Trump Tax Plan Rental Income

I did a rough calculation of the prop taxdepreciationmortgage interest that looks like it mostly cancels out my expected rental income.

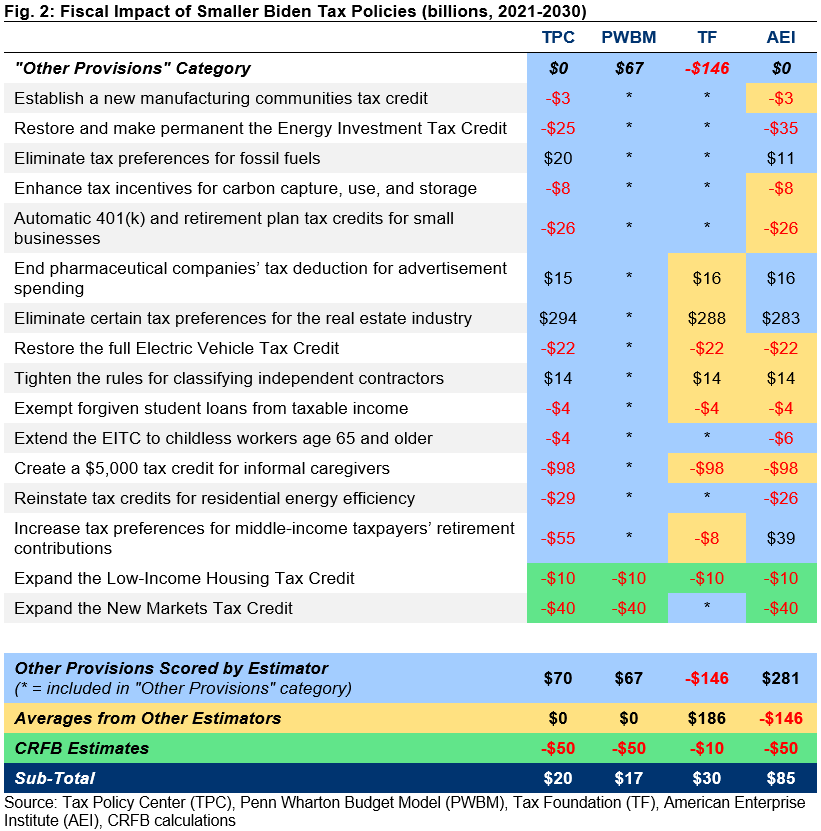

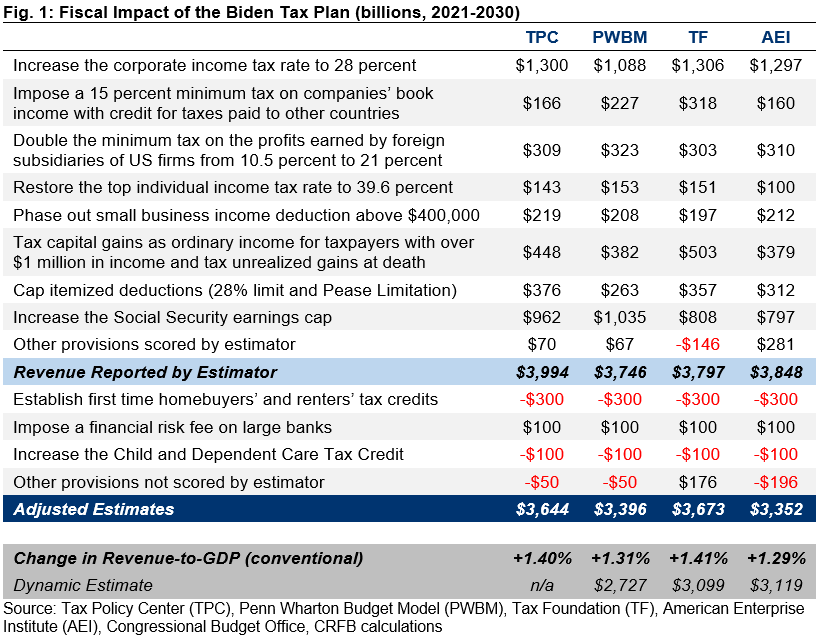

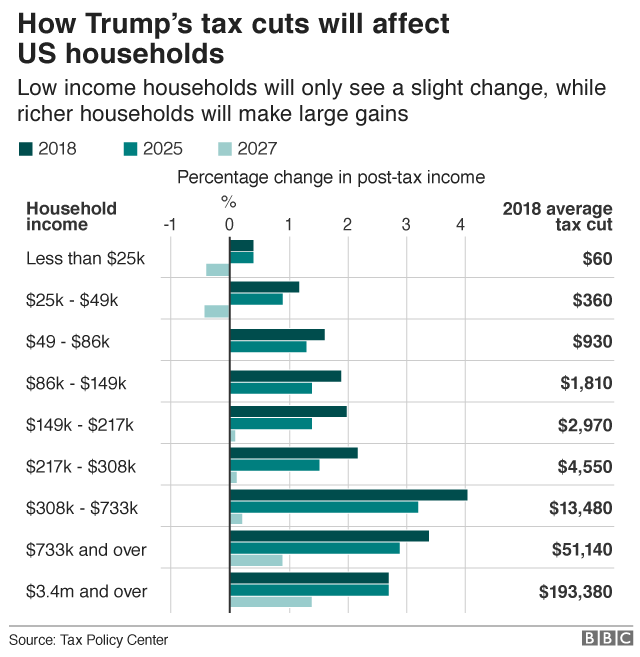

Trump tax plan rental income. The Congressional Budget Office estimated that repealing these two taxes would amount to a nearly 275 billion tax cut over 10 years. Under this law in 2021 those people will get a tax increase of about 365 each. President Donald Trump signed the Republican tax cut bill on December 22 2017.

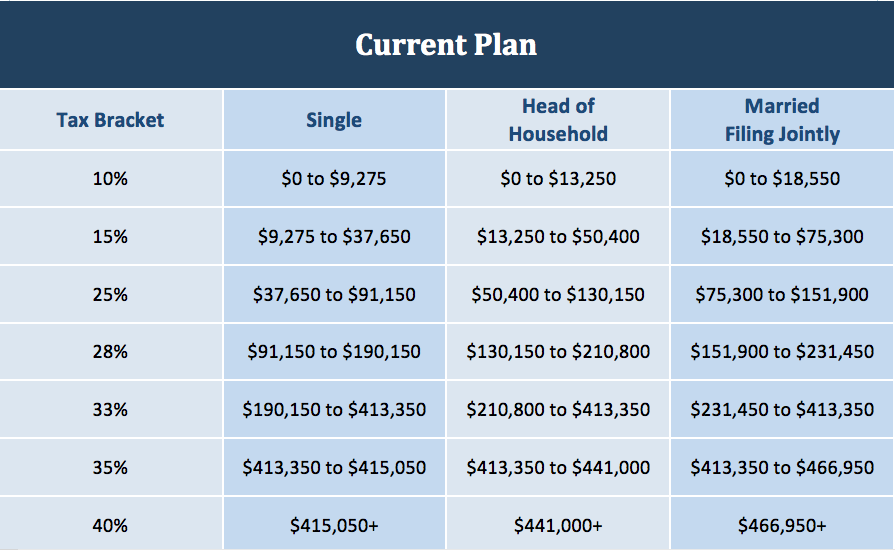

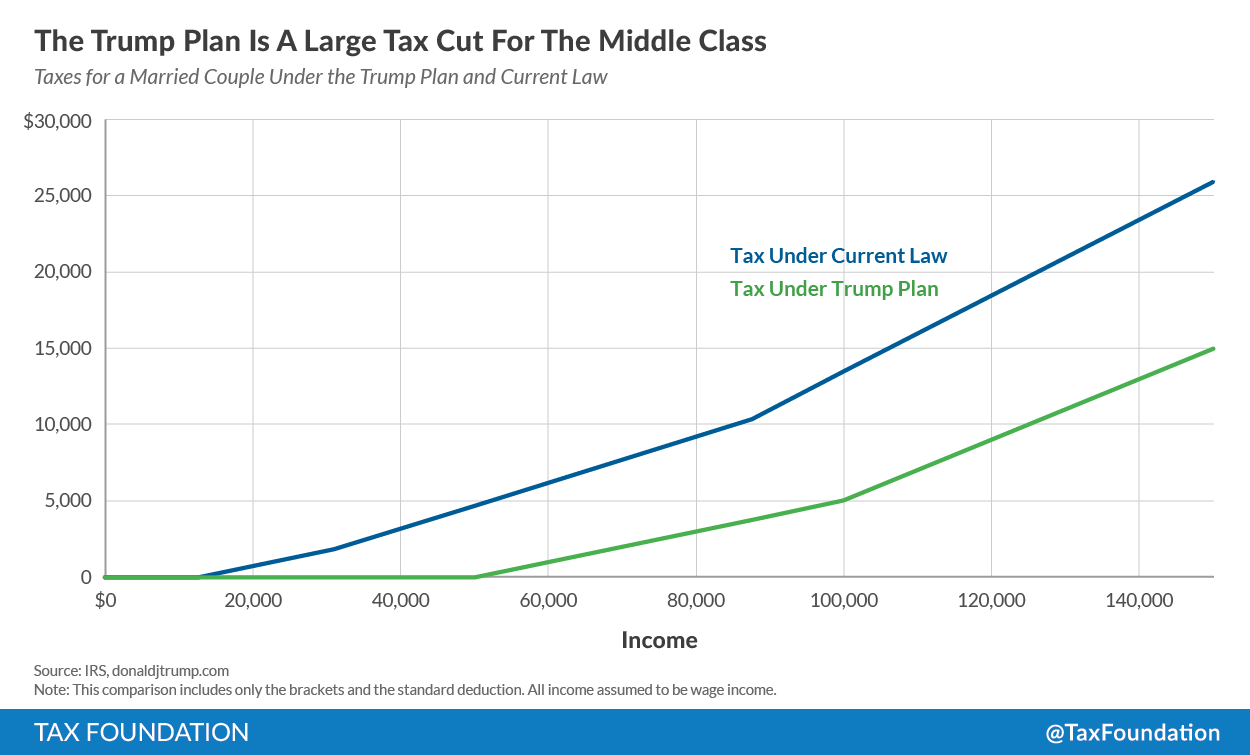

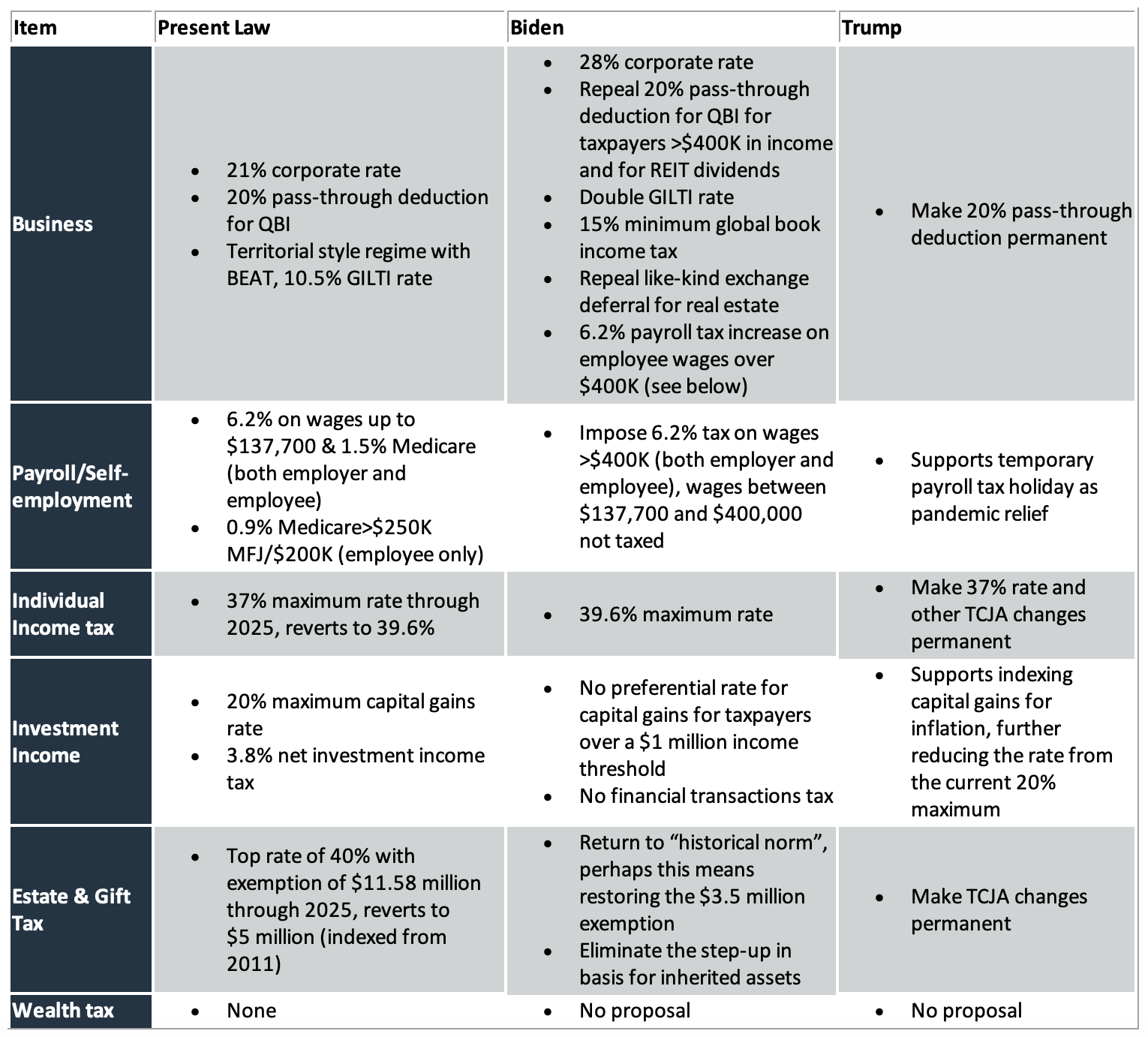

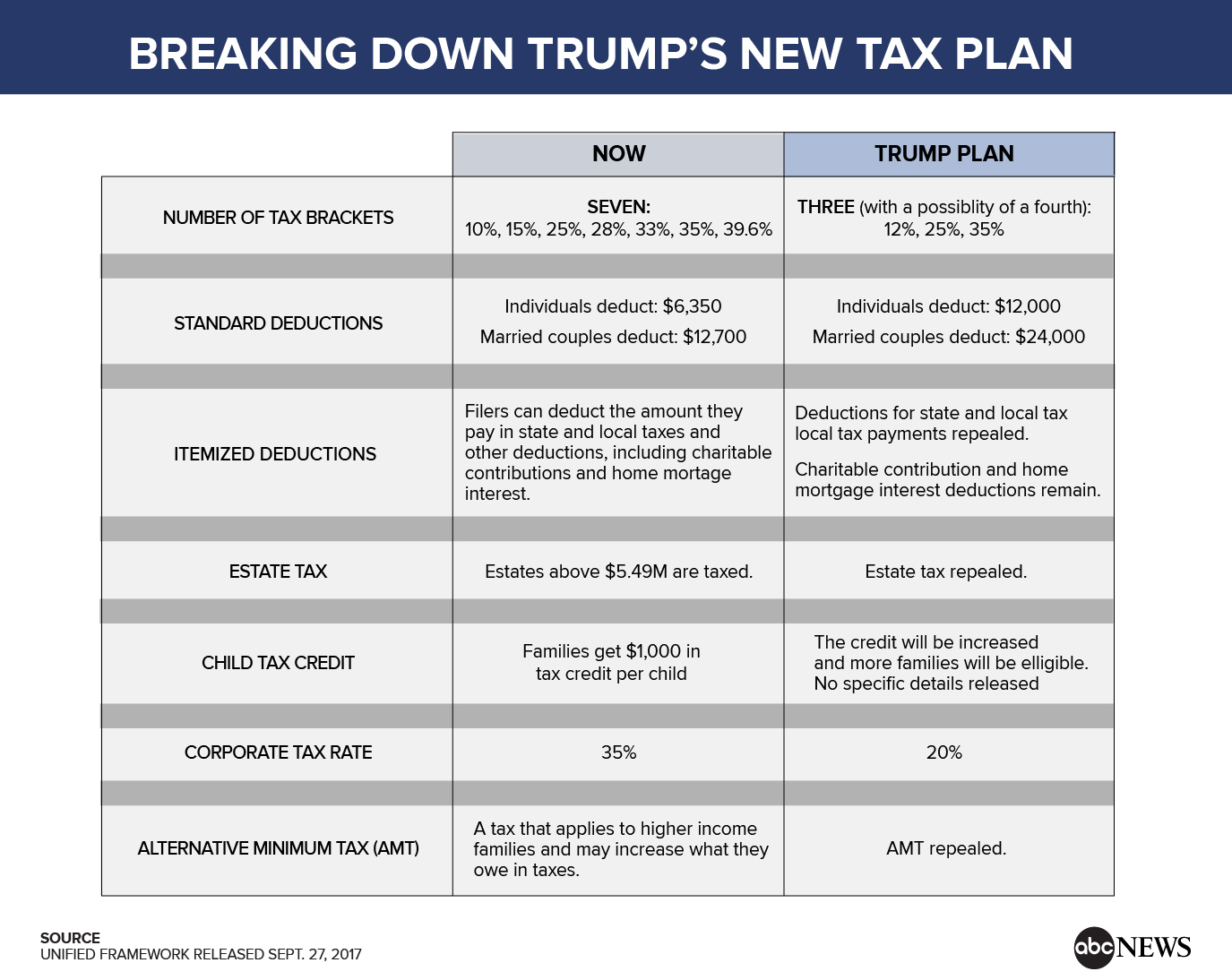

Income Tax Rates. Below is a comparison of current law the House Republican Blueprint and the Trump plan. One of the major victories for the Trump administration over the past four years is the tax plan that passed Congress and was signed by the President in 2017.

This is in addition to all your other rental-related deductions. According to Trumps own calculations his estate contains at least 55 billion in net. This complex deduction is scheduled to end on January 1 2026.

The TCJA reduced the rate to 21. Imposes a progressive income tax where. However since Trump intends to lower the top income rate to 25just 12 higher than the current capital gains ratethe net effect of this is smaller than it appears.

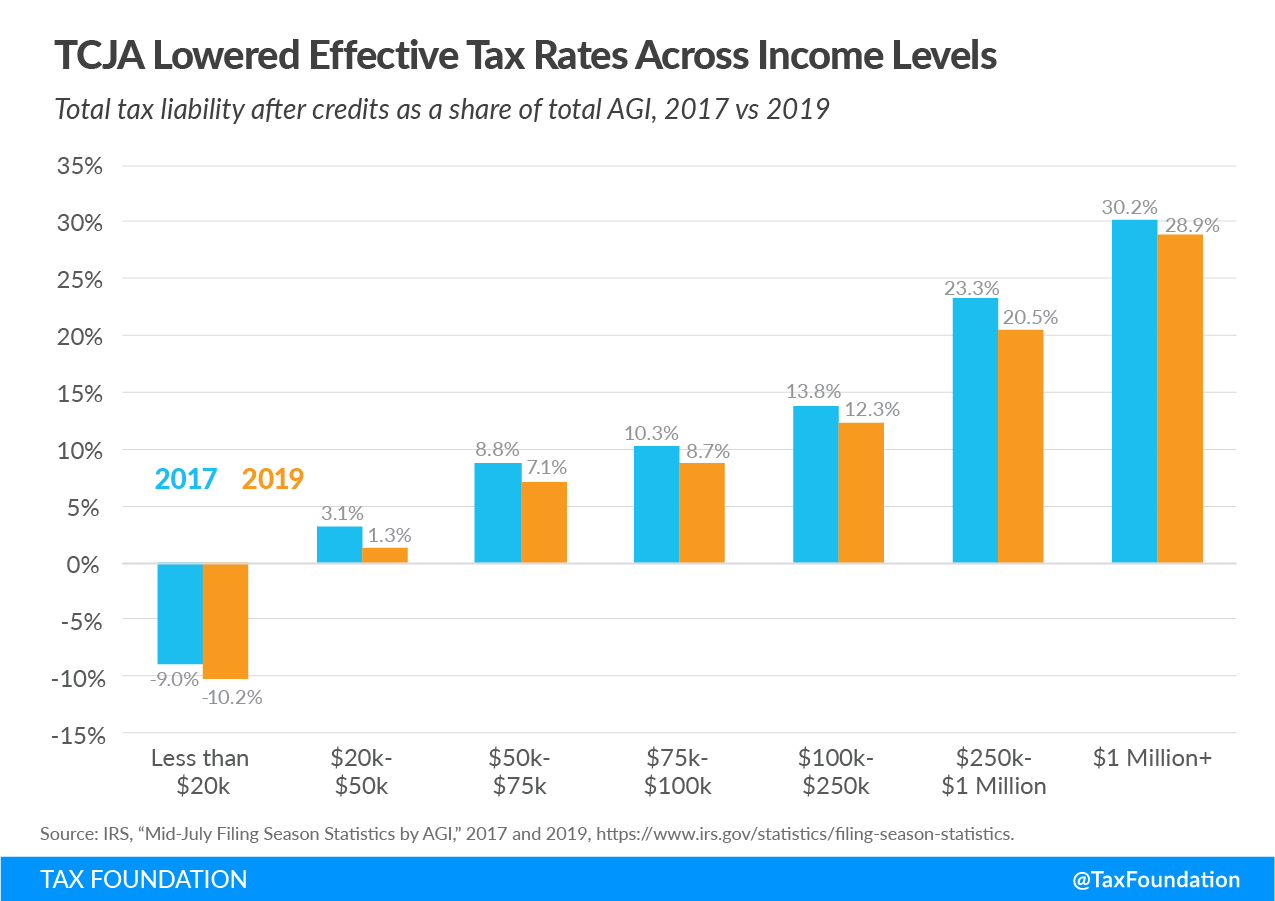

This was a major overhaul of the tax system and established the following tax brackets. These increases on taxes for low-income Americans may have been put in place to try to make up for the massive tax breaks given to the extremely wealthy and corporations during the Trump administration. The Republican tax plan could drive more rental demand.

The tax plan retains the Low-Income Housing Tax Credit LIHTC program which encourages taxpayers to invest in affordable housing whereby owners. Federal Income Tax Bracket for 2020 filed in April 2021. Fannie Mae and Freddie Mac allow.

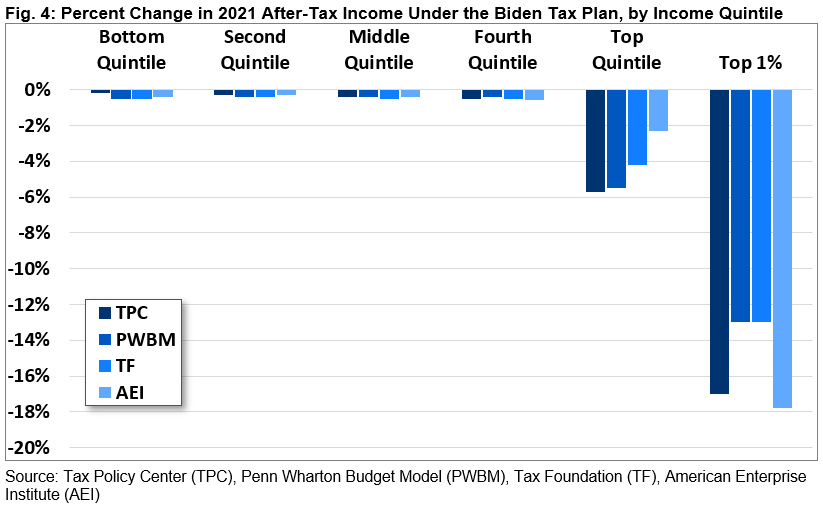

The Foreign Earned Income Exclusion will remove expats who earn under around 100000 from all US tax liability although they still have to file a US tax return to claim it. Thus the effective rate for taxpayers in the top 37 tax bracket is 295. Americans with average earnings of 148100 the 80 to 95 percent would see savings of 7500 or 21 percent of Trumps tax cut.

Expats who earn over 100000 and who rent a home abroad can also claim the Foreign Housing Exclusion on form 2555 allowing them to further exclude the value of many of their housing. Dubbed the Tax Cuts and Jobs Act the sweeping 15 trillion tax reform of the Internal Revenue Code of 1986 is now the law of the land. Stiglitz speculates that this created a budget deficit.

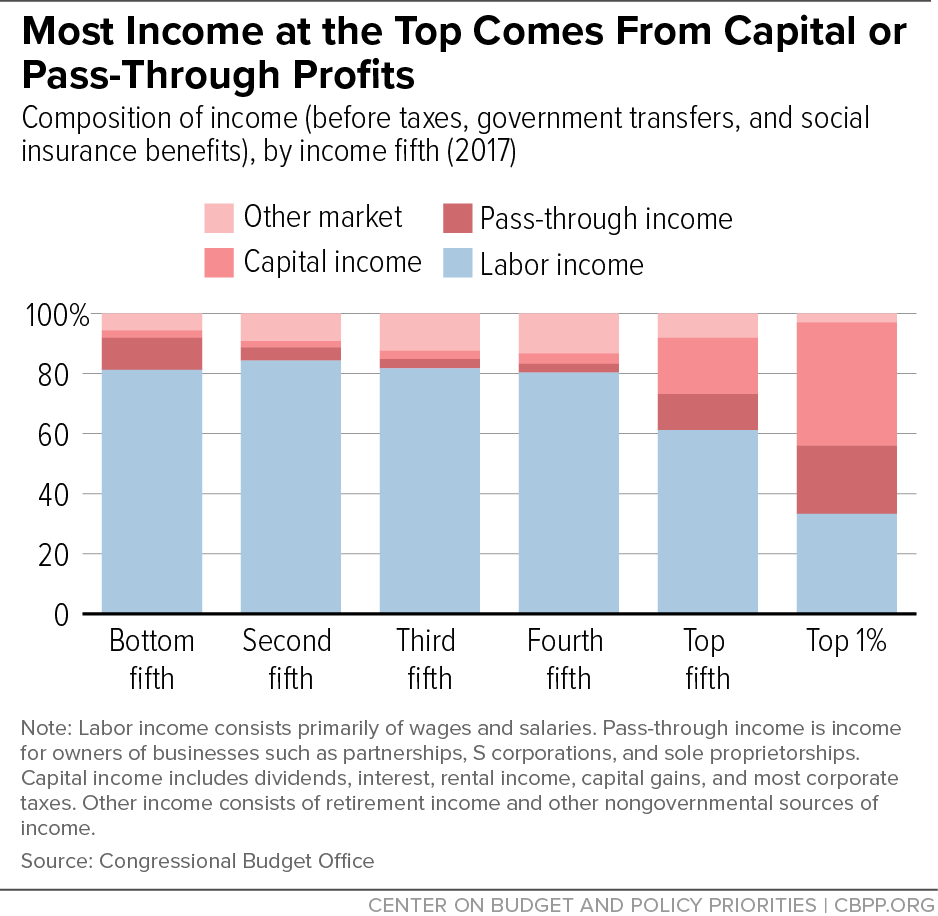

Earners making an average of 84800 the 60 to 80 percent would. Taxes on investment income would be taxed at 20 percent as opposed to the 165 percent rates contemplated by House Republicans. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns.

Before 2018 the corporate tax rate was 35. Investors in single-family homes can write off all the expenses of owning and running a rental. Trump Tax Plan Lowers Corporate Tax Rate.

Trump tax plan not even on drawing board is already roiling rental housing Published. The top rate fell from 396 to 37 while the 33 bracket. Explore President Trump tax plan and Trump second term tax ideas.

Under carried-interest rules a money manager can pay the capital gains ratewhich currently tops out at 238on certain earnings rather than the income tax rate of up to 396. The Trump plan also cuts maximum flow-through tax rates to 15 percent instead of the House Republican plans 25 percent rate. I am especially interested in how Trumps new tax plan affects this situation given that he is capping the mortgage deduction for a primary residence.

March 21 2017 at 238 pm. The replacement would repeal a 09 percent Medicare surtax on high earners and a 38 percent net investment income tax that would apply to capital gains and rental and royalty income among other sources. The tax plan offers a phase-out limit up to an additional 50000 for single and 100000 for couples over the previous limits at a reduce pass-through rate.

The Trump tax plan doubles the estate tax deduction from the 2017 value of 549 million for individuals up to 1118 million. Because their tax returns show the Christies are also landlords the 23818 in rental income they declared in 2015 would be taxed at the flat business rate Trump has proposed to apply to all. The law retained the old structure of seven individual income tax brackets but in most cases it lowered the rates.

This higher limit allows wealthy families to transfer more money tax-free to their heirs. If you qualify for this deduction youll effectively be taxed on only 80 of your rental income.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)