Trump Tax Plan Capital Gains Rate

Today theres good reason to think it could rise to around 40 before at least.

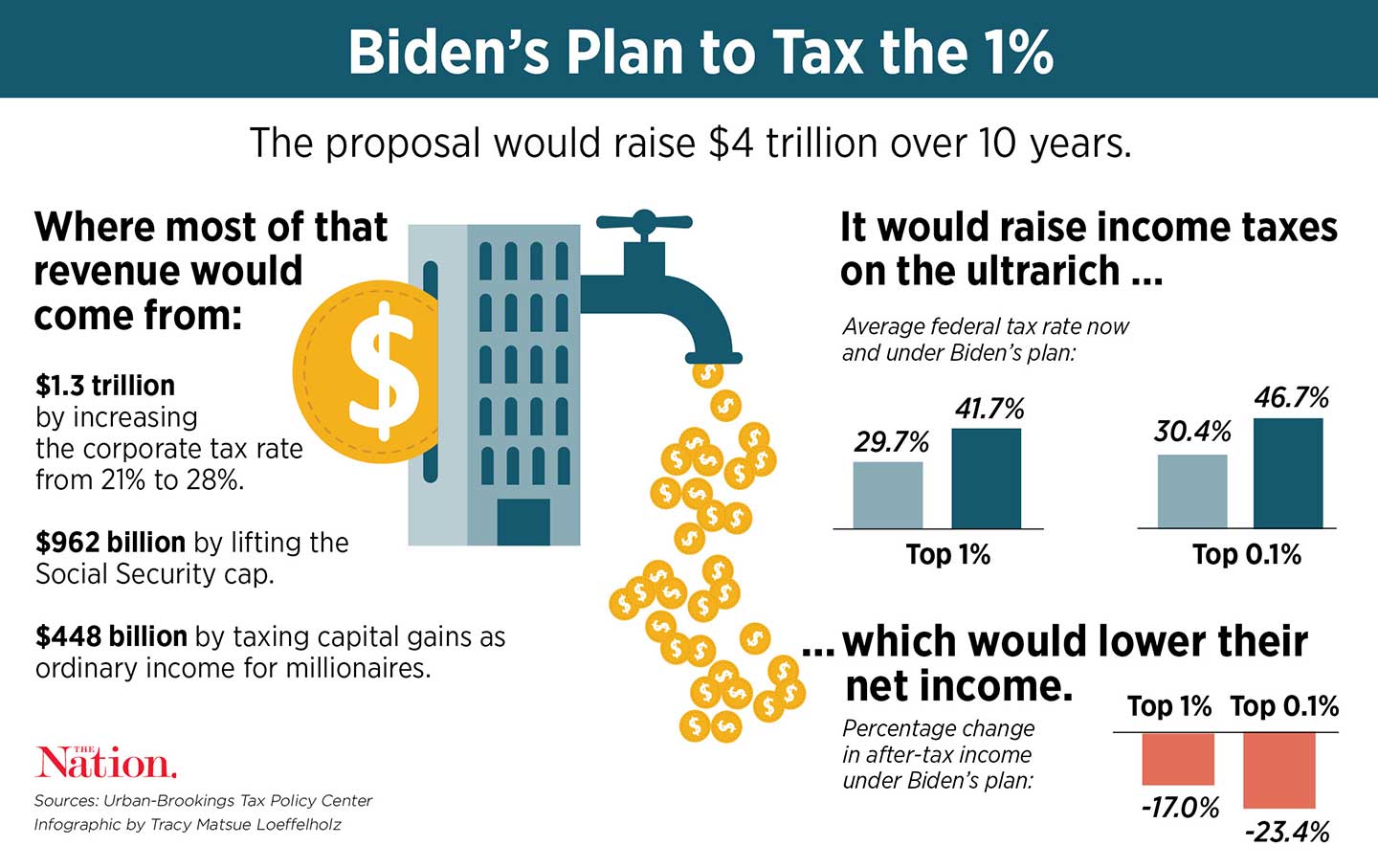

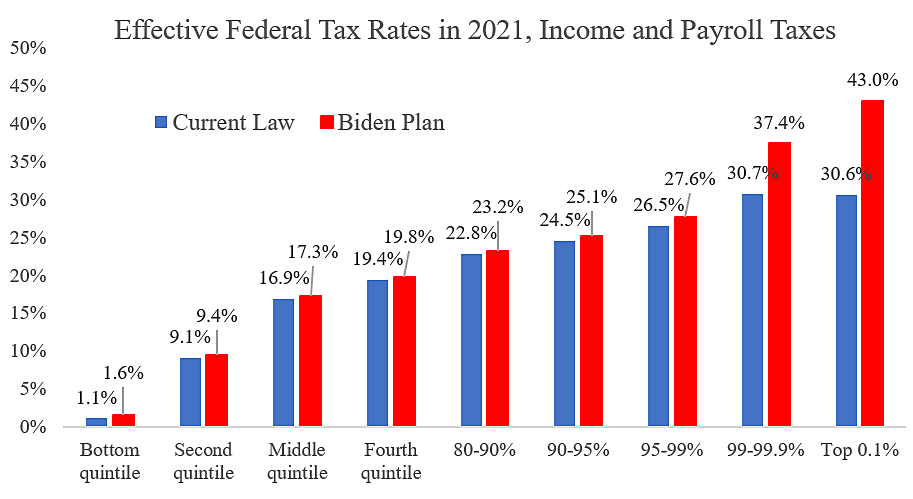

Trump tax plan capital gains rate. It would raise the corporate tax rate from 21 to 265 for businesses that report income of more than 5 million. This tax cut will only benefit tax units in the top 5 percent of the income distribution with. The Institute on Taxation and Economic Policy estimates that 99 percent of the benefits would go to the richest 1 percent of taxpayers.

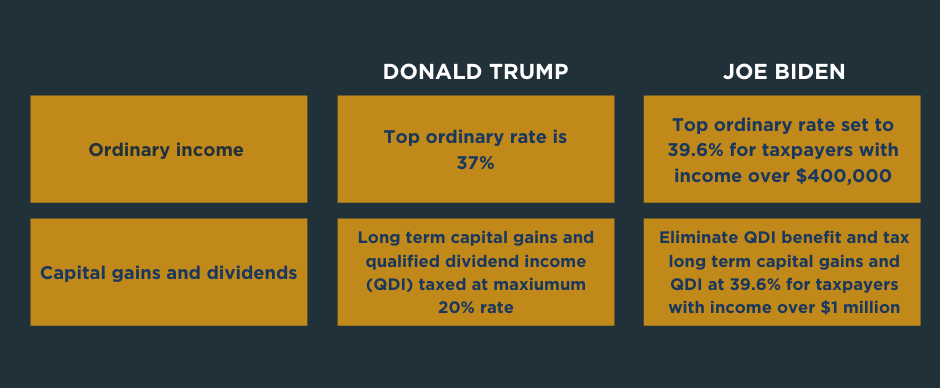

It would raise the top income tax bracket from 37 to 396 for households making more than 450000 annually and individuals making more than 400000 annually. Single married filers with taxable income between 40000 80000 and 441450 496600 face a 15 percent rate while income above that amount faces a 20 percent rate. That is what you pay if you sit at home and watch the money you inherited grow or if you are.

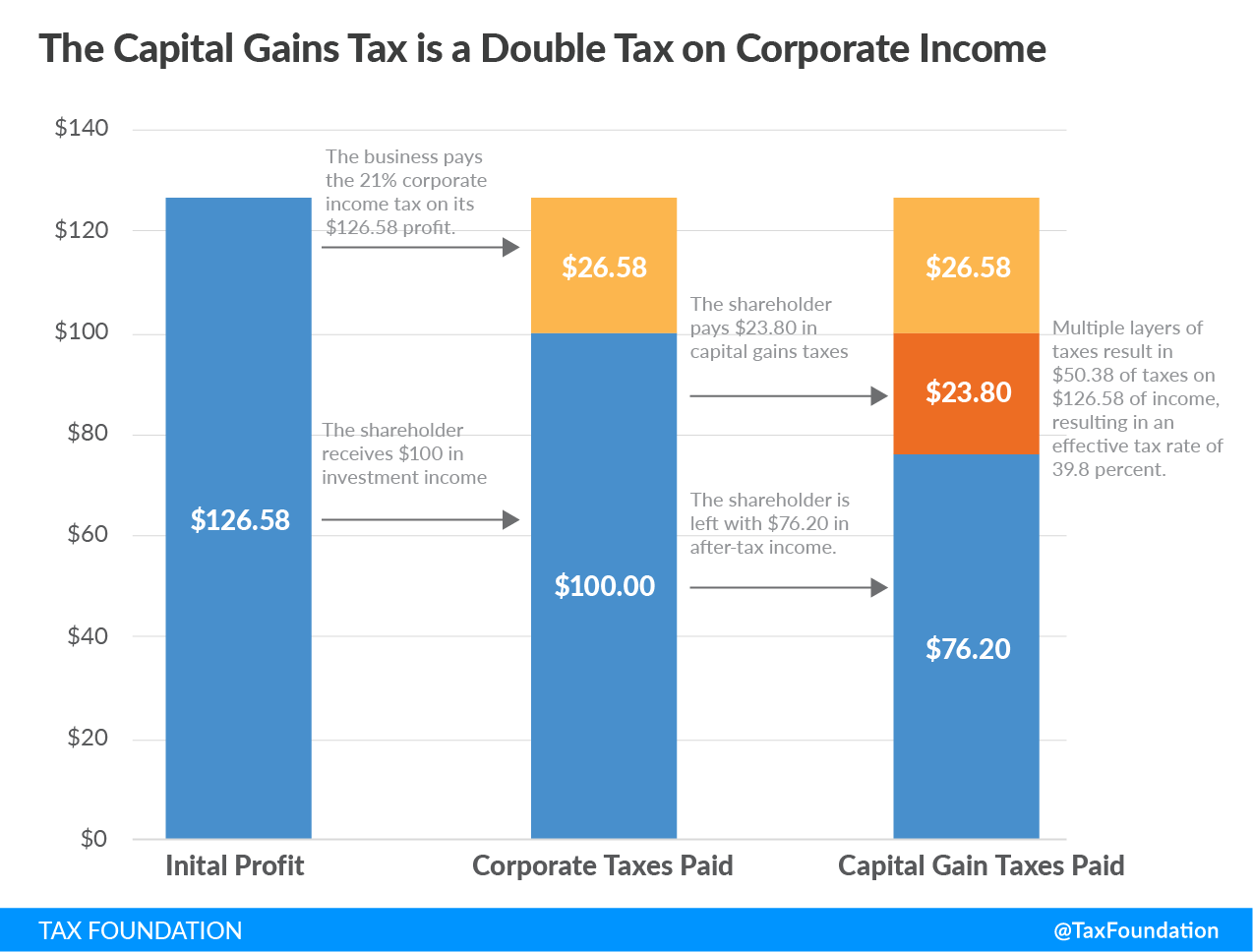

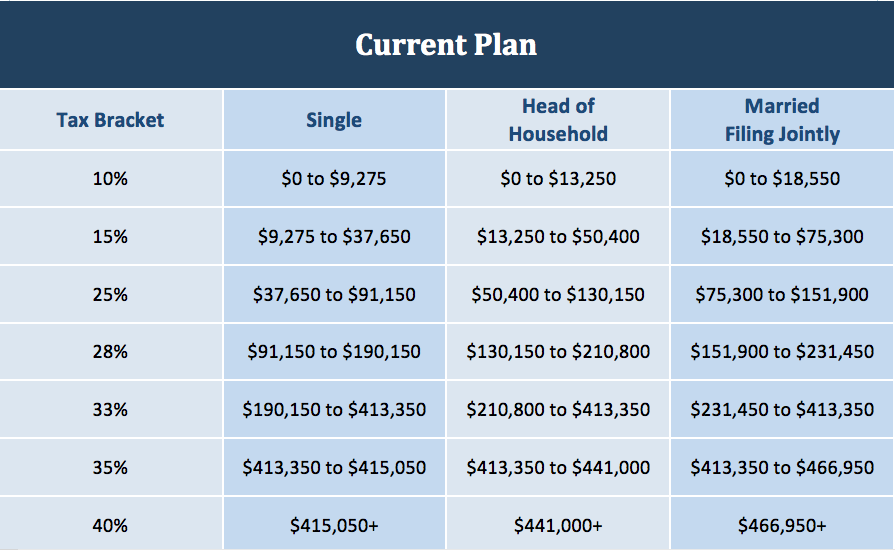

In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Trumps tax plan proposes four federal income tax brackets. In reality the capital gains in this example would be taxed at lower rates.

Short-term capital gains gains on assets held for less than a year are already taxed at normal. PWBM estimates that reducing the top preferential rates on capital gains and dividends from 20 percent to 15 percent will cost 986 billion dollars over the ten year budget window. This plan eliminates the top bracket under current law and any single married filers with taxable income over 441450 496600 would face the 15 percent rate.

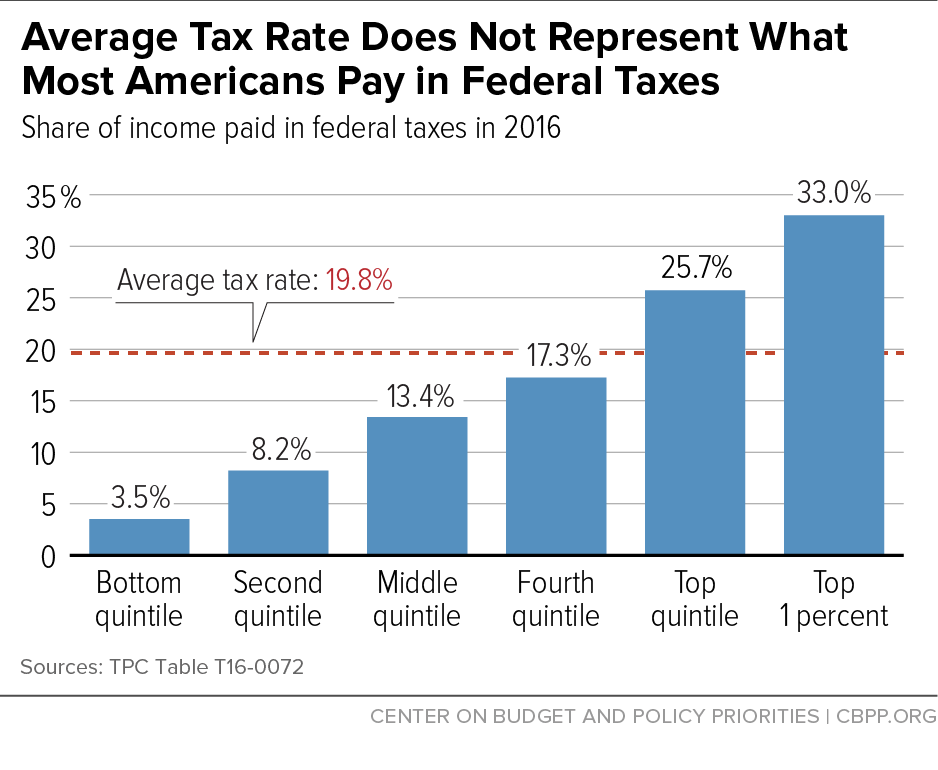

Biden meanwhile wants to stop treating capital gains differently from all other income. Income Tax Rate Long Term Cap Gains Dividends Rate Single Filers Married Filers Heads of Household 0 0 0 to 25000 0 to 50000 0 to 37500 10 0 25001 to 50000 50001 to 100000 37501 to 75000. In recent years the average annual capital gains tax rate paid to the federal government has hovered around 19.

The top capital gain tax rate would go up more modestly from 20 to 25. One very reasonable interpretation of this plan is that Trump is proposing that all capital gains be taxed at ordinary rates meaning a capital gains tax hike from 238 percent today to 33 percent. 13 President Trump pledged to cut the top federal income tax for capital gains to 15 percent.

The figures in this table assume that both capital gains and interest are taxed at ordinary income tax rates. President Trumps Proposed Capital Gains and Dividend Tax Cut. Since wealthy Americans reap the lions share of capital gains Trumps capital gains tax giveaway would be highly skewed to the rich.

Married filing jointly. Steve Wamhoff Director of Federal Tax Policy. How much these gains are taxed depends a lot on how long you held the asset before selling.

Trump had proposed the idea of lowering this as part of a plan that he said would lower overall middle class tax burdens. In his Indiana speech of 2018 Trump said that cutting the top corporate tax rate from 35 to 20 the rate proposed at the time will cause jobs to start pouring into our country as companies. In a speech in August Trump indicated he would align his proposed individual income tax rates with that of the House Republicans tax reform plan.

15 Tax Rate. August 18 2020. President Trumps Republican administration is seeking a 15 rate on capital gains on investments down from todays 238 while his Democratic rival Joe Biden would raise the top rate to 39.

A top rate of 37. Why Trump Administrations Plan to Index Capital Gains to Inflation Is Just Another Giveaway to the Wealthy. The tax rate on most capital gains is already much lower than the tax rate on wages20 plus a 38 surcharge on investment income of married taxpayers with income above 250000 a year vs.

Tax long-term capital gains and dividends above 1 million at the ordinary income rate of 396. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property -- at 25 up from 20.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)