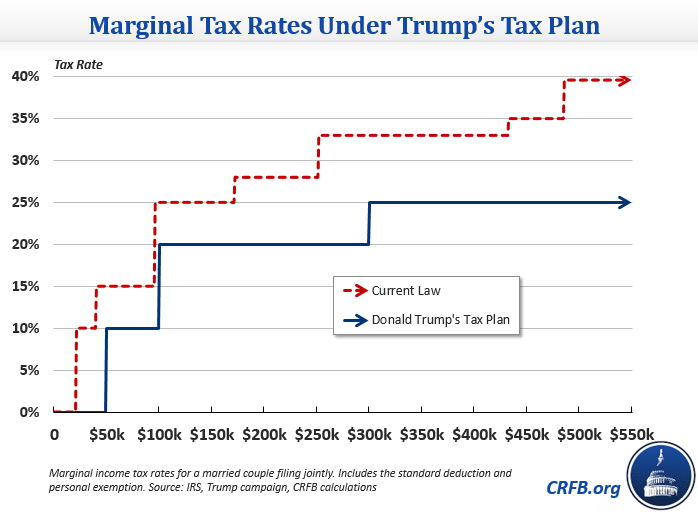

It reduces the top personal tax rate to 35 percent and preserves incentives for home ownership while proposing eliminating other tax loopholes presumably the deduction for state and local taxes.

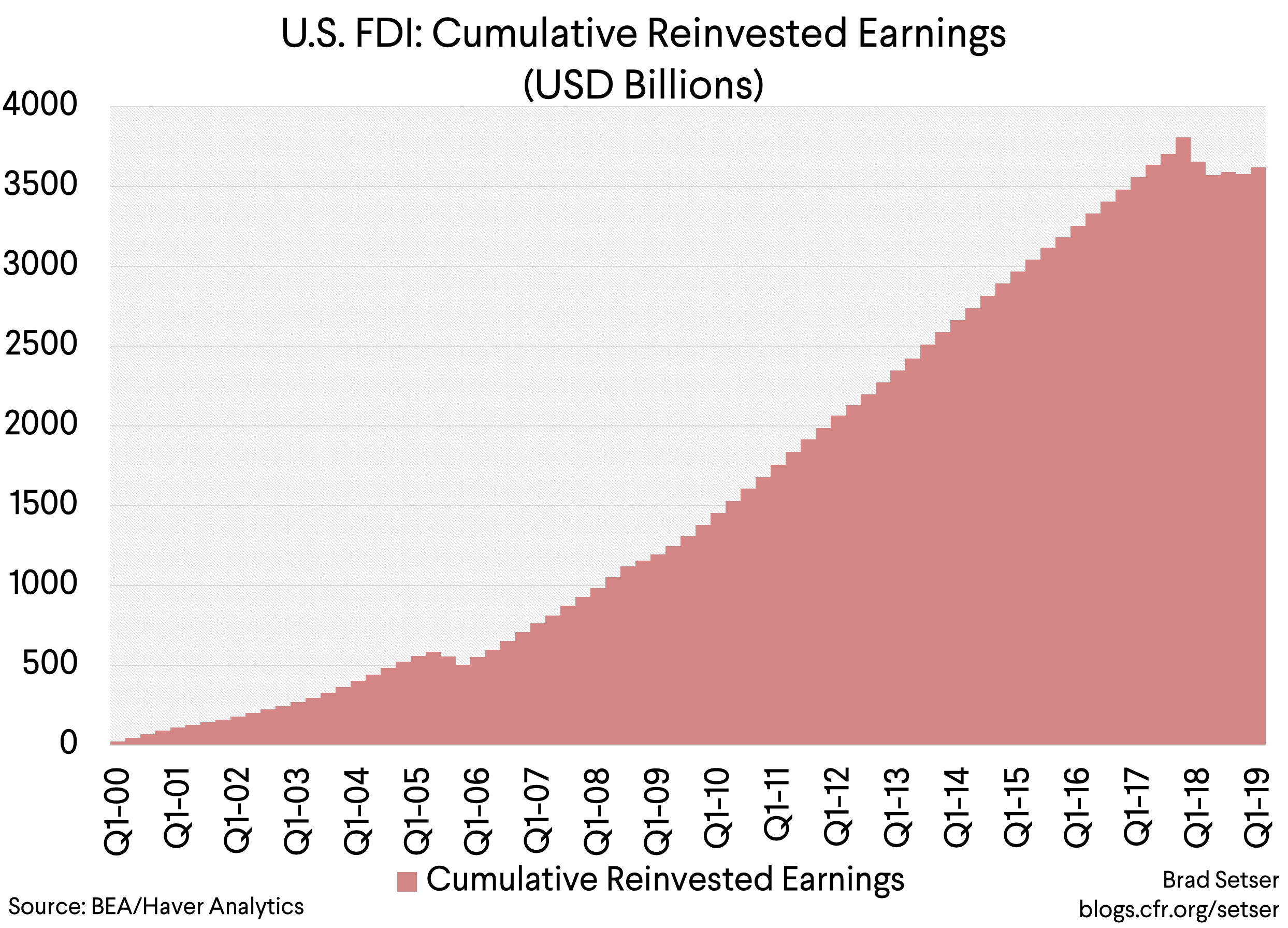

Trump tax reform plan. This higher limit allows wealthy families to transfer more money tax-free to their heirs. The one-page Trump plan proposes cutting the business tax rate to 15 percent and includes a one-time tax of unspecified size on dollars held overseas. Itemized deductions would be capped at 200000 for joint filers and 100000 for single filers.

The Trump-GOP tax reform plan would eliminate the value of the mortgage interest deduction in favor of the standard deduction. It was never intended as a tax most Americans would pay. Following through on his campaign promise to jump start the US.

Trump would repeal the estate and generation-skipping taxes but would tax capital gains held until death and valued at over 10 million this is intended to exempt small businesses and family farms. The Trump tax cuts are fully paid for by. The Tax Cuts and Jobs Act came into force when it was signed by President Trump.

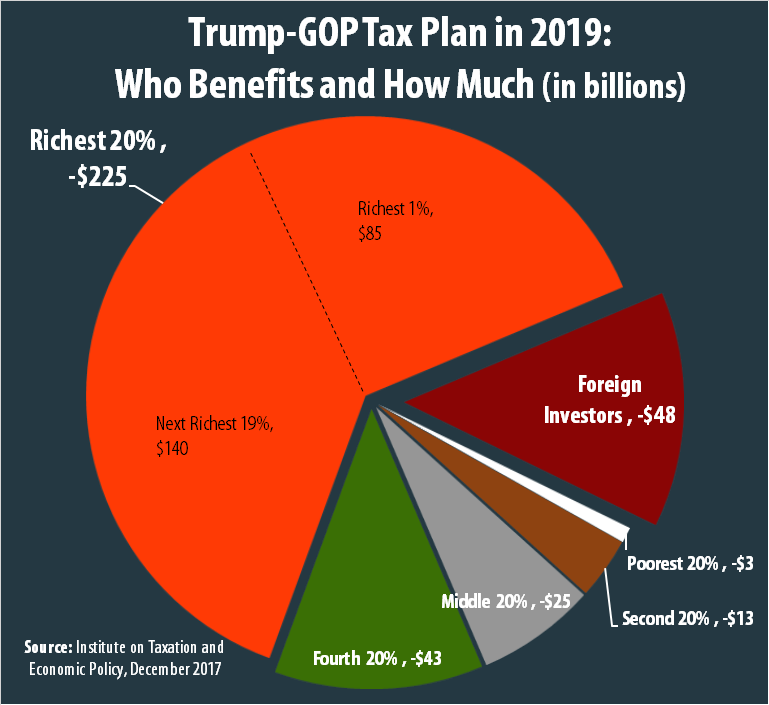

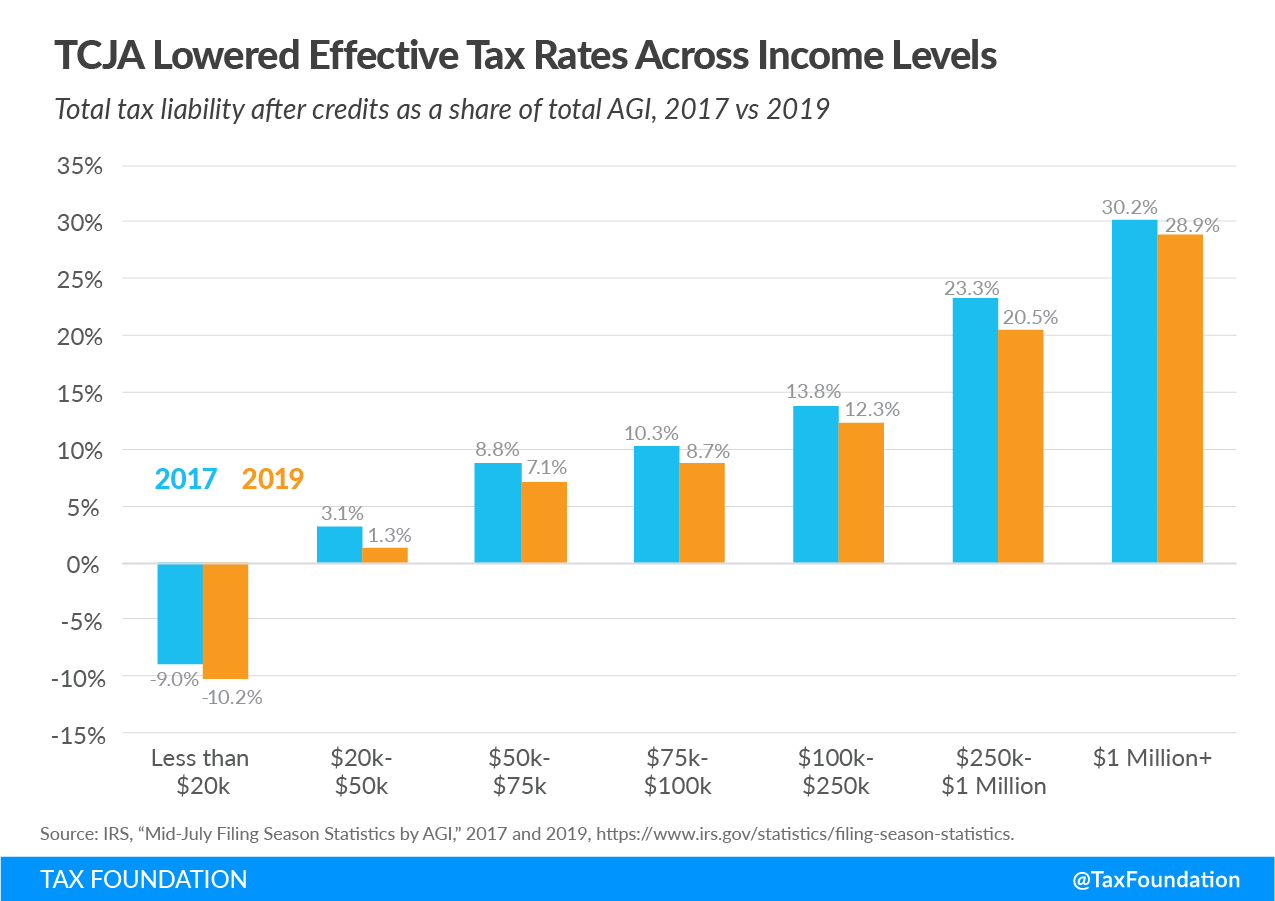

A Simpler Tax Code For All Americans When the income tax was first introduced just one percent of Americans had to pay it. The TCJA reduced the rate to 21. Reducing or eliminating most deductions and loopholes available to the very rich.

Under Trumps tax plan the corporate tax rate dropped from 35 percent to 21 percent. The Trump plan eliminates the income tax for over 73 million households. Before 2018 the corporate tax rate was 35.

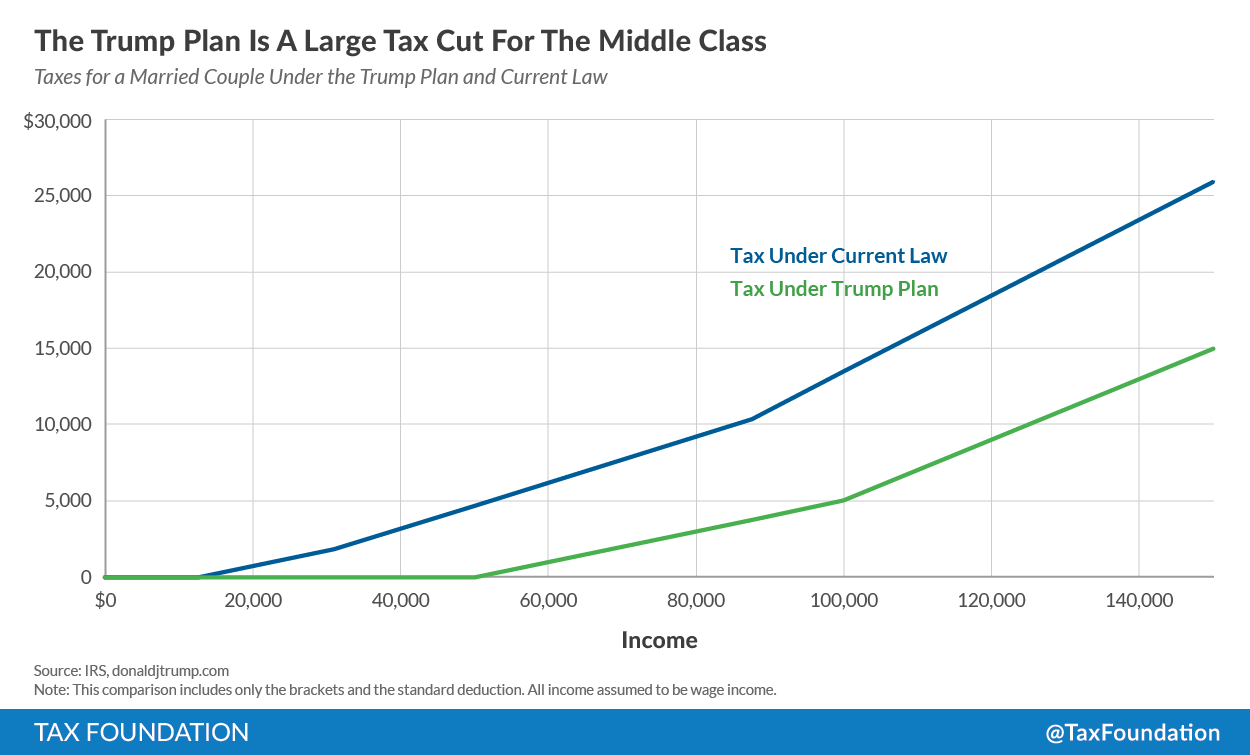

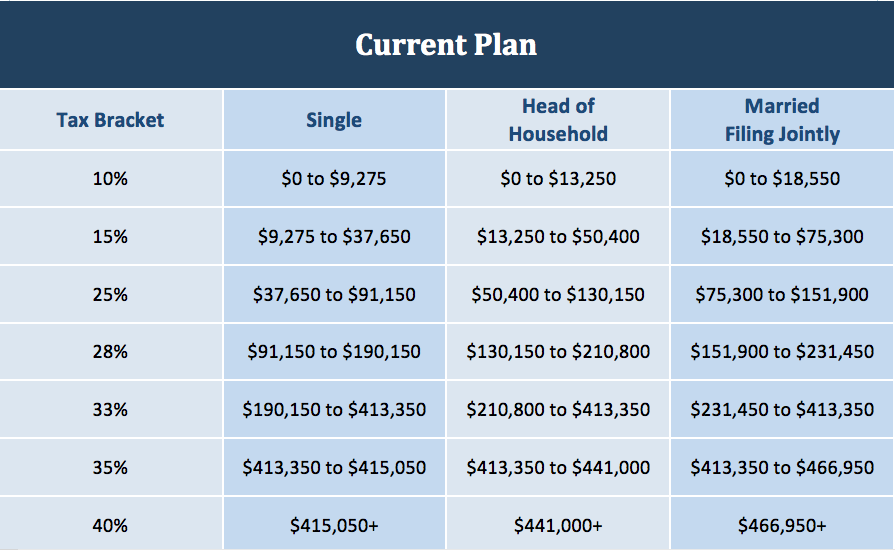

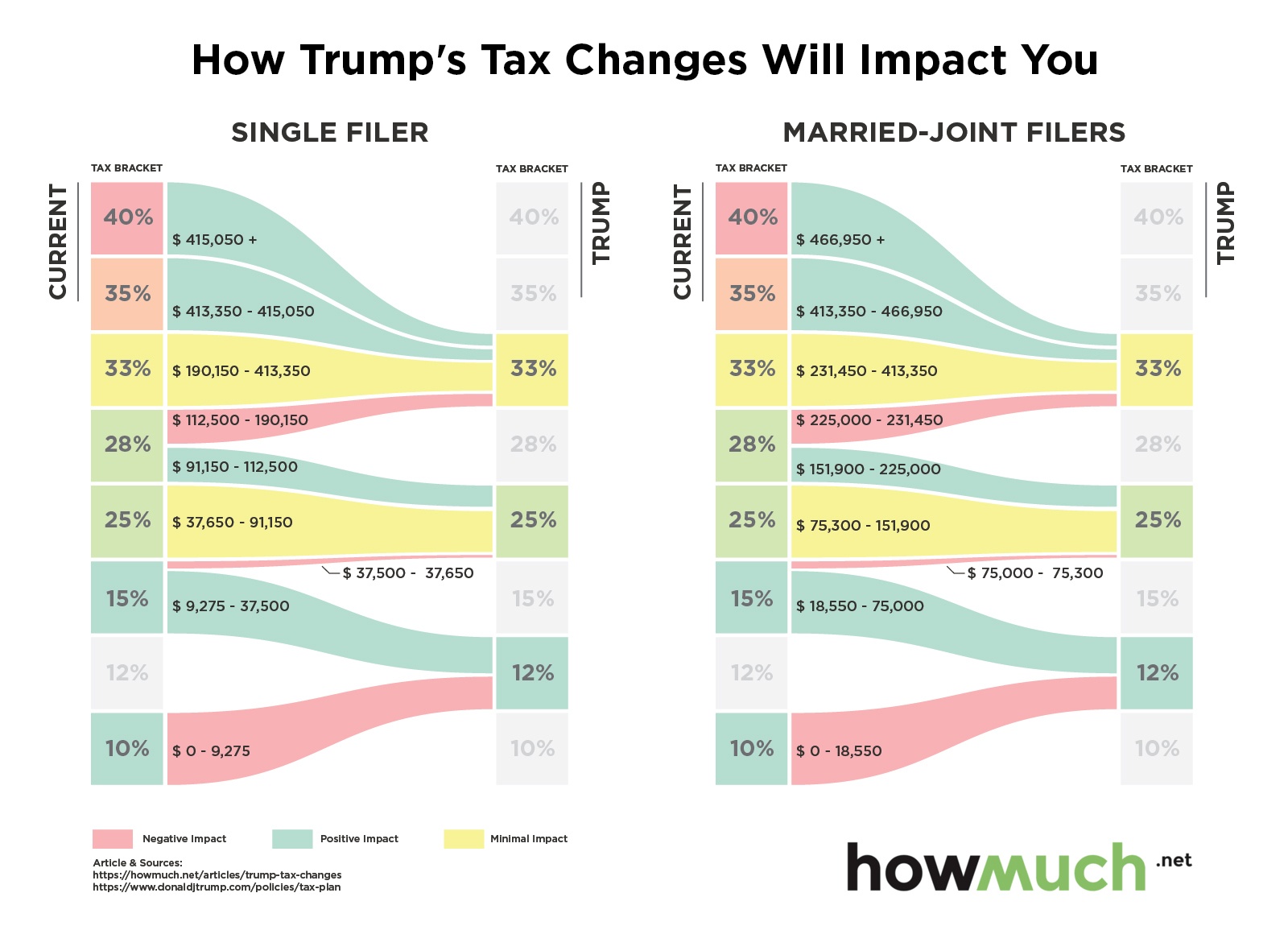

8 rows The chart below shows the tax brackets from the Trump tax plan. The Trump plan eliminates the income tax for over 73 million households All other Americans will get a simpler tax code with four brackets 0 10 20 and 25 instead of the current. Contributions of appreciated assets into a private charity established by the decedent will not be recognized.

It would cut the top 396 percent. Even if a true tax-reform package isnt in the offing anytime soonthe last reform of the tax code took place more than 30 years agoTrumps party has the power to simply slash rates this. A one-time deemed repatriation of corporate cash held overseas at a significantly discounted 10 tax rate followed by an end to the deferral of taxes on corporate income earned abroad.

Other tax reform plan changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions. The Trump plan eliminates the income tax for over 73 million households. Trump Tax Plan Lowers Corporate Tax Rate.

See How Trumps Tax Plan Will Change Things. 10 15 and 35. The law leaves the head of household filing status in place.

Cutting the current seven tax rate brackets to three. The brackets proposed are 12 25 35 and 396. It lowered the corporate tax rate to 21 from 35 at the turn of 2018.

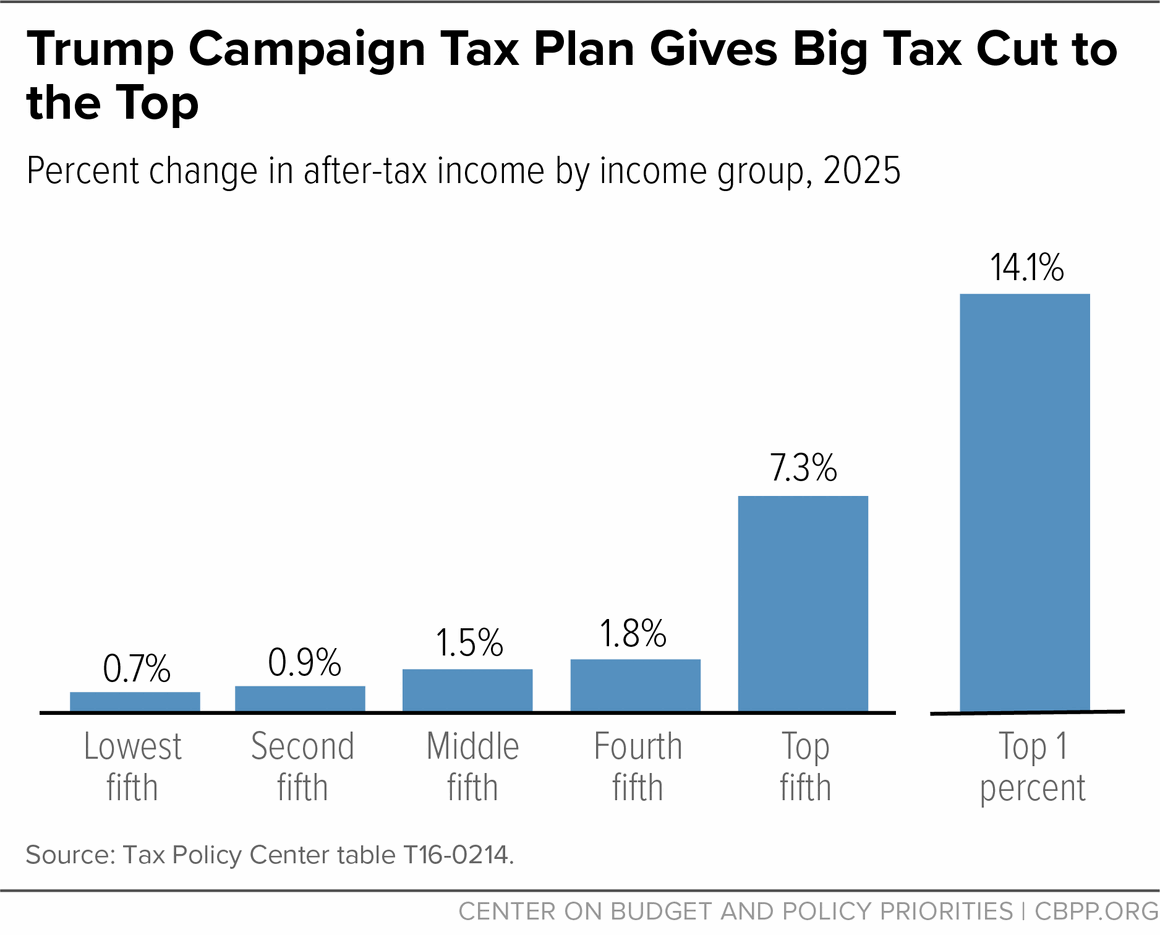

The Trump Tax Plan Is Revenue Neutral. 42 million households that currently file complex forms to. Trumps revised campaign plan released in 2016 would have scrapped the head of household filing status potentially raising taxes on millions of single-parent households according to an estimate by the Tax Policy Center TPC.

Trump would increase the standard deduction for joint filers to 30000 15000 for single filers and would eliminate the personal exemptions as well as the head of household filing status. Since 2016s electoral campaign Donald Trump has proclaimed his plan of reducing taxes for both individuals and businesses. President Donald Trump on Wednesday rolled out a tax plan which includes a 20 corporate tax rate and the elimination of the state and local tax deduction.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9354235/tpc_distribution_big_six.png)

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)