Trump Capital Gains Tax Plan

Trump had proposed the idea of lowering this as part of a plan that he said would lower overall middle class tax burdens.

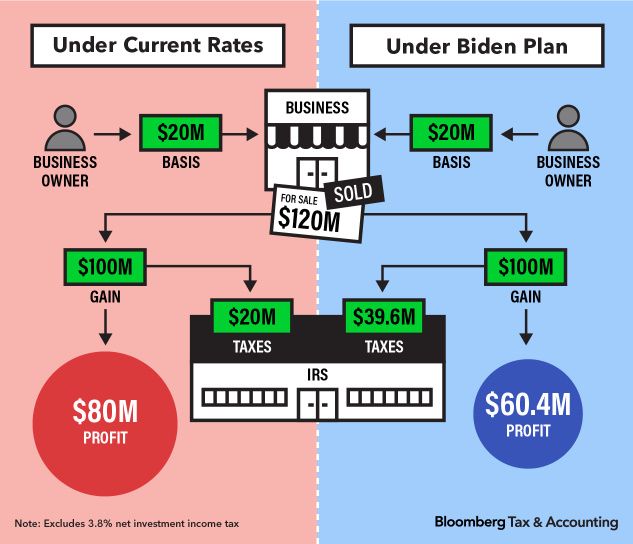

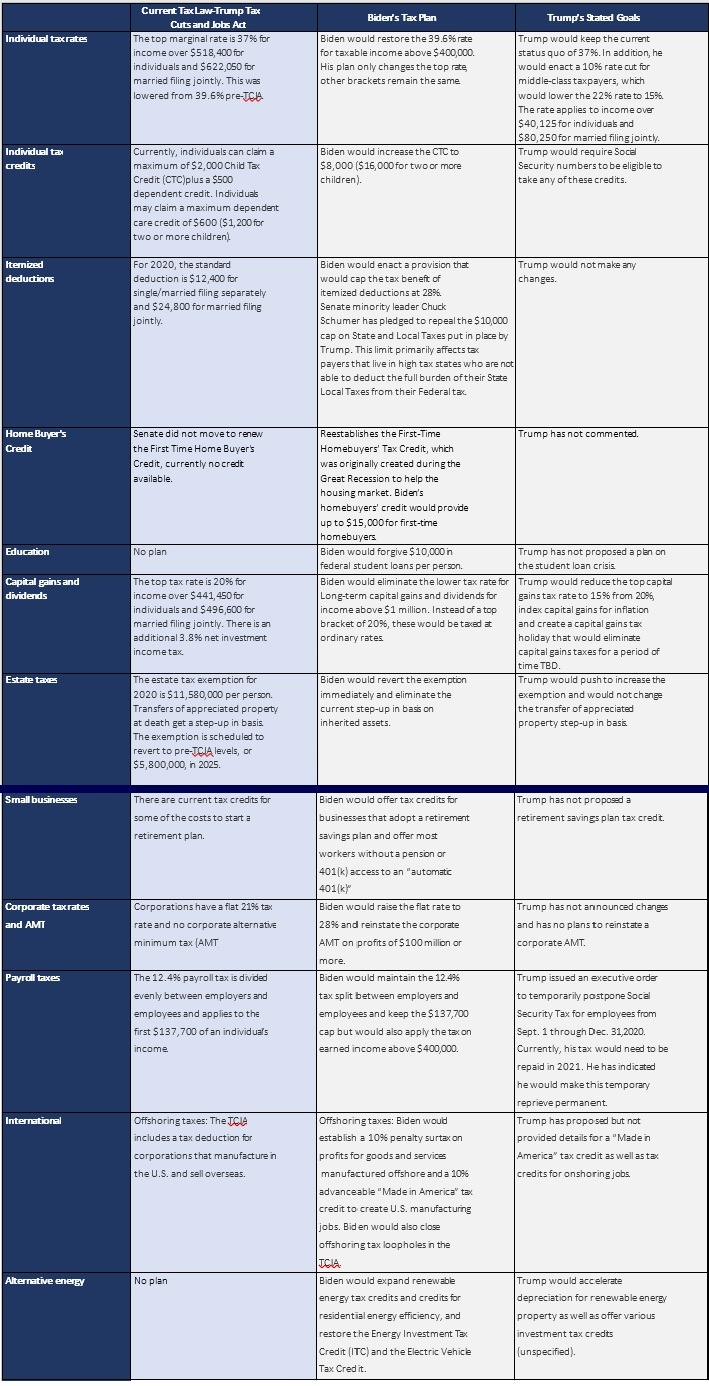

Trump capital gains tax plan. Biden meanwhile wants to stop treating capital gains differently from all other income. If the owner sells hes looking at about 1M in capital gains tax leaving him with 4M cash. PWBM estimates that reducing the top preferential rates on capital gains and dividends from 20 percent to 15 percent will cost 986 billion dollars over the ten year budget window.

This tax cut will only benefit tax units in the top 5 percent of the income distribution with. 22 2017 bringing sweeping changes to the tax code. The White House is reported to be planning to unilaterally adjust the way capital gains are assessed to benefit the wealthiest Americans.

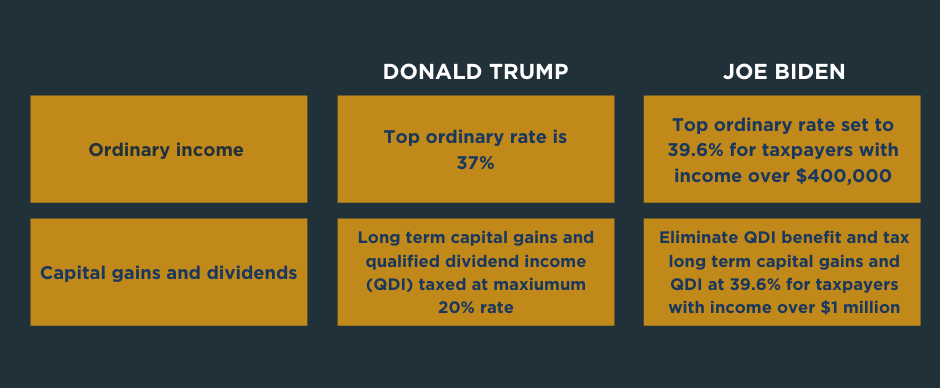

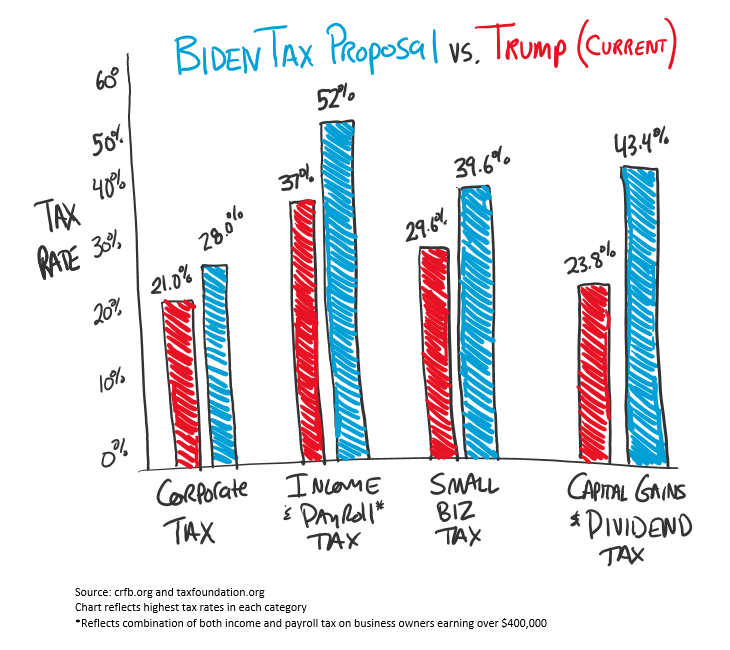

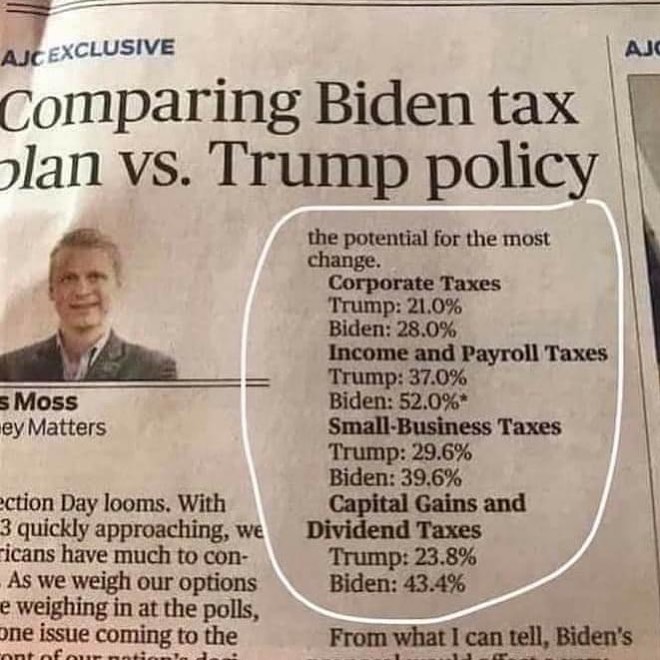

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. A year after first floating the idea of indexing capital gains to inflation and then wisely shying away from it the Trump administration is again considering handing the richest 1 another meaty tax cut at the expense of everyone elseand doing it without Congresss approval. The latest plan would also impose a 3 surtax on people with an adjusted gross income of over 5 million.

In this case he is better off cash-wise selling and paying the tax. Income from labor will grow at an average annual rate of 13 between 2016 and 2021 while capital gains will increase at an annual rate of 63 over the same period the CBO estimates. 9 rows August 18 2020.

High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. If instead he takes out a mortgage at 3 he can borrow 33M at 100k a year in interest wiping out his income. A financial advisor may be able to help with tax planning.

Probably the biggest outlier to your tax planning will be capital gains. President Trump signed the Tax Cuts and Jobs Act TCJA into law on Dec. Changes to the Tax Code.

Why Trump Administrations Plan to Index Capital Gains to Inflation Is Just Another Giveaway to the Wealthy. The proposal would adjust capital gains for inflation reducing taxes disproportionately for the. Currently these gains are taxed at a rate of up to 20.

Besides probably being illegal the proposal would cost up to 200 billion do little or. Short-term capital gains gains on assets held for less than a year are already taxed at normal. The new plan proposes raising the top capital gains tax rate from 20 to 25 instead of nearly doubling it to 396 as Biden had initially proposed.

Now double the capital gains rate. Lets break down how these tax changes could affect you. Under the Trump tax overhaul effective as of tax year 2018 most of the old tricks to avoid or reduce the capital gains tax bite on sales of appreciated assets still work albeit with tweaks.

Trump Tax Plan Strategy 5. When you sell an asset with a lot of gain you may find that you uncharacteristically bump your income up. Often that means youve just blown through the income threshold.

President Trumps Proposed Capital Gains and Dividend Tax Cut. And the corporate tax rate would only go up to 265 instead of 28. One very reasonable interpretation of this plan is that Trump is proposing that all capital gains be taxed at ordinary rates meaning a capital gains tax hike from 238 percent today to 33 percent.

How people felt in principle about the 15.