Trump Tax Plan Rates

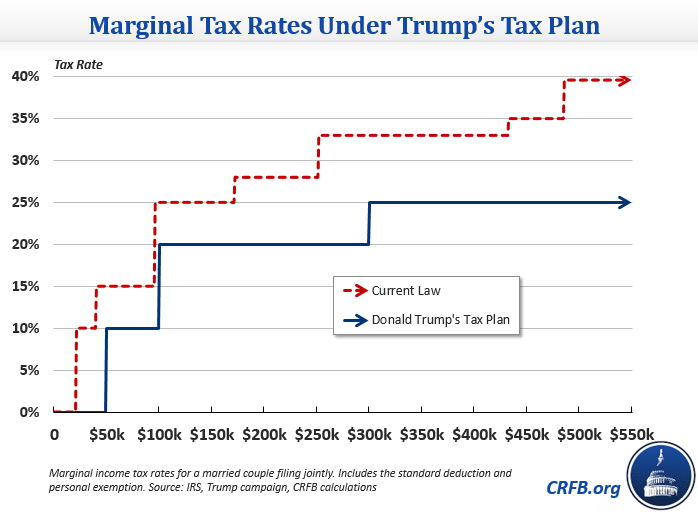

Trump called for cutting the top individual tax rate from 396 percent to 25 percent.

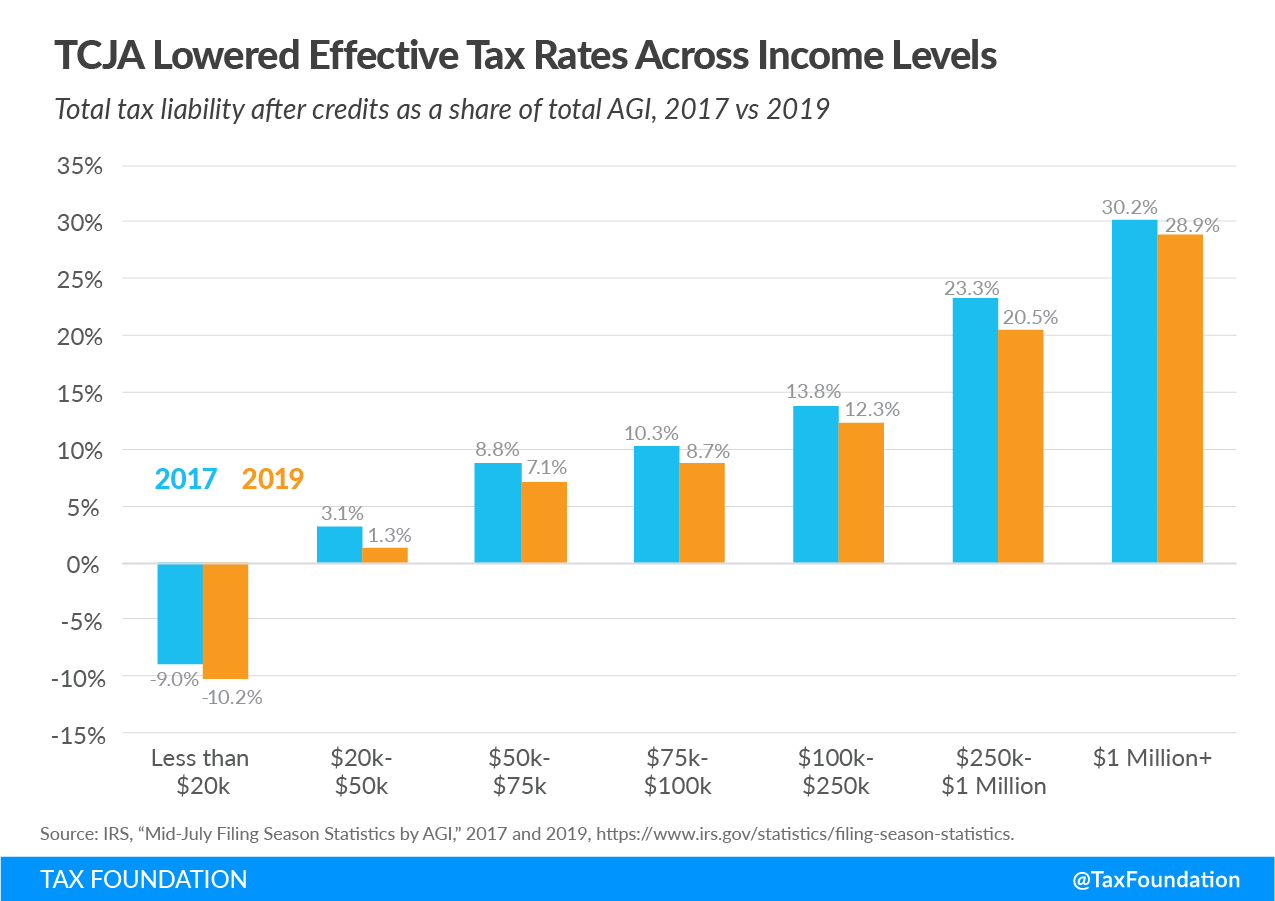

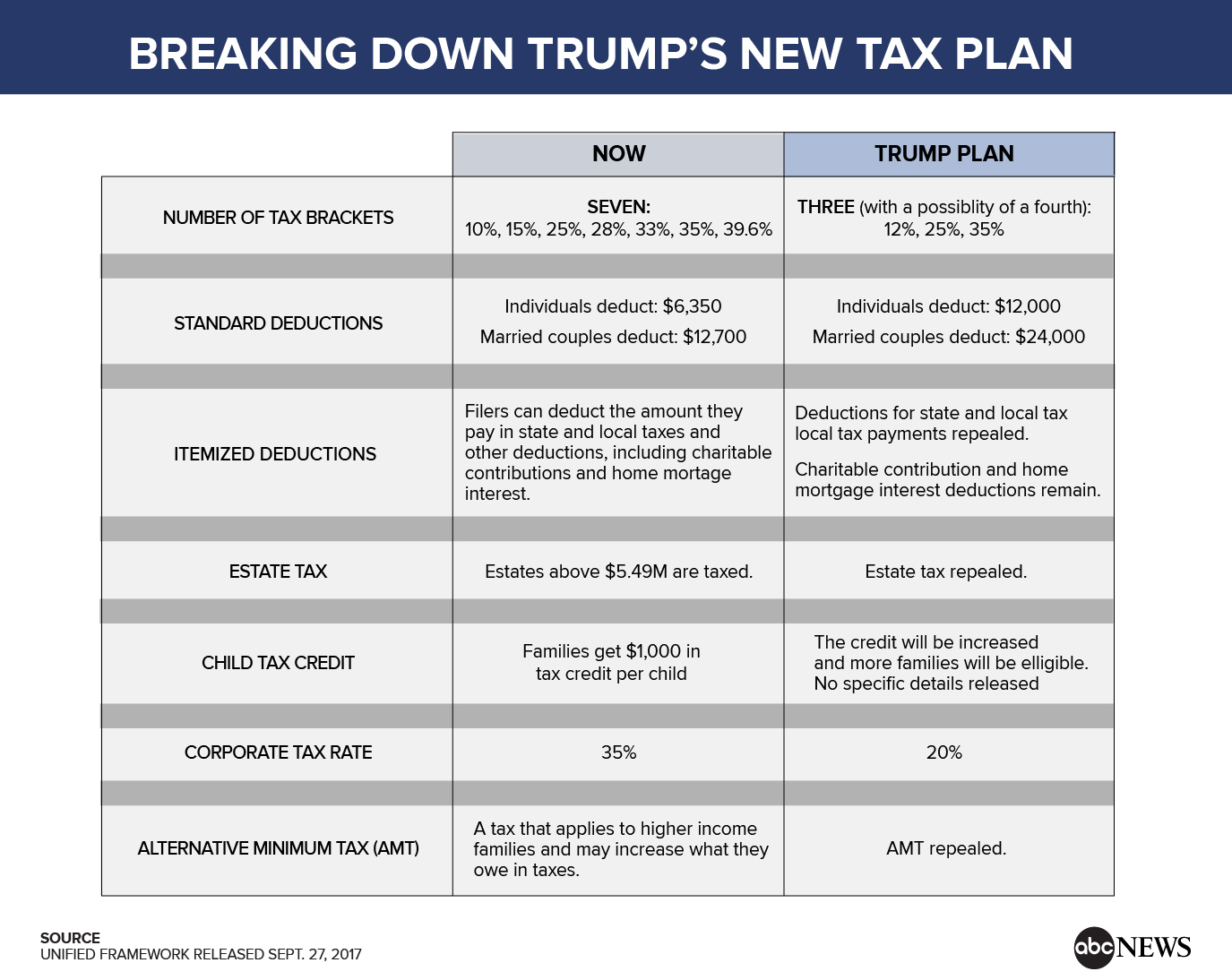

Trump tax plan rates. Trump tax plan brackets chart. The Tax Cuts and Jobs Act came into force when President Trump signed it. It lowered the corporate tax rate to 21 from 35 at the turn of 2018.

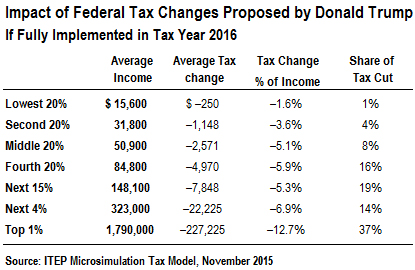

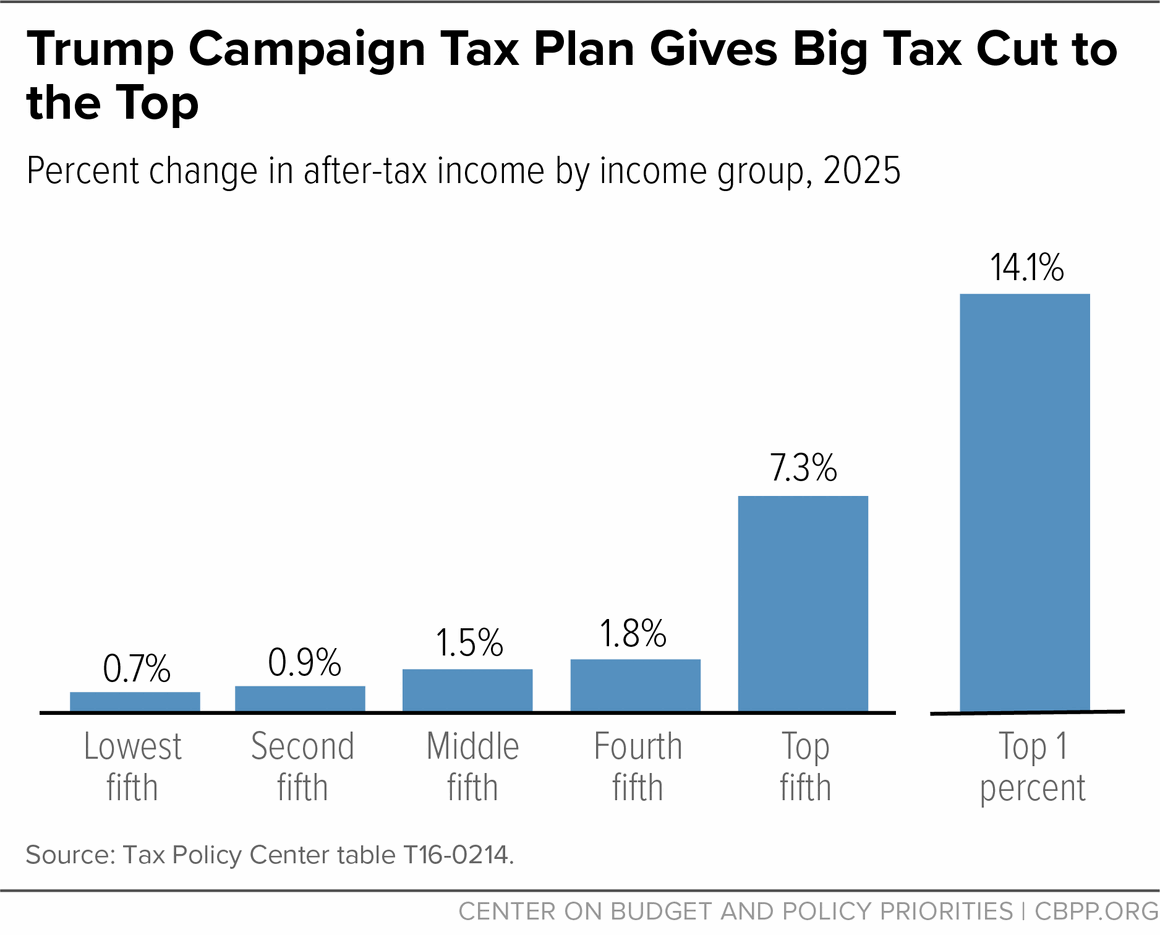

Currently these gains are taxed at a rate of up to 20. Republican presidential candidate Donald Trump unveils a tax plan that would drop the maximum rate from nearly 40 percent to 25 percent. The 2017 Republican tax law took the corporate rate down to 21 from 35 lowered the top tax rate for the highest-earning Americans to 37 and made dozens of other changes that amounted to a 1.

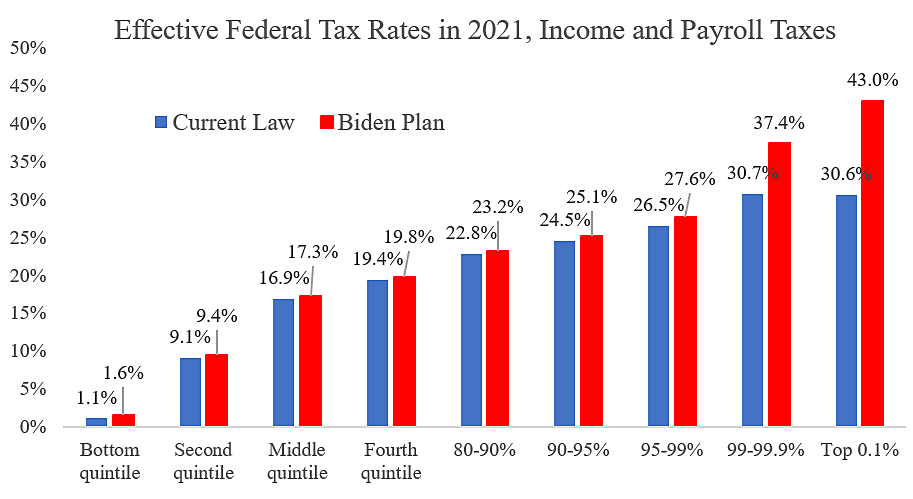

Raise the top marginal individual income tax rate for incomes above 400000 to the pre-TCJA rate of 396. He would repeal the AMT. The highest tax bracket is now 37 for big earners.

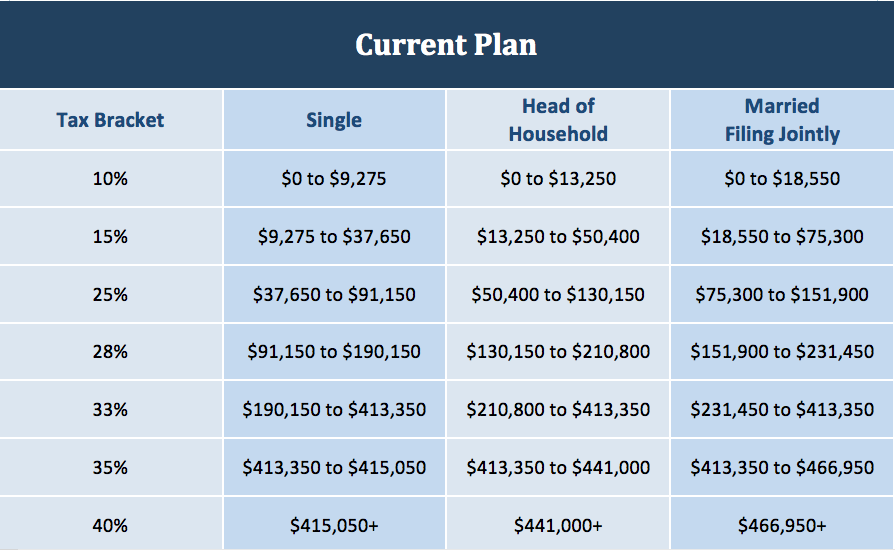

For taxpayers whose marginal rate is cut to 25 percent the price of giving a dollar would rise to 75 cents. Biden meanwhile wants to stop treating capital gains differently from all other income. There are still seven federal income tax.

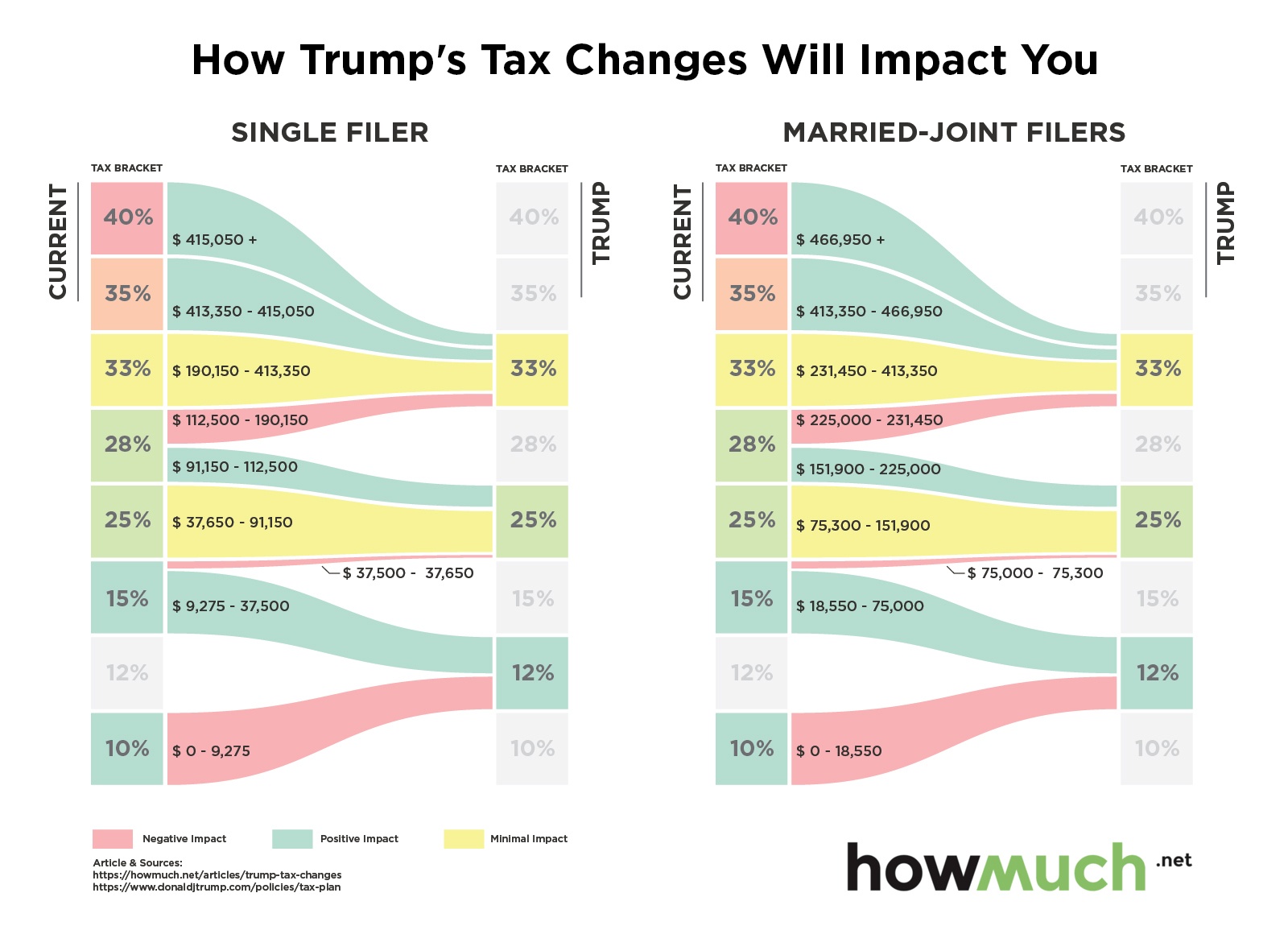

Trump would have individual rate brackets of 12 25 and 33--the latter being a tax cut at the top but it would kick in at a relatively low level. Job creators as well. Reduction in their tax rates.

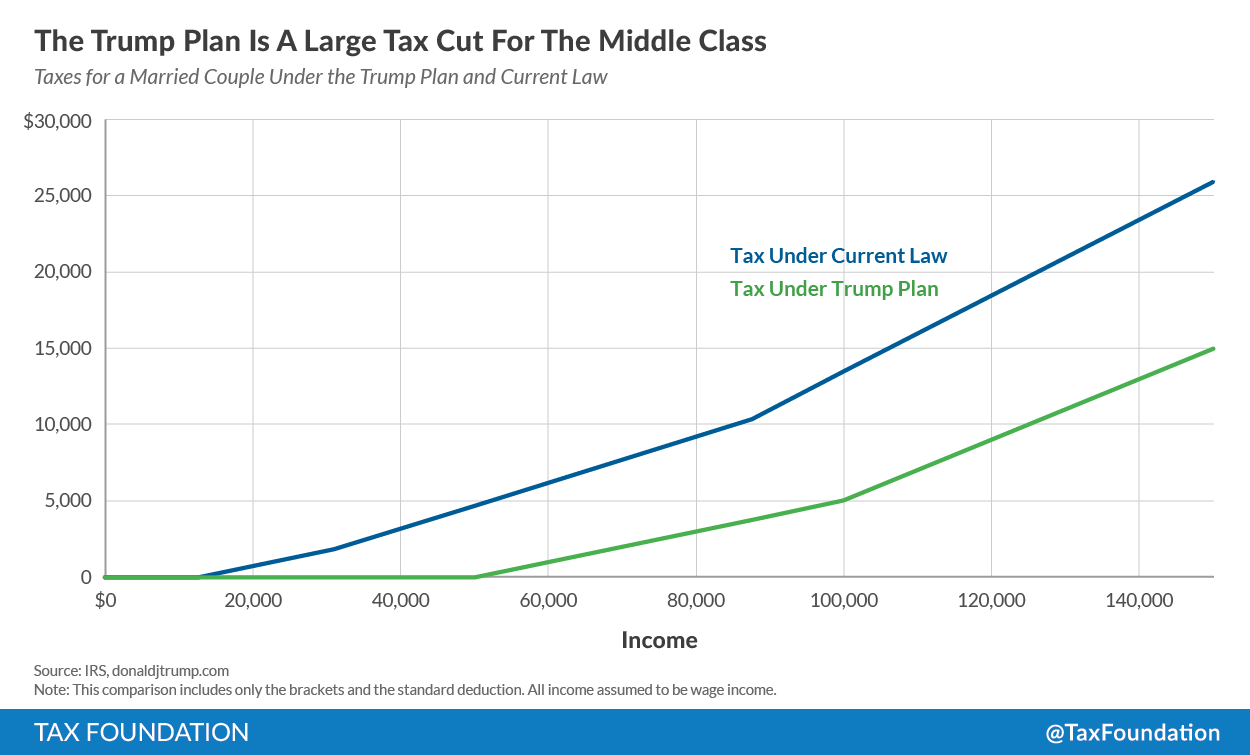

Those making between 25000. 8 rows The biggest changes under the new Trump tax plan came for those in the middle of the chart. These lower rates will provide a tremendous stimulus for the economy significant GDP.

He has also proposed lower rates throughout all tax brackets. Trump and his advisers a year ago floated the idea of a 15 income tax rate for middle-income Americans down from the current 22 for individuals making up to 85000 a year. Other changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions.

This 20 rate will kick in for all taxpayers in the top bracket 127500 if single and 255000 if married filing jointly. Because taxes on pass-through income are paid at the individual level at individual rates the top rate for such income today is generally 396 percent. 10 percent 20 percent 25 percent.

Businesses would also get much lower rates. 7 rows In his Indiana speech of 2018 Trump said that cutting the top corporate tax rate from 35 to. Trump had proposed the idea of lowering this as part of a plan that he said would lower overall middle class tax burdens.

During the presidential campaign Mr. The plan would reduce the number of individual income tax brackets from the current seven brackets to three with rates of 10 20 and 25 percent table 1. He wanted fewer tax brackets and deductions to simplify the code.

The Trump plan addresses this challenge head on with a new business income tax rate within the personal income tax code that matches the 15 corporate tax rate to help these businesses entrepreneurs and freelancers grow and prosper. Trumps plan would lower the rate for all pass-through income to 15 percent.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9896769/tpc_final.png)